Jump to: What is a Gold Bar? | Gold Bars as an Investment | Gold Bar Weigh | Understanding Gold Bar Prices | Current Gold Bar Prices | What are Premiums?

As of August of 2024, gold bars are selling, on average: $99.40 for 1 gram; $$2,573.10 for 1 Troy ounce; and $82,556.33 for 1 Kilo.

Gold bar prices are mainly defined by the current gold spot price + the dealer's premium (which is basically a markup, or price spread). Take a 1 troy ounce gold bar, for instance. If the current gold spot price is $2.500 for 1 Troy ounce of gold, and the bullion dealer is asking a $35 premium, the cost of a 1 Troy ounce gold bar will be $2.535.

Understanding the market dynamics that affect the gold spot price of gold is paramount to making an informed decision and investing in precious metals sensibly. This article will help both newbies and seasoned investors understand, in depth, how much a gold bar is worth.

Key takeaways:

- The value of a gold bar is determined by factors such as its weight, purity, and the current gold bar price. Common sizes include the single-ounce gold bar and larger options measured in troy ounces.

- When you buy gold bars, consider the price depending on the bar's size and mint, with smaller bars like those weighing a few grams offering flexibility, while larger bars, such as a one ounce gold bar, may provide better value per ounce.

- Investing in gold is often a strategy to hedge against economic uncertainties, especially during periods of rising inflation rates.

- Prices vary for gold bars, and gold bar costs can include premiums over the spot price, influenced by size and market conditions.

- Institutional investors and financial institutions typically prefer larger bars for efficiency in large transactions, while individual investors might opt for smaller bars for liquidity and diversification.

- Alongside gold bars, silver coins can be another investment option, offering a different way to diversify your portfolio.

- Understanding your risk tolerance and long-term goals is essential when deciding whether to invest in gold, buy gold bars, or consider alternatives like silver coins at a future date based on anticipated inflation rates.

What is a gold bar?

For most of civilization's history, gold was a base metal for circulating gold coins and a store of value in gold bars that were resistant to tarnish and would not corrode.

A gold bar is a form of gold bullion, also known for gold ingot, and it is a piece of refined gold that has been cast or minted, varying in size and most commonly recognized when produced according to industrial standards, which include markings and labels.

Types of Gold Bars

There are two different types of gold bars: minted and cast.

1. Cast bars require a simpler process. Refineries pour molten gold into a pre-manufactured mold and let it cool. They tend to contain simpler engravings: just the weight and purity, a mint logo, and, sometimes, a serial number.

2. Minted gold bars are made with thin layers of gold. They are fed into a die to reach the precise shape and weight desired, forming gold blanks. Then, these blanks go in a minting machine to receive obverse and reverse refined engravings. Due to the detailed manufacturing process, the minted bars tend to be more expensive.

Notice how the minted bar has a polished, more refined appearance.

Gold Bars as a Form of Investment

Gold as a precious metal has long been valued for its intrinsic value, making it a reliable means of preserving wealth and hedging against inflation. When fiat currencies lose value due to inflation, gold tends to retain its purchasing power.

As one of the most liquid real asset investments, gold carries no default or counterparty risks, which is why it is widely used to diversify investment portfolios and gain exposure to other investments besides stocks or currency.

What's the difference between gold bars and other forms of gold?

PHYSICAL GOLD

It is usually easier to sell gold bars at the gold market, to bullion dealers, or directly to private investors than to sell other real assets, such as real estate or artwork. Gold jewelry and coins can also be valid options for gold investment. However, gold bars tend to have lower prices.

To be considered an investment quality gold bar, it must be at least .995 fine gold. That is the minimum purity level required for any gold bullion products to be deposited on a Gold IRA, for instance.

NON-PHYSICAL GOLD

Investors have a variety of options when it comes to buying gold, each catering to different preferences and needs.

