Gold bullion is always measured in fiat currencies or fiat currency indexes.

Fiat currency vs gold price examples include:

Although the values of fiat currencies vs gold bullion are constantly fluctuating, growing fiat currency creation ensures losses in value to physical gold bullion will likely continue onwards.

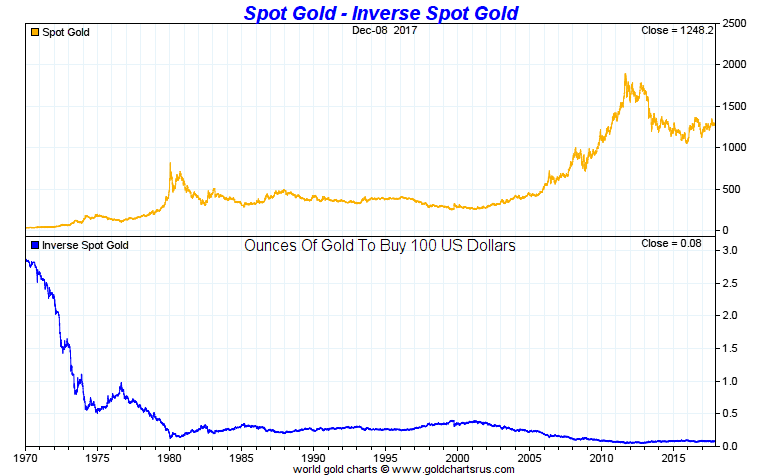

The following Gold vs US dollar chart spans price data from 1970 to 2017 AD.

Gold vs US dollar

The final closure of the Bretton Woods agreement by the USA on August 15, 1971 signified a global monetary system transition from a quasi-gold backed rules based standard to one in which various national fiat currency values have fluctuated against one another.

Within this same timeframe vast advances in technology and human ingenuity have helped to mask some price inflations for goods and services (e.g. computers, food, clothing). Yet over time, the data is clear. In purchasing power and value terms, gold bullion has substantially outperformed every fiat currency issued by any government anywhere.

Physical precious metals are extremely finite in supply compared to competing fiat currencies, hence over long time spans, gold bullion tends to gain purchasing power versus rapidly expanding fiat currency supplies.

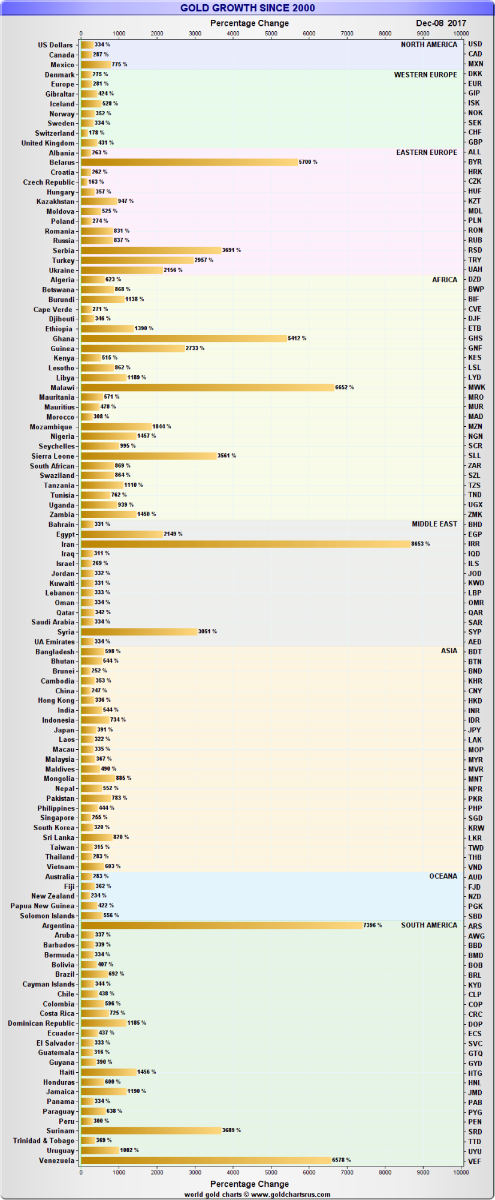

Since the beginning of this 21st Century, the world has witnessed a pronounced increase in gold’s value priced in every single national currency issued by any government worldwide.

