Silver has entered the first semester of 2026 above $90 and surpassed the $100/oz-margin in January for the first time ever. Heightened geopolitical uncertainty, including developments in Latin America and the Middle East, has reinforced gold’s safe-haven demand, while silver’s industrial drivers and supply constraints have kept the Gold–Silver Ratio historically elevated.

We have put together a comprehensive article that explains this shift and how it may impact investors' decisions going forward.

Key Takeaways

-

The Gold-to-Silver ratio shows how many ounces of silver are required to buy a single ounce of gold at any given time and can be used to identify trends and patterns in the precious metals market, becoming a very important tool for investors.

-

Even though Silver is mainly demanded for industrial usage, the Gold-to-Silver ratio remains elevated as persistent geopolitical uncertainty reinforces safe-haven demand while Silver simultaneously faces rising industrial demand and constrained supply.

-

Silver plays a distinct role in portfolio diversification, but its higher volatility, lack of income, and differences between paper and physical exposure require careful risk assessment.

-

The Gold–Silver ratio provides market context rather than investment advice and should not be used in isolation to decide when to buy gold or silver.

The Silver Ratio Explained

If you are not familiar with the Gold Silver Ratio, it expresses, in simple terms, how much silver one can theoretically purchase with a fixed amount of gold. We calculate the price of one ounce of gold divided by the price of an ounce of silver.

(The Troy ounce is equivalent to 31.1 grams, the official unit of measure for precious metals, used since the Middle Ages.)

Over the last century, the Gold-to-Silver ratio stood (on average ) at 40-80:1, and at the beginning of last year, it was fluctuating around 90.

The image above, however, shows the gold–silver ratio at approximately 46 (at the time of this publication), meaning you must sell more ounces of silver to obtain the same amount of gold.

The ratio is a crucial metric in precious metals investing, helping investors decide when to buy silver or gold.

Keep reading to understand how silver prices have moved throughout history.

What History Tells Us About Silver Price Movements

For most of history, silver was priced in relation to gold through fixed ratios, making its value relatively predictable.

The Bimetallic Standard and The Gold Standard

In the United States, the Coinage Act of 1792 formalized this dynamic by establishing a 15:1 silver-to-gold ratio under the bimetallic standard, with paper currency backed by gold and silver.

Over time, however, economic data show that silver steadily lost value relative to gold, setting in motion an interesting dynamic still alive today: gold was preferred for hoarding, while silver was preferred for currency.

The later adoption of the gold standard removed any fixed ratio, allowing gold and silver to trade independently.

This shift marked the end of silver’s price being directly guided by gold.

Nowadays, we don't operate on a gold standard, and the value of gold and silver is no longer tied to the dollar. In reality, industry demand influences silver's prices, while geopolitical events impact gold prices more significantly, exactly because it sits outside the money.

Today, more specifically at the end of 2025 and the beginning of 2026, recent movements in silver prices raise the question of whether this long-standing dynamic has changed and what has happened to global silver supply and demand.

Gold Silver Ratio Fluctuations

The earliest recorded relationship between the two metals dates back to around 3200 BCE in Ancient Egypt, where silver traded at roughly 2.5:1 in relative value to gold.

Centuries later, the Roman Empire formally fixed the gold-to-silver ratio at 12:1, treating both metals as core financial instruments in its monetary system, where even a single ounce carried a clearly defined value.

These early ratios were not arbitrary. They reflected how societies across time evaluated precious metals through many factors such as scarcity, utility, trust, and cultural perceptions, establishing a structured relationship that endured for centuries.

Following the COVID-19 pandemic, investor sentiment toward precious metals changed materially, as both gold and silver came under new and overlapping stressors.

The pandemic illustrated this shift clearly: the price of gold began a sharp rise, while silver volatility intensified, driving the Gold-to-Silver ratio to levels rarely seen before. This divergence culminated in April 2020, when the ratio peaked above 125:1, signaling a market increasingly driven by sentiment, uncertainty, and systemic risk rather than historical norms.

Let us dive into that.

Above-Ground Supply and Inventory Depletion

As noted earlier, periods of uncertainty tend to drive investors toward gold, reinforcing its role as a monetary reserve asset. Unlike silver, which is largely consumed through industrial use and remains in circulation, gold is predominantly held in vaults, as central banks worldwide continue to buy gold to strengthen reserves, while most silver is held by private institutions.

This distinction is reinforced by geology itself: it is estimated to be around 16 times more silver abundant in the Earth’s crust than gold; this low scarcity compared to gold has historically made it more accessible for widespread industrial and monetary use.

