When dealing with precious metal investments timing is of utmost importance. Understanding the market and identifying trends can help you maximize the return on your investments. Interested in what the silver price has been doing over time? Check out these Silver Insights to see the Top 10 Silver Price Moves. Don't forget to sign up for Silver price alerts so you never miss an opportunity to buy or sell at the right price!

Live Silver Spot Prices at SD Bullion

View the live silver spot price per troy ounce, gram, and kilogram. You can also see the 24-hour price trend for each weight. Below, you'll find an interactive live silver price chart with historical pricing as well as various historic long term silver price charts.

Shop Silver at SD Bullion

Metal Performance History

January 09, 2026 3:00 AM EST

| Time | Price | Change

|

Change % |

|---|---|---|---|

| 1 Day | $76.98 | +0.231 | +0.30% |

| 7 Days | $72.86 | +4.367 | +5.99% |

| 30 Days | $61.82 | +15.404 | +24.92% |

| 6 Months | $36.39 | +40.836 | +112.23% |

| 1 Years | $30.12 | +47.101 | +156.37% |

| 5 Years | $25.45 | +51.771 | +203.41% |

| 10 Years | $13.94 | +63.284 | +453.99% |

| 15 Years | $28.49 | +48.733 | +171.05% |

Silver Price Insights

Silver Prices Today and What Investors Must Know

On this page, you can find the live silver price in US dollars as well its 21st Century performance versus other currencies. As well you will find many unique long-term silver price charts depicting price trends over time.

Not only do we provide the live silver spot price, but we also offer a full 24-hour price chart to help make faster investment decisions. You can also make use of our interactive chart, as well as view many of the various silver bullion choices we both actively sell and buy.

Current Silver Prices and Historical Silver Prices

Our interactive silver price chart above allows you to view prices for a wide range of periods and custom date ranges. We also provide a “quick view” chart that provides the price today, within 24 hours, for the past month, the past six months, and for a full year.

We are also proud to offer access to both the silver price today, as well as historical charts below.

Silver Prices Today and What Investors Must Know

On this silver price page, you can find the live silver price, as well as longer-term silver price charts depicting silver price trends over time.

Not only do we provide the live silver spot price, but we also offer a full 24-hour silver price chart to help make faster investment decisions. You can also make use of our interactive silver price chart, as well as view many of the various silver bullion choices we offer for discreet delivery to door.

What are the fundamental reasons for investing in Silver?

Get our 100% FREE guide there ➩ SD Bullion Silver e-book

Understanding the Silver Spot Price

Like gold, silver has a spot price. Silver prices change quickly during worldwide trading hours, often from minute to minute and certainly from hour to hour.

Knowing the current silver spot price should help ensure that you’re able to make savvy decisions with your investing, whether you are holding, selling, or buying silver bullion for the long run.

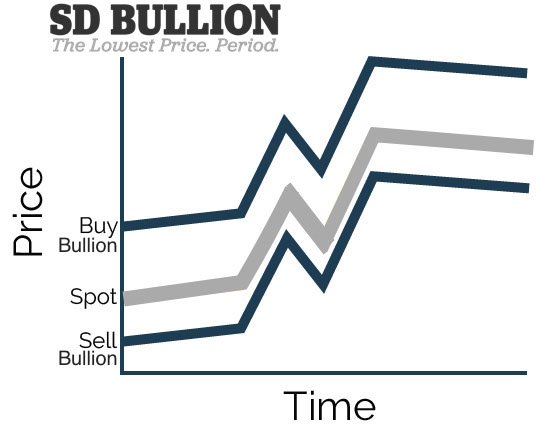

The spot price of silver is the cost of one troy ounce of silver at that particular second. However, the silver spot price is not the actual or exact price of a .999 fine ounce of physical silver bullion. Silver bullion dealers add a slight premium to the spot price to ensure profitability. Our physical silver bullion prices are updated continuously to reflect the current rate of silver on the market, as well as our dealer premium.

