Successfully saving for retirement requires individual foresight, planning, and discipline.

Along the way, one can use certain investment vehicles such as a Gold Silver IRA not only to hedge their wealth but also protect retirement savings from potential lawsuits, unforeseen bankruptcy proceedings, etc.

Precious Metal IRA diversification is an excellent option for individuals looking to get both the tax benefits of bullion in their Individual Retirement Accounts as well as the proven performance of prudent precious metal allocations for retirement.

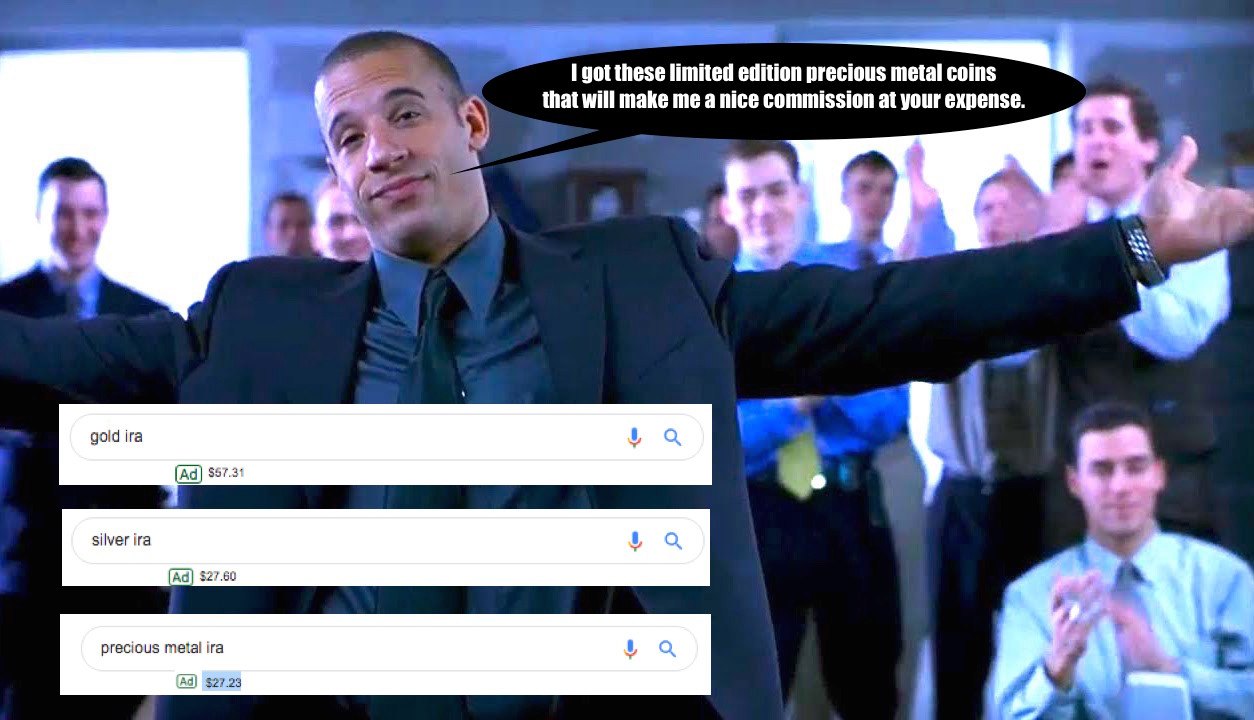

The trouble is that there is a multitude of unscrupulous gold dealers who use underhanded sales tactics to get would be bullion IRA buyers to choose overpriced limited edition coins for their Precious Metal IRAs.

Here are a few less than obvious issues with Precious Metal IRAs.

Precious Metal IRA: Problem #1

The physical gold and silver industry is unregulated and still has a large number of unscrupulous precious metal dealers and high ranking kickback affiliate websites that take advantage of unknowing, would be low-price bullion IRA investors, by marketing and selling them either overpriced proof or exclusive low mintage government issued coins.

Based on Google data alone, our industry’s most expensive search ads (i.e., Ad) are Gold IRA, Silver IRA, and Precious Metal IRA respectively.

Large groups of unscrupulous overpriced coin salesmen pay Google a premium to run top-ranked IRA Ad campaigns with IRA Kit lead capture boxes to take advantage of unknowing investors out there.

Crooked dealers often pay up to $57 per click on their Gold IRA Ads to acquire sales leads to potentially take advantage of. To pay over $50 per click alone, should tip off all end users just how much profit some untrustworthy dealers are making from unknowing IRA holders.

The good news is that there are honest high volume bullion dealers who are merely interested in getting you qualified low premium bullion products for your Precious Metal IRA if you have an interest in bullion wealth diversification products.

Precious Metal IRA: Problem #2

Self-directed Precious Metal IRAs can be somewhat confusing.

The primary bottom line to successfully acquire physical precious metals for your IRA is to find a trustworthy bullion dealer who follows the letter of the law and can get you in touch with an honest high service Precious Metal IRA custodian.

An individual retirement account (IRA) is a type of retirement plan provided by many financial firms within the United States of America. An IRA is designed to provide tax advantages of retirement savings for the exclusive benefit of taxpayers and possibly their beneficiaries.

Introduced in 1974 with the enactment of the Employee Retirement Income Security Act (ERISA), as of 2011 (according to the GAO) an estimated 43 million taxpayers had IRAs.

Internal Revenue Service (IRS) regulations require that a qualified IRA trustee or custodian hold IRA assets on behalf of the IRA owner.

