Even if you think technical price analysis does not matter, it does. Especially professional price forecasts matter to the financial markets when commodity price discovery gets derived via derivatives for the most part.

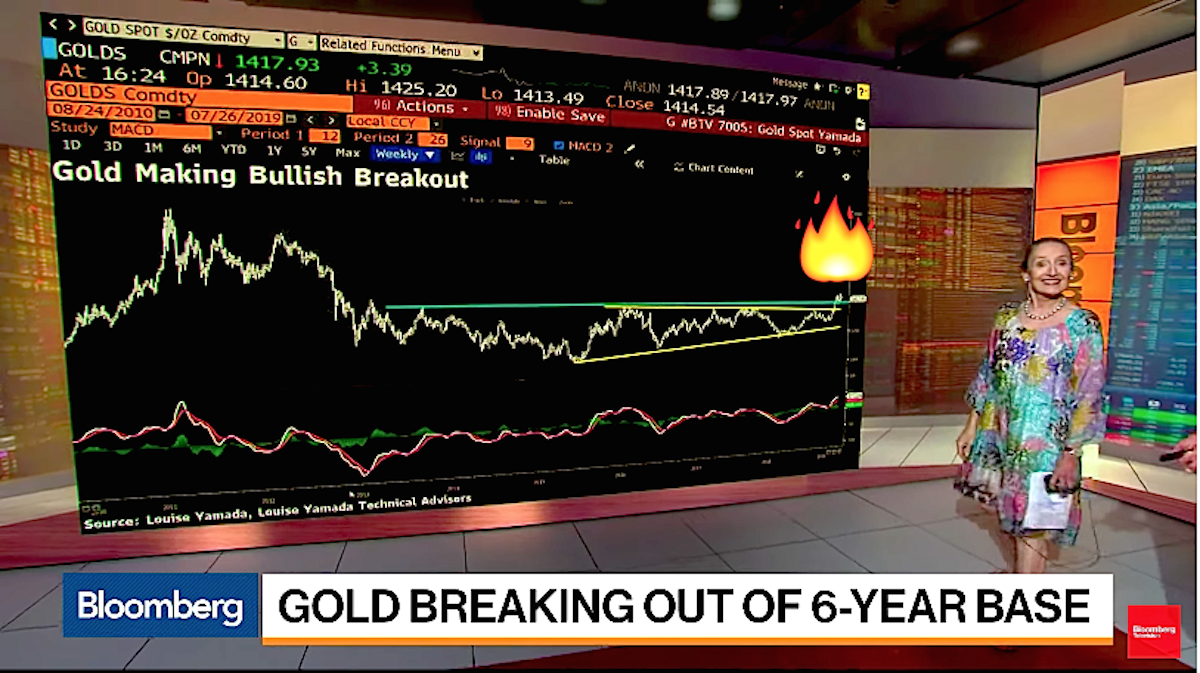

In terms of technical gold price analysis, Louise Yamada gold price forecasts are always worth noting. This recent gold price bullish read by Ms. Yamada is six years in the making. Ms. Yamada gold forecasts are part of her work as the managing director of Louise Yamada Technical Research.

In the following clip from late last week, Ms. Yamada gold price bullishness was pervasive. Watch as she technically explains why gold prices are likely to rise given this 6-year base price pattern building in fiat US dollar-priced gold.

Louis Yamada Gold Price Record from 6-Year Base

-

Before founding Louise Yamada Technical Research Advisors in October 2005. Previously Louise was Managing Director and Head of Technical Research for Smith Barney (taken over by Citigroup). While there she became a leader in the Institutional Investor poll for the top-ranked market technician in 2001, 2002, 2003 and 2004.

At Smith Barney for 25 years, Ms. Yamada authored a weekly flagship report "Market Interpretations,” where she identified among many other items:

- the lift in gold prices 2001 and 2002 gold prices, for a 21st Century structural bull market ongoing (albeit with gold price suppression post-2011 that is becoming common knowledge now).

Louise Yamada, gold price insight, is her identifying that the interim bear market for consolidating gold prices post-2011 is beginning to show technical signs of a breakout.

Yamada is not the only gold price forecaster calling for new record gold prices in the coming years.

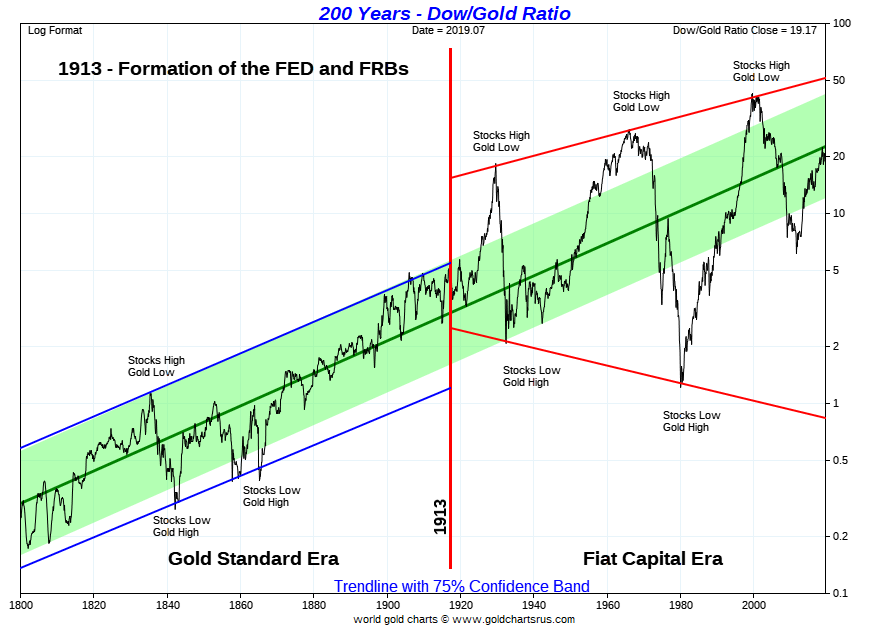

The Dow Gold Ratio that she points out towards the end of the technical gold-related chart clip is also enjoyable.

Dow Gold Ratio 2020s?

Typically gold bull markets peak around when the Dow and Gold reach parity or near one another in nominal numbers. When will one troy ounce of gold's fiat US dollar price equal or near the Dow Jones Industrial Average nominal number?

The Dow at the moment is hovering around 27,203. Many gold bullion bulls believe that someday the fiat US dollar price for gold will be equal again to the Dow.

Here is a more in-depth discussion on how the Dow Jones misleads stock investors. Learn why there are better valuation metrics for publically traded US stock prices. Keep the arbitrarily rotating 30 large-cap US stock index called the Dow in its proper long term perspective (i.e., Why did GE recently get kicked out of the Dow Jones Industrial Average valuation metric?).

Learn about backtested prudent gold investment allocations and best practices in bullion buying/selling with our free SD Bullion Guide.

Thanks for visiting us here at SD Bullion.

***