Jump to: Types of Gold Bars | Top Picks for Investors | Why Gold Bars? | Purity and Weight | Pricing Insights | Where to Buy? | Where to Store? | Selling Your Gold Bars | FAQs

In 2025, the best gold bars come from top sovereign and private mints—Argor-Heraeus, Perth Mint, Royal Mint, Royal Canadian Mint, Valcambi, Johnson Matthey, and PAMP—offering investment-grade .9999 purity, tamper-proof security features, and a range of sizes.

Key Takeaways

-

Reputable brands such as Argor-Heraeus, Perth Mint, Royal Mint, and the Royal Canadian Mint offer quality, security, and a range of sizes to fit different investment needs, along with unique features like divisibility.

-

Gold bars typically carry lower premiums than gold coins, are easier to store, and act as a hedge against inflation, making them a solid choice for diversifying investment portfolios.

-

Larger bars typically have lower premiums per ounce but offer less liquidity than smaller ones, with the 1 oz bar being the most popular choice among investors.

-

Minted bars are machine-cut with a polished finish, ideal for presentation and resale. Cast bars, on the other hand, are mold-poured, simpler in appearance, and better suited for low-cost, bulk investment.

Type of Gold Bars

Gold bars, in general, are produced by both sovereign mints and private refineries, following strict standards regarding shape, weight, and purity.

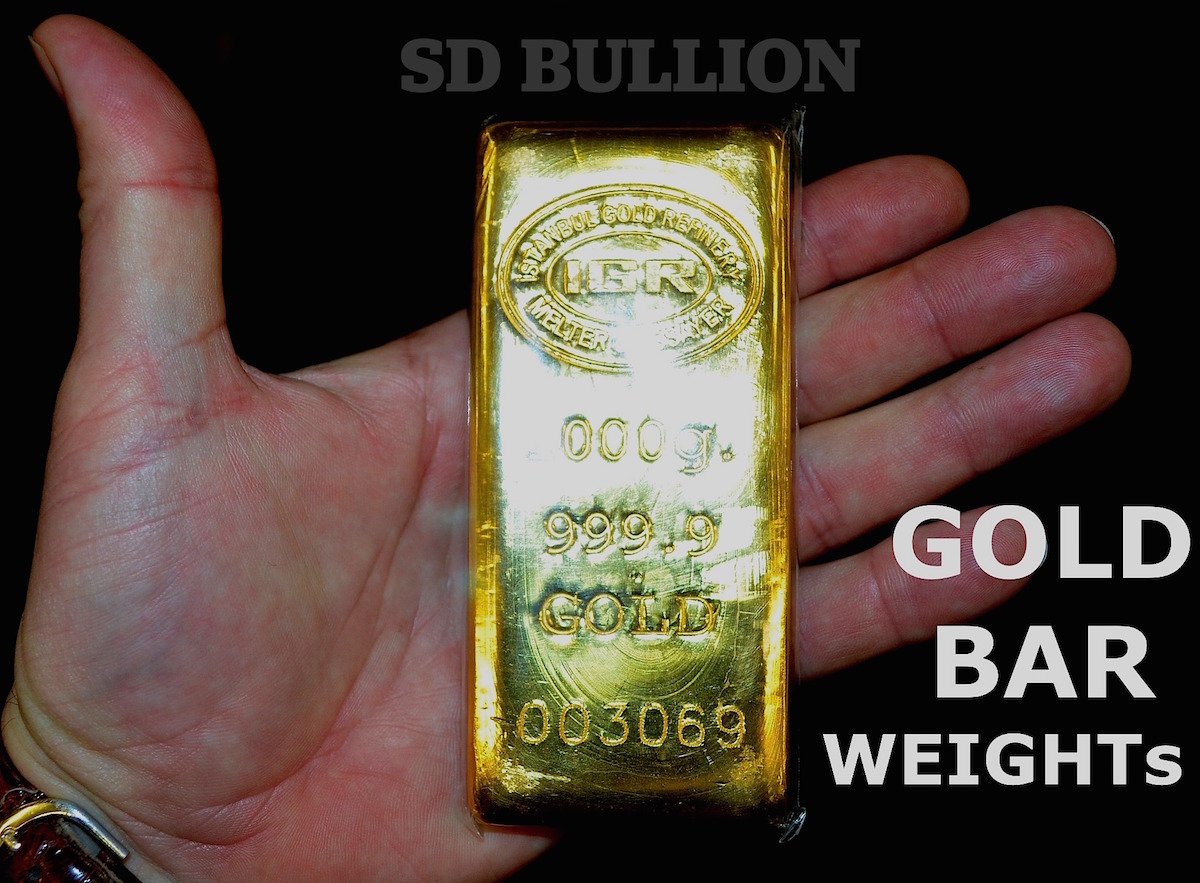

Cast Bars

Cast gold bars are one of the most basic forms of bullion, made by pouring molten gold into molds. The manufacturer's name, weight, and purity are engraved afterward. They’re simple in design, often available in larger sizes, and come with lower premiums due to their ease of production. However, their rough appearance can make them less appealing to buyers, reducing liquidity.

