Jump To: Size Comparison Chart | How Heavy is Gold? | Types of Gold Bars | Common Gold Bar Sizes | Gold Bars as an Investment | FAQs

Among common gold bar sizes, the most popular is the 1 troy ounce bar, equivalent to 31.1035 grams (1.097 regular ounces). Central banks, in turn, use the 400-troy-ounce Good Delivery bar, equivalent to about 13 kilograms and widely traded among bullion dealers.

Key takeaways

-

Gold bars come in different sizes across the world, ranging from 1 gram to the largest gold bar used in global markets, the 400-troy-ounce Good Delivery bar, weighing around 13 kg.

-

Gold weight is measured in troy ounces, with the 1 oz bar being the most popular due to its balance of liquidity and affordability.

-

Larger bars usually carry lower premiums per ounce, while smaller bars offer easier resale and greater flexibility.

Size Comparison Chart

See below a comprehensive chart comparing the different sizes of gold bars available in the market: their main advantages and disadvantages, and how they differ in terms of investment approach and profile.

|

Gold Bar Weight and Size |

Investment Strategy (Why people Invest In Them) |

Weight in Troy Ounces (oz) |

Premium over Spot |

Liquidity |

Storage Needs |

|

1 gram |

Entry-level investment & small savings; bertering. |

0.032 oz |

Very High |

Usually Very High |

Very easy |

|

5 gram |

Beginner investment & small-increment stacking, still high cost per gram. |

0.16 oz |

High |

Usually Very High |

Easy |

|

10 gram |

Balanced entry size; moderately suitable for early portfolio building. |

0.32 oz |

Moderate |

Usually High |

Easy |

|

20 gram |

Mid-range, still highly liquid. |

0.64 oz |

Moderate |

Usually High |

Easy |

|

50 gram |

Balanced medium size, lower premium than smaller sizes, with still solid liquidity. |

1.61 oz |

Lower |

Usually High |

Moderate |

|

31 grams |

Many individual investors prefer them because they offer a perfect balance, combining the ability to quickly buy and sell with a significant amount of gold involved. |

1 oz |

Lower |

Usually Very High (Global Standard) |

Moderate |

|

100 gram |

Serious accumulation, good balance of cost efficiency and resale flexibility. |

3.22 oz |

Low |

Usually Medium-High |

Better secure storage is required. |

|

250 gram |

Wealth building: popular mid- to large-bar for longer horizons. |

8.04 oz |

Lower |

Usually Medium |

Secure storage recommended |

|

500 gram |

Substantial holdings, cost-efficient but less easily sold in parts. |

16.08 oz |

Lower |

Usually Medium |

Secure vault |

|

1 kilogram |

Institutional investors' favorite: Long-term wealth preservation, lowest cost per gram, best for large allocations, but less liquid. |

32.15 oz |

Lowest |

Usually Lower |

Best in vault storage |

How Heavy Is Gold?

In precious metals, the weight of products like bars and coins is measured in troy ounces, a unit dating back to the Middle Ages, with one troy ounce approximately equal to 31.10 grams.

Gold is among the densest metals on Earth, with a density of about 19.3 grams per cubic centimeter.

While it is not the densest metal, osmium (Os) holds that distinction at roughly 22.59 g/cm³; gold is nearly twice as dense as silver. As a result, a one-kilogram silver bar is almost twice as thick as a gold bar of the same weight.

Type of Gold Bars

Knowing the density of gold is essential when buying gold bars because it helps verify authenticity, assess value accurately, and understand why gold bars look and feel the way they do.

They are generally produced by both sovereign mints and private refineries, meeting strict standards for shape, weight, and purity.

Check the main types of gold bars.

Cast Bars

Cast gold bars are among the most basic forms of bullion, produced by pouring molten gold into molds. The manufacturer's name, weight, and purity are engraved afterward.

They’re simple in design, often available in larger sizes, and come with lower premiums due to their ease of production. However, their rough appearance can make them less appealing to buyers, reducing liquidity.

Mandatory markings on gold bars include the serial number, assay stamp of an acceptable refiner, fineness, and the year of manufacture.

Minted Bars

Unlike cast bars, minted bars have a polished and refined appearance. They are often gold blanks minted or stamped from rolled gold sheets and embellished with details and designs.

They tend to be more liquid, often with security features such as holograms, serial numbers, and assay certificates. The precise manufacturing, inspection, and polishing make them more visually appealing, frequently leading to higher premiums.

Common Gold Bar Sizes

Small Bars

Small bars offer divisibility and high liquidity, whereas a larger bar would require you to sell the whole piece to assess its value.

With small bars, one can easily enjoy the gold price spikes, making it an excellent option for those investors trying to understand how the market works.

These are the most common sizes considered small gold bars:

-

1/100th troy ounce;

-

½ gram (0.016 troy oz);

-

1 gram (0.032 troy oz);

-

2 grams (0.064 troy oz);

-

2,5 grams (0.80 troy oz);

-

5 grams (0.16 troy oz);

-

10 grams (0.32 troy oz).

Take a look at this example. Even though the 50 x 1 g Valcambi Gold CombiBar - In Assay, which is more than one troy ounce of gold, can be physically split into 50 one-gram gold bars, making it easy to trade.