On a global scale, this combination of higher availability and higher technological consumption has fundamentally shaped silver demand.

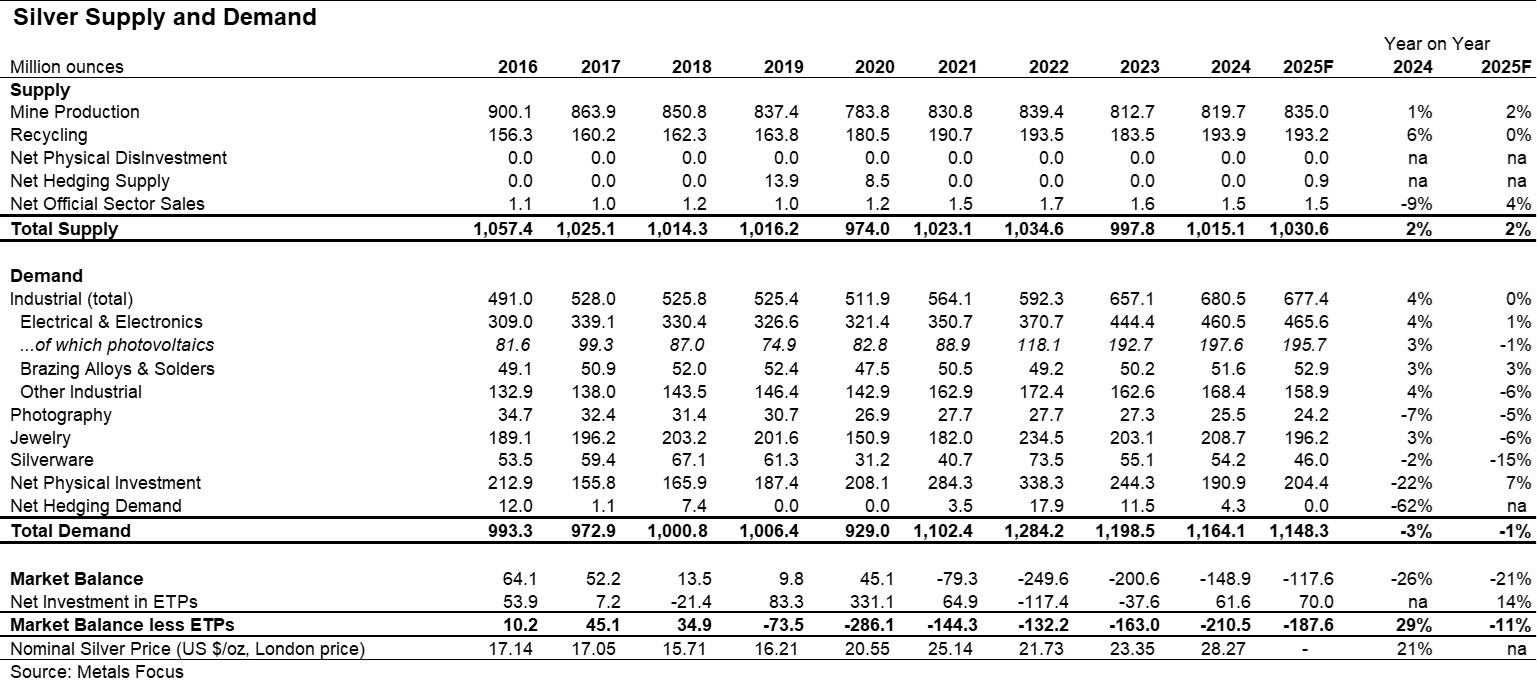

According to the Silver Institute's most recent reports, industrial uses play a central role in absorbing silver supply and tend to provide a relatively stable baseline of demand.

In recent years, overall demand remained muted, largely due to declines in traditional sectors such as silverware and photography. During this period, electronics and electrical applications were the primary drivers of consumption, as shown in the report above.

Understanding this helps readers see why periods of price strength are not purely speculative and why decisions to buy silver should consider long-term demand, depletion, and usage trends, not just short-term market sentiment.

How to Read Market Trends and Silver Prices

The recent surge in silver, however, is a different phenomenon. Silver prices have increasingly made headlines, following a trend that gold had already established in the last few years after COVID-19.

However, unlike gold, silver is primarily an industrial metal, widely used in electric vehicles, solar panels, and defense-related technologies. Its price is not driven solely by mining supply, but largely by demand. Mainly because silver is often produced as a byproduct of mining other metals, such as copper.

