Silver bullion is the least expensive precious you can buy.

Owning physical silver bullion directly protects wealth from economic disruptions, bank bail-ins, currency devaluations, and global financial crisis.

The following short video cover silver investing fundamentals in 2018.

Silver bullion is most often measured in fiat currencies ( US dollars, yen, pounds, euros, pesos, yuan, etc. ) or fiat currency indexes ( US dollar index DXY, IMF SDRs etc.).

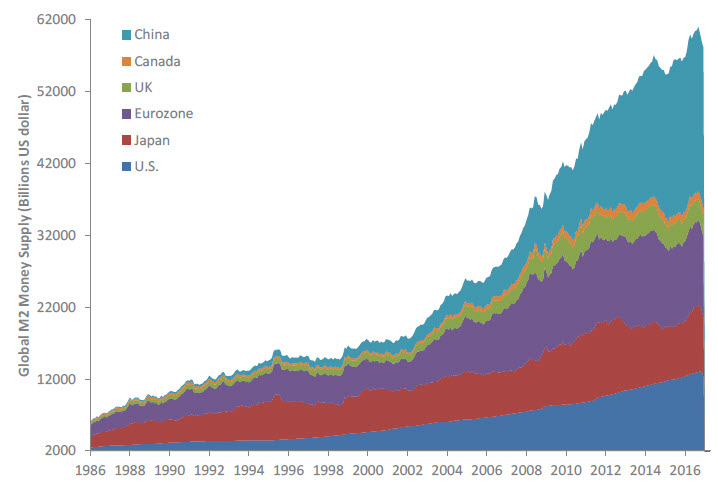

Although values of fiat currencies vs silver bullion are constantly fluctuating, growing fiat currency creation (e.g. Global M2 money supply chart below) ensures the ongoing trend of silver bullion gaining value vs fiat currencies will likely continue long term.

Various advances in technology and human ingenuity have helped hide some price inflations for some goods and services (e.g. computers, food, clothing), yet the data is clear. In overall purchasing power and value terms, silver bullion has substantially outperformed every fiat currency issued over this same timeframe.

The inverse mirror reflection of rampant currency creation is generally reflected in increasing precious metal values.

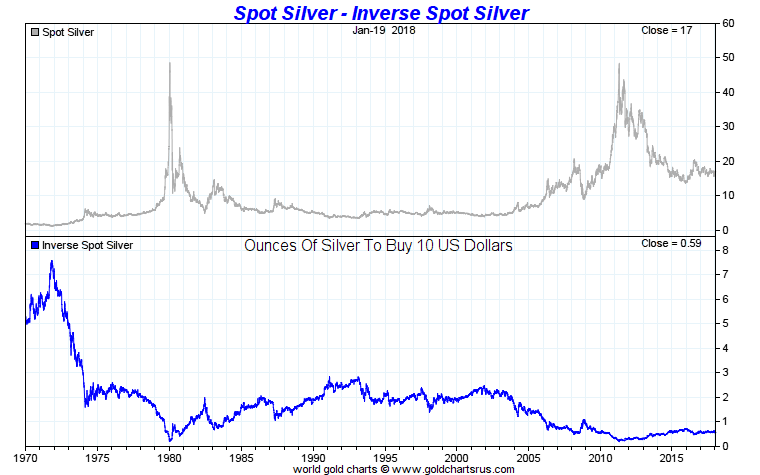

An example of this can be seen in the following Silver vs US dollar chart below which spans from 1970 - 2017 AD.

The long term trend is painfully clear for US dollar holders.

Silver Prices in US dollars & Ounces of Silver to Buy $10 USD (1970 - 2017 AD)

