Jump to: Intrinsic Value | Types of Coins for Stacking | Market Considerations | Coin Stacking vs Coin Collecting | FAQs

Introduction to Coin Stacking

When thinking about the future, you have likely considered saving money to protect yourself from economic uncertainty or to eventually live off your savings. Even if you haven’t, many investors have. Among the various investment options, going from stocks to precious metals.

One common strategy is accumulating gold or silver for personal purposes, whether for bartering, capitalizing on rising prices, safeguarding wealth for future generations, or securing financial stability in retirement.

Intrinsic Value in Coin Stacking vs Coin Collecting

To understand the difference between coin stacking and coin collecting, it's important to clarify the concept of intrinsic value. It refers to the inherent worth of an asset, independent of external factors.

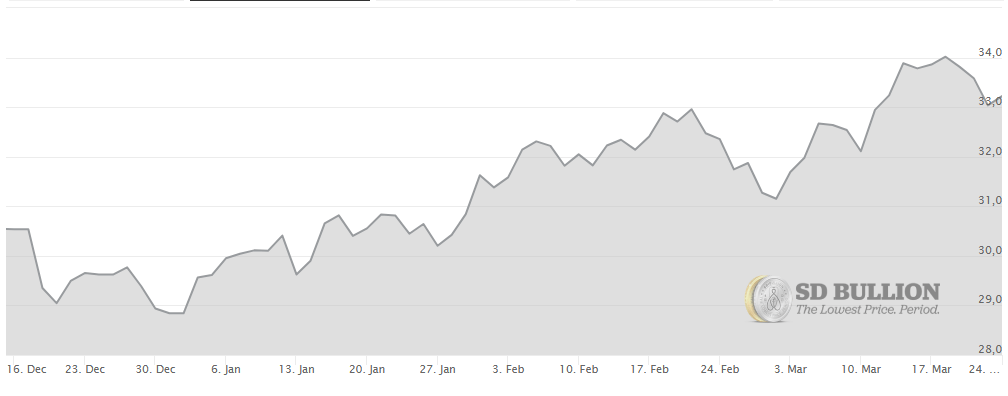

Silver and gold have inherent value as precious metals, but they are also subject to the spot price, the market price at which they can be bought for immediate delivery at any given moment.

Coin collecting, on the other hand, is not always about the metal composition itself. Instead, its value is often influenced by a coin's historical significance, design, minting errors, or unique varieties.

Types of Coins for Stacking

Bullion Coins

Bullion coins are high-purity precious metal coins, such as gold and silver, created primarily for investment rather than daily circulation. These coins typically have a minimum fine metal content of 0.999 (99.9%) for silver and gold.

Valued by their weight and fineness, these silver and gold coins differ from numismatic coins, which derive value from rarity, condition, and age.

Many countries, like the U.S. have their official investment coin, such as the American Eagle, https://sdbullion.com/gold/gold-coinswhich is crafted by the U.S Mint, and are often considered legal tender.

Bullion coins are highly liquid and widely recognized around the world. In economic downturns, investors may prefer sovereign mint coins for their government-backed reliability, while private mints offer greater flexibility and artistic designs, often best suiting collectible goals.

Silver Bullion

One of the main reasons for silver stacking is its role as a hedge against inflation. Unlike fiat currency, which loses purchasing power over time, precious metals retain intrinsic worth and are not directly tied to government-issued money.

Many investors turn to physical silver to preserve wealth, as its value tends to remain stable or increase during rising inflation periods.

Gold Bullion

Gold bullion is widely regarded as a store of value and a hedge against currency devaluation. While it is more stable and valuable than silver, silver is more closely tied to the global economy, with great part of its supply used in heavy industry and high technology.

Unlike silver and other industrial metals, gold is less impacted by economic downturns since its industrial applications are relatively limited.

The Silver Stacker's Perspective, Economic and Market Considerations

While many silver stackers accumulate it as a safeguard against economic crises, where traditional currency may lose its value, others treat it as a trading asset: buying low and selling high regardless of long-term stability. For these investors, staying informed about market fluctuations and trends in the precious metals market is essential.

For example, gold is less tied to the global economy, so it tends to perform well during crises. Its value rises when confidence in other financial assets drops, particularly during inflation, economic uncertainty, or geopolitical instability.