The following is a calm market illustration of both typical buy and sell prices for silver bullion concerning the fluctuating silver spot price.

What Affects the Price of Silver?

Like the price of gold, silver prices are influenced by a wide range of factors. However, the situation is somewhat different from that of gold. The yellow metal is mostly a monetary and financial tool, whereas silver has a myriad of industrial and commercial uses.

Silver is an even more precious commodity in our everyday lives than gold is in terms of use cases. Thus, there are even more factors that can change silver prices positively today. Some of the factors that play a role in improving the price of silver include supply and demand factors, new industrial, or medical uses for the metal, fluctuations in fiat currency values and more.

Why Is Silver a Good Investment Choice?

In times past, silver was the de facto currency of the world, even more so than gold. That has changed, and today, silver is an ideal investment option. By following silver prices from day to day, investors can determine whether there is an up or downtrend, and buy or sell appropriately.

Who buys silver?

Individuals, banks, and significant investment groups are all actively buying silver. However, silver is also purchased for use in the medical industry, in electronics, in aerospace, in the automotive sector, and many more use cases. Of course, there are also private investors keeping a close eye on the silver price per ounce to protect their financial situation, as well.

As an investment, silver is used similarly to gold, as a hedge against the devaluation of fiat currencies. However, other people invest in silver so that if the dollar ever completely crashes, they will have a means of buying goods and services (rather than attempting to barter products, these individuals believe that we’ll be using silver as money).

You’ll find a host of different silver investment options on the market, all of which get tied to the spot silver price. There are silver rounds and bars, as well as silver coins and collectible options (numismatic coins with historical value and scarcity that increase their value substantially over that of silver bullion).

Of course, there are also electronic options (ETFs), as well as silver futures and other choices. However, these are not necessarily ideal investment choices for all comers, as they are not tied as closely to the silver price and are affected by a variety of other market factors.

Common Questions about the Silver Spot Price and the Price of Silver Today

Table of Contents

The fluctuating spot price of silver gets mostly set by COMEX headquartered in New York and gets based on the amount of the highest traded near-term silver futures contracts. As with the spot price of gold, the spot price of silver is relatively the same around the world, even though it trades in separate exchanges valued in various other fiat currencies.

Note that the NYMEX in New York mostly sets both platinum prices and palladium prices daily.

The silver spot price market is open almost 24 hours per trading day, with a 60-minute closed period each day between 5:00 EST and 6 PM EST.

The silver price per ounce, therefore, changes almost always, and you must have an up-to-date silver price chart to compare the current silver price to historic silver prices. This page will provide you with information about the overall trend, whether moving up, down, or staying static.

For what is the silver spot price used?

The spot price for silver is the theoretical cost right now for one troy ounce of .999 fine silver bullion. However, the price can change by the minute, so lower spot prices do not get considered accurate when locking in a trade. It is crucial to know precisely what the silver spot price is at the moment you want to buy or sell silver bullion.

Why should I track live silver prices?

The primary benefit of tracking live silver prices is that it provides you with a baseline on the cost of your silver investment. For instance, by knowing the price of silver per ounce, you can then determine if a particular dealer is charging too high a premium, whether now is the right time for you to buy silver if it would be wise to sell silver you’re holding, and more. We use industry-leading technology to ensure that our live silver prices are always up to the second, to empower our customers in their investing needs.

What currency is the spot price of silver given in?

Silver prices quoted here at SD Bullion are always in US dollars. Even if you’re investing in silver in another country, the spot price will be in US dollars and then converted into your local currency. The US dollar is the international standard for gold, silver, and other precious metals, and it allows standardization across all nations. You’ll also find that most silver price charts show the cost of a troy ounce of silver. However, others may show grams or fractional weights. You must make sure that you’re comparing and tracking the same information (ounce to ounce comparisons, rather than an ounce to a gram comparison, for instance). Inaccurate comparisons can lead to mistakes with your investing strategy.

