Given the current down trend in precious metal spot prices of late, we shall examine a bearish case scenario of history’s potential rhyme if this continues or perhaps worsens through the end of the summer and into the fall of 2018.

Over the last few years we have worked through a goldilocks ‘everything bubble’ timespell where waning interest in bullion products has increased secondary product inventory levels and thus compressed product premiums on both old and new bullion product offerings.

I remain confident this will change sooner than later as non-commodity valuations sober up and either mark to market lower or default.

Having joined the team here at SD Bullion in the fall of 2017, I am now the grizzled "broken office record" on the matter of a potential future bullion shortage to come.

The big questions of course are always how, which scapegoats whys, and precisely when.

Having started in the bullion industry in the summer of 2008, we have already witnessed durations in time in which spot prices diverged from rising bullion price premiums coupled with extreme limited availability and prolonged delivery dates.

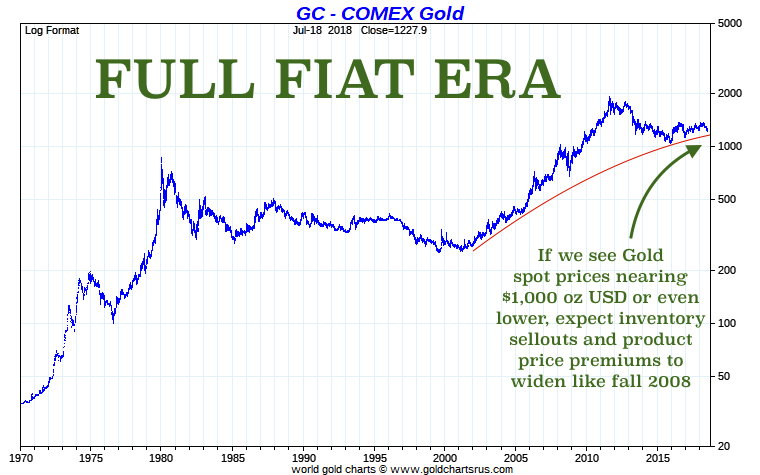

Below are 2008 Gold Prices and 2008 Silver Prices respectively.

The Longest Running, Lowest Price Premiums in Bullion Markets since 2008

Past is Prologue for Precious Metals

In 2008, we saw respective gold spot price falls from over $1,000 oz to $680 oz USD, and silver spot prices fall from over $21 to as low sub $9 oz USD.

We also witnessed weeks of time in the fall of 2008 without any bullion products to ship to customer doors and industry wide multi-month backorder delays.

Sure you could lock in your product and price, but you had months to wait for the delivery of your backorder bullion products.

Rare indeed was the situation where you could get just in time bullion delivery upon payment clearance. There was simply overwhelming demand on an industry that was wholly unable to deliver in matching physical bullion volumes or supply.

To confirm my first hand experiences during this timeframe, you can look for yourself through various now bankrupt bullion dealer websites using the Wayback Machine (e.g. 2008 NWTmint, Tulving, Bullion Direct).

The list of reasons as to why we'll have another global financial crisis are piling, as you likely know.

I will not belabor the myriad points here, but you can find many on our 21st Century Gold Rush page. We live in a finite world, yet we keep operating the world's monetary system as if we don't.

With ever increasing record global debt levels today are over 40% higher than from the fall of 2008.

That crisis was brought to us by terrible lending standards, greed and sloppy fractional reserve banking. We had a chance to delever the system back then, but greed and fear won out, so we blew it out to today.

Expect the next bullion market shock to be even more extreme than last. Enduring even longer than then, also.

