Hello Metals & Markets listeners out there, today is Friday September 14, 2018.

I am your host James Anderson of SD Bullion, and this week we will do a curated tour of some recent notable commentaries and choice media coverages, a decade since the 2008 collapse of Lehman Brothers.

We will also cover some trial balloons in the financial media in regards to responses for the next recession.

As for the precious metals this week, gold and silver have mostly traded sideways and appear to be closing their week trading flat.

Gold spot price in US dollar terms is closing just under $1,200 oz, with Silver spot right near the $14 oz level.

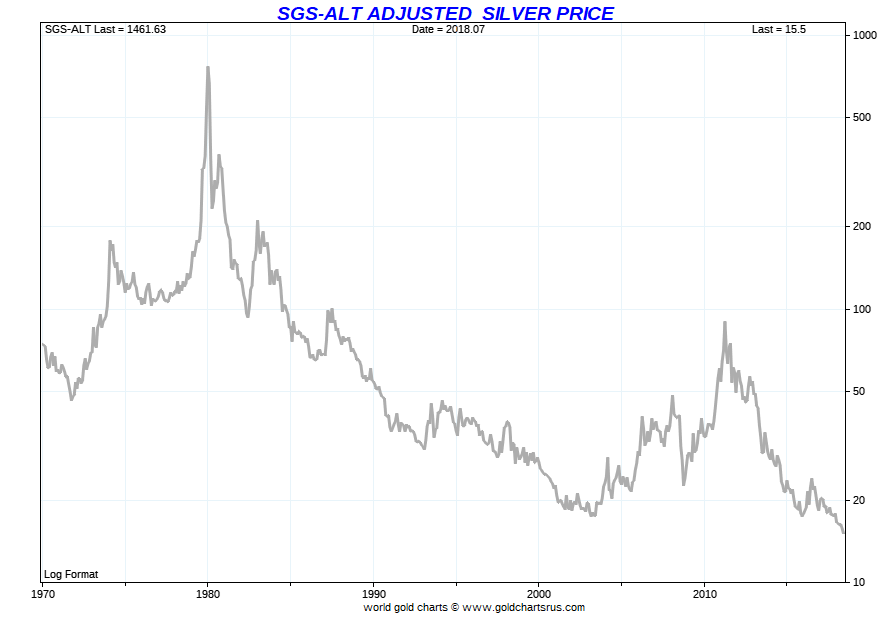

Although still nominally priced well above their 2008 price lows, gold and silver are now the cheapest they have ever been throughout this full fiat currency era when one uses 1980 methodologies of measuring inflation. The way in which US government officials used to measure inflation before they started consistently rigging the data to underreport price increase levels.

This week, if you have consumed any mainstream financial press, chances are you might have felt like you were wading through a myriad of half truths and over simplifications as to how the 2008 financial crisis came about.

Like everyone listening to this podcast I myself have my own experiences, world views, and biases. But instead of just letting the lapdog financial press get in all their talking points w/o any rebuttals, I figured I would present a curated coverage on this daunting subject matter for the record.

My hunch is that the vast majority of you lived through 2008 and have studied it since, so I will just cut to my curation and commentary.

But first, FAIR WARNING: much like 9/11, this subject matter can produce triggered rants, political, racial, and tribal like belligerency.

I purposely sourced many critics from the left side of the political spectrum to illustrate how much many of our likely mostly conservative audience has in common.

At a minimum in knowing a truly capitalist system, we did away with long ago.

We begin with CNBC who interviewed one enabler of the 2008 financial crisis, plus two other fellow overseers of the multi trillion dollar bank and financial bailouts that followed.

First you will hear a stumbling Freudian slip by Hank Paulson, followed by former Federal Reserve head Ben Bernanke shuffling away large portions of the blame and backlash that have surely somewhat obstructed his path since.

