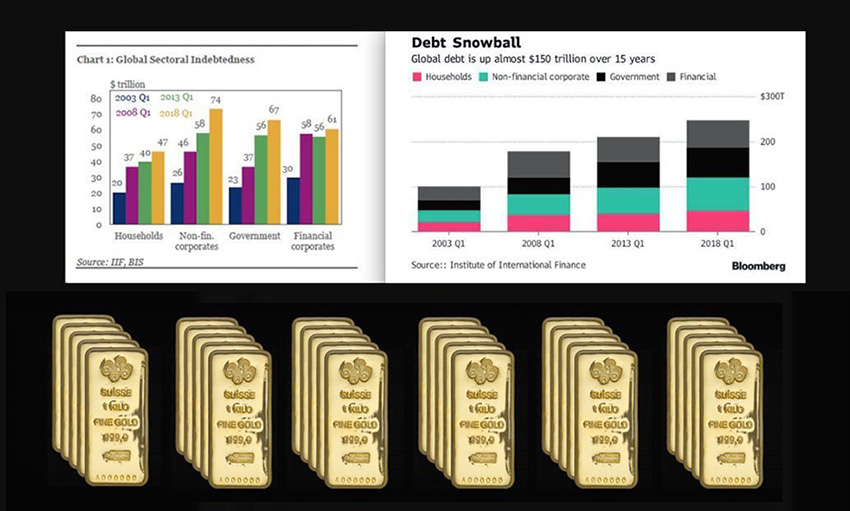

Even after the debt driven 2008 financial crisis, we continually reach new record debt levels worldwide year after year.

To conclude the first quarter of 2018, the Institute of International Finance (IIF) published another alarming print on the growing record levels of global debt building (now over $247 trillion USD in total).

Historically the response to global debt levels which cannot be paid off with productivity and profitable growth, is through combinations of debt defaults and further fiat currency devaluations.

Gold bullion has historically gained value versus other asset classes in either scenario.