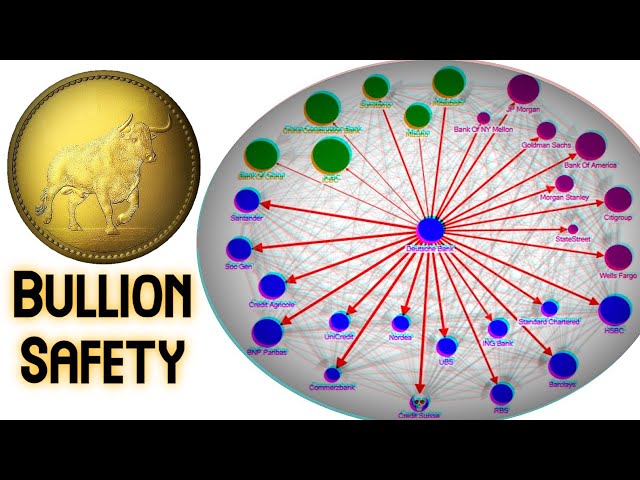

After last weekend's UBS buyout of Credit Suisse for a few cupro nickels in value per stock share, it now seems the bank shorting crowd has begun taking dead aim at another major teetering Global Systematic Important Bank (G-SIB) – a major German one called Deutsche Bank.

A far more connected and threatening tier 2 global systemically important bank as defined by the BIS' Financial Stability Board in late 2022.

- Credit Default Swaps or CDS insurance purchased against the potential failure of that major German G-SIB bank called Deutsche Bank are again spiking

- Deutsche Bank's stock price seemingly continues to tank in value.

- The fiat Federal Reserve raised its fiat Fed Funds rate another 25 basis points or one-quarter of one percent.

- The fiat Fed claims and poses like they are supposedly fighting price inflation while also purportedly battling against the further failure and or consolidation of our increasingly brittle and collapsing banking system, both domestically and internationally speaking.

- ∞QE∞ keystrokes of mass fiat US dollar currency creation are again driving up the fiat Fed's Balance Sheet rising again this week.

- Last two weeks, nearly 2/3rd’s of all the supposed Quantitative Tightening over the last year’s timespan has been erased in a steep vertical rise of the fiat Fed’s Balance sheet.

The monetary precious metals had a mostly positive week in trading.

The spot gold price briefly cleared the key $2,000 oz price resistance psychological level, only to finish the week closing just under $2,000 per troy ounce.

Of course, in the physical bullion world, most retail investment-grade gold bullion products have been trading over $2,000 oz for some time.

The spot silver price ran upwards for most of the week, closing with an interesting wedge pattern where long traders take some of their week's gains with them into the weekend.

The spot gold silver ratio slid down to 85 at the end of trading last week.

And while another major Global Systemic Important Bank threatens to begin a potential major bank failure sequence. I personally have my eyes on soon buying some extremely rare platinum, even possibly acquiring this disappearing bullion hallmark format.

At currently less than half the price of gold, platinum is now historically undervalued.

That is all for this week's SD Bullion Market Update.

As always, to you out there.

Take great care of yourselves and those you love.