Jump to: What is Gold? | Gold Coins | Gold Bars | Gold Jewelry | Gold Spot Price | Gold Price Calculator | When to Sell Gold? | Where to Sell Gold? | Researching Potential Buyers | Preparing Your Gold for Sale | FAQs

Deciding the right moment to liquidate your assets can be overwhelming, even for the most seasoned precious metals investors. Because gold is considered a long-term investment, patience is an essential ally in the path to protect your wealth against inflation and maximize your returns.

As you look for resources and educate yourself about the gold industry, we hope this article will help you through the selling process. We will take you through the current and historic gold prices and assist you in finding a reputable buyer for your gold coins and bars.

What is Gold?

Gold, a valuable metal found in the Earth's crust, has always been highly sought after by people. Leaders have used it to convey power and status and to build armies and palaces. Some might even say that gold has been crucial in building both ancient and modern civilizations.

Gold bullion is a term used to refer to gold for investment purposes. It usually refers to gold bars or gold coins of at least 99.5% purity, also known as the Good Delivery standard by the London Bullion Market Association (LBMA).

Gold Coins

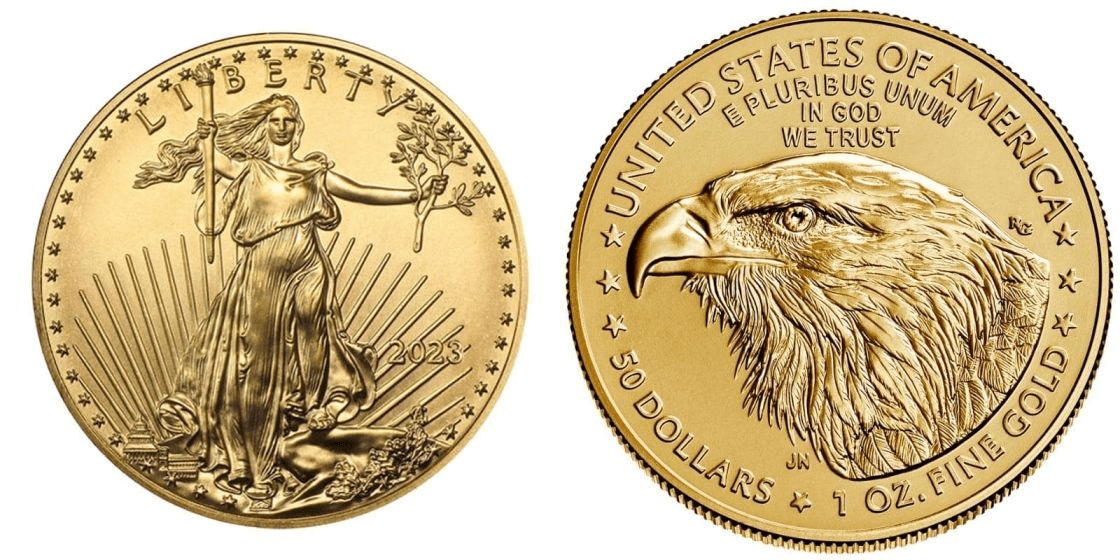

Gold coins are physical rounds made of gold that are issued and backed by a government mint.

In most cases, gold coins carry a face value and enjoy legal tender status within their country of emission. Nevertheless, you will never see a gold coin being used in day-to-day transactions because its intrinsic value (i.e. its gold content) is much more valuable than its denomination.

Humankind has used gold coins as a form of currency for millennia. The term can refer to antique coins from Greek and Roman times, or to more recent forms of monetary items, such as Pre-1933 Gold Coins, before the ending of the gold standard.

Since the beginning of the fiat currency era, when all forms of money became free from any commodity backing, bullion coins made of 99.9% pure gold have become a form of private investment, beginning with the South African Krugerrand first released in 1967.

Nowadays, the American Gold Eagle is arguably the most recognizable gold coin in the industry. Issued by the U.S. Mint, it sells hundreds of thousands of units each year.

In addition to being a possible profitable investment, gold coins can make for a great coin collection.