Medium Bars

Medium Bars can offer the main features of both large and small bars, combining liquidity and long-term wealth protection.

Investors can easily afford medium-sized bars while diversifying their portfolio with a secure option.

Here's a list of those gold bar sizes:

-

20 grams (0.64 troy oz);

-

1 troy oz;

-

50 grams (1.6 troy oz);

-

100 grams (3.22 troy oz).

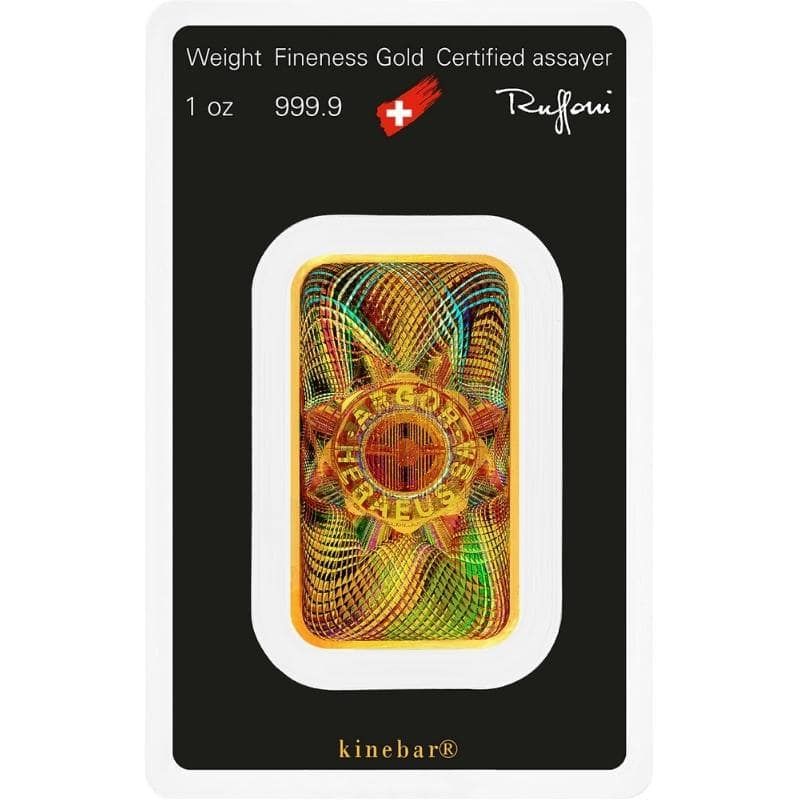

The 1 oz Gold Kinebar contains .9999 fine gold, shaped with smooth, rounded edges and an elegant design. Kinebar Technology delivers stunning colors and provides additional security measures to prevent fraud.

In addition to a unique serial number, the bars come with an assay card to certify their authenticity and identity.

Large Bars

Large bars are more cost-effective per ounce because they have a lower overall premium. Institutional and individual Investors often turn to larger bars when they want a long term wealth protection.

Check the large bars below:

-

5 troy oz;

-

250 grams (8.04 troy oz);

-

10 troy oz;

-

500 grams (16.08 troy oz);

-

1 kilogram (32.15 troy oz);

Gold Bars as an Investment

The standard gold bar held and traded internationally by central banks and bullion dealers is called the Good Delivery bar and weighs 400 troy ounces.

Investment-grade gold bars must have a minimum fineness of 995 parts per thousand (or 99.5% minimum purity) to be classified by the London Bullion Market Association (LBMA) Good Delivery bar.

LBMA lists these bars and should meet a range of standards to be included:

-

fine gold weight;

-

purity

-

physical appearance (markings and surface quality);

-

reliability of the brand.

Choosing the Right Gold Bar for you Investment Goals

While there are many sizes and weights of gold bars, each gold ingot represents a different investment strategy and set of investment needs.

Understanding how much does a gold bar weigh helps seasoned and first time investors choose the right size for both purchase and sale, balancing liquidity, storage needs, and long-term value preservation.

FAQs

How much does a bar of gold cost?

A bar of gold does not have a fixed cost. Its price depends on the current spot price of gold, the bar’s weight (in troy ounces), and any dealer premium. Nowadays, gold is about $4,340 per troy ounce. So a 1-ounce bar costs roughly that, plus a small premium; a 10-ounce bar about $43,400; and a 400-ounce bar about $1.7 million before premiums.

How heavy is a standard bar of gold?

In retail markets, a standard gold bar weight is one troy ounce (about 31.10 grams). In global bullion markets, the standard weight for a London Good Delivery bar, which is around 400 oz (about 12.5 kg), is used in institutional trading.

What is a gold bar really worth? Its weight only?

A gold bar’s true worth is based mainly on its intrinsic value, which comes from its gold content and weight. However, its value is also shaped by history, scarcity, and gold’s long-standing role in trade, wealth preservation, and as a symbol of power.

How big is a gold bar?

Not all gold bars are the same size, as they come in various sizes and bar form designs. A typical one-troy-ounce gold bar measures around 40.4 × 23.3 mm, with a thickness of around 1.9 mm. For example, the popular and affordable 1 oz PAMP Suisse Lady Fortuna bar measures approximately 41 × 24 × 1.66 mm.