On this week’s SD Metals & Markets podcast we welcome back returning guest Louis Cammarosano from Smaulgld.

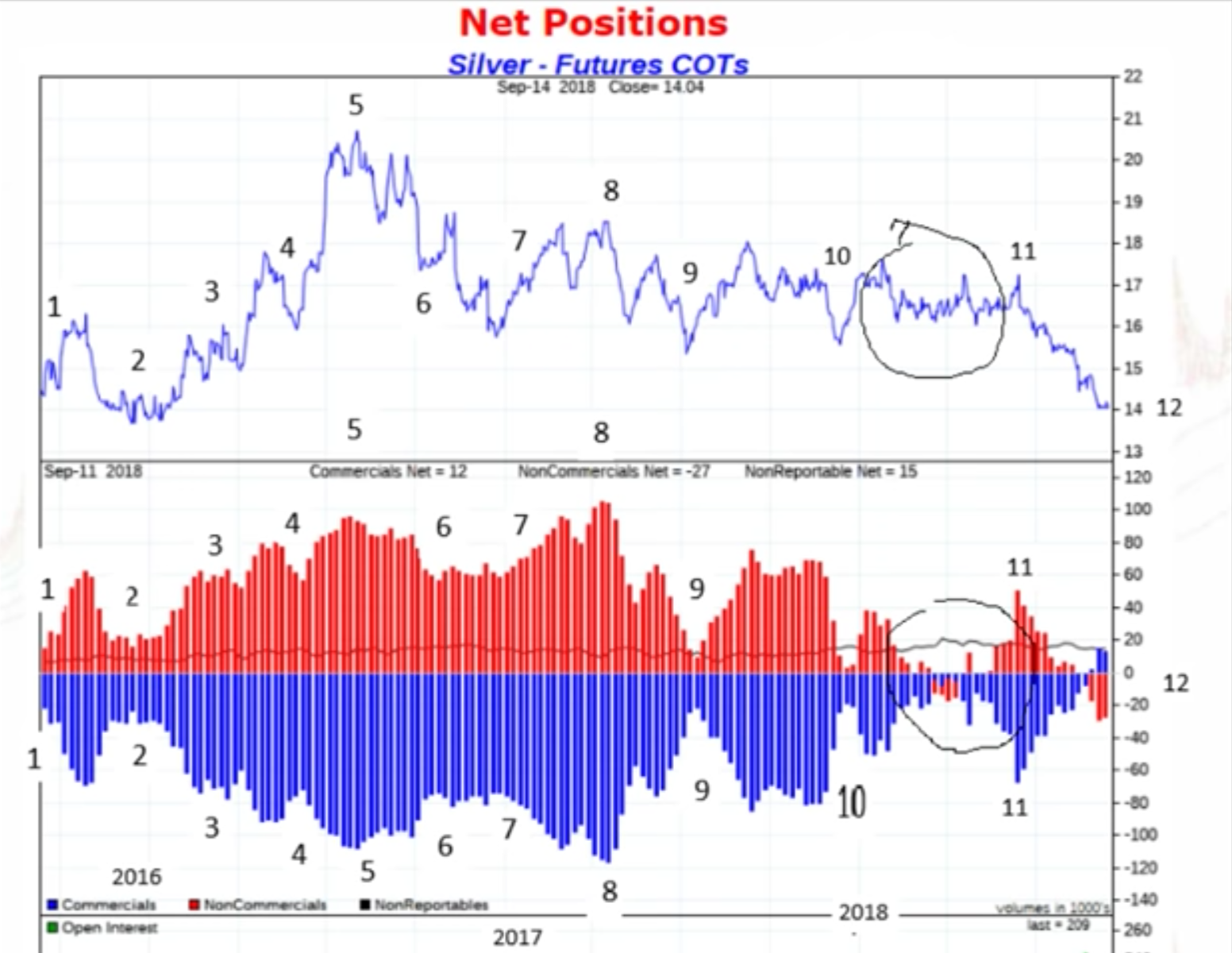

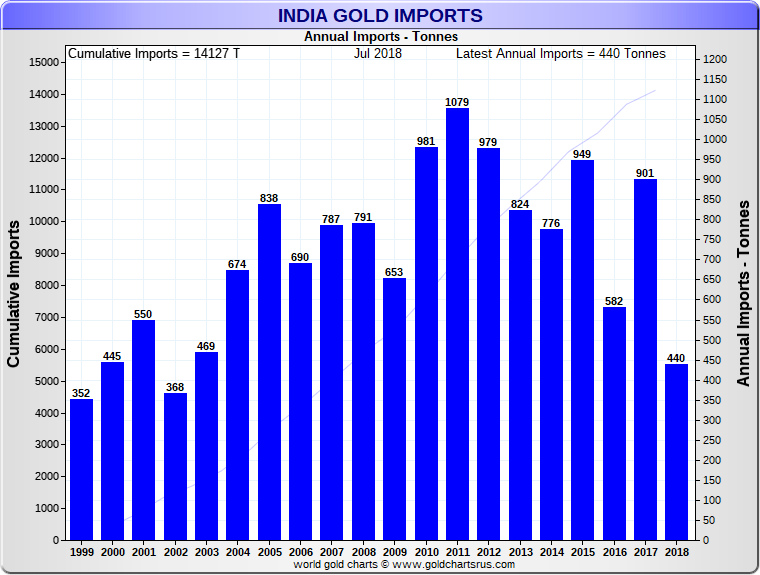

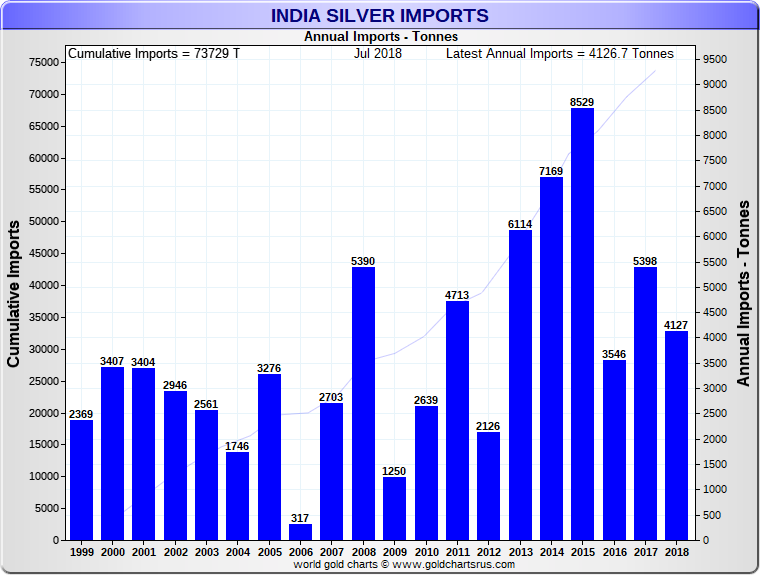

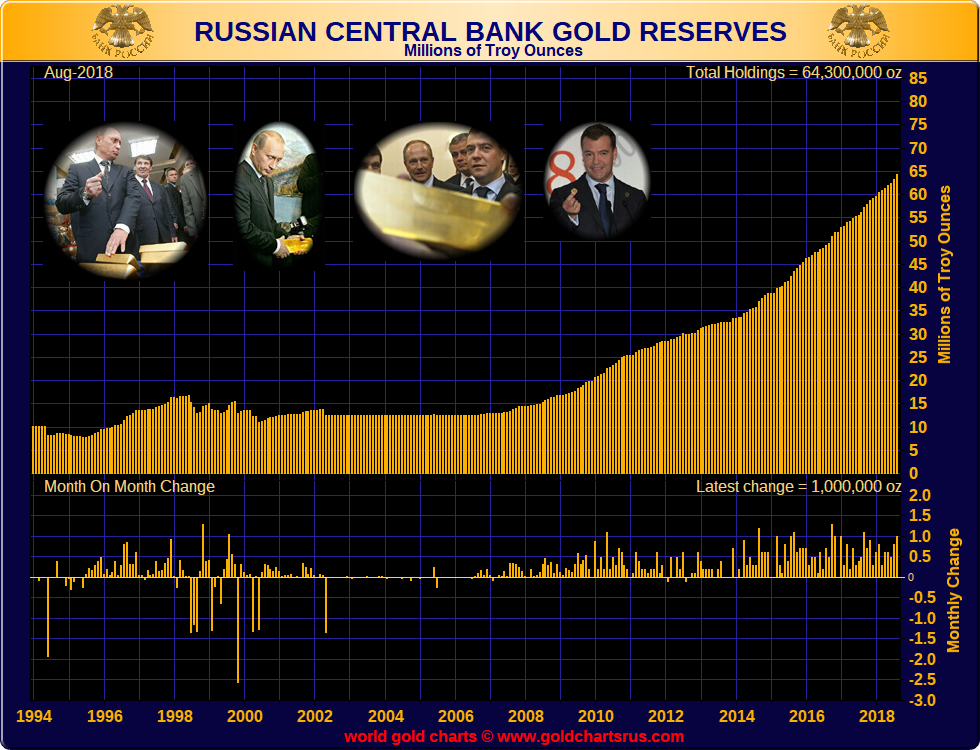

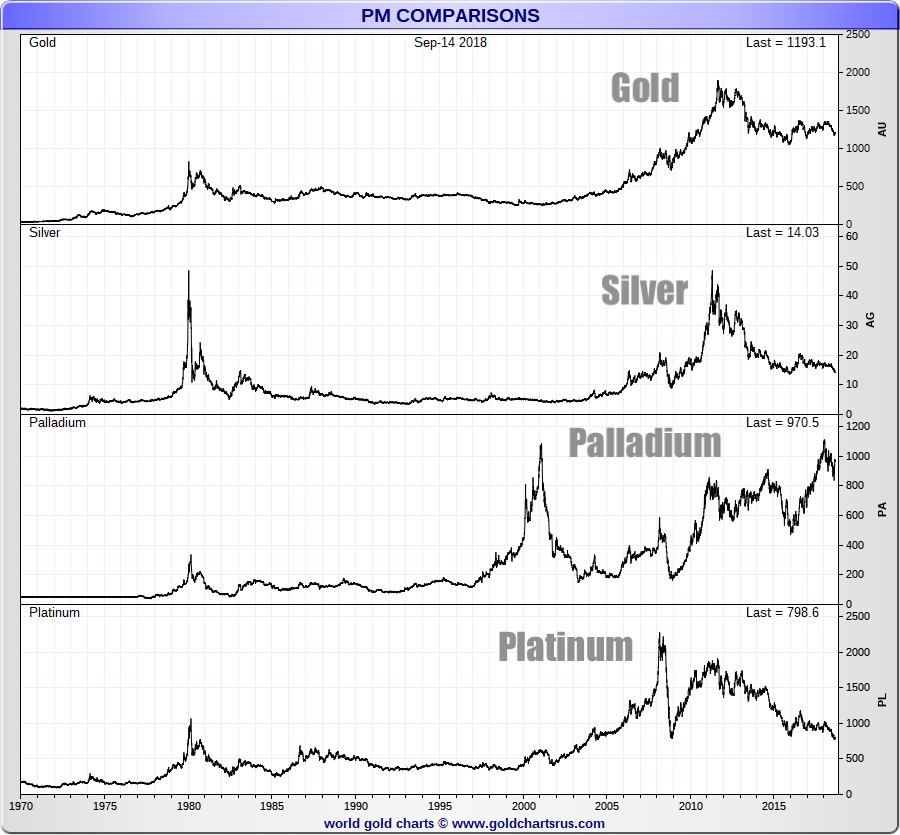

