This recent everything but bullion (and commodities) bubble will likely revert ahead.

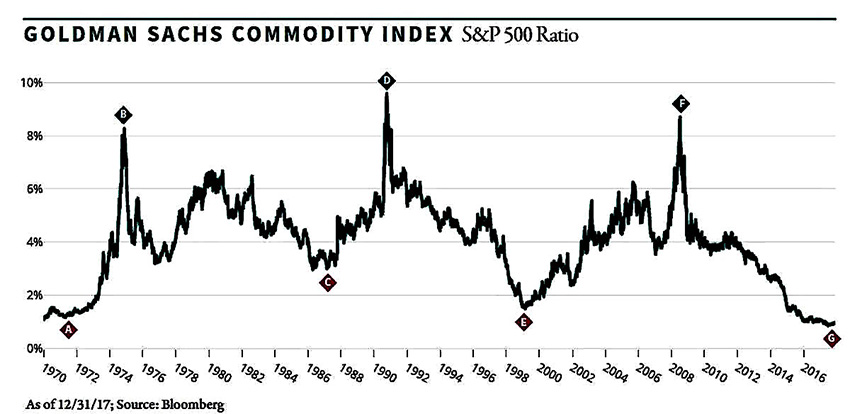

The following chart provided by recently Comex gold future contract stopping Goldman Sachs provides us with the knowledge that commodity prices versus stock values ending in 2017 and into 2018, have not been this out of whack in a long time.

It is reasonable to not only expect that the chart above will revert to its average or mean around 4%. But too, to also suprass and overshoot to the upside as the aging Baby Boomers begin selling off their retirement savings (mostly held within the US stock market).

Similar to the 1970s, sharply rising bullion values are often the inverse to stock bear markets and crises in monetary confidence.