For this week's Metals & Market Wrap we speak with Criag Hemke of TFMetals Report about this summer's devaluing Chinese Yuan and US dollar prices for Gold, Silver, Platinum, and other non-precious commodities.

Is it possible we are seeing the beginning phases of a Chinese Gold Yuan Peg?

Recently Craig wrote an article posted over at Silver Doctors' website entitled, "The Yuan-Gold Peg and The COT Report".

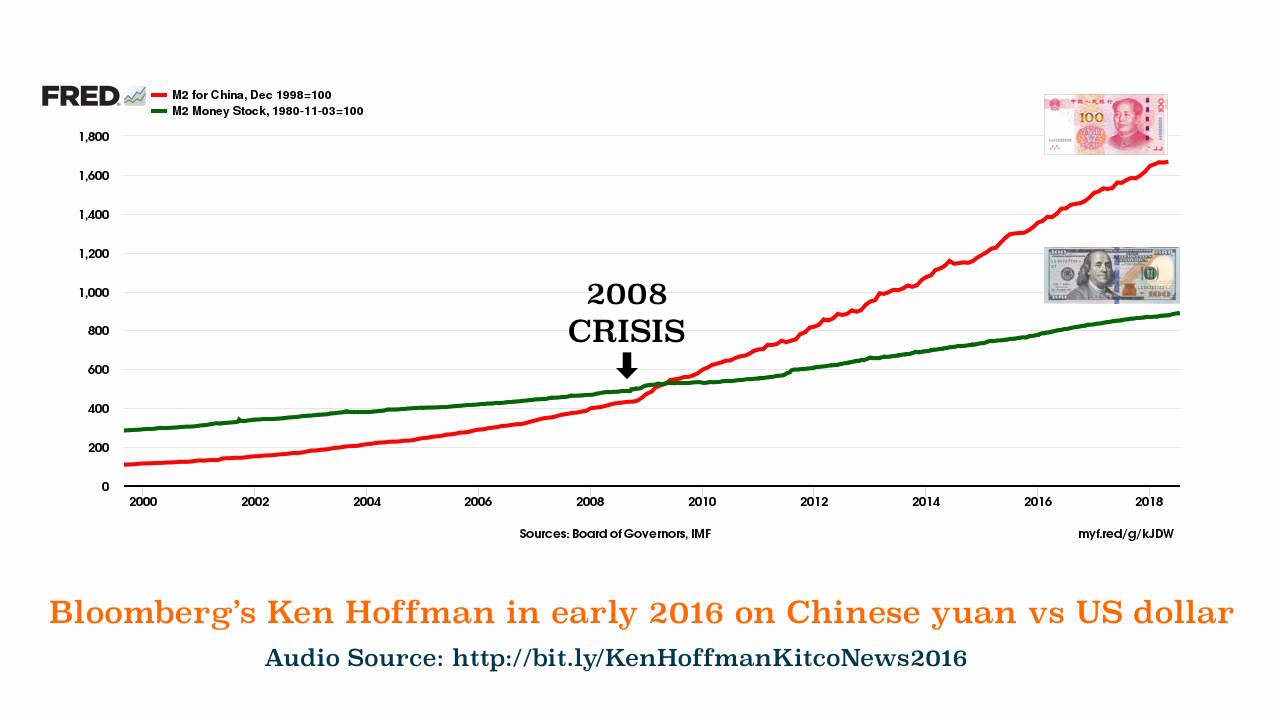

China yuan / Chinese renminbi M2 vs US dollar M2 2000s

