Ever since 2013, The Chinese Gold & Silver Exchange Society (CGSE) has been building out the Belt and Road Initiative for payment settlement and arbitrage opportunities for 1 kilo gold bullion bars and offshore Chinese yuan renminbi payments.

Here is a short synopsis on who the CGSE is and how they operate their physical gold bullion exchange.

The following is an explanation of the "One Belt One Road" process and Chinese achievements thus far.

Building a Belt and Road Gold Corridor in Asia

CGSE explains how it is facilitating settlement and creating arbitrage opportunities for physical gold and CNH between various gold and CNH pools at different locations (Hong Kong, ASEAN and countries along the Maritime Silk Road). by The Chinese Gold & Silver Exchange Society (CGSE)

The Belt and Road Initiative, BRI in short, is a cultural and economic strategy proposed by Chinese President Xi Jinping in 2013.

It is described as a gigantic project aiming to connect over 65 countries in Asia, Europe and Africa along land and sea trade routes, known respectively as Silk Road Economic Belt and Maritime Silk Road.

The collaborative effort will be focused on infrastructure building, financial connectivity, and disentangling commercial disputes between fellow countries.

Both Hong Kong and Singapore, given their exceptional geographic locations, well-developed financial and legal systems, and their functions as key offshore Chinese renminbi (CNH) clearing centers, are well placed in Asia to facilitate and support the initiative.

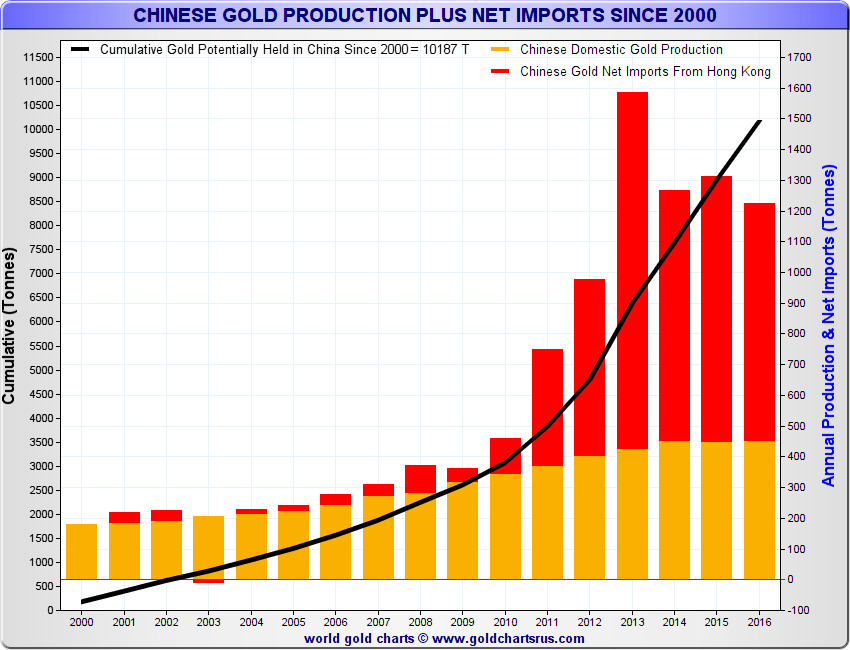

China has been the fastest growing gold market and largest importer of gold in the world. The estimated volume of gold import is 1,000 metric tons in 2017.

What is Qianhai Gold and how does it work?

Qianhai Gold are contracts traded and settled in CGSE’s clearing system in Hong Kong.

CGSE sees the great opportunities offered by the ever-growing Chinese gold market together with the setting up of the Qianhai free trade zone, the Belt and the Road initiative and the Greater Bay economic co-operation circle. CGSE, therefore, envisages the establishment of a well-regulated CNH-denominated gold trading platform in Hong Kong designed and geared particularly to take advantage of all its strategic benefits to further promote gold trading in and between China, Hong Kong and the rest of the world.

Plans for the new trading platform are underway. The main features of the system as envisaged are as follows:

- Each contract will be backed by the full amount of gold and CNH.

- Central clearing system for all contracts among members.

- Selected banks from China, Hong Kong and Macau will take part in the settlement process.

- Central reserve of collaterals in gold and/ or cash as security for the performance of contracts traded on the platform to afford protection to participating members.

- Introducing gold lending and financing facilities to facilitate and encourage trading on the platform.

- Provision of vault storage facilities in Hong Kong and Qianhai by CGSE to facilitate settlement and physical delivery of gold under contracts traded and cleared on and by the clearing platform.

- Set good delivery standard with accredited and approved list of gold refineries.

- Contract settled with 9999 Gold kilo bars and CNH (Chinese yuan renminbi currency).

CGSE is in the final stages of discussions with various stakeholders on the technical and other details of setting up the clearing and settlement platform, including settlement banks, CGSE members, bullion traders, vault operators, system solution experts, and more. It is expected that the plans will be finalized in the coming months and that implementation will begin as soon as possible.