Minted Bars

Unlike cast bars, minted bars have a polished and refined appearance. They're made from gold strips cut and stamped with details and designs. They tend to be more liquid, often with security features such as holograms, serial numbers, and assay certificates. The precise manufacturing, inspection, and polishing make them more visually appealing, frequently leading to higher premiums.

Top Gold Bar Picks for Investors

Investors seeking high-quality gold bars prioritize certified purity and reliability, as the more trusted the mint, the more globally liquid their products tend to be. A few standout brands lead the market by consistently offering some of the most trusted and desirable bullion. Among these premium producers known for crafting some of the best gold bullion bars available are:

Argor-Heraeus Gold Bars

Argor-Heraeus is one of the world's oldest gold bar manufacturers. The company is a private mint and family-owned for nearly 400 years.

Initially, the company was based in Germany under the original Heraeus brand. It has merged with the Argor brand in Switzerland, where their gold refining and production are done.

1 oz Argor-Heraeus Kinebar Gold Bar is an exceptionally prized product. Kinebar Technology brings stunning colors and ensures extra security measures to prevent fraud attempts.

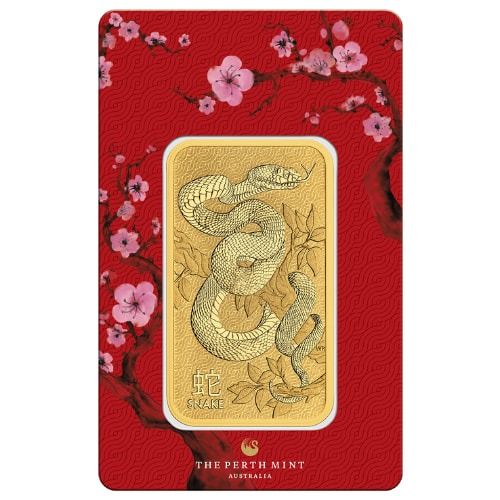

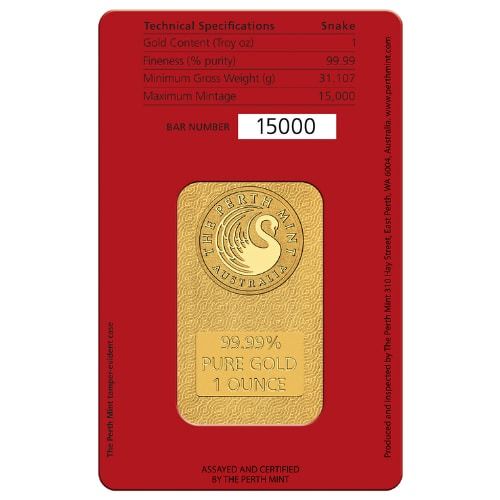

Perth Mint Gold Bars

Located in Australia, the Perth Mint produces gold bars that embody exceptional craftsmanship and are adorned with cultural symbols, such as the kangaroo and the Chinese zodiac. These representations celebrate Australian traditions and underscore the mint's dedication to crafting high-quality precious metals.

Innovating the Series, the Perth Mint strikes for the second edition, the Minted Gold Bar imprinted with a Snake Design on the obverse side, a unique look celebrating the Year of the Snake in 2025.

Security is a top priority for Perth Mint, with each gold bar sealed in tamper-proof packaging and accompanied by a certificate of authenticity. This ensures both protection and visual appeal, merging beauty with safety.

Valcambi Suisse Gold Bars

Gold bars from Valcambi Suisse represent the finest standards, boasting an impressive .9999 purity level indicative of investment-grade gold. The prestigious reputation of the Valcambi Mint is bolstered by their high-caliber products that allure those in pursuit of both sophisticated beauty and fiscal merit when choosing their suisse gold bars.

Atop its series stands CombiBar, the mint's ingenious creation designed for divisibility into smaller units, granting investors unprecedented adaptability and convenience in managing their assets.

The 100 x 1g Valcambi Gold CombiBar In Assay is a 100-gram gold bar composed of 100 1-gram gold bars, enabling investors to purchase a 100-gram gold bar that can be broken down into smaller units.

Every bar is meticulously encased by Valcambi, accompanied by an assay certification and a distinct serial number, serving as indelible signs of dedication to ensuring genuine provenance and heightened security.

