Jump to: Birth of the Gold Standard | The Bimetallic Debate | Rise and Fall | Gold Confiscation Act | Bretton Woods Conference | The Fiat Era | Gold and Silver Today | Gold Standard Return?

Gold has fascinated humanity for millennia, symbolizing wealth, power, and stability across ancient civilizations. From the glittering artifacts of Ancient Egypt to the vast treasuries of the Roman Empire, gold has been a measure of value, a medium of exchange, and a safe haven during times of economic uncertainty.

While the use of gold as money dates back thousands of years, the concept of a structured “gold standard” emerged more recently, fundamentally shaping global economics for centuries.

Julius Caesar Assassination Eid Mar Coin

The Birth of the Gold Standard

The formal gold standard began in the 19th century, most notably with the United Kingdom’s adoption of the system in 1821. By fixing its currency — the British pound — to a specific quantity of gold, the UK set a precedent that other major economies would soon follow.

By the late 19th century, nations like Germany, France, and the United States had also pegged their currencies to gold, creating a global network of stable, gold-backed currencies. This system allowed for relatively stable exchange rates, facilitated international trade, and limited inflation.

The Bimetallic Debate: Gold and Silver

Before the full embrace of the gold standard, many nations operated under a bimetallic system, using both gold and silver to back their currencies.

The United States, for example, utilized a bimetallic standard in the 19th century, fixing the dollar’s value to both metals. However, fluctuating silver prices and discoveries of vast silver reserves led to instability, making a pure gold standard more appealing. By the late 19th century, most major economies had abandoned silver, further consolidating the dominance of gold.

The Rise and Fall of the Classical Gold Standard

The late 19th to early 20th centuries marked the height of the classical gold standard.

World War I, however, disrupted this balance. Countries suspended gold convertibility to fund their war efforts, leading to excessive money printing and inflation.

Despite attempts to revive the system during the interwar period, the Great Depression and the economic turmoil of the 1930s ultimately led to the collapse of the classical gold standard.

FDR’s Gold Confiscation: A Controversial Measure

In response to the Great Depression, U.S. President Franklin D. Roosevelt took a dramatic step to stabilize the economy. Through Executive Order 6102 in 1933, Roosevelt mandated that American citizens surrender their gold holdings — gold coins, bullion, and certificates — to the Federal Reserve in exchange for paper currency at a fixed rate of $20.67 per ounce. The order effectively criminalized private gold ownership beyond small amounts for numismatic purposes.

FDR at the Oval Office || Source

This unprecedented move aimed to boost the nation’s gold reserves and regain control over monetary policy. Following the confiscation, the government revalued gold to $35 per ounce, significantly devaluing the dollar.

While the policy helped fortify U.S. gold reserves, it also marked a controversial intrusion into private wealth and a departure from traditional economic freedoms.

Bretton Woods and the Last Glimmer

In 1944, as World War II neared its end, world leaders convened at Bretton Woods, New Hampshire, to establish a new economic order. The result was a modified gold standard where the US dollar was directly convertible to gold, while other currencies were pegged to the dollar. This established the dollar as the world's primary reserve currency, backed by the United States' substantial gold reserves.

Bretton Woods Conference in 1944 || Source

However, mounting deficits, the cost of the Vietnam War, and rising global inflation pressured the system. By 1971, US President Richard Nixon suspended the dollar’s gold convertibility, effectively ending the Bretton Woods system and severing the last official ties between major currencies and gold.

The Fiat Era: Prosperity or Precarity?

Since the collapse of the gold standard, fiat currencies — money without intrinsic value, backed solely by government decree — have dominated global finance.

While fiat currency allows for greater flexibility in monetary policy, it also leads to the risk of unchecked inflation, currency devaluation, and economic instability.

The financial crises of the late 20th and early 21st centuries have fueled debates about the sustainability of a purely fiat-based system.

Gold and Silver in the Fiat Currency Era: A Hedge Against Uncertainty

Despite the dominance of fiat currency, gold and silver have retained their roles as reliable hedges against inflation and economic uncertainty.

In times of financial turmoil, investors often flock to precious metals, seeking protection from the erosion of purchasing power. Gold, with its intrinsic value and historical significance, serves as a safe haven asset—a stable store of wealth when confidence in fiat currency falters. That is why many investors allocate part of their portfolios to bullion, such as gold bars and coins.

Silver, though more volatile in price, has gained traction as an accessible investment and a potential medium of exchange in scenarios of widespread economic collapse. The concept of “silver stacking” — accumulating silver coins and bars — has emerged as a strategy among those concerned about severe currency devaluation or the failure of the global banking system.

While the likelihood of such scenarios is debated, the demand for silver as a tangible asset underscores its enduring appeal.

For both gold and silver, the distrust in fiat currency fuels their demand, reinforcing their status as valuable, tangible assets that cannot be manufactured at will.

Could a Gold Standard Return?

As debt levels soar and confidence in fiat currency wanes, the idea of returning to a gold or gold-silver standard occasionally resurfaces.

Advocates argue that a gold standard could restore discipline to monetary policy, limit inflation, and strengthen currency value.

Critics, however, point out that a return to the gold standard could hinder economic growth, limit central bank intervention, and prove impractical given the limited global gold supply.

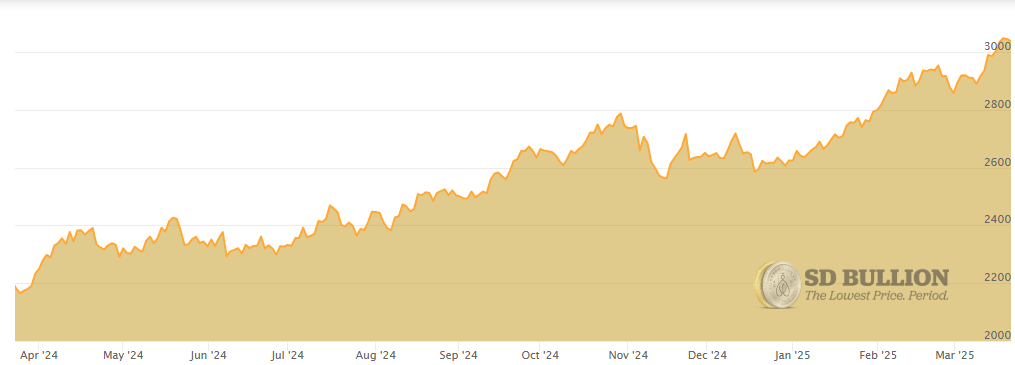

However, as we see gold prices soaring above $3,000.00 (three thousand dollars) for the first time ever in March 2025, it is undeniable that precious metals, as a whole, still play a significant role in the global economy.

A Shimmer of Hope?

While the likelihood of a gold standard’s return remains slim, the enduring allure of gold as a store of value persists.

In a world of unprecedented debt and fluctuating currency values, gold continues to symbolize stability in a sea of uncertainty.

Whether a return to the gold standard is a distant dream or a potential reality, the debate highlights the growing unease with the current monetary system — and the timeless appeal of gold itself.