If you pay attention to physical gold flows and increased government gold bullion buying figures, you will often hear and or see the term “gold ton” or “gold tonne” used.

When referring to precious physical metals, a ton refers to a metric tonne. For .999 fine physical gold bullion or any other precious metal, a metric tonne is exactly 32,150.7 troy ounces of gold or other precious metal.

What is a ton of Gold worth?

A rough calculation can be executed using a simple live gold spot feed and a simple calculator, smartphone, or search engine.

The equation for 'How Much is a Gold Ton Worth' is as follows:

32,150.7 oz X live Gold Spot price = A whole lot of continually debasing fiat currency.

At the moment of writing this blog post:

A ton of gold is worth just over $46.5 million fiat US dollars, in July 2019.

What does a ton of Gold cost?

One caveat to note when trying to gauge "What a tonne of gold is worth?".

Even the last 1980 gold bullion bull market's good delivery standard 400 oz Gold Bullion bar standard requires paying slight premiums over the spot price of gold.

Government central bank size 400 oz gold bullion bar ask prices, will typically have a slight basis point premium about the fluctuating gold spot price (minor fractions of 1%). This minute price premium is so large 400 oz gold bar refiners can maintain profitability.

The following video clip gives you an idea of the size of 1 ton of gold bullion. The Perth Mint recently showed off the world's currently largest gold coin which weighs one tonne.

What does a ton of Gold look like in the real world?

-

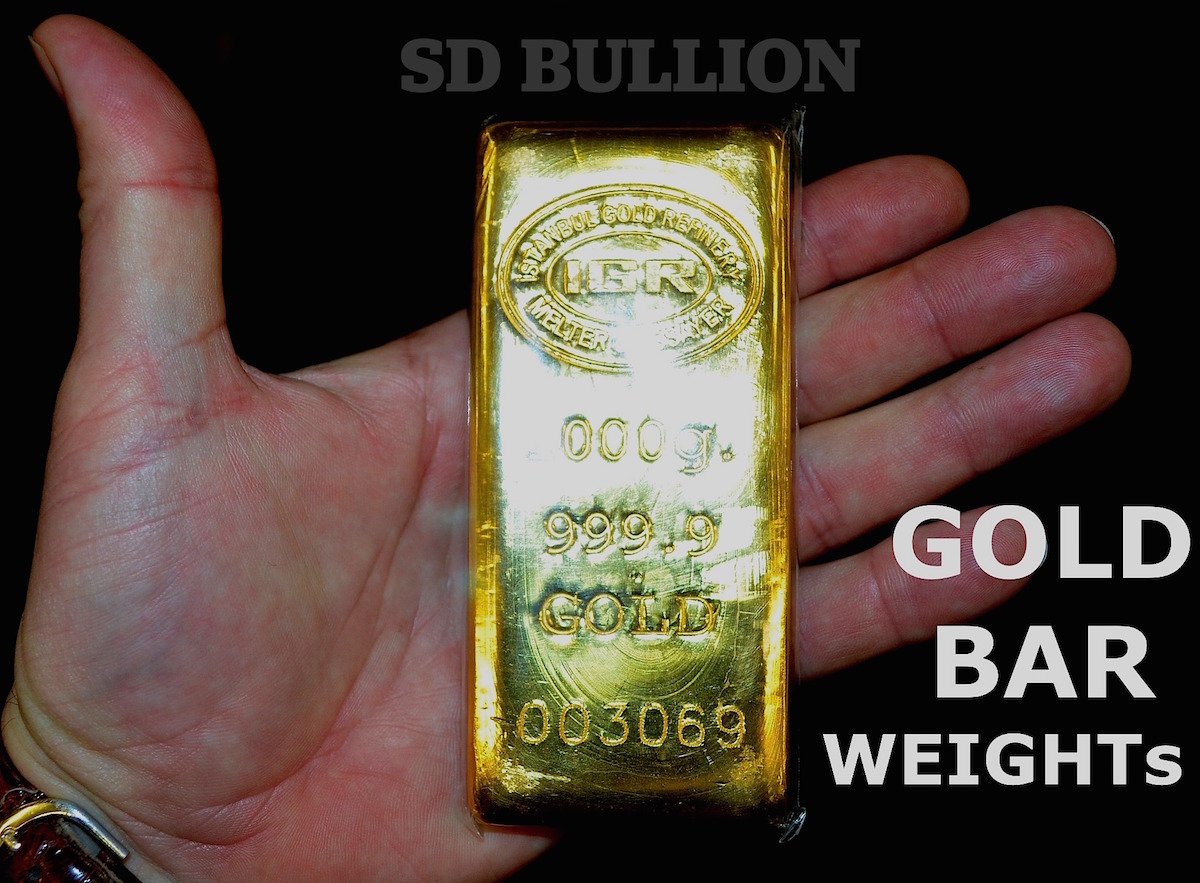

German Bundesbank (German Central Bank Gold) - Frankfurt, Germany

1 ton of gold = about 80 of these gold bars

Buying Gold in Tonnage is Not Easy

To acquire tonnes of physical gold bullion requires relations with the most significant physical gold bullion trading desks in the world (e.g., Bank for International Settlement's Gold Desk likely the largest). The BIS has advertised it's gold and FX intervention desk services to its central bank and commercial bank members over the years. They are often involved with gold swaps in the hundreds of tonnes per their annual report documentation.

To buy gold bullion by the ton also requires available gold bullion sellers at current gold spot price points where often today both government central banks and the eastern world are gobbling up all-new line physical gold bullion supplies.

Often if someone is trying to sell metric tonnes of gold in an email or online, it is a tip-off that a greed-driven gold scam attempt is in the works.