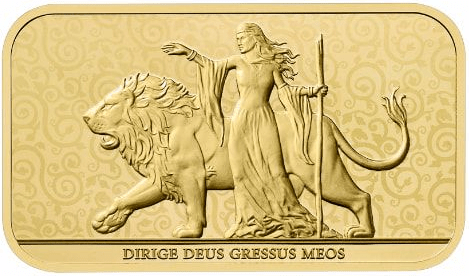

The Royal Mint Gold Bars

The Royal Mint produces the Britannia gold bars. They are extremely popular, as they carry a beautiful design and come in a protective assay card. The Royal Mint is the oldest mint currently in production. This is why they call themselves The Original Maker.

The exclusive Una and the Lion Collection, is one of the most beautiful designs in the gold bar market today.

The Royal Canadian Mint Gold Bars

The Royal Canadian Mint is possibly the most popular brand for 1 oz gold bars and also 100 oz silver bars. They have publicly invested in a massive amount of technology to create extremely high-quality products that hold their quality over the long term.

Like all other major brands mentioned here, the RCM ships their 1 oz gold bars serialized with a unique serial number in a protective assay card.

PAMP Suisse Gold Bars

PAMP Suisse (Produits Artistiques Métaux Précieux) is the world's leading privately operated precious metals refinery based in Ticino, Switzerland. Since their assaying services are world-renowned, as every PAMP product is made to the highest standards of craftsmanship and purity, assets certified and sealed by PAMP have a unique status in the precious metals market.

In 2025, the Year of the Snake, PAMP's 5-Gram Gold Bar features the white snake, a symbol of immortality in Chinese mythology. It comes in themed packaging with an assay card and a unique serial number.

Johnson Matthey Gold Bar

Johnson Matthey is a renowned name in the precious metals industry, with over 200 years of history. Founded in 1817, Johnson Matthey is known for its quality and innovation. It has earned a lasting reputation as a leading global refinery, with bullion products prized by investors and collectors worldwide.

Packaged in a Certificate of Authenticity, the 1 oz of .9999 Pure Gold Bar In An Assay is a top seller among their products.

Like all the bars mentioned in this article, this product is IRA-approved, a testament to its reliability.

Investing in Gold: Why Gold Bars?

Gold bars are a great option for investors, offering lower premiums than coins and easy storage. Their practicality and reliability make them ideal for long-term investment strategies.

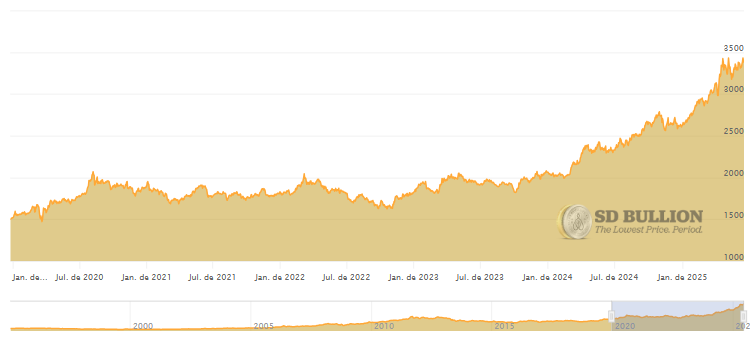

Even though, like any investment, gold carries some risk, recent geopolitical events, much like the COVID-19 pandemic, have driven prices to historic highs, showing how crises influence gold's performance.

In early 2020, gold reached record levels and has continued rising since, fluctuating as of mid-2025, at 3,400 per ounce. Based on its strong performance during economic downturns, gold bars (as a cheaper way of bulking) remain a valid option for short-term investment, financial security, and long-term wealth preservation.

The Significance of Purity and Weight in Gold Bars

The fundamental determinants of a gold bar's inherent value are the purity and weight of the bar. For the gold bars to be considered an investment-grade, they must possess 99.5% minimum purity.

Most gold bars minted today, though, include 99.9% purity, with most major brands producing 99.99% pure gold bars to buy.

Understanding Fineness

A gold bar’s purity is measured by its fineness, with 24-karat (999.99) being the highest standard. Highly pure bars like these are prized by investors for their value, purity, and attractive appearance.

Choosing the Right Weight

The size or weight of the bar can vary drastically. However, this is good as it allows all budgets to participate in the investment process. You can choose from 1 gram to 1 kilo bars.

Please note that, while the rest of the world operates on the gram system, American buyers are used to measuring in Troy ounces. Therefore, 1 oz and 10 oz gold bars are the most popular sizes for US buyers, while gram sizes are much more popular overseas.

Pricing Insights

Spot Price Influence

The gold market is driven by the spot price, which is the current cost of one troy ounce of pure gold, fluctuating daily based on global economic factors and central bank actions.

