When it comes to investing in precious metals, there’s no shortage of opinions — and let’s be honest, a few tall tales too. Gold and silver have been trusted stores of value for centuries, but somehow, there are still some myths and misconceptions about investing in them.

Today, we're busting five of the biggest misconceptions that might be holding you back from diving into the shiny world of bullion.

1. “You need to be rich to invest in precious metals.”

Let’s kick this off with a classic. Yes, gold bars look like they belong in a billionaire’s vault, but that doesn’t mean you need a yacht and a butler to get started.

In fact, many gold and silver coins or rounds come in fractional sizes, meaning you can invest at a level that works for you. You can start stacking silver with just a few bucks. Seriously.

1/4 oz Silver Rounds - Design Our Choice

2. “Gold is outdated—it’s just a ‘grandpa’ investment.”

We love grandpas, but this one’s way off. Gold isn't stuck in the past — it's stood the test of time for a reason. It’s been used as a hedge against inflation, currency devaluation, and economic uncertainty across every generation.

Plus, in an increasingly digital and unstable financial world, tangible assets like gold and silver are gaining new relevance. So if anything, gold’s kind of a timeless rock star.

2025 1 oz American Gold Eagle Coin BU

3. “You can’t spend gold or silver, so what’s the point?”

While it’s true you won’t be buying coffee with a silver round (unless your barista is really into metals), that's not the point. Precious metals are about preserving wealth, not replacing your debit card.

In times of economic distress, they can be traded, bartered, or sold when fiat currencies lose value. Think of them like a financial seatbelt — you hope you don’t need it, but you’ll be glad it’s there when you do.

90% Constitutional Silver Coins

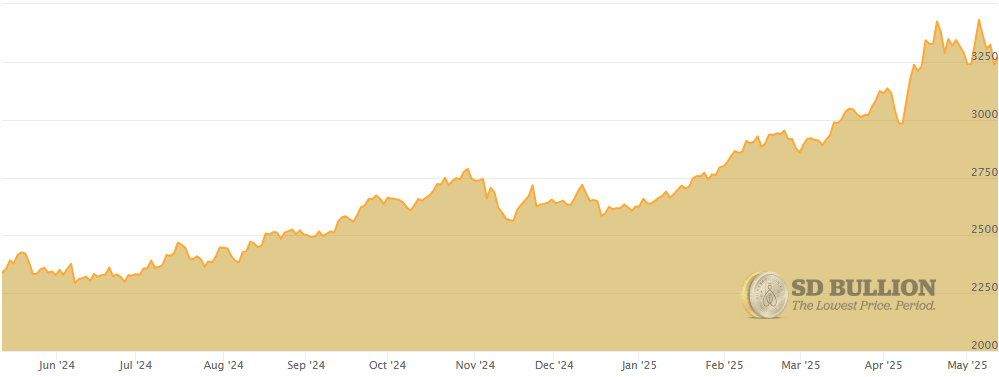

4. “It’s risky — prices go up and down all the time!”

Let’s be clear: all investments carry some level of risk. But compared to high-volatility assets, such as meme stocks and cryptocurrencies, precious metals tend to be more stable over the long term.

They may not double overnight, but they offer a cushion when the rest of your portfolio is doing backflips.

We have pricing pages with current prices, charts, historical data, and more information, so you can do your research and stay up-to-date on everything related to precious metals.

5. “It’s too complicated—I wouldn’t even know where to start.”

We get it. Walking into the world of bullion can feel intimidating at first, but that’s where we come in.

At SD Bullion, we make it easy to understand the basics, compare prices, and find trusted products. Whether you’re into coins, bars, or rounds, you’ll find options that fit your goals—and your budget.

Check out these top tips for new investors from our CEO, Chase Turner, on how to buy gold and silver.

Final Thoughts

Investing in precious metals doesn’t have to be confusing, exclusive, or reserved for Wall Street insiders. Once you cut through the myths, you’ll see that gold and silver are more accessible, practical, and versatile than you might’ve thought.

Ready to start stacking with confidence? Check out our Beginner’s Guide to Precious Metals or explore our best-selling bullion products today. And remember—when it comes to investing smart, it never hurts to add a little shine to your portfolio.