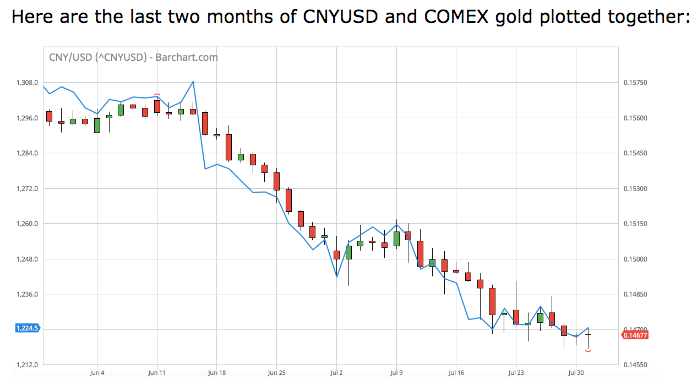

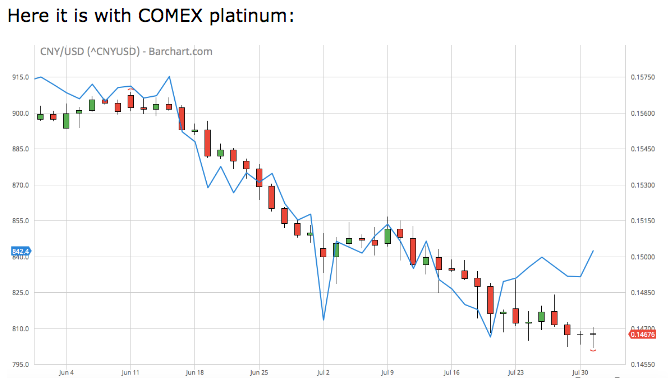

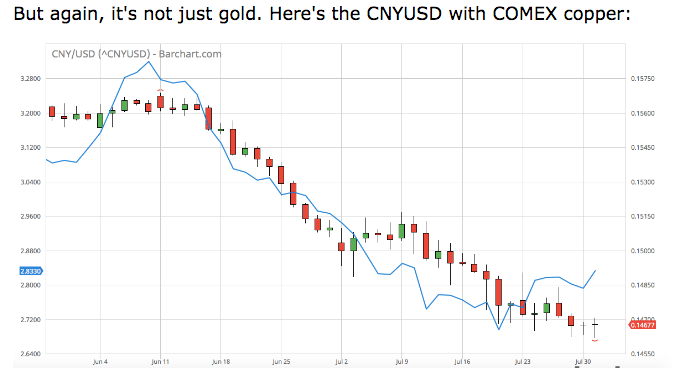

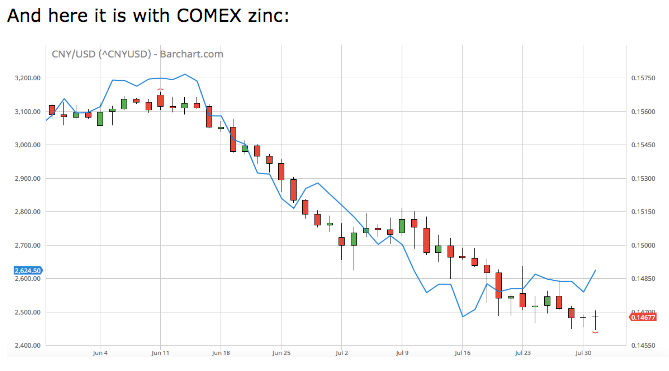

Chinese yuan, China renminbi / US dollar value vs Gold, Platinum, Copper, Zinc Prices

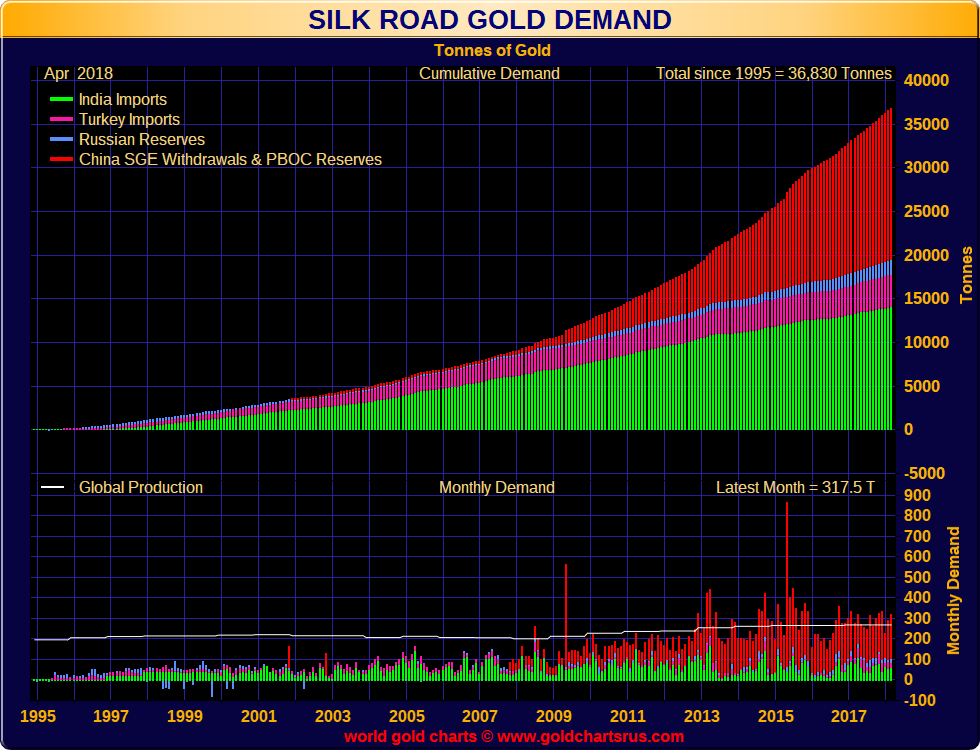

China Gold Bullion Imports 1995 - 2018

#MAGA: Tweet Spring 2018 on Currency Manipulators (China / Russia)

Prudent Bullion Allocations are Critical for Long Term Wealth Preservation

***