We have confirmed some news of private bullion mint troubles, allegations of government bullion mint shortcomings, and even potential failings.

In the video embedded above, we look at many of those allegations below, in this week's SD Bullion Market Update.

The spot silver price and gold spot price both traded slightly up for the week, respectively.

The gold-silver ratio stayed at the 66 levels, the same as we closed last week.

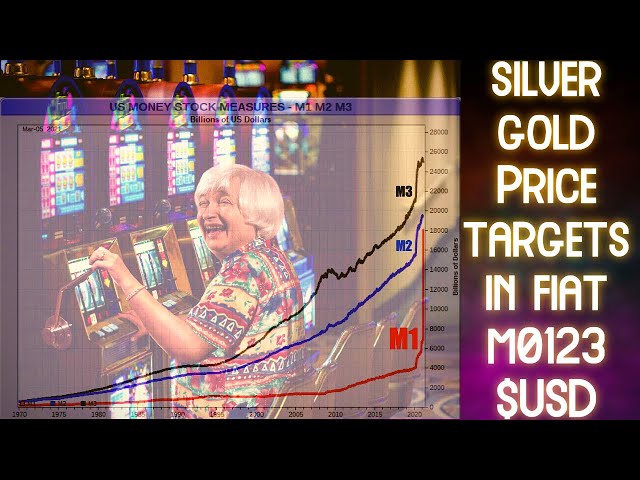

The Federal Reserve's balance sheet is almost $7.7 trillion now.

How long until this hits $10 trillion? (POLL RESULT)

One could reasonably expect once the $10 trillion levels get reached, we would also have new record nominal price highs for gold. Simultaneously, the then silver spot price should be then running into and through the $30s in the $40s per troy ounce.

Many retail silver bullion products have already reached those price levels year to date, Q1 2021.

Thus far, in 2021, the investment demand chasing silver has been well higher than the last year 2020 (which already recorded record-high levels in pandemic 2020).

And this week, we had some allegations and a confluence of reports citing issues in the global silver bullion investment markets.

What it Takes to Be a Silver Whale Bullion Stacker

Get your bullion positions secured while you still can.

That's all for this week. Take great care of yourselves and those you love.