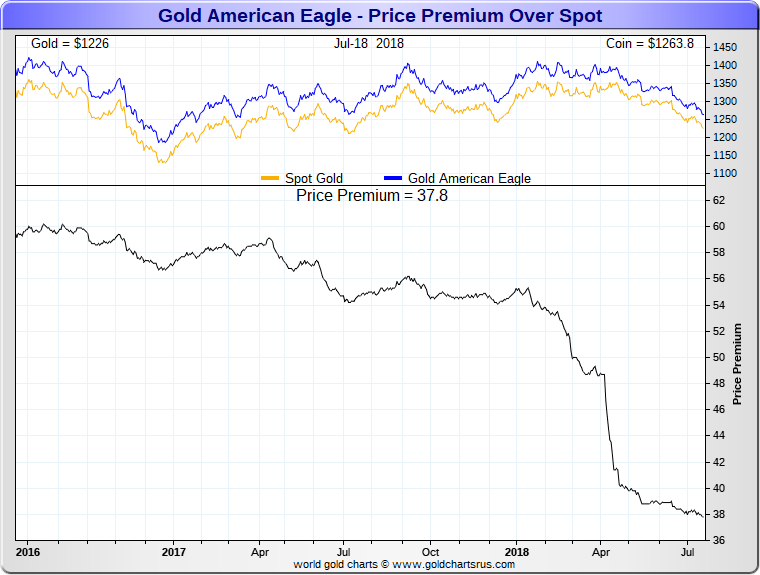

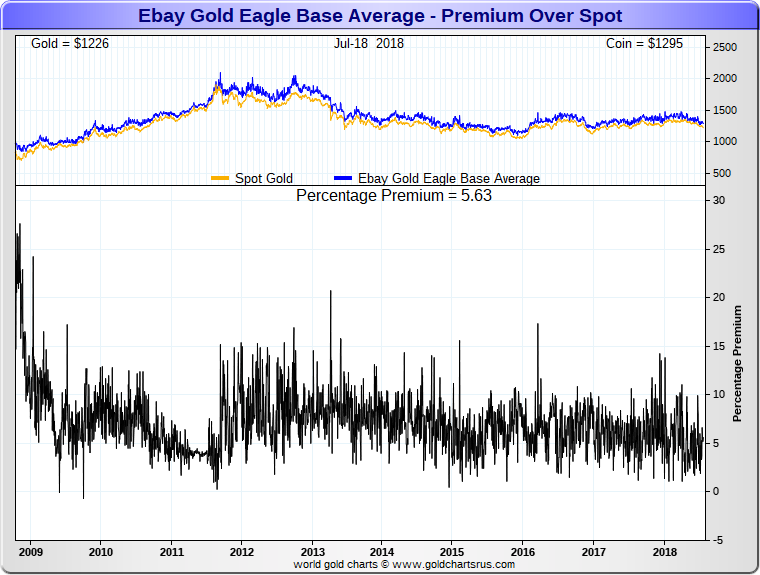

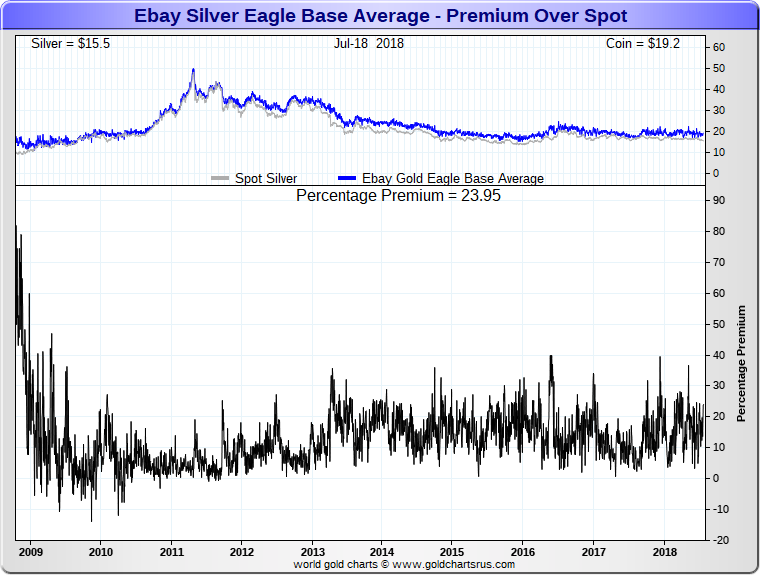

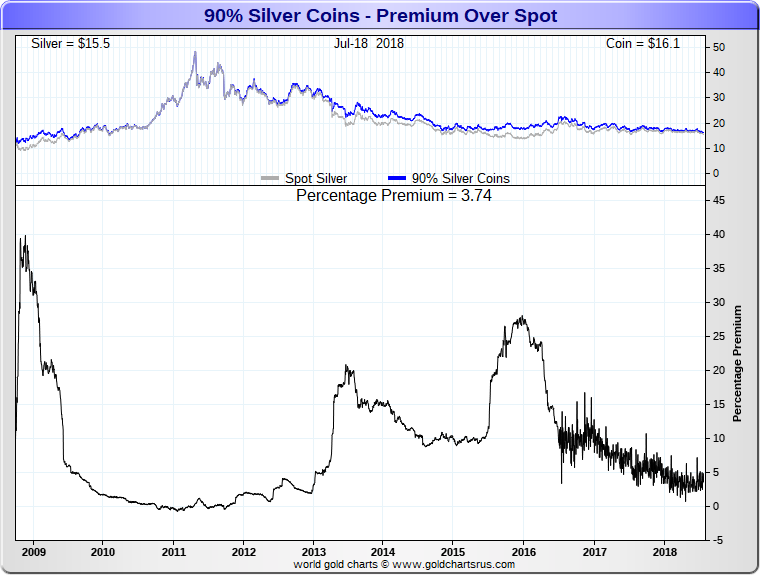

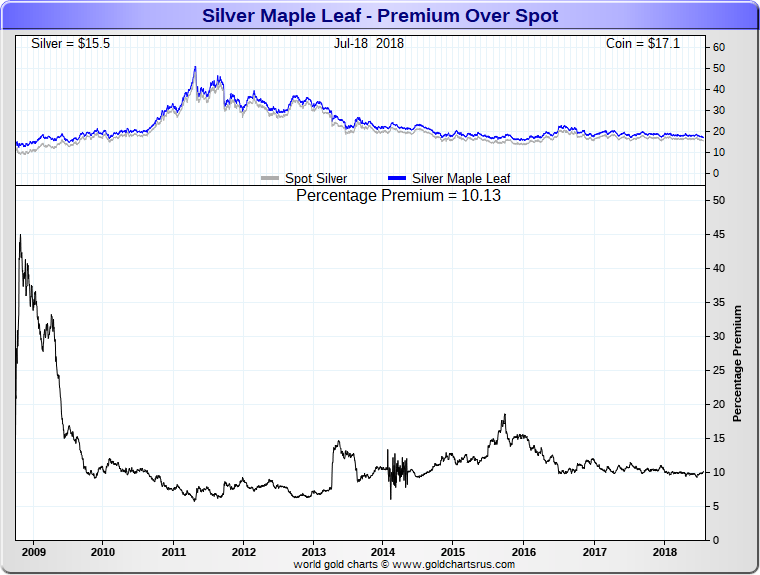

Bullion Price Premium Charts 2008 - 2018

Below you can see various charts reflecting bullion product price premiums above spot prices over the past decade.

Again within them you will see, we’ve never endured a duration of compressed price premiums coupled with slowing new bullion product demand. At least since the 2008 financial crisis paused by extraordinary non-conventional central bank policies.

Financial Lockdown Laws: Post 2008

Bank bail-ins have and will continue to occur.

Indeed relatively new bank bailin laws were not enacted throughout the G20 by the BIS' FSB for fun.

The world's largest banks (G-SIBs) are on a real mark to market basis most likely bankrupt allowed to mark to model since 2009.

Question remains which of them wins their derivative bets and consolidates the others? How many people and companies will lose out and get diluted equity shares in place of their underinsured demand deposits?

Perhaps but one contributing factor to why JP Morgan has since ammassed a larger silver bullion hoard than either the Hunt Brothers or multi-billionaire Buffet ever did.

Precious Metal 'Price Discovery' to Come?

Since late 2014, the largest contributing precious metal ‘price discovery’ mechanism (COMEX / NYMEX) has implemented price circuit breakers. You can ponder on your own as to perhaps why.

Potentially ending in late January 2019, central bank commodity futures contract 'price discovery' trading discounts may be a tell on future timing for a commodity price meltup and partial debt write offs.