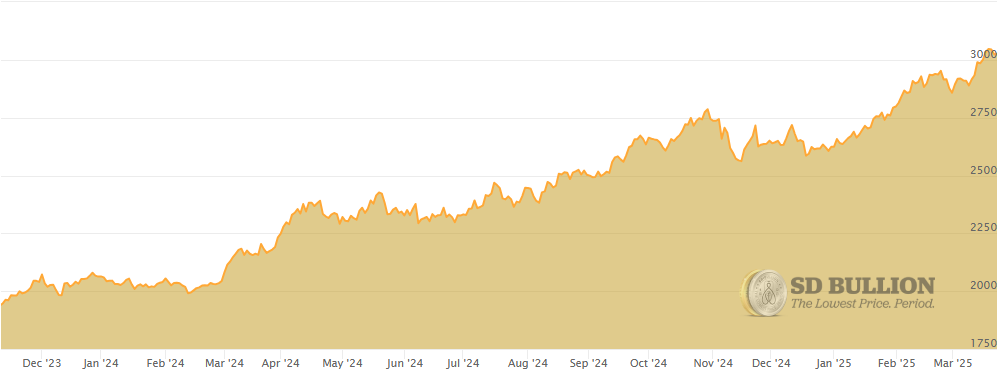

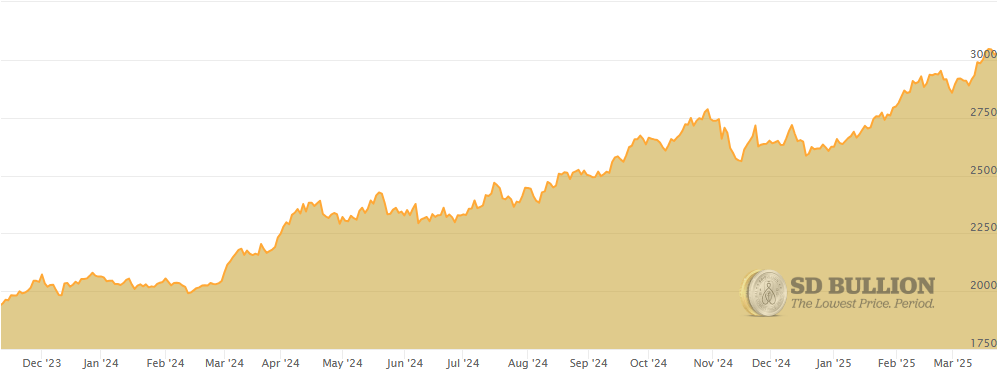

The current record-high gold prices reflect various factors, including geopolitical conflicts, as rising economic and political instability increases demand for gold as a safe haven.

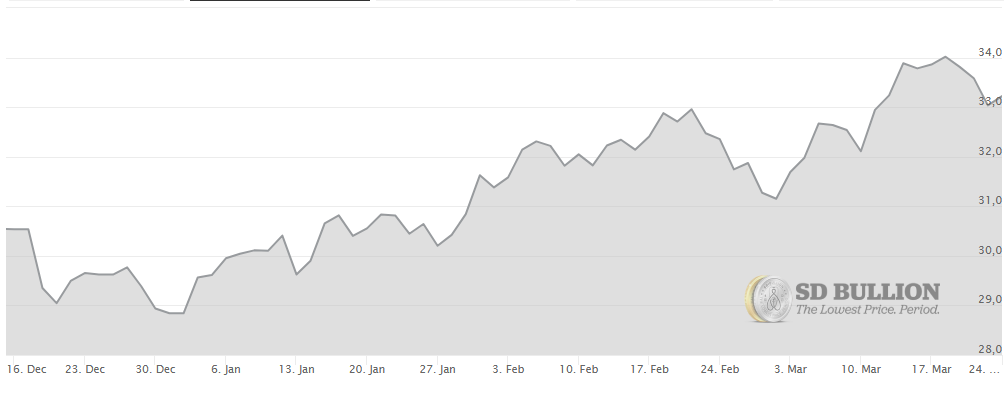

In contrast, silver, driven by industrial demand, tends to perform better in a strong economy. While price differences have always existed due to demand, the current political and economic climate has been a major driver behind the record gold prices we have seen.

Coin Stacking vs Coin Collecting

In the debate between coin stacking and coin collecting, both offer distinct approaches to investing. Stacking focuses on the metal content of coins, with the goal of long-term value appreciation. Stackers watch market trends and track metal prices, valuing stability and preservation.

