In 2021, a single coin sold for a staggering $18.9 million at an auction. The 1933 St. Gaudens Gold Double Eagle shattered records and cemented its place as the most expensive coin in the world.

Stories like this might seem like outliers, but they shine a light on something often overlooked: coin collecting isn’t just about nostalgia or a hobby. It’s a pursuit grounded in history, rarity, and in some cases, real financial potential.

In this article, we’ll explore how coins move beyond their sentimental value to become tangible assets, touching on rarity, value appreciation, and how coin collecting can be an enjoyable hobby with the potential for a financial return.

Tangible Value and Rarity

Intrinsic vs. Numismatic Value

The coin mentioned in the introduction is a gold coin with a fascinating background, possessing both intrinsic and numismatic value. The inherent value reflects the coin’s composition, specifically, its content of precious metal.

Gold, being a noble asset, is often regarded as a safe haven and is frequently used by investors as a hedge against inflation.

In addition to its inherent worth, this coin holds significant numismatic value. This is due, in part, to its historical and artistic significance: it was crafted by Augustus Saint-Gaudens, an essential figure in American fine arts and widely acclaimed as the nation’s preeminent sculptor, depicting important American symbols such as Liberty striding forward and the Bald Eagle.

Rarity and Condition

Following the gold recall order signed in 1933 by President Franklin D. Roosevelt, double eagles dated from 1929 through 1932 have become exceedingly rare. Although the Mint produced nearly half a million 1933 coins, the government maintains that these were never officially released into circulation, making it illegal to own them. This coin was once owned by the King Farouk of Egypt and iconic shoe designer Stuart Weitzman.

It was stolen, hidden, owned by royalty, lost for decades, recovered by the U.S. government, and ultimately sold for millions as the only legal specimen in private hands.

Semi-Numismatic Bullion Coins

While traditional numismatic coins are often collected for their own sake, semi-numismatic bullion coins strike a unique balance between hobby and investment.

Struck by reputable mints, these coins usually feature special editions, various sizes, and exclusive designs, offering both aesthetic appeal and the potential for a solid financial return.

For collectors and investors alike, they present a compelling opportunity: the chance to own beautifully crafted pieces with enduring value. Available in both gold and silver, semi-numismatic coins combine the artistry of collectible coins with the reliability of bullion investments.

American Eagles

The American Gold Eagle is the official bullion coin of the United States and a top choice among investors worldwide.

Available in both gold and silver, it holds the number one spot domestically and enjoys strong global recognition. Its iconic design captures the essence of the American spirit, featuring Lady Liberty as a symbol of freedom and a majestic bald eagle representing the nation’s strength and courage.

Canadian Maple Leaf

Featuring the official portrait of King Charles III on the obverse and Canada’s iconic sugar maple leaf on the reverse, this coin blends national symbolism with refined design.

Its detailed inscriptions highlight purity, weight, and origin, making it a meaningful and highly collectible piece for investors and enthusiasts alike. A prime example of the Royal Canadian Mint's craftsmanship. This coin is 999.9 pure gold and comes in various sizes, including 1 oz, ½ oz, ¼ oz, 1/10 oz, and 1/20 oz.

Austrian Philharmonic

Highly prized across the European market, the Austrian Philharmonic bullion coins, available in gold, silver, and platinum, celebrate the universal language of music.

Named after the renowned Vienna Philharmonic Orchestra (Wiener Philharmoniker), the coin's design draws direct inspiration from Austria’s rich musical heritage.

The obverse of the 1 oz silver coin features the grand pipe organ of the Golden Hall in Vienna’s Musikverein. At the same time, the reverse showcases an elegant arrangement of orchestral instruments, including a Vienna horn, bassoon, harp, and four violins centered around a cello.

Thomas Pesendorfer, chief engraver of the Austrian Mint, masterfully created both designs.

British Britannia

The British Gold Britannia is one of the most respected bullion coins on the market, known for its high purity and imposing design.

Issued by the Royal Mint with a £50 face value, it contains 1/2, 1/4, 1/10, and 1 oz of .9999 fine gold and features enhanced security elements, making it both a reliable investment and a collector's favorite.

The obverse displays the official portrait of King Charles III, introduced in 2023 and designed by Martin Jennings. In line with tradition, the king faces to the left, and the inscription includes his name, face value, year of issue, and the Latin phrase “D.G. Rex F.D.”, meaning “By the Grace of God, King” in Latin.

On the reverse, Philip Nathan’s classic depiction of Britannia, a warrior holding a trident and shield, symbolizes the strength and spirit of Great Britain. The surrounding text highlights the coin’s purity, weight, and series.

