A recent White House proclamation has quietly placed silver—and dozens of other critical minerals—at the center of U.S. national security policy. While the announcement did not dominate headlines, its implications for supply chains, industrial demand, and long-term silver availability are significant.

In October 2025, the U.S. Secretary of Commerce delivered a report to the President examining the national security risks posed by the United States’ reliance on imported processed critical minerals and their derivative products. The conclusion was clear: the United States is importing these materials in quantities and under conditions that could impair national security. Silver is among the minerals now formally caught up in this assessment.

Key Takeaways

- Silver plays a vital role in modern industry, technology, energy systems, and national infrastructure.

- The United States remains heavily dependent on imported refined silver, raising long-term supply considerations.

- Industrial demand for silver continues to grow alongside advances in technology and electrification.

- Silver supply is constrained by mining and processing limitations, contributing to price volatility.

- Silver’s importance extends beyond price movements, reflecting both industrial utility and monetary relevance.

Why Silver Matters at a National Level

The proclamation focuses on processed critical minerals and their derivative products, warning that current import levels and supply-chain dependencies threaten U.S. national security. Silver appears naturally within this framework due to its unique properties and irreplaceable role in modern technology.

Silver is widely used across industries critical to national defense and economic infrastructure, including:

- Electronics and semiconductors

- Advanced weapons systems

- Energy infrastructure, including solar and nuclear

- Data centers and artificial intelligence hardware

- Vehicles and consumer electronics

From an engineering standpoint, silver remains the most electrically conductive metal on the periodic table. In applications where performance, reliability, and efficiency matter most, silver is often not optional—it is the standard.

Import Dependence and Silver Supply Vulnerabilities

According to U.S. government data referenced in the proclamation, the United States remains significantly reliant on foreign sources for critical minerals. Even where domestic mining exists, processing capacity is often lacking, forcing materials to be sent overseas before they can be used.

Silver falls squarely into this category. Roughly two-thirds of U.S. silver supply is imported, leaving domestic industries exposed to geopolitical risk, trade disruptions, and foreign export policies. In recent years, several producing nations have already demonstrated a willingness to restrict exports of strategic resources to protect domestic interests.

From a policy perspective, this level of dependency presents a clear vulnerability.

Rising Demand Meets Structural Constraints

The timing of this designation is notable. Demand for silver continues to expand alongside high-growth technologies such as artificial intelligence, advanced computing, renewable energy, and electrification. At the same time, global silver supply has struggled to keep pace.

Unlike many commodities, silver production is often a byproduct of mining for other metals, limiting how quickly supply can respond to higher prices. This structural constraint helps explain why silver markets have experienced increasing volatility in recent years.

The government’s own assessment acknowledges this reality, explicitly noting that critical mineral markets are prone to price instability—an observation long familiar to precious metals investors.

Policy Tools Under Consideration

The proclamation also outlines potential policy responses aimed at securing supply chains. Among the measures under discussion are:

- Trade negotiations to secure critical mineral access

- Consideration of price floors or minimum import prices

- Other trade-restricting mechanisms to protect domestic availability

While these measures are still conceptual, they reflect a broader shift toward strategic resource management rather than purely free-market sourcing. Historically, when governments intervene to secure essential materials, market dynamics tend to change—sometimes significantly.

Current Price of Silver

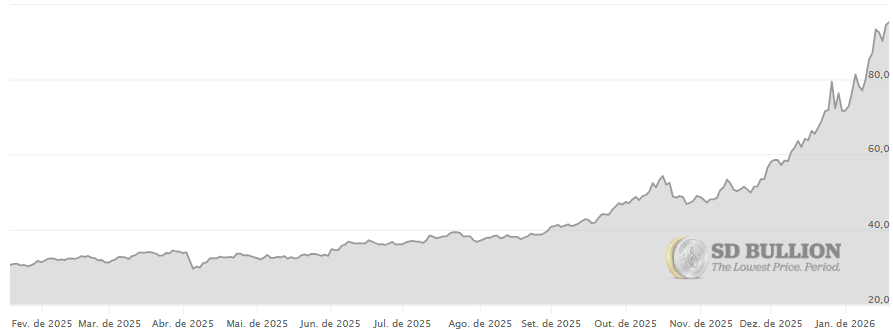

Since January 2025, silver prices have already risen close to 200% with many experts now saying this is not a commodity blow-off, but a secular trade.

Silver spot price rises over 200% from January 2025 to January 2026

A key driver of the surge has been persistent supply deficits. Global silver production has struggled to keep pace with rising demand, particularly as mining output faces structural and cost-related constraints. When supply growth lags while demand accelerates, prices tend to respond sharply upward.

At the same time, industrial demand for silver has expanded rapidly. Silver is essential in electronics, renewable energy, medical applications, and advanced manufacturing. Because it is difficult to substitute and used in relatively small but critical quantities, even modest increases in industrial usage can have an outsized impact on prices, providing strong fundamental support.

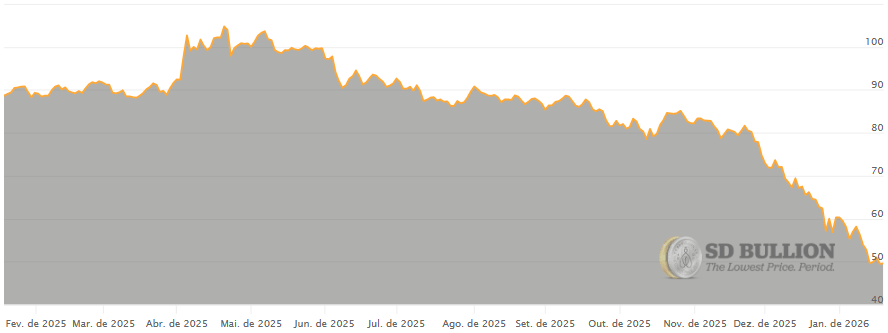

Over the past week, spot silver climbed rapidly toward $90 per ounce, driving the gold–silver ratio down to around 51:1 and briefly into the high-40s intraday—levels that have historically marked the early phases of silver outperformance.

Gold-Silver Ratio throughout 2025 and early 2026

What This Means for Silver Going Forward

Silver’s designation as a national security material does not guarantee higher prices, nor does it remove short-term volatility from the market. What it does signal is a structural repricing of silver’s importance within the global economy.

Silver is no longer just a monetary hedge or an industrial input—it is increasingly viewed as a strategic asset tied to energy, technology, and defense infrastructure. That reality reinforces the case for why silver continues to occupy a unique position among precious metals.

For investors, understanding these macro-level shifts is often more important than attempting to time short-term price movements. Policy decisions, supply constraints, and industrial demand trends tend to unfold over years, not weeks.

Final Thoughts

The U.S. government’s move to formally recognize silver as a national security concern underscores what the market has already been signaling: silver’s role in the modern economy is expanding, while its supply remains constrained.

Whether viewed through the lens of technology, geopolitics, or long-term capital preservation, silver’s fundamentals are evolving in ways that merit attention. As with all precious metals, informed decisions are best made by focusing on structural trends rather than headlines alone.

Disclaimer: The information provided is for educational and general informational purposes only and should not be interpreted as financial or investment advice. Always consult a qualified professional before making decisions involving precious metals.