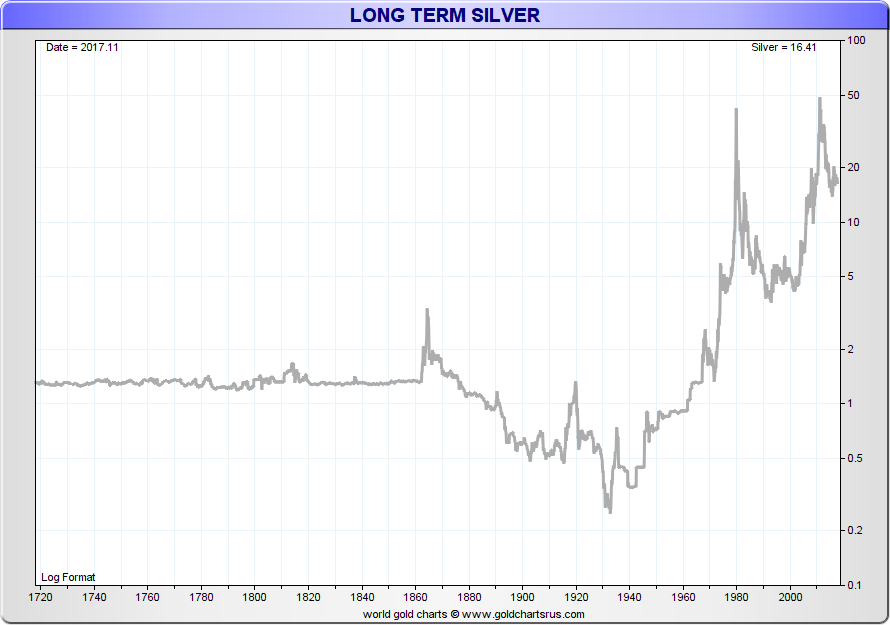

Using an even longer term perspective let's pull back before the USA was officially formed, back when Spanish silver pieces of eight coins were the main circulating currency.

See how steady the price of silver was until the mid 19th Century.

Also be sure to take note of the current multi-decade running 'silver cup and handle' technical pattern being formed by silver's US dollar price currently.

Many silver analysts postulate much higher future prices for silver in the years to come.

Silver Price in nominal US dollar terms (1720 - 2017 AD)

Following that large banking houses demonitized silver (late 1800s) and later a US central bank (1913) was formed which often fixed silver prices below their true value. Then finally in the current fiat currency debasement era which went into full overdrive post WW2.

Surely you have heard someone tell you price inflation is near to nothing these days.

While this may be true in terms of buying the latest electronic gizmo or technically produced items (e.g. Moore's Law).

The claim that we have no price inflation is flat out erroneous if measuring the growing and current prices of bonds, equities, tuitions, high quality food prices, residential housing prices in metropolitans, rents in most major cities, and health care costs.

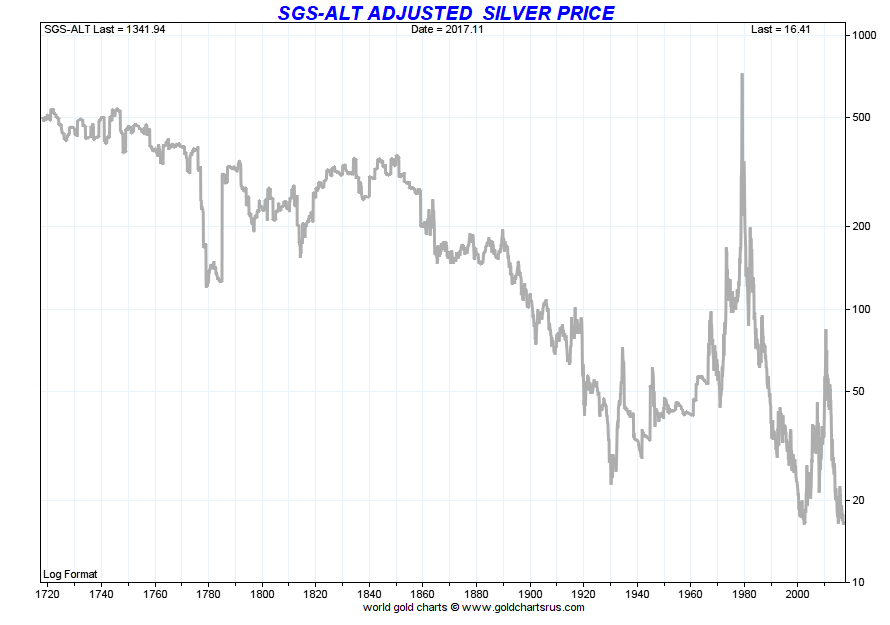

Over the last three to four of decades in the United States, the quality of US government reporting (BLS) has deteriorated sharply. Data reporting problems have included methodological changes to economic reporting that have pushed headline economic and inflation results well below the realm of real-world or common experience.

Using 'Shadow Government Statistics' and data analysis behind and beyond US government economic reporting we find the price of silver past and present over this same 300 year timeframe.