SILVER vs. FIAT CURRENCY KEY

Silver vs. USD = Silver vs. US dollars, Silver vs. fiat US dollars

Silver vs. ARS = Silver vs. Argentine pesos

Silver vs. AUD = Silver vs. Australian dollars

Silver vs. BRL = Silver vs. Brazilian real

Silver vs. CAD = Silver vs. Canadian dollars

Silver vs. CHF = Silver vs. Swiss francs

Silver vs. CNY = Silver vs. Chinese yuan, Silver vs. yuan, Silver vs. renminbi

Silver vs. EUR = Silver vs. euros

Silver vs. GBP = Silver vs. pound sterling, Silver vs. British pounds

Silver vs. IDR = Silver vs. Indonesian rupiah, Silver vs. rupiah

Silver vs. INR = Silver vs. Indian rupee, Silver vs. Rupee

Silver vs. KRW = Silver vs. South Korean won, Silver vs. won,

Silver vs. JPY = Silver vs. Japanese yen, Silver vs. yen,

Silver vs. MZN = Silver vs. Mozambican metical, Silver vs. metical

Silver vs. NZD = Silver vs. New Zealand dollars, Silver vs. NZ dollars

Silver vs. RUB = Silver vs. Russian ruble, Silver vs. rubles

Silver vs. TRY = Silver vs. Turkish lira, Silver vs. lira,

Silver vs. ZAR = Silver vs. South African rand, Silver vs. randAs the spot price for gold and the platinum price, silver prices today are the similar no matter where you might be around the world. However, this only applies to the silver spot price.

Silver bullion dealers tack on a premium to their silver bullion investment offerings, and those premiums can vary significantly from one dealer to another.

Know the current price of silver first, and then you’ll have the foundation to begin comparing silver bullion dealer options.

Is the spot price of silver what I will pay for an ounce of silver bullion?

No, you will not pay the spot price of silver. Dealers are not even able to purchase silver at the spot price. Therefore, dealers must add a premium to the purchase to ensure profitability. Depending on the dealer and the investment in question, your cost can vary significantly. Without that premium, dealers would not be able to stay in business. However, it is essential to shop smart, as some dealers can charge very high premiums.

Does the spot price of silver apply to collectible coins?

Only marginally. Collectible coins do have some grounding in the price of silver, but that is not the whole story. Rounds and bars get more closely tied to the spot price. Collectible coins have other factors that contribute to their value (or detract from it), including rarity, condition, minting errors, and more. For new investors, it is highly suggested to start with rounds or bars, which are not collectible and are valued only for their content of the precious metal. There are also newer collectible coins, such as the American Silver Eagle and the Canadian Silver Maple Leaf which are less rare, and thus make better choices for new investors more interested in hedging their wealth against devaluation.

New investors studying silver price charts to determine the current silver price might be curious about the bid and ask prices. The bid price is what the dealer works off of when you're looking to sell silver to that dealer. The 'ask price' is what the bullion dealer works off of when you're looking to buy silver from that dealer.

The difference between these two prices, called the bid-ask spread, is also essential. The narrower the gap, the more price-competitive the market and the fewer fees are involved, the less price appreciation required to 'break even.' The wider the bid-ask spread gap, the more charges are applied, and the less competitive the specific precious metal product may be.

What are the best options for investors seeking to find a low price of silver per gram?

There are many options when it comes to investing in silver. If you’re looking for the lowest price of silver per gram, your best option is to go with silver bullion bars.

The larger the silver bullion bar (100 oz) you purchase, the lower your cost per ounce will be.

Kilo silver bars (32.15 troy oz) also offer some of the lowest costs per ounce on the market, but they are so large that they might be out of financial reach for some smaller silver investors.

You can also invest in silver bullion rounds, which look like coins but are not official legal tender in any country. These typically do not carry any numismatic value, so they are tied closely to the price of silver, rather than being inflated by sentiment, rarity, or condition. So long as they contain the specified amount of silver (one troy ounce is the standard), then retail prices should be predictable.

