Give all the major precious metals market news of late, this will be the first of a two-part Market Update for this final week of late July 2020.

We have some record-breaking data insights to cover later in this video.

But first, we will begin with some popular bullion product price premium expansions of late.

Early last week, Tuesday, July 21st, 2020 - we sent an email to our SD Bullion client base, notifying them that silver spot prices were on the move having then passed $21 fiat Federal Reserve notes per troy oz.

We also informed those on our free SD Bullion email list, of a then breaking emergency US Mint conference call, regarding a continued viral bottleneck at the West Point bullion coin production facility.

Well at the start of this week, Bloomberg reported further details on this emergency meeting.

Easy to guess that with current trends, authorized buyers will demand the US Mint focus on producing the Silver Eagle Coin over all others. There will likely be no more fractional gold coin pieces the remainder of the year. So 1 oz Gold Eagles and 1 oz Silver Eagles should remain the US Mint's focus.

The US Mint is on pace to have a strong year in bullion coin output when compared to the last few. And that is even with Viral shutdowns and manufacturing social distancing slowdowns ongoing.

The problem is, there's just not enough bullion products to meet demand. Case in point is the most popular silver bullion, the 1 oz American Silver Eagle. You can see on this chart the recent rebound in premiums, and with an increase too in spot prices, virtually all American Silver Eagles are being bought with prices in the $30s per troy ounce now.

Remember too, both the American Gold Eagle coin and Silver Eagle coin reverses or backsides are being redesigned for the year 2021.

And they will have new anti-counterfeit features at long last. If you want to see some artists redesign entries, I'll leave a few links in the comments below for you to go check them out.

With this added value, I will go so far as to suggest that seignorage fees on both these most often bought by sales volume bullion coins will be rising in 2021. No official redesign has been selected yet.

And the last time the US Mint increased premiums on American Silver Eagle coins was right around these same spot prices, early October 2010, as allegedly JP Morgan and other net short commercial banks got to run on by silver longs through nearly the end of April in the following year 2011, as the spot price of silver more than doubled in about a half year of time.

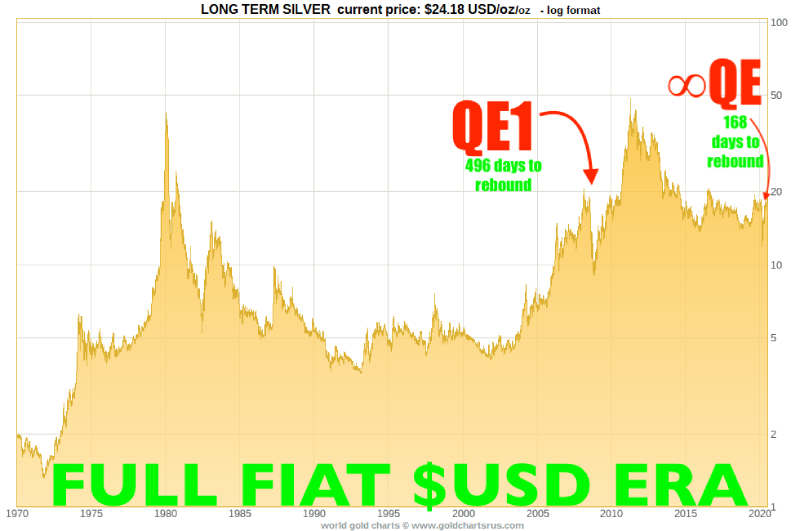

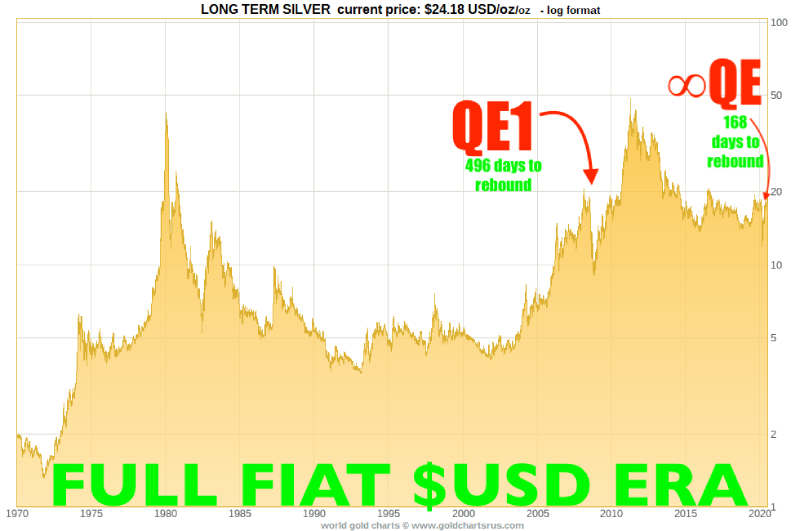

Remember too that the last major upside run in silver was a response to QE 1&2 along with some by then standards large net inflows into silver ETFs.

Both now ∞QE policies ongoing and net Flows to Silver ETFs are record-breaking.

I look the other day, just to give you and myself an idea of the speed at which things are moving.

I got Silver's QE1 spot price to recoup having taken 496 days

InfinityQE'$ recoup from the crash of mid-March this year 2020, that only took 168 days to get back, nearly 3X's faster.

And now we've blown well beyond where we once were.

Surely there will be corrections, retracements, climbing the bullion bull market of worry. But look for what follows once $2,000 gold and $25 silver become support.

--

Moving onwards to unbelievable gold ETF and record silver ETF inflows.

After I finished week's SD Bullion market update I ran into this humongous fund flow for just one week of time into the world’s largest derivative ETF called SLV.

About $700 million investor funds in only five business days chased into that fund looked after or custodian by alleged RICO criminal precious metals trading unit, known as JP Morgan.

Now another time we'll go through why SLV is a poor choice even for short term trading, and certainly for long term store of value holdings but I digress, we're not going down that rabbit hole today.

I want you to think about that 2010 to 2011 run in silver spot price in the context of today. Look at how much more is running into this derivative today versus back then. Back then, we see a slow steady rise, today it's like an exponential ramp mimicking the spot price of late.

Further, let's look at the other two major Gold ETF fund flows over the last one week and two days of time.

This Top 10 list here is ranking the largest investor flows over the past 7 trading days. The top three of four are the GLD, IAU, and SLV with a combined over $4 billion fiat Fed Notes chasing into their coffers.

--

So not only are current investor bets on hard money bullion and derivative proxies, hitting many record levels of late.

But so too is the investor's Gold & Silver Hive Mind.

Gold Price Google Trend Search Volumes

Silver Price Google Trend Search Volumes

Just your average gold and silver bull on the street, they are well conscious of the brief mid-March 2020 spot price meltdown, rebound, and now outperformance.

They are likely also, as best as any of our brains can fully fathom, likely also aware of the unparalleled global fiat currency creation bailout fest that has since sprung-off central bank keyboards. Many people's confidence is shot.

Investors, both small retail bullion buyers, high net worth family office estate money managers, hedge funds, financial institutions, you name them. We are all mostly and increasingly betting on bullion's price and value to rise in the coming months and years.

That is all for the first half of this two-part, news heavy week for the precious metals.

Stay tuned for late tomorrow, we will have part two for you then.

'Til then, all the very best, to you and yours.