The world's most popularly purchased gold ETF is a gold spot price chasing exchange-traded derivative called GLD.

Started in the year 2004, the GLD is a gold ETF traded like a stock that is designed to track the spot gold price.

Although there have been various durations of time when gold bullion prices far outperformed GLD (e.g., fall 2008). One can still make a short to medium term trading-case for using GLD as a quick and nimble gold price related trading vehicle.

While GLD can be a useful tool for short to medium term trading needing exposure to the gold spot price, here we explain in detail why GLD is no substitute for a bedrock gold bullion investment allocation.

Retail GLD shareholders remain unsecured creditors of the GLD fund. Many also remain oblivious to the risks they run by perhaps believing their gold ETF shares are somehow a safe haven instead of actually owning real gold bullion.

GLD Fees - 0.40% Per Year

Retail GLD shareholders pay 0.40% of their holdings in fees to the fund per year, yet remain unsecured creditors all along the way.

This means if the GLD fund were mismanaged and somehow went into a bankruptcy proceeding, said retail GLD shareholders will likely lose all their capital in a long drawn out court battle without repercussion.

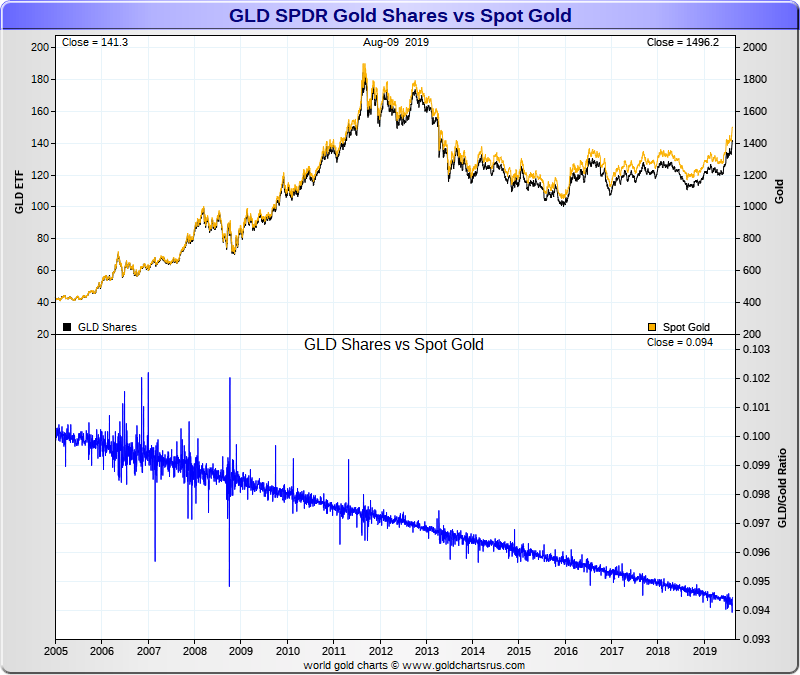

In fact, GLD shareholders have their GLD holdings slowly siphoned away in value by annual fund expenses and liabilities diverging the GLD value further from the 1/10th fiat US dollar spot gold price year after year (see the chart below for proof of that statement).

GLD ETF vs Spot Gold Price Divergence Ongoing

GLD vs Gold Spot Price chart compares one gold derivative to another. Learn about gold price discovery to understand that statement. GLD merely represents 1/10 oz of the fiat US dollar gold spot price less annual fees compounding - hence the price of GLD is always declining vs the 1/10th the fiat US dollar gold spot price.

Standard retail GLD stock shares give retail shareholders no ownership to any physical gold bullion. GLD shareholders on a retail level just get some diluted gold spot price exposure without upside premium or price potentials. GLD shares cannot be traded 24 hours x 7 days a week as physical gold bullion can. This most popular gold ETF is not a safe haven gold bullion investment, even though its marketing teams campaign as if it were somehow so. Try reading the GLD prospectus.

If GLD shareholders actually took the time to read the SPDR GLD prospectus, they would perhaps fully appreciate many of the claims we are making here.

For instance, the following list of GLD Authorized Participants are the only entities which can withdraw supposed gold bullion bars held from the trust. Retail GLD shareholder, of course, cannot, and do not own any of the gold bullion supposedly held for the trust.