Futures, ETFs and Other Forms of Silver Investment

When analyzing silver investing options, you’ll no doubt come across intangible silver investment options. These include silver futures and ETFs. Silver futures are just contracts that say you’ll buy X amount of silver on X day in the future. You can buy futures contracts as an investment option, but this is not best for long term silver bulls. There’s a significant chance that the price of silver will likely change between the time you buy the contract and when you take delivery of the silver.

The industry standard for this type of contract is purchasing 5,000 ounces of silver. The issue is that you pay for your silver at the time of purchase, not the delivery. If the delivery is several months down the road, there’s a chance that the price of silver may drop. The seller of the silver would make a very nice profit, as they do not have to source the metal until it is time to deliver. Even a drop of $2 per ounce can add up to a significant amount of money on a standard contract purchase.

Also, where you actually to take delivery of the silver in the futures contract, you’d incur additional fees. Ultimately, it’s not the right way for new investors or those with limited funds to get into precious metals investing.

ETFs are another option and are mostly pieces of paper or synthetic derivatives attempting to track the silver price with supposed silver bullion backing that is getting stored somewhere else.

While they attempt to track the silver price today and likely to involve some claimed silver backing, you’ll never be able to hold the metal in this instance. ETFs also charge annual fees which eat into investment capital over the years at compounding rates. You can find some popular silver ETF fees here as you learn the best way to buy physical silver.

Silver ETFs trade differently than the actual silver bullion metal on the precious metals market. Our advice is to stick with actual physical silver bullion purchases and study a silver price chart to ensure you’re getting the best deal possible on your investment.

Notice in the chart below how the most popular silver ETF called SLV has its price was diverging from the silver spot price over time. Conversely, during the 2008 financial crisis, 1 oz American Silver Eagle coin premiums spiked to over 80% above the then fluctuating silver spot price.

Factors That Affect the Silver Price Today

Like gold, silver prices today are impacted by many factors. These range from the state of the worldwide economy to the demand for silver from various industries. Silver has more factors that affect live silver prices than gold does.

One factor that influences the silver price is production. If the price of silver drops too low, mines can slow down production, causing the price to rise more. However, if demand is high and supply is low, prices could increase as well. Of course, geopolitical instability also plays a role in the silver price per ounce as does the fear of inflation, investor action, government actions, and ongoing industry demand.

Is there too much volatility in the silver market for individual investors?

While the silver market is pretty volatile, knowing the current spot price for silver and tracking historical performance with a silver price chart can help make things considerably more comfortable. It’s also important to note that the silver market is no more volatile than others, including the stock market. Finally, if you are investing in physical silver to hold as a long-term hedge against inflation and devaluation, you should not worry about the risk of short-term fluctuations that create that volatility. In short, you can track the price of silver, and then sell when the time is right without worrying that your investment will lose its value overnight.

Is the silver price dropping?

At one point in 2011, the price of silver per troy ounce approached $50. It has fallen since then and seems to have bottomed in early 2016. While it is not as low as it once was, it has not yet regained the heights it once enjoyed. This is good news, as it not only makes it simpler to make an accurate silver price forecast, but it allows more investors than ever before to take advantage of this valuable precious metal while the price of silver is still low.

Additional Questions and Answers about Silver and the Silver Price Today

Investing in silver is very similar to investing in gold, platinum, and other precious metals, but the fact that this metal gets used in many industries changes things a little. To help clarify the situation and make the best possible use of a silver price chart, we must explore additional questions and answers surrounding spot silver prices, how the silver gets sold, used, and more.

Below is a long term full fiat currency era comparing silver fiat US dollar price versus the top 20 countries ranked by GDP silver fiat currency prices. As you can see, since 2014, the fiat US dollar price of silver has underperformed silver's fiat currency prices in other major foreign markets.