The following footage is only one summer removed, it was shot last July, 2017. Listen to what the world's current price discovery head honcho (CME’s CEO of COMEX, NYMEX) had to say only a summer ago.

Will there be more market interventions to come and follow?

Certainly so.

This classic article from the year 2000, confirms much of what we have since seen the turn of the 20th into this 21st Century.

So long as we operate in a fully fiat currency monetary system with top down interest rate setting, free markets we will not have.

The battle of Gold vs US dollar values ongoes. China continues acquiring her physical gold bullion dwarfing the volumes that France did some years before, the last time the gold price fully accounted for US dollar debasement.

When will we again see Record Gold Silver Prices?

Bullion Buyers and the Internet Have Long Memories

Even price rigging apologists admit, the other eye of the structural reset hurricane is likely bearing down.

With it, you can pretty much toss your technical charts out your window and batten them down shut. The real reasons why various financial lockdown laws have since been put into place since the last financial crisis is because it is not over.

Although rare, prudent bullion allocations are common sense mathematics. From here to there, expect future bullion product and price dislocations returning with a vengeance.

Bearish Case: Gold Silver Price Drops Fall 2018?

Below you can hear a recent interview I had with Roy Friedman a multidecade market maker in the physical bullion markets worldwide.

His experiences cover not only the 2008 financial crisis to today, but also look back all the way to the last silver and gold secular bull market highs in 1980.

Have a listen for yourself.

***