GLD Authorized Participants | GLD APs

- Credit Suisse Securities (USA) LLC

- Goldman Sachs & Co.

- Goldman Sachs Execution & Clearing, L.P.

- HSBC Securities (USA) Inc.

- J.P. Morgan Securities LLC

- Merrill Lynch Professional Clearing Corp.

- Morgan Stanley & Co. LLC

- RBC Capital Markets LLC

- UBS Securities LLC

- Virtu Financial BD LLC

Some of these same GLD APs are under current investigation by the US Department of Justice for precious metals market manipulations, while other GLD APs listed have paid fines for precious metal manipulations without formally admitting their guilt or anyone going to prison yet

GLD shareholders have their GLD holdings slowly siphoned away in value by annual fund expenses and liabilities (see the chart below for proof of that statement).

While many of the commercial banks alleged to have been rigging precious metals prices for years and perhaps decades can continue converting GLD baskets into purported gold bullion bar deliveries (many of which are going to India and China, see 2015 gold refiner interview).

GLD and other Fractional Reserve Gold Market Schemes are Relatively Tiny

The 400 oz gold bullion bars held for GLD are allegedly held in London vaults on behalf of the fund.

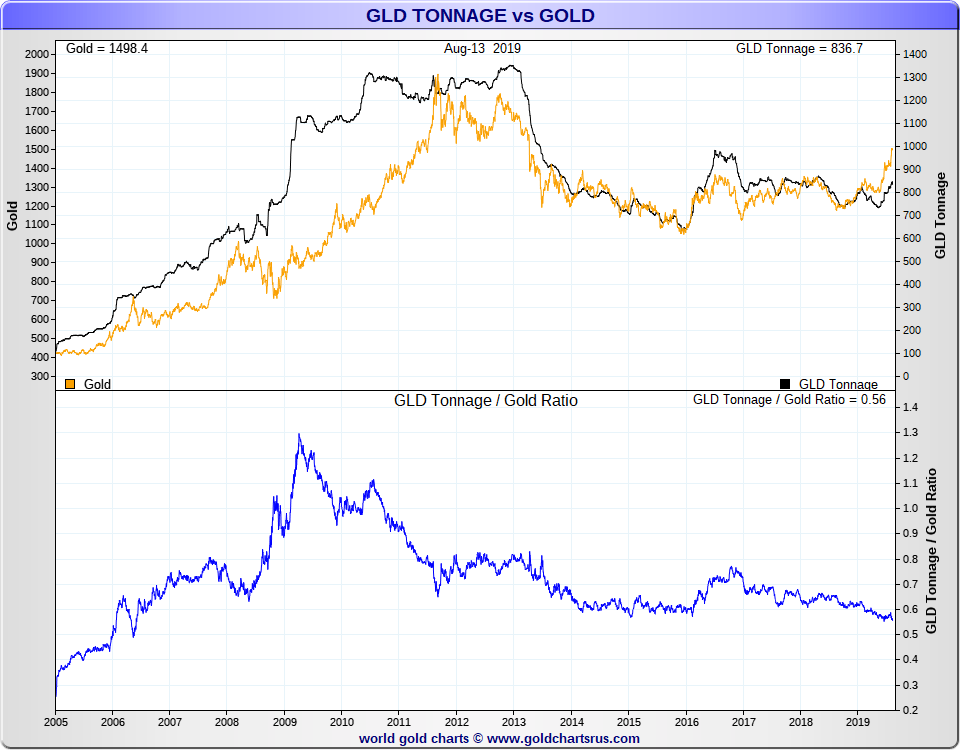

In the following chart below you can see how the fund's gold bullion holding level mimics the fiat US dollar gold spot price action over time.

GLD Gold Holdings vs fiat US dollar Spot Gold Price

-

To summarize this discussion on "What is GLD," it is essentially a fractionalized fiat US dollar gold spot price derivative that may be useful for day trading. It also useful in confusing would be gold bullion buyers to remain in fiat US dollar-based derivatives.

But know henceforth, GLD is certainly not a safe haven investment like physical gold bullion you can buy and own directly with little to no counterparty-risks associated.

You can learn more about best gold bullion practices when both buying gold and selling gold with our SD Bullion Guide.

Thanks for visiting us here at SD Bullion.

***