How does silver price per troy ounce differ from silver price per gram?

Silver typically is sold in troy ounces, which are different from grams. There are over 31 grams in a single troy ounce so that the silver ounce price will be higher than the silver price per gram. With that said, the price per ounce is generally lower when you purchase more units. For instance, you’ll pay a higher silver price per gram when you buy by the gram than if you purchased a single ounce of silver. Usually, larger volume purchases are the better option, allowing you to maximize your investment dollars.It’s important to understand several factors involved with silver bullion buying or investing in any precious metal for that matter. The silver spot price is typically not the exact price you will pay for any type of silver bullion anywhere. The silver spot price is essentially is the cost of an ounce of silver before being cast into bars, rounds or coins. Additional work adds additional costs and price premiums per product. Then, other additional supply-demand factors affect the overall cost.

The reason that the price of silver coins is higher than the price of silver per ounce is due to the additional quality, artistry, and effort that goes into minting coins. Bars and rounds are plain and cost less to manufacture. That gets reflected in the relative price of each silver product. There’s also the chance that some coins will have historical value. These are primarily older coins, not currently minted ones. Once a government stops minting coins, their value rises over time.

What are sovereign silver coins, and why are their prices different from the amount of silver per ounce?

You’ll find several nations that mint their silver coins today. Some good examples of these types of silver coins include the Mexican Silver Libertad, the Silver Krugerrand, the Australian Silver Kangaroo, and many others, as well. The reason these coins have different pricing than what you’ll find in a silver price chart for the price of silver per ounce is that they are 1) coins, not rounds and 2) they are minted as both legal tender and carry some collectible value. While they take only minimal numismatic value when first created, that value increases over time as they become rarer and harder to find on the market.

Is silver sold around the world at all times?

Yes, like gold, the silver spot price is used around the world for 24-hours per day trading.

The silver market closes only for 60 minutes per day on weekdays, from 5:00 PM EST to 6 PM EST. The COMEX mainly sets the price of silver per ounce, and other markets too (e.g., LBMA).

Although silver spot prices will usually be adjusted locally to show the local currency price per troy ounce, rather than the fiat US dollar price, silver price discovery mainly originates in fiat US dollars, as are many other investment options.

The following chart shows the east vs. west silver price bias, in which the silver price tends to go up overnight in Asian trading versus sideways and or down during western trading hours (LBMA fix AM and PM and New York trading hours on the COMEX).

The eastern silver price bias upwards remains empirically evident in the 21st Century. The following east vs. west silver price chart covers the full fiat currency era, from 1970 to 2019 silver market data using basic compounding arithmetic.

What is the difference between an ounce and a troy ounce?

When you use a silver price chart to compare today’s silver price with the silver price history, what you’ll be seeing is the value of a single troy ounce of silver. A troy ounce is different from the standard ounce we use for weights and measurements. It’s slightly heavier (it equals 1.09711 standard ounces). Always ensure that the silver price chart you’re studying lists silver by the troy ounce and not by grams or any other measure.

Why is there such a difference between today’s silver prices and historical silver prices?

The price of silver continually changes, sometimes by the minute. However, it also goes through cyclical ups and downs. A few years ago, silver hit a historic high price. Since then, and coupled with the "recovery" of the global economy, the price of silver has come down quite a bit off it's high. By understanding how silver prices per ounce vary over time, you can begin to predict future movements and make your silver price forecasts to inform your investing efforts.

How do I invest in silver for retirement while reducing my level of risk?

It’s important to understand that all forms of investing come with some element of risk. With that said, in our opinion, investing in precious metals carries less risk than playing the stock market, or investing in mutual funds, as well as most other options. To safeguard yourself and your financial future, you must do several things:

- Always Track the Spot Price of Silver: If silver is your metal of choice, then you’ll need to ensure that you always have access to up to the minute, accurate silver prices. A silver price chart can allow you to see the spot price of silver today, yesterday, last week, for the preceding six months, or even a full year and more. Our silver price chart is always accurate and always up-to-date. We also provide advanced functionality to allow you to use custom periods to ensure that you’re making the soundest possible decision.