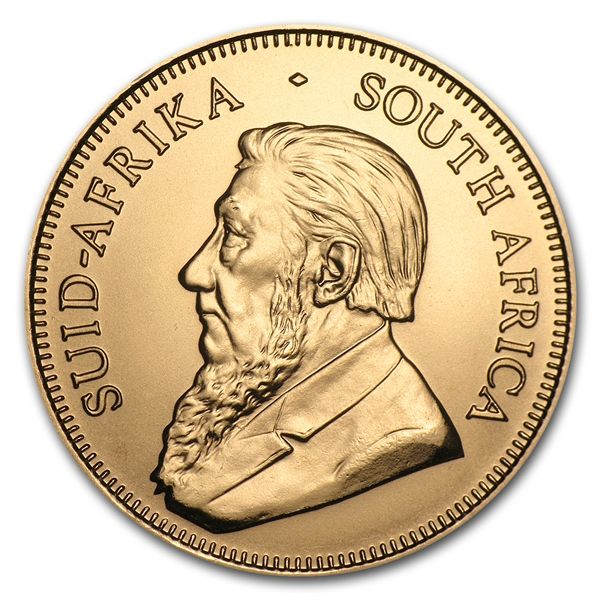

South African Krugerrand

The Gold Krugerrand is a pioneer in the bullion market and remains one of the most recognized gold coins worldwide.

First issued in 1967 by the South African Mint, it was the world’s first modern bullion coin and quickly dominated the global market. Struck in 22-karat gold (0.916 pure), each coin contains one troy ounce of fine gold and is valued based on its gold content, despite bearing no face value.

The obverse features a portrait of Paul Kruger, the first President of the Republic of South Africa. The reverse depicts the graceful Springbok antelope, the country’s national animal, referring to the country's majestic wildlife.

For over half a century, the Gold Krugerrand has been a trusted choice for investors seeking a reliable and cost-effective way to add gold to their portfolio. Its historical significance and enduring popularity make it a timeless asset in any collection.

Chinese Panda

The Chinese Gold Panda is a globally admired bullion coin known for its adorable designs and high gold purity.

First minted in 1982 by the China Mint, each year, the obverse features a new depiction of the Giant Panda, making the series especially appealing to collectors. Designs vary from solitary pandas to playful pairs, often surrounded by bamboo, with inscriptions for weight, purity, and face value.

The reverse shows the Hall of Prayer for Good Harvests in Beijing’s Temple of Heaven, with the inscription “People’s Republic of China” and the mint year.

With its unique design and trusted purity, the Gold Panda is a favorite among collectors and investors worldwide.

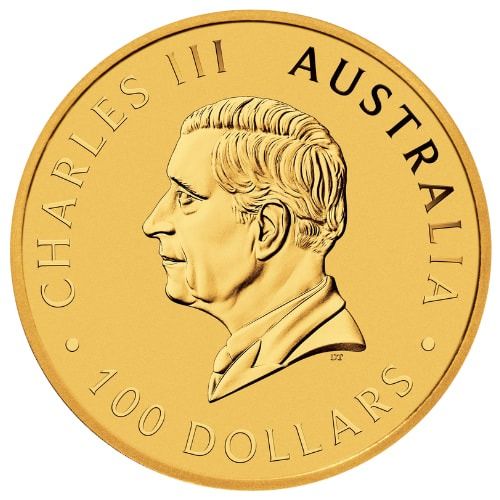

Australian Gold Kangaroo

The Australian Gold Kangaroo is one of the Perth Mint’s most memorable bullion coins, known for its annually changing designs and exceptional purity.

First introduced in 1986, the series celebrates Australia’s native wildlife, with each edition showcasing a new depiction of the kangaroo, an enduring national symbol of progress and vitality.

Struck from 1 oz of .9999 fine gold, the 2025 edition marks the coin’s 39th release and features a fresh reverse design along with advanced security features. The obverse features King Charles III, accompanied by inscriptions that denote Australia’s name, face value, and the monarch’s title.

With its blend of artistic appeal and investment-grade purity, the Gold Kangaroo is a favorite among both collectors and investors.

Legal tender in Australia with a face value of 100 AUD, it offers both beauty and bullion value in one trusted package.

Why do People Invest In Precious Metals?

There are several compelling reasons why individuals choose to invest in physical bullion. One of the main attractions is its status as a tangible asset, which can provide a sense of security during uncertain times.

It can also be a wise strategy to diversify one’s investment portfolio, as it tends to retain its value and can provide stability while other investments tied to fiat currency fluctuate or lose public trust.

Historically, gold has served as a reliable store of value, often acting as a haven during periods of economic or political instability. The United States once backed its currency with gold, and even today, central banks and financial institutions hold significant reserves of the metal as a safeguard against economic turmoil.

With its proven resilience and lasting value, precious metals, especially gold, have consistently stood the test of time as a trusted and successful investment option.