The Gold vs Home Price Ratio is a way to measure if average home prices are historically undervalued, overvalued, or fairly valued. We use gold for this measurement because it is the most stable and lasting money we have. All all other currency derivatives debase and vanish given enough time.

To see true value in charting asset classes, we suggest measuring stuff vs stuff to garner a truer sense of what is under, over, or fair value.

We have been living in a full fiat currency standard since 1971 to date. We are talking almost 50 years time. That means, most people who are alive today only know times when currency supplies have been expanding.

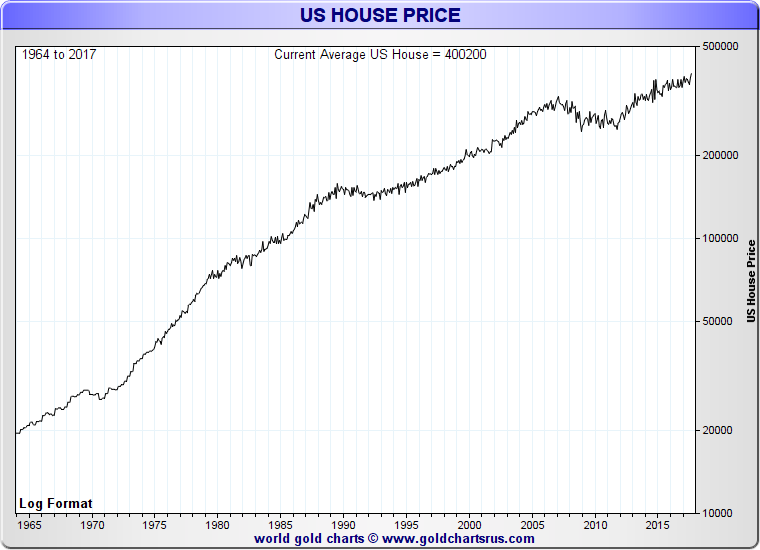

This is perhaps why the persistent misconception that home prices always go up still exists (or at least until the 2008 Financial Crisis).

We suppose others may also think that bond prices always go up forever too (or perhaps not).

Average US House Prices in US Dollars (1964 to 2017 AD)

Most prices vs median wages for basic things have risen over the last 50 years ( e.g. safe housing, nourishing foods, energy for transportation, health care, education / skill attainment, etc.).

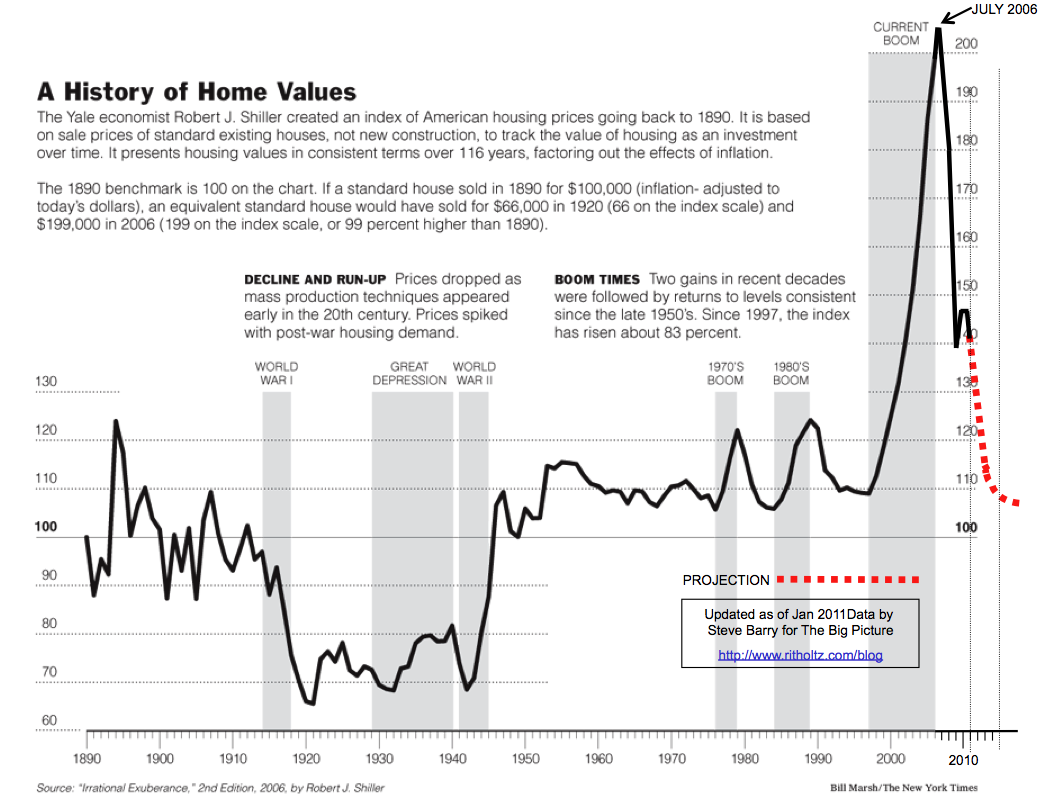

This was not always the case in the United States. War price inflations aside, prices often fell over a citizen’s lifetime through the 19th Century with sounder money practices in place. With the money supply more stable back then while our productivity and technology kept increasing, prices for many things went go down in time.