Moving along to Bill Clinton's late 20th Century repeal of the 1933 Glass Steagal Act which used to lawfully segregate large commercial banks from gambling with depositor funds.

Only 9 years following that law's repeal, Wall Street imploded and took the world economy with it.

Of course there have been average citizens who've protested and resisted these events, all along the way.

Some of these persons run one of the best online criticisms of Wall Street shenanigans and complex white collar criminality. Their website is WallStreetOnParade.com, one of the purveyors is named Pam Martens. She worked on Wall Street for 21 years.

The final decade of her career, she was an outspoken critic of Wall Street's corrupt practices, including its privately run justice system. Here is Pam Martens in 1998 testifying to the Federal Reserve, against the repeal of the Glass Steagall Act which one could argue its repeal may continue to lead to the somewhat Japanaziation, of our current US financial system.

Quickly retouching on the potential further Japanization of the US stock market, both Pam Martens and her husband this week covered on their website various trial balloon stories in the financial arena floating the idea that the Federal Reserve should have the legal option to buy stocks outright in the next financial crisis.

Of course Japan, Switzerland, and other government wealth funds are already heavily trading stocks. Many would argue the Fed is also doing likewise through proxies, but the idea of the Fed doubling its over $4 trillion USD balance sheet to buy equities was explicitly covered by two sources of which I will link in the show notes for you to find.

As for commodity markets, it's public record that the CME group incentivizes central bank commodity market trading, where often majority price discoveries for various raw goods, energies, and precious metals take place.

Turning our attention to how many average citizens currently think about the financial system, and more specifically results of the 2008 Financial crisis.

Democrat Elizabeth Warren breaks down in 2 minutes how many people feel about the trillions in bailouts and their resulting outcomes.

Popular journalist Matt Taibi covered the financial crisis heavily since 2008. He was recently triggered with feelings of anger after again writing on this 10th year anniversary of the financial crisis. I will backlink his latest writings in the show notes as well.

To more easily frame the sheer magnitude and scale of the 2008 market intervention.

Matt cites in a recent Rolling Stone piece, that since 9/11 the War on Terror, has cost the USA about $6 trillion. Listeners might also cite unaccounted for multi trillions by the Pentagon over this same timeframe.

Yet also, the 2008 Financial bailouts were estimated to be as high as $29 trillion in total.

Of course this comparison of the two events and fallouts to follow, somewhat trivializes larger losses of life in the middle east with the former event especially when compared to the later. But one can easily argue both episodes have shaken our culture and its faith in virtually every institution, once perhaps thought better than they are now.

Here's Matt speaking about his experiences covering the Financial Crisis on Joe Rogan's popular podcast earlier this year.

Speaking of mainstream financial press, you can perhaps get no higher a seat in that arena than John Authors of the Financial Times in London.

He wrote a recent article citing his very own experience during the Lehman Brothers collapse in which he admits now to have not fully covering key details of the size and scope.

I will read direct from his recent FT article in his own words.

In this same FT article, John Authors failed to mention anything about current bank bail-in legislation signed into law by the largest G20 nations. This relatively new law basically makes holders of bank accounts larger than $250,000 USD on the hook as unsecured creditors if another large commercial bank some how fails again.

The final point I would like to make before ending this week's podcast is by studying mainstream financial media talking points this week, one can already hear the chorus and the warnings about the next financial crisis begin larger than just the banks in the next iteration. Now being called into question is the future strength of the US dollar with increasingly rising debt and unfunded liability levels.

I'm not saying the US dollar will crash tomorrow, it may actually strengthen further in the short to medium term which is good news for those looking to acquire more precious metals at or perhaps even lower than today's depressed prices.

What I am saying though, is that the world at large faces a present and future likely full of unplayable debts and promises made.

My expectation is the in coming years, many promises made will go undelivered upon, or at the very least, heavily devalued.

Now is likely a good time to be acquiring assets currently out of favor.

Thanks for watching, we'll see you next week.

***