Graded coin specimens attract both investors and collectors as they know exactly what quality to expect. Although there are many grading agencies out there, two of them are regarded highly in the precious metals market, especially here in the United States – NGC (Numismatic Guaranty Corporation) and PCGS (Professional Coin Grading Service).

The Sheldon Scale

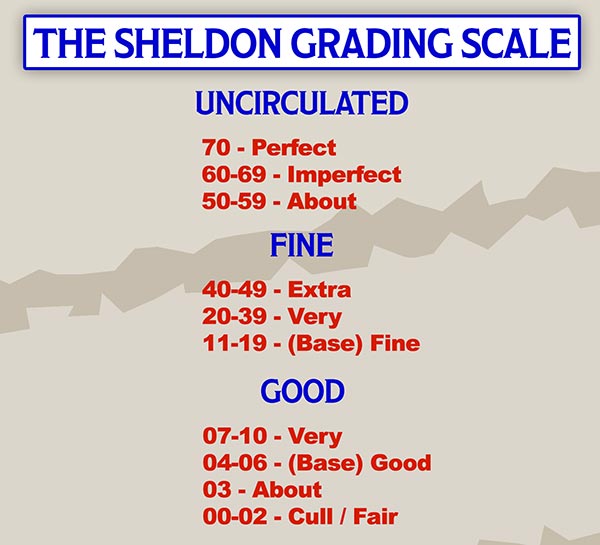

Without a global standard, the entire grading process would be wrought with confusion as buyers try to decipher what grade indicates what conditions using charts and figures from various agencies. Hence, grading services usually use the Sheldon Scale – a globally-recognized scale used to grade coin specimens.

This scale was created by Dr William H Sheldon. The original scale was published as a way to grade large cent coins in 1949.

Today, most grading agencies, like the NGC and PCGS, use the Sheldon Scale to assign standardized grades to all coin specimens. The scale ranges from 1 to 70 and is preceded by letters that indicate the strike type of the coin in question.

While the Sheldon Scale used by these companies doesn’t vary, the designations and letters used to denote strike type often do.

Common Coin Grade Types (Grades between 60 and 70)

Uncirculated coins are assigned a number between 60 and 70 to indicate their condition. A grade of 70 is considered flawless, because it doesn’t display any surface imperfections even when inspected by experts under magnification. Hence, collectors and investors are quite willing to bear the premiums they command.

- MS (Mint State): Coins that haven’t been circulated. They’re only assigned grades between 60 and 70 on the Sheldon Scale.

- PF/PR (Proof): Reserved for proof coins struck in a special format, usually for collectors. They’re also only assigned grades between 60 and 70 on the Sheldon Scale. While ‘PF’ is used by NGC, ‘PR’ is used by PCGS. Nonetheless, they both denote proof coinage and aren’t different in any way.

- SP (Specimen): Reserved for coins that cannot be classified either MS or PF and fall somewhere in the middle. These coins are usually a hybrid/cross between Mint State and Proof coins.

Sheldon Scale Grades (Below 60)

Circulated coins understandably exhibit a bit of wear. From slight wear and tear to barely recognizable, the Sheldon Scale grade assigned to the coin can tell you a lot about the coin in question.

- AU (About Uncirculated): Assigned grades of 58, 55, 53, and 50 on the Sheldon Scale. Coin specimens can display as high as slight wear on 50% of the designs to only slight wear on the highest points; a grade on the Sheldon Scale is allotted accordingly.

- XF (Extremely Fine): Coins won’t lose any detail and might feature minor wear on most high points. Grades assigned are 45 and 40.

- VF (Very Fine): Nearly complete or moderate design details with softness on design areas. Grades assigned on the Sheldon Scale are 35, 30, 25, and 20.

- F (Fine): Although recessed areas will exhibit softness, letters and digits remain sharp. These coins are given grades of 15 or 12 depending on the condition.

- VG (Very Good): The design as a whole has seen some wear and the letters and digits exhibit some softness. Grades assigned on the Sheldon Scale are 10 or 8.

- G (Good): Peripheral digits and letters are displayed in full and the rims are either sharp or exhibit some wear. Depending on the condition, the coins are given grades of 6 or 4 on the Sheldon Scale.

- AG (About Good): Most letters and digits are readable but the rims are worn out. These coins are assigned a grade of 3.

- FR (Fair): Only some details are still visible, while the rims are barely visible. Given a grade of 2 on the Sheldon Scale.

- PO (Poor): Graders can see just enough detail to identify the coin’s date and type. The rims are nearly flat in most cases. This is the lowest grade possible and is assigned a 1 on the Sheldon Scale.

Numismatic Guaranty Corporation (NGC)

Established in 1987, NGC is one of the most prestigious third-party coin grading services in the United States. Moreover, being independent of any private or sovereign Mint (IE: US Mint), their motivation is simply to provide the best quality assurance service to coin collectors and investors.

Furthermore, the coin graders employed at the NGC cannot buy or sell coins, as per their employment contracts. Hence, they remain impartial in the coin grading process, as they aren’t personally or financially affected by the grades they assign to any particular coin.

Over the past two decades, NGC has become one of the most trusted grading agencies in the world with over 35 million coins graded to date. It is known for authentication, grading, attribution, and encapsulation of millions of coins and its reputation has been steadily rising ever since its inception.

Professional Coin Grading Service (PCGS)

PCGS is one of the oldest coin-grading agencies in the United States and was established in 1985. It is headquartered in Santa Ana, California. The sole aim of the seven dealers, including the current president of PCGS, David Hall, while setting up the agency was – providing more information about coins to the public, before they dip into their wallets.

Over the past three decades, PCGS has built a solid reputation upon millions of accurate grades, making it one of the most respected authorities on coin grades. Their vast experience inspires confidence among buyers who trust their grading system, knowing that the grade assigned to any coin by the PCGS is bound to reflect its condition accurately.

PCGS was formed with the aim of protecting prospective buyers from spending a considerably higher amount of money for a lower quality product. With over 38 million coins graded to date, it is safe to say that the agency is well on its way to accomplishing its goal.