Sideways week in terms of fiat US dollar price action for both silver and gold price discovery derivatives.

The spot price of silver sold off to close the week’s trading and will finish just below 15 fiat US dollars per troy ounce.

The spot gold price touched as high as $1,357 only to sell off into a close just over the $1,340 fiat Federal Reserve notes per troy ounce.

The gold-silver ratio finally cleared and closed above the near 30-year high-level mark, with it now costing about 90 ounces of silver to acquire 1 ounce of gold. In the coming months.

We’ll likely find out in the coming months and year if this critical ratio can distort to record high gold-silver ratio levels of over 100, only reached during the 1930s Great Depression.

In our bullion podcast below, we get a big picture tour of the global economy from a returning guest, Mr. David Jensen of Jensen Strategic consulting.

If you are a large chart and data person, or someone who subscribes to more common sense economic theories, you won’t want to miss Dave’s contributions to this week’s podcast.

-

-

Welcome to this week’s Metals & Markets wrap. I am your host James Anderson of SD Bullion.

With us, this week is a returning guest, precious metals analyst and mining consultant David Jensen of Jensen Strategic.

This interview got recorded Friday, June 14th, 2019, at 1:30 PM eastern time.

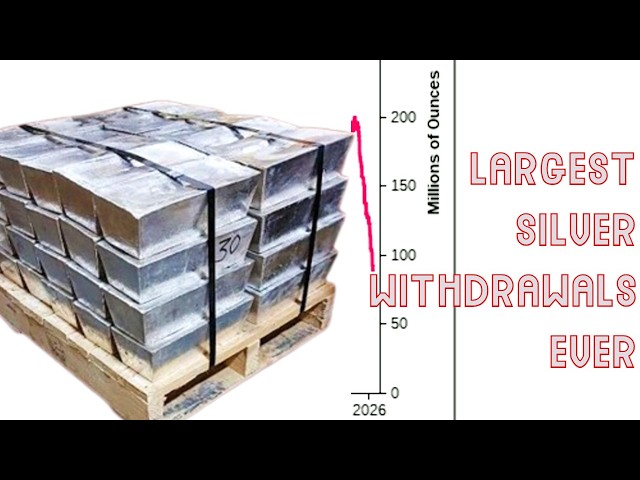

Below are the charts and slides that David was kind enough to gather and bring to this week's discussion and bullion podcast.

-

Once Nixon defaulted on the US dollar by taking it entirely away from gold discipline in August 1971, this is how we got going down the current path.

-

This chart covers perhaps David's most crucial point in our discussion.

The tightening of the True Money Supply inevitably pops the financial bubbles and calls into question both sound and malinvestments everywhere.

Thank you for visiting with us here at SD Bullion.

***