With gold prices skyrocketing, many investors are eager to understand the factors influencing the value of gold and other precious metals like platinum.

In this article, I will briefly explain the key drivers behind gold prices, compare them to platinum, and provide an overview of why these two metals are crucial for investors looking to navigate the world of noble metals.

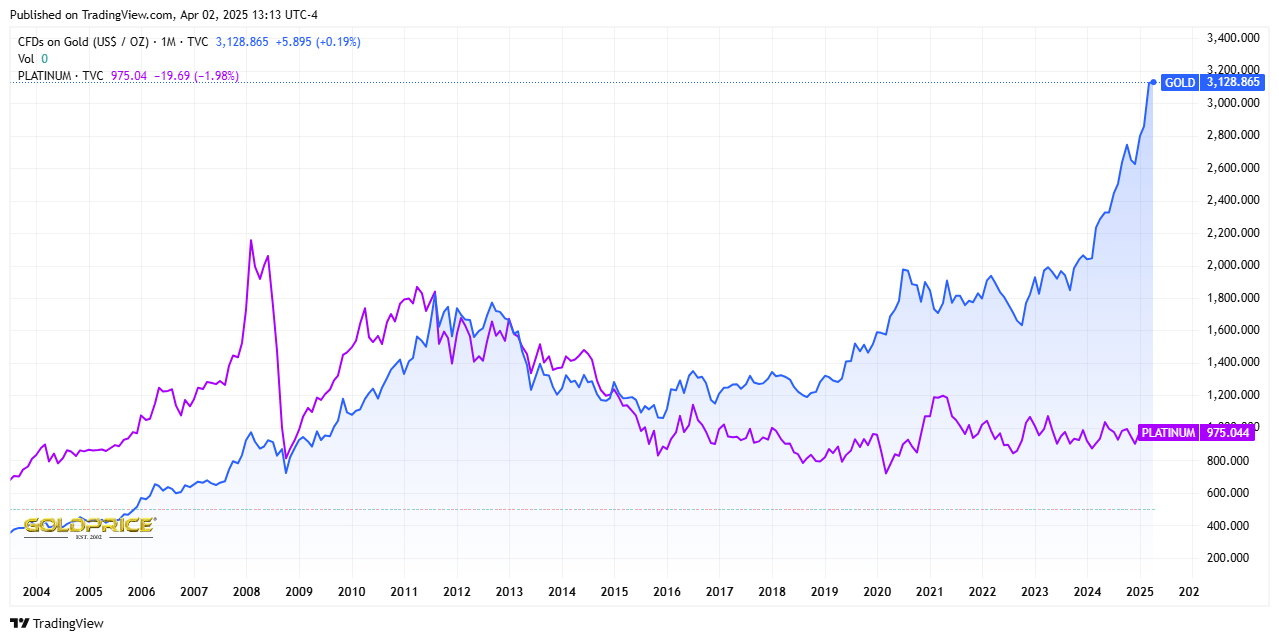

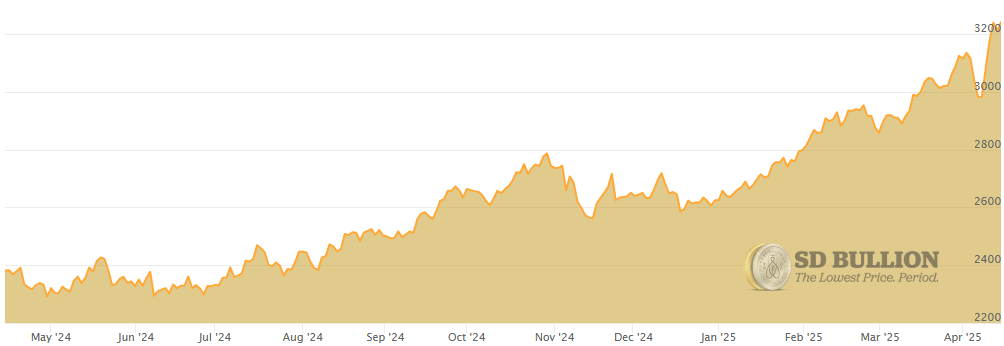

Platinum Vs. Gold Price Chart (Monthly Data)

As you can see in the chart, while gold has been going through historical record prices every month, platinum has been maintaining a stable performance for the last decade.