- Diversify: Precious metals are highly beneficial, but you should never put all of your eggs in one basket, to quote the saying. Diversification is the key to hedging your wealth against devaluation and the effects of inflation, and silver should be just one of your options.

- Know Silver Bar Prices for Different Sizes: As the size of the bar of silver increases, the cost of silver per ounce decreases. By tracking silver bar prices for different weights, you can maximize your investment options. New investors might be okay with buying silver by the ounce, but experienced investors with more capital and in need of more exceptional hedging capabilities might do better investing in kilo silver bars or 100 oz silver bars.

- Compare Silver and Gold Prices to Stock Valuation: With a diversified portfolio, most agree investors should have precious metals, stocks, bonds, and other options. As the economy changes and moves from a growth cycle and into a downturn, compare the silver and gold prices to stock valuations. You’ll see the price of gold and the price of silver began to rise. This offsets the loss you’ll experience on your stocks, bonds, and other traditional investments.

Additional Questions and Answers about the Price of Silver

Silver is an excellent addition to your portfolio, but we understand that you can have many questions about this precious metal that must get answered before you decide to purchase. We strive to provide accurate information about the silver price, as well as providing access to the broadest range of silver options; including coins, rounds, and bars from mints around the world.

What should my decision be if I’m only interested in building up a stockpile of physical silver, and not concerned with collectibility?

If your only goal is to invest in silver and to do it in a way that allows you to create a significant buffer against devaluation and disaster, the best path forward is to buy low premiums silver rounds or silver bars. The amount you purchase initially will hinge on how much capital you have to invest. Those with limited funds might decide to buy a few ounces at a time.

Those with more capital might consider buying larger bars with each purchase. However, those buying larger sized bars will ultimately see the lowest price per ounce of silver. The reason is it costs companies less to create larger bars than it does smaller ones. In a way, it’s a lot like buying in bulk. The more ounces you buy at once (in one bar), the lower the price will likely be. Note that this does not generally apply to buy multiple one-ounce silver bars. In so doing, you will still pay a higher price of silver per ounce than if you were to buy larger silver bars.

The spot price of silver only includes the cost of that weight of metal without any refining or shaping. It does not involve putting it into the form of a round or bar, or the loss of turning the raw ore into a coin, complete with artwork. It also does not include the dealer premium applied to silver sales. With that getting said, it is still crucial that investors know not only the current spot price of silver but historical silver prices as well. Some dealers may include a higher markup than others on their products, and knowing the live silver prices helps you shop around better. Additionally, knowing historical silver prices lets you track and predict how the metal could perform. With this information, you’ll be able to make more informed decisions with your investing dollars, knowing when it is the optimal time to buy silver, sell silver, or hold your silver against market movements.

What taxes can get added to current silver prices?

Sales taxes are largely only added to purchases of silver if you live in a state where local sales tax applies — currently, not all states in the US tax precious metals. If you are buying silver online and live in a country that does require this, the sales tax will likely get added to your order at checkout. Note that fees on silver bullion purchases are based on your billing address, rather than your shipping address.

Coins are very different from rounds and bars. Unlike silver rounds or silver bars, silver coins have an additional value that can make them more valuable than their weight of silver would dictate. For instance, a Silver Morgan Dollar from a scarce minting year that is in excellent condition would sell for much more than the price of silver. This factor can be shared because it is a rare collectible coin with considerable numismatic value. There are many other examples of this on the market as well. Even current silver coin prices have a higher premium applied to them due to their initial numismatic value. Collectible silver coins can be good options for investors interested in this path, but they can be much more costly than rounds and bars, so investors only interested in buying precious metals may wish to avoid them.

