Psychology of human investors globally.

One of the keys to successful investing and speculating, is having a large swath of the growing investing public agree with you... later.

Key to this axiom is also that their agreement comes within a reasonable timeframe.

Meantime one should also persistently try to identify other undervalued soon to be rising asset classes during this holding timeframe.

For bullion in the coming 3 to 5 years, one of the industry’s most hated, yet one of the most historically accurate analysts, has recently gone on record as being bullish on bullion. CPM Group’s Jeff Christian is now on record calling for new record nominal bullion prices by 2022 to 2024.

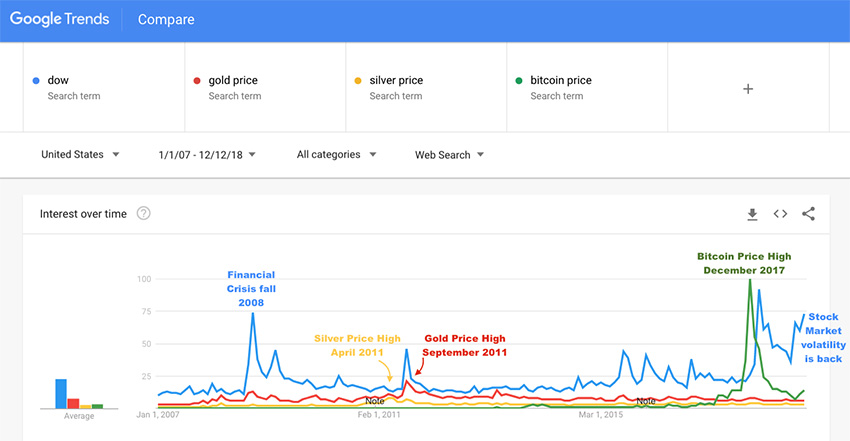

One of the most powerful free tools one can use to understand mass market psychology is google trends. Often crowds of internet searches gather around price highs and volatility to the up and or down side.

In the chart below you can see this phenomenon coincides with respective nominal price highs of various retail investor interests.

We expect in the decade to come, a timeframe in which mass interest in the price of gold supersedes all others, most likely coinciding with a bullion bull market top.