Gold Bars

Gold bars are mostly produced by accredited private refiners and mints around the globe, including some of the most well-known names in the precious metals industry, like PAMP Suisse, Argor-Heraeus, and Valcambi.

An investment-grade gold bar is usually made of 99.9% pure gold (24-karat gold). They can range from small 1-gram bars to 1 kilogram in order to accommodate the needs of varied investors.

Reputable gold bullion bars often come with an assay certificate or in tamper-evident packaging. The assayer's mark is a confirmation of the product's indicated weight, purity, and authenticity.

Unlike gold coins, though, bullion bars will usually not carry any numismatic or collectible value. In addition, they are usually not legal tender nor carry a face value.

There are mainly two types of gold bars available for investors: cast and mint bars.

The manufacturing of a cast bar is simpler. It mainly involves pouring molten gold into a cast. Mint bars undergo a more complex process that involves the use of minting press machines.

Gold Jewelry

Gold jewelry is not always considered an investment per se. When you buy gold jewelry, you are also paying for the craftsmanship, design and brand markup. Those costs are not usually attributed to gold bullion or scrap gold.

If you're in a tough financial situation and need money fast, you can consider selling the jewelry you have in your jewelry box. It's a quick way to get some cash.

In addition, 24K gold jewelry is recently becoming another form of diversifying an investment portfolio.

What is the Current Spot Price of Gold?

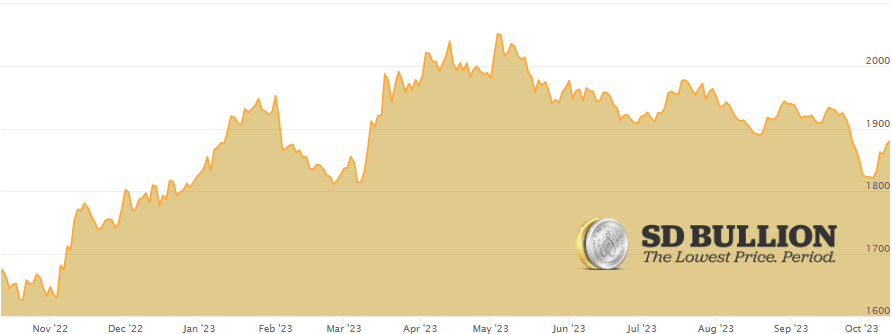

The gold spot price refers to the current market price of gold for immediate delivery and payment, also known as "on-the-spot" or "cash" price. It represents the real-time value of one troy ounce of pure gold (31.1 grams) in the global precious metals market. The spot price is constantly changing throughout the trading day as a result of supply and demand dynamics, economic factors, geopolitical events, and market sentiment.

The gold spot price serves as a benchmark for buying and selling gold in its raw, unprocessed form. Precious metals dealers, investors, and financial institutions use the spot price as a reference when determining the value of gold products, such as gold bars, coins, and jewelry.

It's important to note that the spot price does not include any additional costs or premiums associated with buying physical gold, like dealer markup, taxes, shipping, or handling fees. These extra expenses are typically added to the spot price to calculate the final price of gold products sold in the retail market.

Do You Get Spot Price When Selling Gold?

As we have explained in the previous section, the gold spot price is a benchmark but not a fixed price.

Gold dealers, like in any other business, need to cover overhead costs and still turn a profit to make a living. So, when you receive an offer from a gold buyer (i.e., the bid price), you can expect it to be lower than the current spot price.

Likewise, when you buy gold from a gold dealer, they will charge you above the spot price (i.e., ask price).

Gold Price Calculator

You can access our gold price calculator for a complete list of gold, silver, platinum, and palladium products.

When to sell your gold?

Deciding the right time to sell your gold items can be directly related to the gold spot price. Obviously, there are instances in life where you might feel the need to liquidate your gold holdings for an emergency or personal reasons.

However, if you want to maximize your profits, understanding the dynamics of the precious metals markets is essential.

Like other commodities, gold fluctuates in value over time. Gold prices tend to perform well during times of economic uncertainty. So, investing in gold is not much different from investing in the stock market. You have to understand the dynamics of the ups and downs of the precious metals industry to succeed.