IRA custodians or trustees provide the following services:

- Maintain custody of the IRA’s assets.

- Process all transactions within the IRA.

- Safeguard all records on the IRA.

- File required IRS reports.

- Issue client statements to the self-directed IRA owner.

- Help clients understand the rules and regulations on IRAs.

- Perform additional administrative duties for the self-directed IRA beneficiary.

The IRA owner chooses amongst many investment options allowed by their IRA custodian.

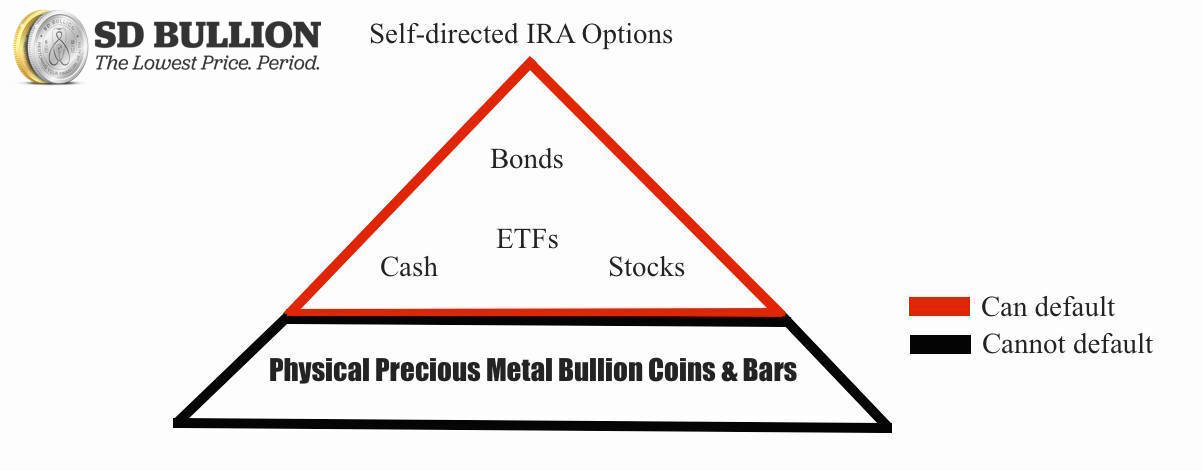

For regular IRAs, investment choices usually include paper assets like stocks, bonds, and mutual funds. But with a self-directed IRA, owners can enjoy having a significantly broader range of alternative investments available to them.

Importantly self-directed IRA owners can choose to own approved physical precious metal bullion coins and bars which have never historically defaulted on savers and form an excellent bedrock for virtually all investment portfolios.

What does “Self-directed” mean?

"Self-directed" is a descriptive term, not an IRS term or legal distinction.

Self-directed IRAs are a specialized type of Individual Retirement Account (IRA) which allow a broader range of investments for retirement savings.

Examples of allowable investments within Self-directed IRAs include:

- stocks

- demand deposits (cash)

- mortgages

- franchises

- partnerships

- private equity

- tax liens

- qualified physical precious metal bullion products (Gold, Silver, Platinum, Palladium)

Self-directed IRA plans also enjoy the same tax advantages as non-self-directed IRAs.

Investors can convert virtually any IRA plan type (Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, HSA) into a self-directed IRA as long as a self-directed IRA custodian holds and safeguards the IRA account.

Qualified retirement plans, such as a 401(k) or 403(b), from previous employers can also be rolled over into a self-directed IRA without penalty.

Unlike with bank or brokerage accounts, you become the direct owner of the physical precious metals purchased in your IRA. Imagine physical gold, silver, platinum, and palladium diversifying your retirement income, fully insured and stored at your IRA custodian’s secure depository.

3 Steps for your Free Self-Directed Precious Metal IRA Application

STEP 1 - Open a Self Directed IRA Account

To own physical precious metals in your IRA, you need to open a “self-directed” IRA account with one of our self-directed IRA custodians. Start by filling out and submitting their application paperwork. This process can be completed quickly over a matter of a few business days timeframe.

STEP 2 - Fund Your Self Directed IRA Account

Once you open your self-directed IRA account the next step is to fund your account. For a new account, you will transfer money to your IRA custodian of choice. If you are moving or rolling over an IRA, speak with your new IRA custodian to ensure all steps are completed fully.

STEP 3 - Buy your IRA Bullion items from SD Bullion

Once you have properly funded your new self-directed IRA account, call us to select your physical IRA-eligible precious metal bullion products and lock in your pricing. Your physical precious metal bullion products will then be safely shipped and safeguarded at your IRA custodian’s secure depository of choice.

Having some safe-haven bullion for your IRA is essential especially today given the risks inherent to other counterparty-risk laden asset classes. Bullion by its very nature cannot become worthless, unlike most other asset classes typically held in Self-directed IRAs.

Today the U.S. federal government is officially nearing $22 trillion in debt, and the record global debt levels are again hitting all-time high levels.

While that may be alarming, the total “unofficial” off-book federal debts for programs like Social Security, Medicare, Medicaid, future defense, and other spending obligations are over $200 trillion in deficit.

With an increasingly insolvent Federal government future, U.S. citizens must plan and act on their retirement future planning now more than ever. Luckily there are options.

If you have an interest in prudent wealth diversification using a Precious Metal IRA, have a look at the honest services we provide.

Thank you for visiting us here at SD Bullion.

***