Silver Price in US dollar terms using Shadow Government Statistics data (1720 - 2017 AD)

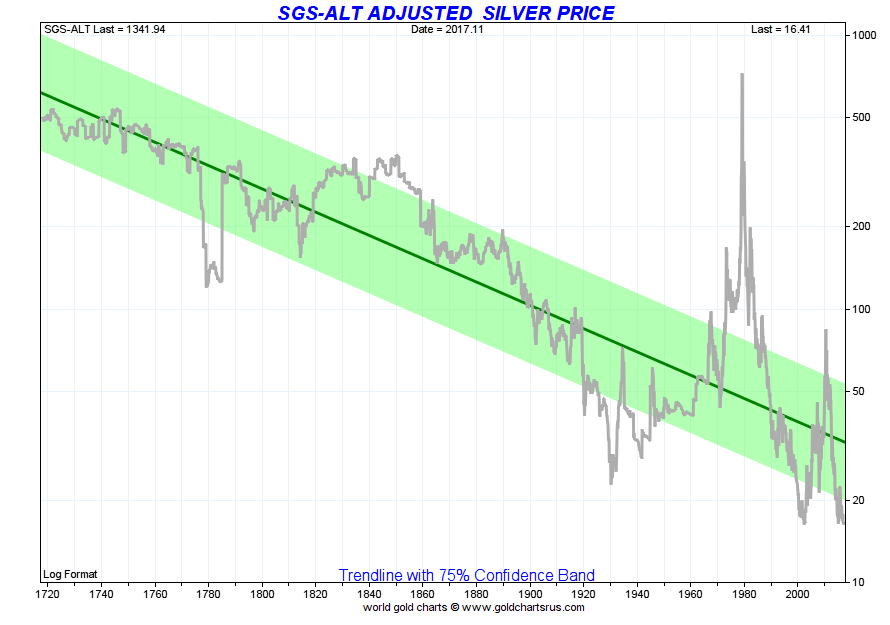

Surely with the industrial revolution mining and acquiring silver ore became easier, yet we would argue most of the easiest silver finds have been mined.

Most primary silver mining companies are struggling to produce profits with $17 oz silver spot prices.

Using a trendline with a 75% confidence bandwith, silver looks as undervalued today as it was back when the government fixed its prices below $1.29 oz pre-1971.

Silver Price in US dollar terms using Shadow Government Statistics data + trendline (1720 - 2017 AD)

The final closure of the Bretton Woods agreement by the USA on August 15, 1971 signified a global monetary system transition from a quasi-gold backed rules based standard to one in which various national fiat currency values have fluctuated against one another (all losing tremendous value to physical precious metals over time).

Physical precious metals are extremely finite in supply compared to competing fiat currencies, hence over long time spans, silver bullion tends to gain purchasing power versus rapidly expanding fiat currency supplies.

For many thousands of years silver has served as a trustworthy store of value, specie money for day to day transactions, and as a vehicle for long term savings.

Silver is the most common and least expensive of the various precious metals (compared to gold, platinum, and palladium). Often referred to as the poor man’s gold, silver was first minted in Lydian coinage around 600 B.C.

Silver coins throughout history have been mostly struck in sterling silver.

Sterling silver coins typically have copper added to achieve further durability during monetary circulation. Virtually every successful long standing culture since the end of ancient times issued or had sterling silver coinage in their monetary system.

Examples include ancient Lydian silver coins, Greek drachma silver coins, the silver Roman denarius coin, British pound sterling silver coins, US silver circulation coins, and Canadian silver circulation coins.

“The major monetary metal in history is silver, not gold,” according to Nobel Prize winning economist Milton Friedman in 1993.

Friedman was most likely referring to the fact that based on overall historic human to human transaction volumes, silver coins have served mankind more as money than any other past commodity money or fiat currency issued today.

Here is a brief 12 minute video showing why silver is so valuable still today.

Silver literally means money or cash in French, Thai, Greek, Portuguese, & Spanish.

Today millions of silver investors privately hedge their wealth against economic disruptions, bank bail-ins, fiat currency devaluations, and systemic financial crisis by acquiring either old formerly circulated silver coinage and as well 100% pure privately minted modern day silver bullion rounds, newly issued government guaranteed silver coins, and silver bullion bars.

More so than merely a monetary metal, silver today is a heavily used precious industrial metal. Silver remains 2nd only to crude oil in the amounts of real world products and applications it is used in.

We cannot live our modern way of life without silver for it:

-

has an extremely high reflection for light hence its usage in mirrors.

-

is the most electrically conductive metal of all.

-

is the best thermal transmitter of all metals.

-

is germicidal in nature and thus used in various antibacterial applications.

-

is easily malleable and ductile, only slightly harder than gold.

Silver’s industrial applications are vast and highly variant. From silverware, jewelry, dentistry, usage in air conditioning, water filtration, mirrors, car windshields, various electronics, photography, etc.

How much silver do you think is used in the average solar panel, personal computer, or smartphone?

We thoroughly examine industrial silver applications in the silver demand section of our new 21st Century Gold Rush in a convenient portable digital document format (PDF).

You can get yours right now, absolutely 100% free.

Just click here to get yours.