Some may prefer not to hold physical gold due to concerns about storage, security, or insurance. Let's explore some alternative forms of investing in gold that allow you to benefit from its value without the need to store the metal yourself.

Gold ETFs (EXCHANGE TRADED funds)

A gold ETF is an investment fund that holds gold-related assets, like bullion or futures contracts, and is traded on the stock exchange. Its price follows the price of gold, allowing investors to buy and sell shares on the exchange just as they would do with any other stock.

It is a valid option for those who want to gain exposure to gold but do not want to deal with the storage fees that the physical metal requires.

GOLD IRAS (INDIVIDUAL RETIREMENT ACCOUNT)

Also known as precious metals IRAs, Individual Retirement Accounts are tax-advantaged savings plans designed to help individuals prepare for retirement.

These accounts involve purchasing and securely storing physical gold.

MINING STOCKS

Similar to the options above, mining stocks or shares in mining companies offer another investment opportunity. For instance, higher gold prices typically lead to increased profits for gold mining companies.

Investors can capitalize on a rise in gold prices without owning any physical bullion.

How much does a gold bar weigh?

Gold bars should weigh precisely what is inscribed on them on the assay or certificate card.

The 400-oz bar is considered the "standard" weight for gold bars. It is also nicknamed a "Good Delivery Bar" because it meets the Standards set by the London Bullion Market Association.

(Notice that one ounce is equivalent to approximately 28.35 grams, so a 400-ounce gold bar is equivalent to approximately 11,339.8 grams.)

However, 400 oz gold bars are usually not the most practical ones. When buying gold bars, you can find various weights and sizes to choose from.

Smaller gold bars include 0.5 grams, 1 gram, 2 grams, 5 grams, and even 10 grams. They are pretty easy to store and handle. They also offer more flexibility to your investments because you can decide to liquidate just part of your gold portfolio without having to melt it down.

10 Grams Argor-Heraeus Year of the Dragon Gold Bar

However, because gold is priced in bulk, larger gold bars, such as 10 oz or 1 kilo, offer the chance to purchase more gold per dollar invested, potentially saving on premiums.

Many investors go for the 1 troy ounce. It's neither too small nor too heavy. It doesn't require a great investment at once, such as the largest gold bars, and they tend to contain better gold prices in terms of value per pure gold content than smaller gold bars.

2024 1 oz Una and the Lion Gold Bar

Gold bars' worth will be determined mainly by their weight and purity. Prices will, of course, vary according to how much gold you are purchasing.

Understanding Gold Bar Prices

The base prices of all physical gold products, like those of other precious metals, are determined mainly by the spot price of gold. The spot price is the current price of an ounce of gold that can be sold or purchased at a given moment.

It is a system of price discovery mechanisms in which the interactions between buyers and sellers, trading gold thousands of times during the day, influence the final price.

In other words, it follows the basic laws of supply and demand.

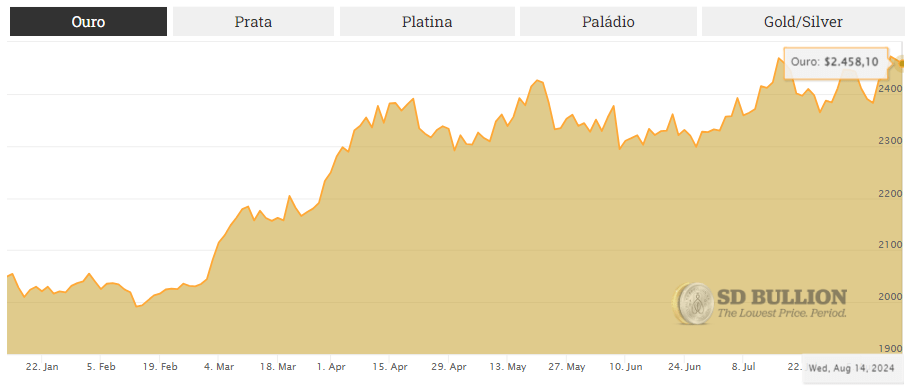

Gold prices tend to perform well in economic downturns. Given the current geopolitical events, this commodity has seen many changes this year. At the time of writing this article, the record price for one troy ounce of gold (oz) was $2,457.84 as of August 2024.