To understand the factors driving their prices, let me first elaborate on why precious metals hold a secure place in the investment world and why they might be a smart addition to your portfolio.

During times of economic uncertainty, people show increased interest in physical assets as a key component of wealth preservation, providing stability, intrinsic value, and protection against inflation.

Unlike paper currency, which can lose value, assets like gold tend to retain or even increase in worth. Their tangible nature makes them more secure than digital or paper investments, reducing risks from market crashes or cyber threats.

As a fundamental part of human financial history, precious metals and real estate have long served as reliable stores of value. If stocks underperform, investors who have distributed their wealth among other assets are better positioned to mitigate risk and preserve stability.

Additionally, when confidence in banks or fiat currency declines, people prefer hard assets like gold, silver, or platinum, independent of government policies, explaining why gold prices often surge during recessions.

Now that you understand the critical role of precious metals like gold and palladium in investment portfolios, let me introduce a key tool to help you compare their prices effectively. The Gold: Platinum Ratio.

Gold/Platinum Ratio

In short, the gold/platinum ratio measures the relative value of gold and platinum, indicating how much platinum is needed to purchase one ounce of gold. Many things, such as supply and demand, technological advances, and geopolitical events, can influence the ratio.

This is essential information investors use to determine which metal is better to buy or plan future purchases.

The current ratio of Gold-Platinum is 3.26. This means that one ounce of gold is worth 3.25 times the price of one ounce of platinum. This suggests that gold is significantly more expensive than platinum at the moment.

A high ratio, like the current 3.26, may indicate that platinum is undervalued compared to gold, potentially making it a more attractive investment for those expecting the gap to narrow. Conversely, a lower ratio would suggest that platinum is gaining value relative to gold.

Once you recognize their significant price difference, you may wonder which economic factors shape their final value. Keep reading to discover the key forces that determine their cost.

Price of Platinum vs. Gold

According to specialists, the platinum market has a different relationship with economic conditions as it is primarily employed as a catalyst in many auto industrial processes. Catalytic converters represent 50% of Platinum demand each year.

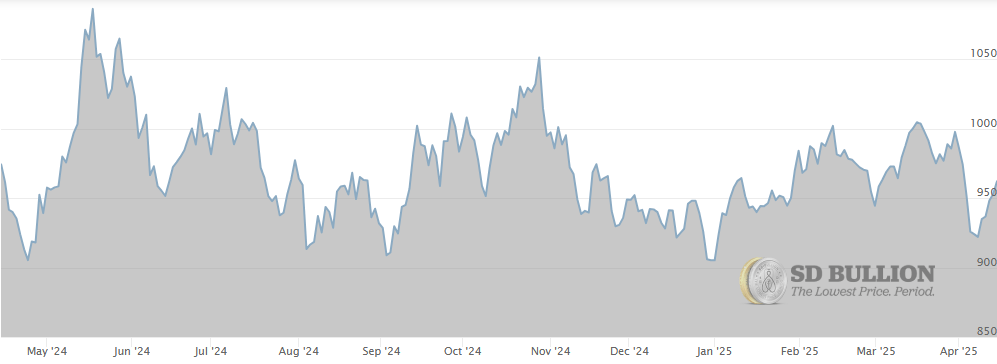

In times of economic downturn, this metal experiences a decrease in demand due to a decline in industrial production and global economic uncertainty. So, due to current geopolitical events, platinum prices have been experiencing a downfall for the past few years.

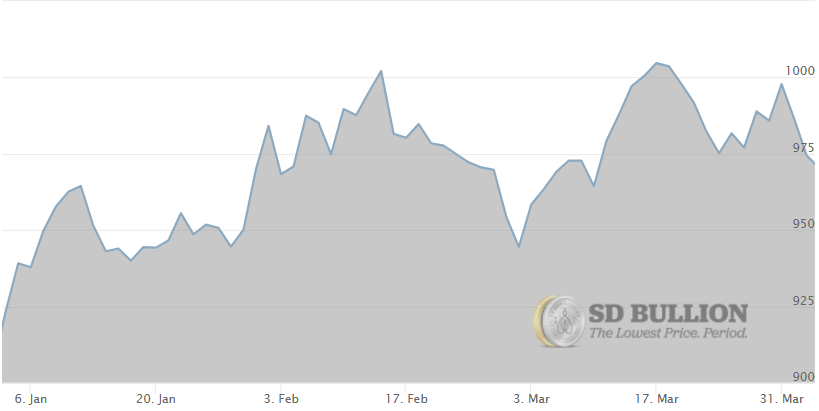

As of the beginning of April 2025, the price of platinum fluctuates around $971. Check below the cost of platinum since the start of the year:

Gold, in turn, has the utmost relevance regarding hedging against inflation and wealth preservation, as it is weakly tied to the global economy. According to recent data, the jewelry industry had the highest demand for gold in 2024.