CGSE foresees that the new infrastructure will benefit the gold markets not just in China and Hong Kong, but also all countries engaged in gold trading in Asia. In particular, they include ASEAN countries and countries along the Belt and the Road. The advantages and benefits offered by the new system include:

- A better regulated and organized clearing and settlement system with international credibility.

- CNH-denominated trading to utilize the huge CNH overseas deposit (estimated at RMB 700 billion); trading activities to increase demand for and release of more CNH and activate the CNH market, which in turn would enhance trading volume.

- Banks engaging in settlement can develop their transaction banking activities and credit and financing business. In the long run, this helps in the greater integration of onshore renminbi and the gradual internationalization of renminbi and the Chinese gold market.

- Facilitating the delivery and import of gold into China, especially the Shenzhen area, with a future plan to set up a bonded warehouse in Qianhai. This would reduce storage and transportation costs, facilitate arbitrage, location swap and product swap of gold in different countries in the region

In summary, the new Qianhai contract aims to integrate clearing, settlement, financing and storage under one system in which participants will conduct business in Hong Kong, a free trade port with no barriers tariffs on imports and exports, under a common law legal system.

About The Chinese Gold & Silver Exchange Society

The Chinese Gold & Silver Exchange Society (CGSE) was founded in 1910 and is the only legally recognized physical gold exchange in Hong Kong. CGSE oversees the trading and settlement of gold trading in the Hong Kong gold market, one of the most vibrant gold markets in the world.

The average daily turnover of the existing CGSE trading platform averages approximately 250 tonnes of gold, worth roughly US$10.2B in money terms.

Of course Chinese debt levels are growing at a never before seen pace in human history.

But so too are her increasing debts owed to her (and thus growing influence) upon startegic resource-rich neighboring countries as well...

“Angola repays its $25 billion debt to Beijing with crude oil” = Take USD, lend USD to Angola, take payment in oil, then either consume or re-sell oil or refined products in CNY, & voila! USD converted into CNY. https://t.co/99r8lu07qg

— Luke Gromen (@LukeGromen) May 13, 2018

Brilliant front-page of Angolan newspaper "Expansão"... about the country's debt.

"Every Angolan owes 754USD to China, 106USD to Israel, 63USD to Russia, 41USD to Brazil, 21USD to Portugal." pic.twitter.com/MOaVZUoj0N

— Zenaida Machado (@zenaidamz) May 11, 2018

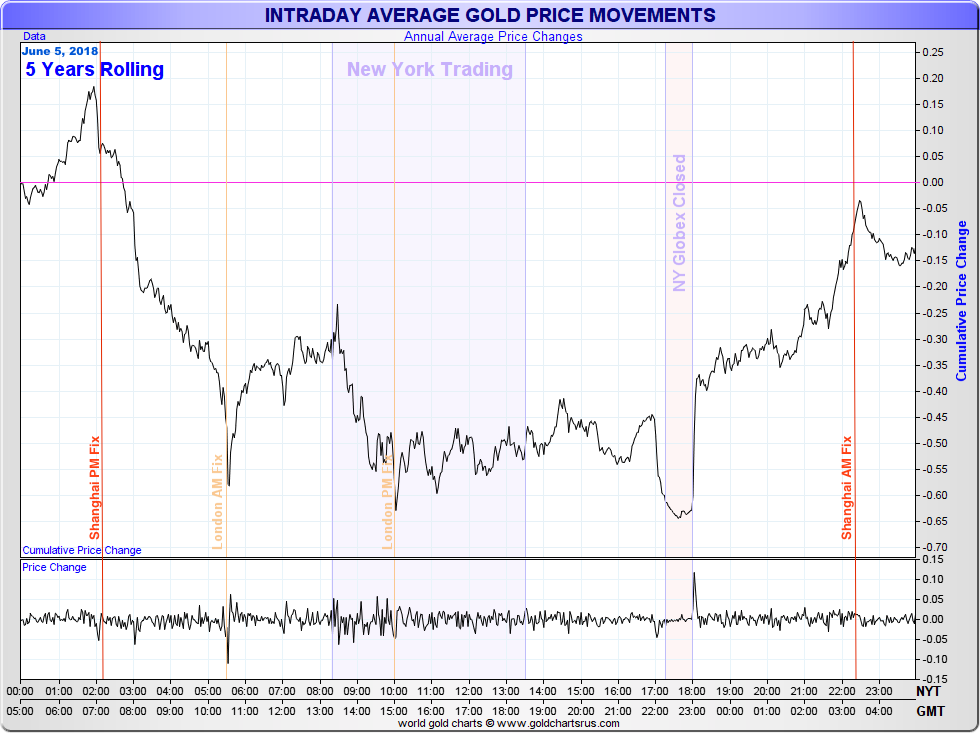

For those paying attention, the following is 5 years of rolling average 24 hour gold price performance data reflected in the chart below.

Notice how gold responds positively once the western world mostly calls it a day in gold future contract tradings. The east is most obviously going long the gold price on average.

***