In this edition of Superinvestors, Jesse Felder interviews Fred Hickey starts at 2:01 in.

Around the 36 and 1/2 minute mark, Fred gets into his thesis for Precious Metals and Gold beginning in earnest in 2001.

Fred Hickey has been writing The High Tech Strategist, a monthly investment newsletter, for over 3 decades.

He like many fellow precious metal investors today, lament having to be so long bullion and precious related assets given what central banks and governments have been doing in the financial sector these past many decades.

Fred has developed an intensive research process focused on the tech sector that gives him extensive familiarity with dozens of individual companies within it along with unique insight into the broader economy.

In this podcast, Fred discusses what his research routines look like on daily and monthly basis and how his discipline with newsletter writings has helped him become a better investor.

Fred also tells a story meeting legendary investor Sir John Templeton near the peak of the dotcom mania and what he learned from that poignant experience.

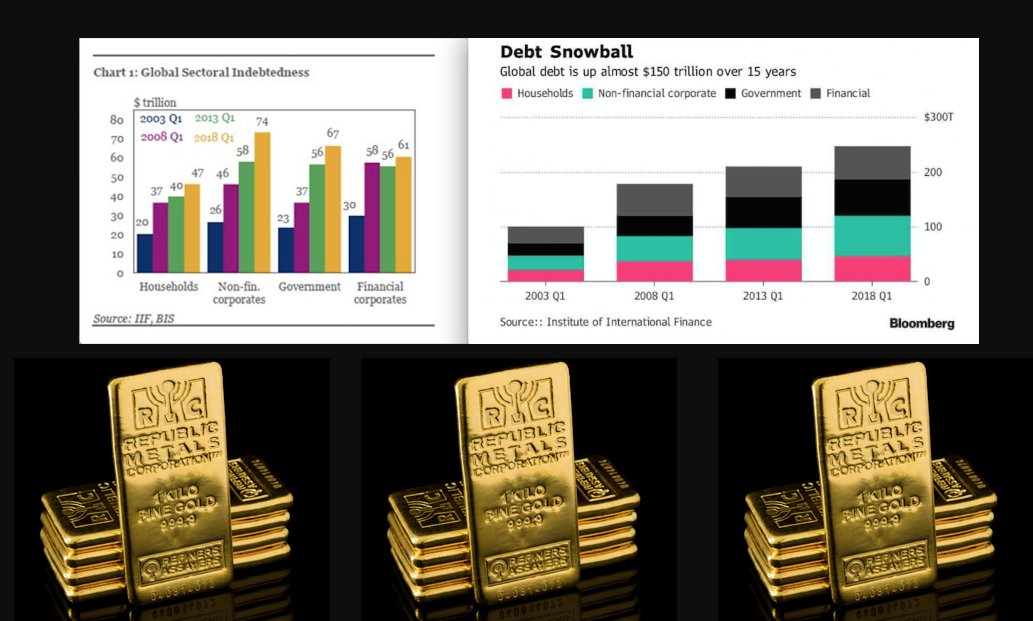

Reasons for having to allocate to precious metal investments, Fred cites various central bank actions which have taken total global debt levels to now likely over $250 trillion USD now in September 2018.

In addition, we discuss how Fred has incorporated a macro approach into his micro-focused investment discipline and why he now chooses to spend so much time in Costa Rica during US winters these days.

Below are a few notes and links related to Jesse Felder and Fred Hickey’s conversation.

-

You can follow Fred on Twitter @htsfhickey