The following chart illustrates the positve price performance of gold vs fiat currency since the year 2000. The following 114 fiat currencies from all over the world have lost tremendous value to gold bullion this century.

Arguably the year 2000 AD, marked close to the beginning of this secular 21st Century gold bull market.

Gold vs Currencies

For multiple millennia physical gold has helped humans insulate and insure themselves against losses of their financial wealth.

During times of undervaluation, gold can simultaneously provide owners a way to greatly increase their wealth via prudent gold ownership and investment portfolio allocation.

The rise and fall of various historical civilizations have been dramatically shaped by the pursuit of gold itself. The yellow precious metal has a more than 5,000 year history in use for adornment and a multi-millenial use as money. Gold remains a dependable store of value, a purchasing power containment vehicle if you will.

Arguably in the first example of written law (in the near 4,000 year old Code of Hammurabi), the word mĕnē is a term used to denote the weight of gold to be paid for crimes or to resolve civil conflicts. Thus a specific unit of weight for gold (or silver) is perhaps the earliest written word for money itself. In fact for most of written history, the term “money” has always meant a standard weight and purity of gold (or silver).

When you hear the term ‘Gold Rush’, you might think 19th Century gold mining frontiersmen in the western US or Canada, perhaps also in South Africa, or in western Australia. This ongoing 21st Century version is a lot different.

The biggest miner, buyer, and non-exporter of gold is now China. The old ‘old west’ if you will, is perhaps now located in some of the world’s last remaining frontiers (e.g. in Africa, and South America).

We are now in the midst of the greatest gold bull market ever based on the sheer size of futures exchange trading volumes and the sheer amounts of physical gold ounces actively mined, refined, bought, sold, and delivered (since the year 2000). This is the first truly global gold rush in history.

Record derivatives trading on fractionally bullion backed gold futures markets are being recorded year after year.

Record Gold Trading Volumes

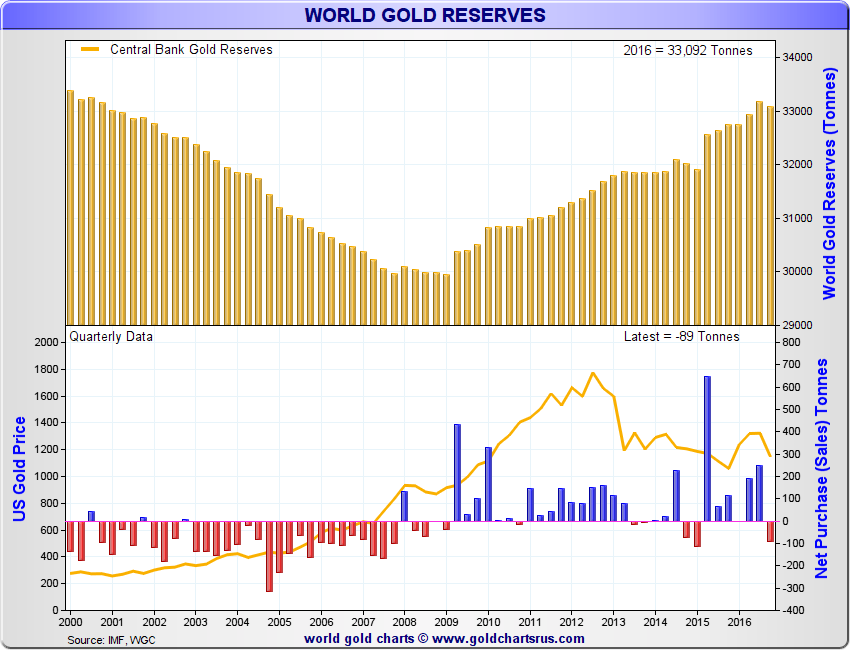

Considering current data covering ongoing government central banks and individual investor actions, the dollar amounts of gold bullion which have been purchased thus far in the 21st Century are unprecedented.