When purchasing gold bars, the spot price serves as your starting point. A premium, which includes production and distribution costs, is added on top to determine the total price per ounce.

Do you know how much a gold bar is worth? Read the full details in our article.

Comparing Premiums

Premiums cover production and dealer costs and can vary depending on the product and seller. To keep costs down, compare premiums carefully and consider the bar’s authenticity, purity, and weight.

Larger bars typically offer lower premiums per ounce, making them more economical than smaller gold bars for bulk purchases, though they can be harder to resell later.

Where to Buy: Securing Your Gold Investment

While traditional brick-and-mortar stores allow you to inspect bars in person, online companies often charge significantly lower overhead costs. This efficiency can translate into more competitive pricing for gold. Furthermore, online dealers typically offer a broader selection than local retailers, giving buyers greater variety and flexibility.

So, if buying online, look for reputable dealers who offer gold or other precious metals at fair prices, be wary of "below the spot price" offers.

Check shipping processes, customer policies, and online reviews. ANA affiliation tends to ensure ethical standards, Best Business Bureau accreditation, and whether the dealer is a US Mint Authorized Purchaser; these are all strong signs of legitimacy.

Storing Your Gold: Safety and Security Tips

Securing your bullion is crucial when investing in gold bars. Unlike intangible assets, physical gold carries theft risks. Here are the most popular storage options, along with key considerations.

Banks typically offer safety deposit boxes and vaults, providing a higher level of security, as expected from a financial institution. However, the main drawback is limited accessibility, since most banks operate only on business days. So, accessing your investment during weekends or holidays in case of an emergency can be challenging.

At-home safes are also a popular option. And they offer some safety, as you need to choose how to unlock it. They generally work well against fire, flood, and natural disasters. However, for a safe to be resistant, it will be expensive and still require strategic placement, as well as attack resistance. A good fireproof and waterproof safe will cost around 2,000.

Companies Depositories: Offers high-level security and full insurance (e.g., through Lloyd’s of London), protecting your metals from theft and home risks. Storage is affordable, with plans starting at $9.99 per month after a free trial. Specialists consider this the safest option, as it offers secure, climate-controlled storage ideal for preserving precious metals, and often provides 24/7 access and full insurance.

Maximizing Resale Value: Selling Your Gold Bars

Should the time come when divesting your gold bars is in line with your financial plans, it's vital to sell for the best possible price. As I mentioned above, if you purchased larger-format gold bars (many serious investors do), these can be more difficult to liquidate. Not all buyers of gold bars will have the funds or process to buy larger-format gold bars.

Therefore, if you are looking for the most liquid product to buy and sell, gold investors worldwide usually start investing in 1 oz gold bars and coins.

Regardless, when you're selling, ensure that you receive the highest bid from a trusted online dealer.

Read our complete guide on how to sell gold bars.

Final Words

Gold bars are an excellent way to invest in physical gold, but a few key factors should be considered for a successful purchase: choose a trusted brand and work with a reputable dealer. Consider potential resale options and understand your storage needs to find what best suits your situation. While gold bars generally come with lower premiums than coins, they also tend to resell at lower premiums.

FAQ

What makes gold bars a better investment than gold coins?

It depends on your investment goals. Gold bars have lower premiums and are easier to store, making them an ideal choice for long-term investment. Coins, while more expensive and more complex to store due to their delicate designs, offer greater liquidity and may fetch higher resale premiums.

How does the weight of a gold bar affect its price?

The weight of a gold bar, like a Valcambi gold bar or Credit Suisse gold bar, means everything in determining the value of the gold bar. For example, it takes 31.1 grams to equal one troy ounce of gold. Therefore, a 1 gram gold bar is 31.1 times cheaper than a 1 ounce gold bar. Kilo bars contain 32.15 ounces of gold thus making them very expensive compared to a one ounce gold bar.

Why is the fineness or purity of a gold bar important?

The purity of a gold bar indicates the percentage of pure gold it contains, which directly affects its monetary value. It can also determine whether the bar qualifies for IRA investment and influence its liquidity when bartering or selling.

Where is the best place to buy gold bars?

Finding a reputable dealer with a strong track record is essential. Online dealers often provide the most competitive prices due to the high volume of trades they handle, which allows them to secure lower rates and pass the savings on to customers.

How should I store my gold bars to ensure their security?

When it comes to protecting your bullion against theft, using a third-party storage company can be a smart alternative to keeping it in a home safe or personal container. Many insurance policies don’t cover the full value of your holdings, and bank safety deposit boxes may not be as practical as private depositories. Companies like SD Bullion offer storage services that allow you to withdraw your assets at any time.