Factors that Can Influence Gold Prices:

- Supply and demand

- Inflation

- Currency fluctuations

- Interest Rate levels

- Government reserves

- Economic data

- Geopolitical events

Anticipating how gold prices will fluctuate is not an easy task, even for the most experienced investors.

Some of the things you can do to educate yourself on the topic are:

- Study historic gold price data and the top market moves.

- Keep track of gold futures prices. Though not a certainty, they can provide a peek into future fluctuations.

- Stay updated about the government's policies on inflation and interest rates. Remember: you can usually expect gold prices to rise when interest rates are low, and vice-versa.

- Analyze data provided by trusted sources, like the World Gold Council.

Where to sell your gold?

After deciding to sell your gold coins or bars, or even your gold jewelry, it is time to find a potential gold buyer. This can be a complex situation as you have a few options to consider.

Pawn Shops

Going to a pawn shop could be a quick and convenient way to sell your gold, but you may not get the best price for your bullion. While pawn shops can provide immediate cash, research and compare other offers to ensure you receive fair value for your precious metals.

Brick-and-Mortar Dealers

Though brick-and-mortar coin dealers specialize in buying and selling precious metals, they tend to have higher business costs to cover than online dealers do: rent, utilities, property taxes, not to mention security systems, and insurance for their inventory.

All those overhead costs usually translate to low offers for your gold because they need to maximize their returns in order to make a living.

Similarly, if you try to sell gold bullion in jewelry stores, you might receive a lower price than you could expect from larger markets such as online gold buyers.

However, if you are selling gold jewelry, you could look for a specialized jewelry store that will appreciate not only the gold content of your piece but also give you a fair value based on the craftsmanship and artistry involved in its making.

eBay and other Marketplaces

Online, you will find a variety of marketplaces, such as eBay, where it is possible to find multiple online buyers to sell your gold item to. However, be aware of possible scams. Thoroughly research your potential gold buyers. Review their ratings and past purchases to make sure you can trust them.

If you choose to sell your gold through online marketplaces, keep a record of the condition of all your products before shipping them. It is also a sensible idea to invest in a trustworthy shipping company with insurance so you can dispatch your gold safely.

Online Buyers like SD Bullion

Selling your gold to reputable online gold buyers, such as SD Bullion, can be a convenient and lucrative practice.

Online platforms provide access to a broader market, allowing you to reach potential gold buyers from anywhere. Trusted online dealers have secure and transparent selling processes, ensuring fair value for your precious metals.

SD Bullion is an A+ company from the Better Business Bureau. We are an online gold buyer and retailer that offers a fair and transparent buyback process with upfront pricing and fast payments. Our team is constantly buying gold bullion and can guide you throughout the entire process, making selling gold online a simple and easy operation.

Researching Potential Buyers

When selling your gold, it's crucial to research potential buyers to ensure a smooth and safe transaction. Here are some factors to consider:

Track Records and Reviews

Look for reputable buyers with a proven track record of fair dealings and customer satisfaction. Check online reviews, testimonials, and ratings on trusted platforms to gauge the experiences of previous sellers.

Fair Price Offerings & Payment Methods

Compare price quotes from multiple buyers to get an idea of the market value of your gold. Reputable buyers should offer fair prices based on the current spot price and the purity of your gold. Additionally, ensure that the buyer offers secure payment methods, such as bank transfers or certified checks, to avoid potential payment issues.

Licensing & Credentials

Verify that the buyer is properly licensed and accredited. Look for affiliations with industry associations or certifications that demonstrate their commitment to ethical practices.

Insurance & Security Protocols

Inquire about the buyer's insurance coverage and security protocols for handling precious metals. A trustworthy buyer should have adequate insurance to protect your gold during the selling process and secure storage facilities.

Preparing Your Gold for Sale

Before selling your gold, it's essential to take certain steps to ensure a successful transaction.

Assessing the Value and Condition of Your Items

Determine the value of your gold items by assessing their purity, weight, and current market price. Use a jeweler's scale to weigh your gold accurately and check for purity markings, such as "24K" for pure gold. If you have gold jewelry with gemstones, consider separating them, as gemstones do not add to the gold's value.

