Industry Pitfalls & Poor Business Practices

Unfortunately there are both incompetent, and worse, alleged bad actors in the gold industry who use various tactics to take advantage of unsuspecting individual investors. Learn to use various free tools and best practices to avoid them always.

The growth of the internet in this 21st Century Gold Rush has been somewhat of a double edged sword in terms of honest and potentially dishonest gold and silver dealers.

Negatively speaking, international internet commerce has helped proliferate various counterfeit Chinese products around the world. Fake bullion coins and bars are often bought by scammers and sold to unknowing individuals who use websites like Craigslist (even eBay). Most fake bullion items are simply cheap gold or silver electroplated versions of the original. More sophisticated and rare fake bullion products can include heavy metal inserts (like tungsten or lead). Avoiding them is not difficult if you stick to some basic best bullion buying practices.

Note that no legitimate bullion dealer regularly falls for counterfeit bullion product scams as there are technological tools (sound, x-ray, water displacement etc.) we use to verify all product authenticity (especially any secondary products purchased).

Authentic bullion dealers always sell bonafide bullion products, otherwise they risk their reputation, business future, or being shut down by law enforcement. Legitimate bullion dealers also do sell real physical bullion products in high volumes through eBay, so it is important to know the counterparty you are buying from and how legitimate their track record is (we’ll discuss how to do this shortly).

On a positive note the growth of the internet has helped expose poor business practices in our industry, yet everyday there are still individuals who are being taken advantage of.

For the most part, local coin and online bullion dealers have good business practices.

While it is embarrassing to have to admit this, there is a surprising level of bad actors in the gold and silver industry who use, while perhaps not technically illegal, various legally gray tactics to take advantage of unsuspecting individual investors.

For example, if a gold dealer advertises on the radio, in a magazine / newspaper, or on TV commercial breaks on CNBC, the highest chance probability is that they are selling high profit margin products (good for themselves mostly, not their unknowing customers).

Most honest online bullion dealers will sell live to you 24 x 7 through their websites with upfront dynamically updating live prices. You don’t need an ‘account representative’ to buy from these types of online high volume bullion dealers. Their business models are often based on transparent, high volume, razor thin, basis point profit margins.

Shortly we will cover how to perform some of the best due diligence practices before you place any orders. We will also cover where and how to look in order to better ensure you don’t do business with potentially bankrupting or nefarious silver or gold dealers.

There are basically a few business models currently operating in the unregulated physical precious metals industry.

Various gold dealer business models include:

- Local Brick & Mortar Coin Shops (Collector Coins / Bullion)

- High Volume Online Bullion Wholesalers / Retailers (SDBullion.com)

- Rare Collector Coin Dealers (Numismatics)

- Semi-Rare and often Overpriced Online Coin Dealers (High Commissions)

- Sell and help you store your bullion models (most with limited, costly delivery)

- Leverage dealers (very risky)

First and foremost when buying physical investment grade bullion products, you want a return OF your capital and then likely with time, an eventual return ON your capital.

There is also a common saying in our industry, “If you can’t hold it, you don’t own it.”

This saying essentially means that when one wants exposure to bullion values, one should have direct ownership with possession either in hand and or in a direct account with professional fully insured non-bank depository services (e.g. Brink’s, Loomis, etc.).

The lone exception being when buying bullion products for an Individual Retirement Account (IRAs) and why the IRS mandates that a 3rd party trustee must be involved (which will cover further in the coming IRA section).

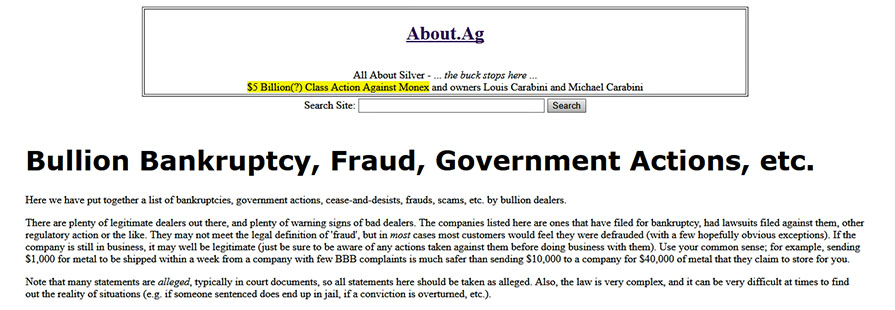

Luckily today the bullion industry has an active blogging, quasi-whistleblower who has documented over 130 industry bankruptcies, alleged frauds, lawsuits, government actions, etc. which can help readers become more aware of some commonly alleged poor business practices possibly ongoing or which may have occurred in the past.

Buying Bullion for the First Time (Understand Search Results)

For beginners seeking bullion, the typically start goes something like the following.