Gold's intrinsic value (its worth independent of external factors) stems from its universal acceptance. Gold has been considered valuable in human history, used as currency, a store of wealth, and a symbol of power for centuries. While its price is influenced by industrial demand, mining challenges, central bank policies, and market trends, unlike platinum, gold thrives during economic uncertainty or declining trust in fiat currency. In such times, investors seek safer assets, and gold remains the most trusted and valuable physical asset today.

Take a look at the current price of a gold troy ounce, which has been fluctuating around $3,230:

Final Thoughts

Ultimately, the choice between gold and platinum depends on your investment goals. Gold remains the strongest contender for those seeking a long-term store of value and inflation protection. However, platinum could present a potential upside if you're willing to navigate price fluctuations and bet on industrial demand. Monitoring market trends, technological advancements, and economic shifts will help you make informed investment decisions.

FAQs

Is platinum more expensive than gold?

No, platinum is actually cheaper than gold. Despite being rarer, gold remains more expensive due to historical trends and its role as a stable safe-haven asset. Platinum is more volatile since its price depends heavily on industrial demand, especially from the automotive sector.

Has platinum ever been worth more than gold?

From the 1800s until the 2000s, platinum was more expensive than gold, and the roles inverted in the late 2000s. Recently, the last time platinum was more costly than gold was in the middle of 2014, and gold has been more expensive since. Platinum was even more challenging to extract and refine in the 80s, when there was little technology to melt it as it is denser than gold, helping understand why it was so expensive.

Does platinum or gold have a higher investment demand?

Gold has a higher investment demand than platinum, primarily due to its reputation as a safe-haven asset. Investors turn to gold during economic crises for stability and wealth preservation, reinforcing its trust and intrinsic value. In contrast, platinum's demand is more volatile, as it is heavily tied to industrial use, particularly in the automotive sector. This makes gold the preferred choice for those seeking a reliable investment, while platinum depends more on market cycles and industrial trends.

Will platinum ever be worth more than gold again?

Predicting an asset’s future behavior is challenging since its price depends on various market factors. A smart strategy is to track the industries influencing its value: platinum is closely tied to the auto industry, while political and economic conditions drive gold. Staying informed about these trends can help you make better investment decisions.

Is platinum rarer than gold?

Yes, platinum is rarer than gold. 2024 global gold production reached approximately 3,300 metric tons, while platinum production was significantly lower at around 170 metric tons. Despite its smaller supply, platinum is not as widely sought after or trusted as gold, which has been a preferred store of value for centuries. This enduring demand contributes to gold’s higher price, even though platinum is scarcer.

Which metal performs better during a recession, gold or platinum?

Gold performs better during recessions, as investors see it as a hedge against inflation. Platinum, on the other hand, tends to decline due to its strong ties to industrial demand, especially in the automotive sector. Platinum performs better when industrial production is strong, but economic downturns drive its price down.

Can platinum overtake gold in price again?

Predicting an asset’s future value is challenging since many factors affect its price. A good strategy is to follow the industries that impact it: platinum depends primarily on the auto industry, while politics and the economy influence gold more. Keeping an eye on these trends can help you make more assertive investments.

Is platinum more difficult to refine than gold?

Yes, platinum is more difficult to refine than gold. It is usually found mixed with other metals, requiring complex chemical separation. Its hardness and higher melting point also make the refining process more challenging than the gold process.

What are the main uses of platinum besides investment?

The demand for platinum extends beyond investment into the automotive, industrial, and jewelry sectors. Around 50% of its annual use comes from catalytic converters, which reduce vehicle emissions. It is also used in jewelry, dentistry, and medical devices due to its durability and biocompatibility.