Additionally, evaluate the condition of your gold items. Well-preserved and well-maintained pieces usually fetch higher prices than damaged or worn-out ones. Clean your gold items using mild soap and water to present them in the best possible condition for appraisal.

It's important to note that some gold items, such as rare coins or antique jewelry, may have additional value beyond their gold content due to their collectible or historical significance. If you suspect any item may be valuable beyond its gold content, consider seeking a professional appraisal or consulting with a specialist before selling.

By conducting thorough research and appropriately preparing your gold for sale, you can maximize your chances of getting a fair price and a smooth transaction when selling your precious metal items.

Document all your gold products

Before shipping your gold products, be certain to document (take photographs) all the contents of the package before sealing the parcel.

This means actually taking pictures of all the gold products and specific packing slip documents you are packing into the parcel. This is an important step in case of the small chance someone steals and/or breaks into the parcel before it reaches its final destination. Or perhaps, in the rare case, there is some discrepancy upon delivery of the gold parcel to the gold dealer you are selling and shipping to.

Shipping Your Parcel

For most individuals, it is advisable not to use FedEx, UPS, DHL, or other private parcel delivery services to ship bullion within the USA.

All the aforementioned private shippers explicitly prohibit, or at least restrict the shipping of precious metals and, thus, gold bullion in their terms of service (e.g. FedEx, UPS, DHL).

Of course, many gold bullion dealers, including us, use these aforementioned private delivery parcel services, but we use third-party insurance policies. If you don't have access to a fully insured shipping service, avoid that.

How to Ship Gold Bullion You Sell Safely?

When shipping gold in the mail within the USA, the USPS Registered Mail service remains the best general shipment option in terms of overall price, safety, value, and potential insurance coverage.

As previously stated, most private shipment service providers like FedEx, DHL, and UPS explicitly prohibit individuals (not bullion businesses with direct operation agreements) from insuring bullion shipments. The main reason is due to potential theft.

On the other hand, USPS Registered Mail can be insured for up to $50,000 USD per parcel at your local USPS Post Office. In fact, the US Postal Inspection Service even helps ensure that USPS Registered Mail will likely remain the safest best option for individuals shipping gold bullion fully insured through the domestic mail system.

In order to ship with USPS Registered Mail, you will need a few items to make a safe and compliant shipment:

- Have a fully filled out USPS Form 3806 before engaging a USPS agent, which you can get at your local USPS office;

- Use a minimum of 2 boxes to package the gold bullion shipment. One smaller box inside to contain and protect the gold bullion packed within, and another Priority Mail box for the parcel’s exterior. Notice, for example, how heavily packaged this small gold bullion parcel was from us to the customer. We suggest you mimic this kind of packaging methodology when using USPS Registered Mail services;

- Make sure there is no loose gold content by putting packed paper or styrofoam peanuts inside each gold coin tube’s top before securely taping them shut and against the interior box. For bullion bars, use tightly taped paper coverings or bubble wrapping between bars for secure silence;

- To make certain that gold coin tube tops stay shut in transit, apply robust filament tape to ensure each tube stays closed;

- All box USPS Registered Mail parcels should have 3″ wide gummed paper tape covering all corners of the outer box to ensure a tamper-proof stamped seal on the outer edges of the parcel.

Frequently Asked Questions About How To Sell Gold

Do you receive the spot price when you sell gold?

You won't get exactly the spot price when selling gold because dealers typically charge a premium to cover their costs and profit margins.

Why do gold prices fluctuate? What causes the price of gold to go up?

Gold prices fluctuate due to various factors, including changes in global economic conditions, currency values, geopolitical tensions, and investor sentiment.

What factors affect the amount of cash for gold I get?

The amount of cash for gold you receive is influenced by the current spot gold price, the purity and weight of your gold items, and any additional premiums or fees charged by the buyer.

Are there hidden fees?

Yes, there may be hidden fees when selling gold, such as refining or assay fees, shipping and handling charges, and commission fees, which can affect the final amount you receive for your gold. It's essential to inquire about all fees upfront before selling and deal only with trusted sources.