We had less financialization and thus less regularly occurring bank crisis back then as well.

Often longer charts that expand outside of the post 1914 central bank era can give us more perspective as well.

120 Year US Home Value Chart (1890 - 2011 AD)

Now in 2018, the United States’ largest generation (baby boomers) moves into 65 year old retirement age at a clip of about 10,000 per day. This continues until about 2030.

About half of the millennial generation currently lives paycheck to paycheck. Many are struggling under the burden of record sized college loans unpaid (approximately $1.2 USD trillion).

Who (other than hedge funds) will be buying the currently unowned, under serviced, and soon to be sold inventory of US houses? Will they be able to do so as interest rates rise?

By studying and understanding the USA’s median and average price home data to gold values, you can garner a better idea of when housing may be expensive or cheap in terms of gold bullion ounces.

Average US homes were cheap in price perhaps at the peak of the last bullion bull market in 1980 yet financed with extremely high interest rates (+20%) back then.

Compare that versus average US homes being overpriced during the early 2000s US housing bubble and the most recent reinflation of housing prices thanks to record low interest rates (as low as 3.3% in 2012).

US House Prices vs Gold (1964 - 2017 AD)

Our expectation is to see an echo of the last 1970 - 1980 gold vs house price cycle from severe gold undervaluation (see years 1971 & 2002 ) to potential gold overvaluation ( see 1980 & 20??).

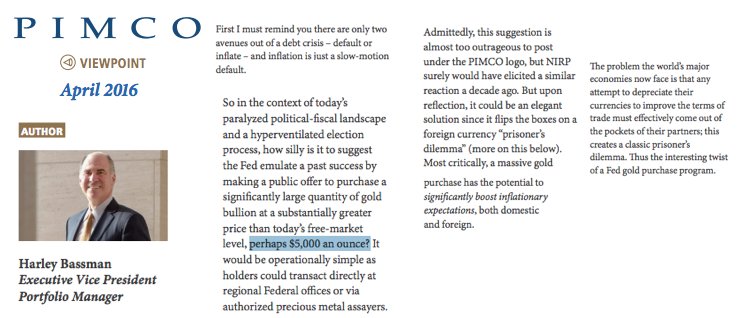

It would not surprise us to see average house prices in the USA to move below 100 oz gold vs average US house price. At today’s US dollar price that would require a gold price of over $4,000 USD oz.

To those with minimal monetary history or perhaps backwards extrapolating 50 year timeframe perspectives, a $4,000 USD oz price for gold may likely sound ridiculous.

Yet even some of the world’s largest bond trading portfolio managers (e.g. Harley Bassman at PIMCO) explicitly understand what kind of future gold prices we’re talking about.

PIMCO: Federal Reserve Gold Reversion to $5,000 oz USD

The questions of how we get from here to there is what confounds us most.

Not so much if, just specifically how and when exactly will this long term retracement cycle complete itself in the United States.

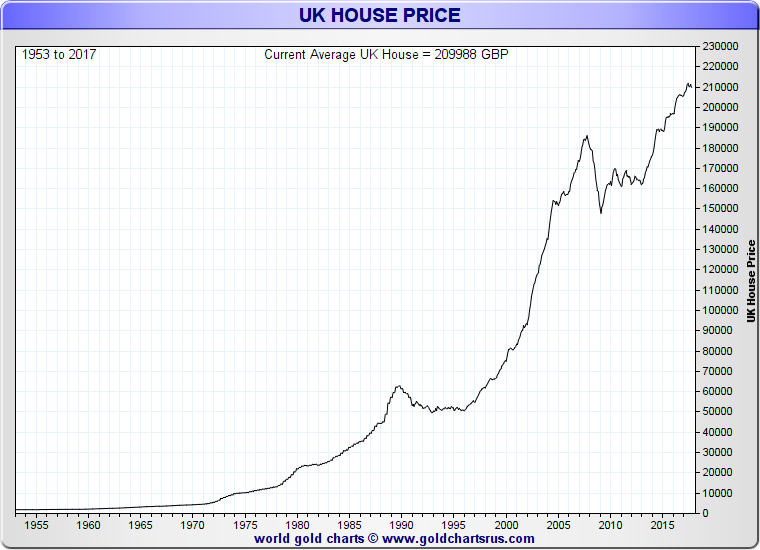

Look elsewhere in the developed world as well, where housing bubbles are even more outsized, exponential, and obvious.

How might all this play out in terms of gold vs average house prices?

Not merely here in the United States but perhaps elsewhere in the western world where historical data is available.