Here is a brief comedic example of a such a commonly occurring would be gold scam phenomenon.

If someone even mentions the word ton, tonne, or metric tonne. It is a 99.9% tip-off of a scam artist.

Bank of England Gold Vault - Various countries store their Gold Bullion here

1 ton of gold = about 80 of these gold bars

A ton of Gold Price in Perspective

Since 1986, the US Mint has been making the world's most popular and often purchased modern-day gold bullion coin.

In the year 1999, the US Mint had its best gold coin sales year ever. The US Mint sold just over 63 metric tonnes of gold bullion coins in total in that record-breaking year of 1999. Annual US Mint bullion coin sales data is at the bottom of the backlinked coin mintage page.

Investors bought 22k American Gold Eagle Coins at a record clip in 1999 likely spurred by a combination of Y2K fears (see 1/10 oz Gold Eagle Coin 1999 sales), the ongoing Asian financial crisis, and generationally low gold prices vs. other financial assets at the time (long term value buyers).

Estimates are currently 190,000 Tons of Gold exist Above Ground

Government central banks own only about 1/5th of the above-ground gold bullion supply. Another 1/5th is spread out amongst private investors in various coin and smaller gold bar size formats.

The vast majority, or around half of all physical gold above ground gets held in gold jewelry form, most of which resides in the eastern world (e.g., India, China, etc.).

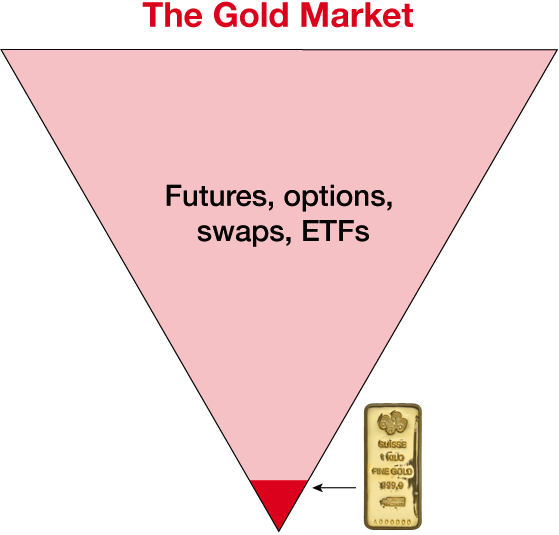

Total notional gold derivative contract trading volumes around the world every year dwarf the entire physical supply of gold in the world. In other words, 'bets on the fiat spot price actions of gold,' are many multiples more than the actual value of physical gold owned by human beings.

This is only one primary reason why when you buy physical gold bullion in any format; you will have to typically pay some price premium above the fluctuating gold spot price.

^ If this illustration does not make sense to you, perhaps learn more about how the gold market works ^

400 oz Good Delivery Gold Bar begin refined into 1 Kilo Bars for China

In the following clip, you can get an inside first-hand tour of one of the world's biggest gold bullion vaults pictured above: the Bank of England gold depository.

-

-

1 Kilo Gold Bars the New Good Delivery Standard (China)

A seminal interview conducted in late 2015 interviewing the head of one of the world's largest Swiss gold refineries (the country has 4 of the world's largest gold refineries), confirmed the fact that China through its Shanghai Gold Exchange, has been forcing a new good delivery gold standard size on the world (1 kilo gold bars).

After moment @4:27, the gold refinery head confirms that the day to day gold spot price action has little to do with fundamental factors.

He also confirms how China's demand for 1-kilo gold bars has his organization working around the clock to meet demand. The physical gold bullion is flowing from west (400 oz gold bars) to east (newly refined 1-kilo gold bars).

How tons of Gold flow through the Gold Bullion Market

Since beginning in 1987, the London Gold Bullion Association has taken the position as the world's dominant physical gold bullion settlement organization.

This situation or trend will likely remain so until the eastern world wrestles away gold price discovery power.

The ongoing disconnect from representative gold derivative traders and physical gold flows is a real phenomenon. Many of the individuals involved in day-to-day trading representing massive gold tonnage have often never even touched a Good Delivery 400 oz Gold Bar throughout their entire working career.

As well, since the LBMA established its dominance in the physical gold ton game, the daily west vs. east compounding daily gold price discovery leaves doubt. Much of what is perceived as gold price discovery has likely meant a more sophisticated western gold fiat price containment over the last three decades or longer. Similar to the attempt made to contain the gold price after World War 2 through the late 1960s with the country conspiring price rigging London Gold Pool.

-

-

Lacking Gold Ton Transparency Adds to Smaller 1 kilo Gold Bar Good Delivery Demand

The world's number one gold consuming and the gold-producing nation is now China.

Her gold bullion buying natives do not trust large 400 oz gold bars. They prefer smaller 1-kilo gold bullion bars, which are easier to test for authenticity using noninvasive methods like ultrasonic sound speed tests.

If tungsten inserts were ever involved in these smaller sized 1-kilo good delivery gold bars, virtually any qualified gold bullion depository would find that out upon delivery when checking physical gold bullion bar deposits with sonar or other non-invasive methods.

How many potential fakes or encumbered 400 oz gold bars are currently within the LBMA's "closed loop" system?

-

-

The high ninety percentile of 400 oz gold bars held in government central bank vaults are most likely genuine. Recent eastern good delivery gold bullion trends suggest that many 400 oz gold bars may continue to get refined into smaller 1-kilo and 1 oz gold coin size lots in the decades to come.

Gold will undoubtedly become prohibitively more costly by the troy ounce long term, and emerging physical gold bullion buying and saving investors will likely get larger in numbers too (e.g., India, China).

Thank you for visiting us here at SD Bullion.

***