When dealers accept credit cards, they must pay fees to the credit card companies. These fees must get worked into the silver price for the silver industry to maintain profitability. This fact is true across the board, and with all credit card companies, although the fee amounts vary from one card company to another. When you pay with a check or a bank transfer, those fees do not apply, and the dealer can offer a lower silver bullion price overall. Paying with ACH or a check can allow you to save money on your silver bullion purchases. You may also want to consider paying with a money order or a cashier’s check, as these methods also do not incur a fee from the dealer. With that said, you will likely pay a fee for money orders and cashier’s checks from your bank. The amount will depend on where you purchase them.

Will the face value of a coin affect silver coin prices?

No. Silver coins minted by national governments carry some face value - $1 for instance. However, that price is only nominal, and no one would use a silver coin to pay for something in the everyday world, simply because their silver content makes them much, much more valuable than their face value. In addition to that, the face value gets not factored into the silver coin's price. That value is based instead on the amount of silver in the currency, the coin’s condition, its rarity, and other factors that impace numismatic value. Note that this is not the case with rounds and bars, which are not typically not collectible, and do not have a face value, nor are they legal tender.

How much is the dealer’s premium added to the silver price per ounce?

All dealers apply a standard, the fixed amount over the spot price of silver products. For instance, it might be $1 over the spot, or something else. This amount gets charged per ounce in most cases, and it will change over time based on fluctuations in the market as well as the supply and demand for each product. Note that different products may have dissimilar premiums. For example, Silver American Eagle coins minted at the US Mint may have a different premium applied than a one-ounce silver round or a 10-ounce silver bar.

While it might sound complicated, it is possible to make money selling silver to dealers. This statement applies to 90% junk silver coins, as well as silver rounds, bars, and more. However, if you wanted to buy an ounce of silver and then re-sell it to a dealer within a short time, the chances are good that you would lose money on the investment. It cannot get overstated that the way to make money with precious metals is to buy and hold. Watch the current silver prices and compare them to historical silver prices. When the silver rate rises beyond what you paid (including the dealer markup), you can then sell for a profit. Silver buyers, gold buyers and other precious metals investors understand that the long-term trends in the price of silver make it a much wiser decision to buy and hold for the long term, rather than attempting to make a short-term profit like in the stock market.

How do I lock in the silver rate if silver prices change from minute to minute?

When you work with a reputable dealer, you’ll be able to lock in the offered price of silver for a limited time at the checkout page or over the phone. Note that this price will only get honored for a limited duration, and it will be specified. Doing so prevents the dealer from being over-exposed to daily market fluctuations. Once the time limit for the lock-in has gotten exceeded, the price will revert to the current prices of silver, if the price of silver has changed. We ensure that you have more than enough time to lock in the amount you want to pay. We also provide the most accurate, up-to-date pricing to keep you informed, as well as providing our customers with the ability to track historic silver prices and compare them to the silver price forecast.

What does the gold silver ratio indicate?

The gold-silver ratio tells you how many ounces of silver it would take to buy one ounce of gold. It’s a simple way to compare the current prices of these two metals and see how they relate to each other.

For example, if gold is priced at $2,500 per ounce and silver is $30 per ounce, you’d divide 2,500 by 30 to get a ratio of about 83. This means it would take 83 ounces of silver to equal the price of one ounce of gold.

Over time, this ratio has moved a lot. In the 1980s, during a major silver price spike, it dropped to around 15. In 2020, during the market turmoil of COVID-19, it briefly climbed above 120.

Understanding this gold silver ratio can help you see how silver’s price compares to gold’s at any given moment, which can be especially interesting if you’re exploring silver for your precious metals portfolio.

Can I buy physical silver right now?

Yes, here at SD Bullion, you can buy physical silver bullion in a range of formats, including silver rounds, silver bars, and silver coins.

We automatically lock in your silver prices at the checkout page, and you’ll see it depicted on the screen. Note that when ordering online, the current silver price is only locked in for 3 minutes before it reverts and will reflect any changes to the price of an ounce of silver plus our premium.