Most long term gold bullion buyers currently buy and own gold to better diversify their wealth and investment portfolios. Most physical gold bullion buyers understand the importance of not having all their wealth only denominated in merely one or two currencies like US dollars or euros for example.

By design all fiat currencies lose their value and real world purchasing powers over time, thus gold bullion is often bought and owned for the long haul to help investors insulate their wealth against this fact.

There is good reason about 1 in 5 oz of physical gold ever mined is currently held by government central banks. Every currency derivative 'tulip' fades away in time.

Gold vs Currency

International financial regimes and rules have changed in 30 to 40 year cycles over the last few centuries. Over 40 years have come and gone since the fully fiat petrodollar system was established (in 1974). Cracks and fundamental changes are now appearing and it is reasonable to expect the rules of the global monetary system to again change sooner rather than later.

Many gold bullion buyers know this. They are diversifying the nature of their wealth positions accordingly, preferring not to hold all their assets denominated by a single currency or lone point of potential failure. Hence both individual investors, billionaire hedge fund managers, and central banks are looking for asset diversification through increased long term gold bullion wealth allocation and ownership.

Be Your Own Central Bank ▂ ▃ ▅ Buy Gold Bullion

Over more than the past century, varying market crashes and bear markets have occurred in both western and eastern nation states in either local or international market economies. Recently the world has undergone an extended period of time where interest rates have been virtually zero and even negative.

When mathematically backtested from 1968 to 2016, gold could have played a much larger role in wealth preservation than most financial commentators or advisors have been, nor are even willing to suggest today.

The growth of online bullion dealers both buying and selling gold coins and gold bullion bars has increased. Older world financial wealth preservation lessons have been releaned by generations shocked by 2008 financial crisis discoveries.

It is now quite common for investors to buy gold coins or gold bullion bars through online gold bullion dealers and take direct discreet delivery to door as well within a professionally insured non-bank bullion depository account.

Why buy Gold Bullion?

Directly owning physical gold bullion can offer investors the following:

-

Wealth diversification

-

Protection from both inflationary and deflationary threats

-

Hedge against Bank Bail-Ins, Bank Bailouts, and Financial System failure

-

Superior financial liquidity (easy to buy and sell, mouse clicks or a phone call)

-

A potentially undervalued asset class (compared to current valuations of equities, real estate, properties, bonds, currencies, etc.)

-

A very private asset to counter cashless and digitally trackable trends

-

Physical and mobile store of value that cannot be hacked nor easily stolen

-

Fortune which can be easily passed on to heirs and loved ones

-

Defense from both slow and even overnight fiat currency devaluations

- A multi-millennial, inter-generational proven store of buying power

The value of gold is not by mere human folly, it is scientific and rational.

Gold bullion remains one of the only default proof assets available to investors today.

Unlike virtually all other asset classes, unencumbered gold bullion as well other physical precious metal bullion products, cannot be made worthless by the failure of counterparties.

Regardless of what the world’s future monetary system becomes, gold’s value for adornment and exchange, its ongoing usage as a store of value, and growing implementations in medicine as well as in aerospace help ensure gold’s future preciousness, usage, and consumption.

Today the world appears to be relearning why gold was, often denied but covertly still remains, the underlying bedrock and foundation of global finance.

If you have interest to learn more about gold and other physical precious metals, click here to receive your free digital copy of 21st Century Gold Rush presented by SDBullion.com

Check out this short video on Gold Investing Fundamentals in the 21st Century

***