Somehow, some way, you got interested in learning more about precious metals. For convenience sake, you likely started your research by visiting Google, Youtube, or perhaps another large internet search engine. There you likely entered various search terms related to precious metals and investing.

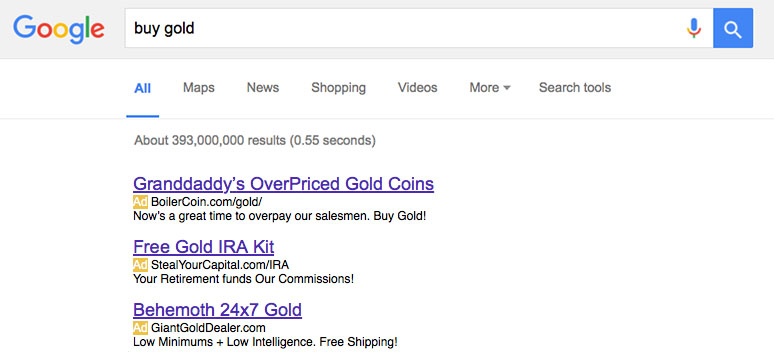

If any of your search terms had the words “silver” or “gold” in them, the top half of that 1st search result page was most likely first filled with retail silver and gold dealers who have paid for their top listings ( e.g. Ad ) through services like Youtube and Google Adwords.

After you scroll down past the paid for advertisement links, you will likely find other online high google ranked gold and silver dealers who have consciously jockeyed and secured high rankings for the specific search terms you entered using search engine optimization tactics (called SEO for short).

How to Figure Out Which Bullion Dealers are Best

Who from this unregulated, mostly privately owned silver and gold dealers should be trusted with your hard earned savings?!

It is not easy.

With over 10 years of experience in the physical bullion business behind me now, here’s how I read the top portion of my latest “Buy Gold” google search:

Truth is whether it is through paid advertising or ‘organic’ optimized high ranking website pages, the top to bottom search results you are given from the internet are hardly ever the best results for your specific needs.

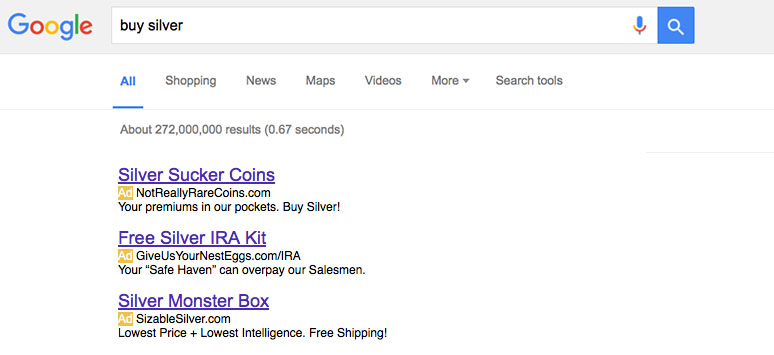

And here’s how I see my “Buy Silver” search today:

As your search continues you will likely visit a bunch of online silver and gold dealer websites. Some will then follow you around the web serving you their banner advertisements trying to entice you back to their website (remove unwanted ads).

Perhaps you proceed to read some of the writings on various gold and silver dealer websites, watch some of their promotional videos, maybe you even called them on the phone. One thing in common with all of them is that you likely will find contradictory information and a wide variance between insightful info vs near worthless marketing drivel.

Next you might think to do a search on local coin dealers in the area. Trouble is many of the search engine results will again give you mixed results between pawn, we buy gold shops, high premium gold jewelry stores, and perhaps a few local local coin dealers most without fully functioning well written websites nor organic online review trails.

Worse yet, there may be state taxes involved with purchasing physical precious metals locally throwing a wrench into a buy low, maybe one day sell some high strategy.

Maybe like me, you figured a smarter way to perform due diligence and learn best practices is to buy some books on bullion. I myself in 2006 visited my local Borders book store and bought the entire portion of the shelf related to gold investing.

That amounted to 4 books in total, two of which were not helpful, while two others were in terms of teaching me new information on the investment class itself. Yet when it came to actionable content on how to safely buy bullion (much less even define the word itself) all these books fell short in real world applicable advices. They were all limited in suggestions on how to perform proper due diligence in order to better one’s chances to safely acquire bullion at a reasonable price.

Five years, later Borders was bankrupt, but the bullion I eventually bought remains solvent within my segregated non-bank storage account. Albeit my successful bullion buying only occurred after many beginner mistakes like buying bank rigged ETFs, having to hear various crooked leveraged account pitches, etc.

So here I am now trying to help you avoid active potential pitfalls using real world tools.

Let’s now discuss how to buy bullion intelligently in 2018.