In contrast, coin collecting centers around rare coins with historical significance, where value is influenced by rarity, condition, and collector demand. Collectors complete their collection by paying attention to details beyond the metal content, such as aesthetics and uniqueness.

In addition, market dynamics for collectors are driven by specific coin trends, while stackers rely on global economic factors. For those seeking stability and tangible assets, stacking is the clear choice, while collectors enjoy the excitement of acquiring rare pieces. Ultimately, both approaches can be valuable, depending on your goals.

FAQs

What is the difference between stacking coins and collecting coins?

The key difference lies in the purpose. A coin stacker accumulates precious metals in the form of coins and other bullion products as an investment or hedge against inflation. A coin collector, however, seeks out desirable coins for their historical or artistic appeal, often driven by passion and personal enjoyment rather than financial gain.

Why is intrinsic value important in coin stacking?

Intrinsic value is the foundation of coin stacking because it ensures that precious metals retain worth regardless of economic conditions. Stackers believe that in an economic downturn, gold and silver will always hold value due to their historical role as a medium of exchange and store of wealth. This perceived stability makes precious metals a reliable asset for bartering or preserving purchasing power when traditional currencies lose value.

How do I start stacking silver coins?

To get started, consider silver coins, as they offer excellent liquidity. You may also explore silver rounds and silver bars, which can often be sold close to the silver spot price. Stick to well known and widely recognized options to ensure easy resale when needed.

Are rare coins valuable for stacking?

Since stacking is primarily focused on the metal content rather than collectibility, rare coins, while sometimes worth millions, are not the best choice for this purpose. If the goal is to safeguard wealth or use the assets for bartering, it's wiser to invest in highly liquid and widely recognized bullion products with high purity levels. Choosing coins that are easily identifiable and accepted in your region ensures smoother transactions and maximizes their practicality in uncertain economic times.

What are the risks involved in coin stacking?

Coin stacking offers the security of a tangible asset, but it comes with risks like theft if stored at home, market volatility that can lead to losses if sold during a downturn, and additional costs for secure storage and insurance. Proper precautions, such as using safes, insured vaults, or diversified investment strategies, can help mitigate these risks and protect your wealth.

Can I be both a coin stacker and a coin collector?

There is nothing stopping a stacker from becoming a collector or vice versa. The key difference is their focus, as the stackers prioritize the metal content and intrinsic worth of coins, while collectors are more interested in rarity, historical significance, and numismatic appeal. Many people enjoy both aspects, stacking for investment while also collecting unique or rare pieces for personal enjoyment.

Are collectible coins a better long-term investment than bullion coins?

Collectible coins derive their value from community sentiment, rarity, and historical significance, making their worth more unpredictable. A coin that is highly valued today could lose its appeal if new discoveries alter its rarity. While collectible coins can appreciate over time, their investment potential relies on market demand rather than intrinsic worth. In contrast, bullion coins are backed by the inherent worth of their precious metal content, making them a more reliable hedge against economic instability. Unlike fiat currency, gold and silver retain value regardless of market fluctuations, making them a more trustworthy long-term investment.

Do premiums matter more for stackers or collectors?

In short, premiums matter more to stackers because their primary goal is financial gain. Stackers aim to acquire silver at the lowest possible cost relative to its spot price, making premiums a crucial factor. On the other hand, collectors focus more on rarity, historical significance, and overall desirability, meaning the price of a coin is influenced more by perceived value and market sentiment rather than just the premium.

How do I determine if a coin is better for stacking or collecting?

You can analyze a coin yourself by considering information like its metal content, rarity, historical significance, and condition. However, the most reliable way to determine whether a coin is better for stacking or collecting is through professional appraisal by services like NGC or PCGS. If a coin has collectible appeal, having it professionally graded can increase its desirability and market value. On the other hand, if its value primarily comes from its metal content rather than numismatic interest, it will be better suited for stacking.

Is it easier to sell bullion coins or collectible coins?

Bullion coins are easier to sell because they have transparent pricing based on the spot price of gold and silver, which is readily available on dealer websites. In contrast, collectible coins are valued based on rarity, historical significance, and market demand, making pricing more subjective and requiring research. While bullion offers liquidity and straightforward transactions, collectibles demand a deeper understanding of history and numismatic trends. The best choice depends on your investment goals, whether you prioritize easy resale or potential appreciation through rarity.