At the time of writing this article, base gold values for one gram of gold have been fluctuating around $79.02 So, for instance, a 100-gram gold bar will have a spot value of around $7,902, whereas one-kilo gold bars would be around $79,020.

All gold bars will have some sort of premium on top of the inherent value of the gold they contain. A premium is a set value or percentage charged above the spot price of gold. Depending on the dealer and the mint of the bars, these premiums can vary widely, finally reaching the retail value, or ask price, for each gold product.

Check out our blog post on How to Buy Gold Bars

Current Gold Bar Prices

What Are Gold Bullion Bar Premiums?

Generally speaking, this added cost over the spot price for any bullion derives from several factors, including the production, storage, and overhead costs incurred by the mint/refinery in producing the coin, plus a "mark-up" indicating the selling cost and the profit for the wholesaler selling the coin to a retailer.

Some premiums are a set monetary amount over the spot price, while other premiums can be a set percentage over the spot. Set monetary premiums are most common among bullion items that are 1 oz in weight.

Keep in mind that gold bars do not usually have numismatic value, even though they can sometimes be considered legal tender by the respective issuing government. Unlike American Eagle coins, which are made of gold and carry a face value, gold bars are valued solely for their gold content and purity.

Prominent Mints Matter

As it is with every mass-produced product, gold bars manufacturers matter when determining how much a gold bar is worth. Prominent private mints, such as PAMP Suisse, Valcambi, or Argor-Heraeus, are usually more sought-after than lesser-known mints. The same goes for government-owned facilities, such as the Royal Canadian Mint, the Perth Mint, and the Royal Mint.

When you buy gold bars from such refineries, you can expect to receive a product that meets the highest standards in the precious metals industry. Likewise, it will probably be easier to sell gold bars from these producers rather than from unknown brands, and you will likely receive better premiums from them.

Premiums to Expect from SD Bullion

***All premiums below are as of August 2024.***

Current Premium for Gold Gram Bars

It is worth noting that gram gold bars will have much higher premiums compared to larger bars because they have similar minting costs to the larger sizes but have less gold content.

1 gram gold bar (Design Our Choice) = $18-$24 over spot

5 gram gold bar (Design Our Choice) = $24-$34 over spot

10 gram gold bar (Design Our Choice) = $24-$35 over spot

20 gram gold bar (Design Our Choice) = $35-$41 over spot

50 gram gold bar (Design Our Choice) = $65-$81 over spot

100 gram gold bar (Design Our Choice) = $85 over spot

Current Premiums for 1 oz Gold Bars:

For 1 Troy ounce gold bars, the premiums vary depending on the quality and mint that they come from.

1 oz Random Design Bars = $35-$40 over spot

1 oz Random Design Bars in Assay = $45-$55 over spot

1 oz Gold Bars from Specific Mints = $50-$60 over spot

Current Premium for 5 oz Gold Bars (Design Our Choice) = $201-$252

10 oz Gold Bars (Design Our Choice) = = $293-$339 over spot

Current Premium for 1 Kilo Gold Bar:

1 Kilo RCM Gold Bar = $1,283-$1,436 over spot

Final Words

In this article, we explored the various factors that influence the value of gold bars. Gold has long been a popular means of preserving wealth, thanks to its intrinsic value. Additionally, we discussed how the gold current spot price plays a crucial role in determining the cost of gold bars.

Additionally, other factors such as interest rates, geopolitical events, stock market downturns, and fluctuations in gold's supply and demand can all influence its current market price and, as a consequence, investor sentiment.

We hope this article has clarified the key considerations for assessing fair prices for gold bars to meet your financial goals or investment needs.