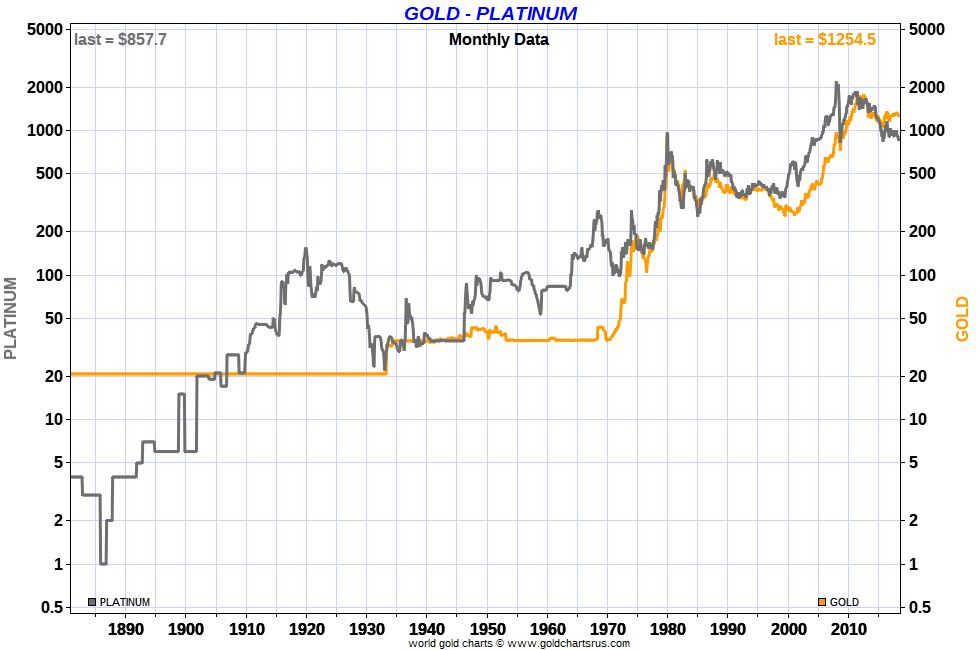

Louis and James Anderson of SD Bullion discuss a wide range of topics including COMEX COT reports, physical gold and silver flows, Sunshine Minting Inc. private mint product sellouts, as well as platinum, palladium, copper, and even aluminum.

Thanks for tuning in this week.

Charts and other subjects discussed below:

#USMint's Gold Eagle /

— James Henry Anderson (@jameshenryand) October 17, 2017

Buffalo #Coin planchets suppliers:

-Sunshine Minting Inc.

-LeachGarner

-Gold Corporation

➤https://t.co/uqWlu5ffu4 pic.twitter.com/HiXt1us02b