So what happens is that its supply cannot respond quickly to sudden demand spikes, and prices start to skyrocket. As a result, sharp price movements tend to occur when demand accelerates faster than the available supply can adjust.

In the first week of January, the U.S. arrest of Venezuela’s president and escalating tensions in the Middle East have intensified geopolitical risk.

So Silver is now rising alongside gold, suggesting a broader loss of confidence. Historically, both metals act as a barometer of global uncertainty, not necessarily signaling war, but indicating that markets are bracing for instability.

And what does that mean for investors?

Investing Strategies: Portfolio Diversification

Major price shifts do not necessarily signal that a global cataclysm is imminent.

However, given that gold and silver, particularly physical gold, are widely regarded as tangible safe-haven assets used for wealth protection, periods like this, when the ratio rises, are a relevant moment for investors to reassess their needs and risk exposure.

And the reason is very simple. It comes from a core principle.

This core principle investors follow is portfolio diversification. One can allocate the same amount (or a larger percentage) to assets with different behaviors, risk profiles, and return potential, whether physical or non-physical. This approach aims to protect overall wealth from market volatility while still pursuing long-term returns.

This is where silver plays a key role as a precious metal asset. Like gold, silver is not directly tied to the dollar or other fiat currencies. While currency movements may influence its price, silver bullion is viewed in many countries as a tangible store of value and, in extreme scenarios, a potential medium for barter.

Take a look at the most popular bullion coins that investors prefer when purchasing silver products.

Additionally, here's what to consider about investing in silver:

Limitations and Risks

All investments involve risk, and precious metals are no exception. Investors should carefully assess their risk tolerance before allocating capital.

Risk tolerance, in simple terms, reflects an investor’s ability to withstand short-term losses in pursuit of long-term gains. A more conservative investor may prefer bonds or other fixed-income assets, while an investor with higher risk tolerance may be more comfortable with volatile assets such as stocks.

One key limitation of precious metals is that they generate no income. While gold bullion and silver holdings may appreciate in value as time passes, they do not pay dividends or interest in the way stocks or bonds do.

There are also practical considerations to account for, including storage, insurance, shipping, and liquidity.

These factors can vary depending on the type of product held; for example, bullion coins are generally easier to resell than larger bars, as they are considered legal tender. Security and safe storage are additional responsibilities that fall directly on the investor.

Take a deep look into the different types of silver investments below.

Paper Silver vs. Physical Silver

The key distinction between silver bullion and other forms of silver exposure lies in the structure of ownership.

Paper silver, such as ETFs, futures, and other derivatives, allows silver investors to gain exposure without handling the metal itself, making it highly accessible and efficient for trading. The same applies to gold; many investors seek exposure to gold through funds and the stocks of gold companies.

However, because these instruments are often driven by expectations and market positioning, their prices can diverge from physical silver and gold.

The ease with which paper positions can be sold or adjusted, compared to the slower and more constrained nature of physical bullion markets, can create temporary pricing discrepancies between paper silver and its physical counterpart.

This matters for understanding why the silver ratio is so high, as paper silver trading can distort price signals in the short term, even when physical supply and demand faced by silver investors point in opposite directions.

What to Expect Next

Historically, the gold market has shown greater stability than silver, a pattern that has held true across different cycles in the precious metals space.

That said, it seems hard to outperform gold. At least consistently.

Furthermore, with education as our primary objective, caution remains essential, as outcomes depend on individual investment profiles and risk tolerance.

No one can predict future movements with certainty, particularly in periods of heightened economic uncertainty. Rather than focusing solely on the current price of silver or short-term fluctuations in the gold price, investors are better served by conducting their own research and evaluating broader market conditions.

In this context, the gold–silver ratio is most effective as a tool for understanding relative value and market structure within precious metals, not as a standalone signal for action of selling ot buying gold and silver.

Final Thoughts

The current gold-silver ratio reflects structural differences between gold and silver, driven by distinct demand forces and market dynamics rather than a single catalyst event. Movements in the gold price and silver prices should be viewed in context, not in isolation.

For investors, understanding how physical gold and silver behave within the broader precious metals industry is more important than expecting the ratio to quickly return to historical norms.

Disclaimer: The information provided is for general educational purposes only and should not be interpreted as financial, investment, legal, or considered investment advice. Because this content does not take into account individual financial goals or circumstances, you should consult a qualified professional before making decisions involving precious metals. All markets carry risk, and past performance is not a guarantee of future results.