UK Average House Price Chart (1964 - 2017 AD)

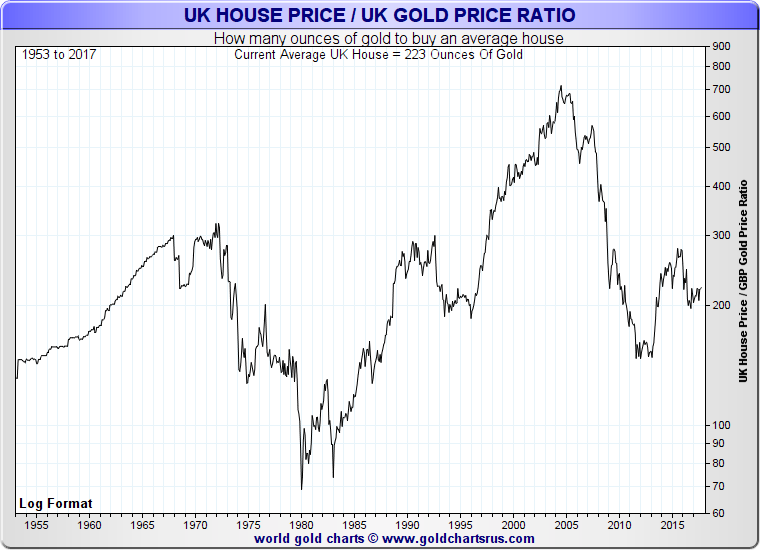

UK House Prices vs Gold (1953 - 2017 AD)

We expect this to bottom below 100 oz of gold per average UK house price

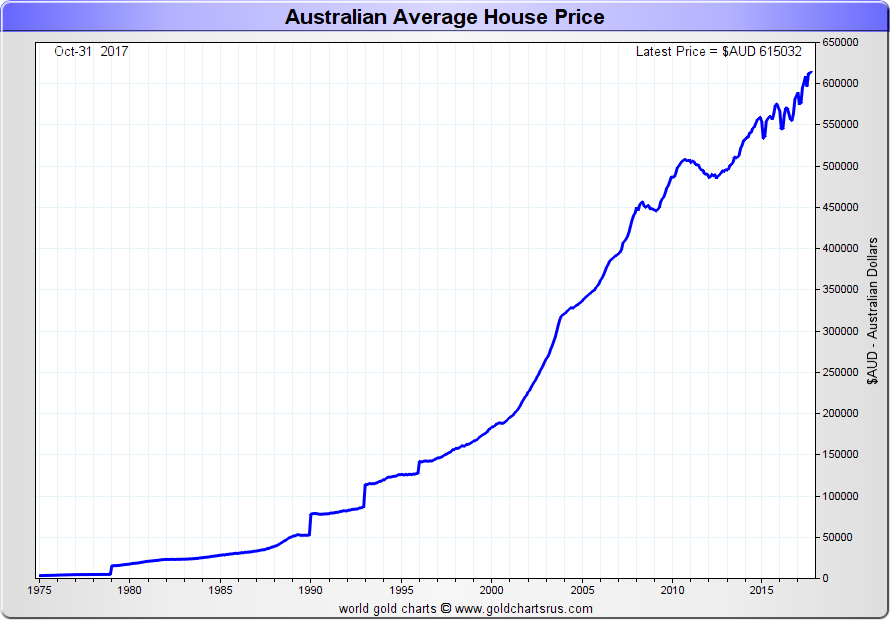

Australia Average House Price Chart (1975 - 2017 AD)

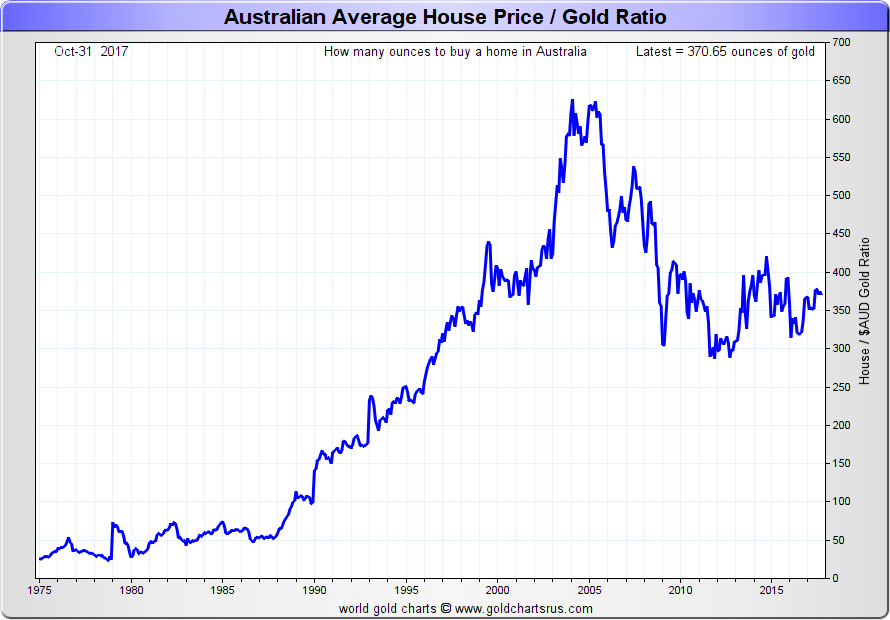

Australia House Prices vs Gold (1975 - 2017 AD)

We expect this to bottom below 100 oz of gold per average Australia house price

If you like these gold vs house price insights,

be sure to pick up our free 21st Century Gold Rush digital guide now.