The following is a global macro economic conversation about risks in the financial system at present based on Keith Dickner's research and view.

In case you did not know already, the global bond market's total size is about double the the world's combined stock market size.

Of course equities get the headlines, but fixed income investments are where the majority of the world's capital is allocated still today.

The confluence of various contributing factors may lead us to the first crisis in bond markets since the full fiat currency era got underway in the 1970s.

This Macro Voices podcast interview begins in easrnest just after the 14 minute mark, we have embed a time stamp for you convenience.

A full written transcript of the interview can be found here on Macro Voices' website.

We will post a few screenshots from various slides Keith refers to throughout the conversation.

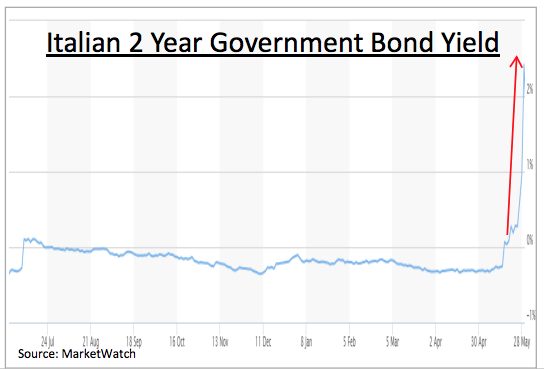

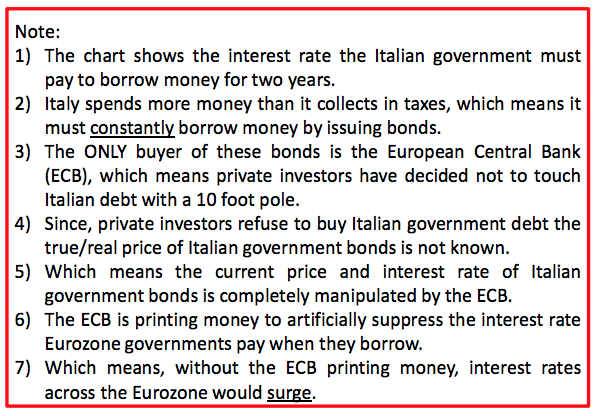

The next crisis Keith believes will likely be in the bond market stemming out of Europe. He points to Italy as possibly being the biggest issue at the moment in the EU.

Keith contends investors and fund managers are not ready for this lack of liquidity in a crisis in the bond market. Most have only lived and been trainded throughout the greatest bond bull market 1982 onwards.

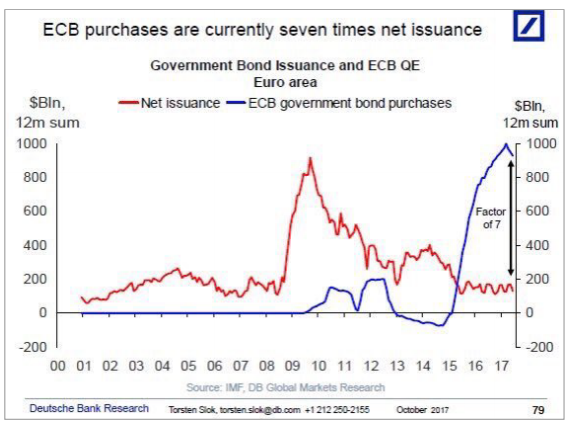

As global debt levels contiue to hit record levels quarter after quarter, likely higher than $250 trillion USD notional now.

One might being wondering, which asset classes may become benificiaries when said rising debt piles get either a mix of default and or debasement.

Keith concludes this through provoking interview with a take on gold that sounds like a short term trader mainly concerned with technical price action charts.

He believes the US dollar will see another surge in strength ahead which should give gold an opportunity to come down one more bump. But, after that, he maintains can see a period where both gold and US dollars do very well simulaneouly.

Most people reading this article get paid in US dollars so if this indeed occurs you will likely have the chance to swapo them for physical bullion at lower prices if they indeed come at all.

Regardless, we would of course argue that all people should maintian a longer view. Virtually any and all who can, should have a prudent allocation to bullion as the increasing reasons to do so appear to only be growing larger around us.

There are many gold allocation studies and market analysts who can further explain why having some bullion allocation makes common sense today.

***