Of all the bullish bullion headlines this past week (e.g. record precious metal ETF fund flows, bullion shortage premium gap outs, and price action, etc.).

Perhaps one of the more important headlines and articles was published by a former long time Financial Times, now Bloomberg columnist, John Authors.

Earlier this week, John wrote the following headline in mainstream financial media. If you've bothered to look of late, the incredible data and facts building within the precious metals arena, make this seemingly hyperbolic headline actually seem tame and grounded.

So we dig into some of his points regarding record gold and silver bullishness building.

Following that, we will dip into more record-breaking data updated from today.

As well, we'll review a few other financial insiders takes over the years, men who have warned along that these days were coming.

--

Back to John Authors, a financial insider, who would never be allowed to publish a headline like this, without his editorial gatekeepers approval.

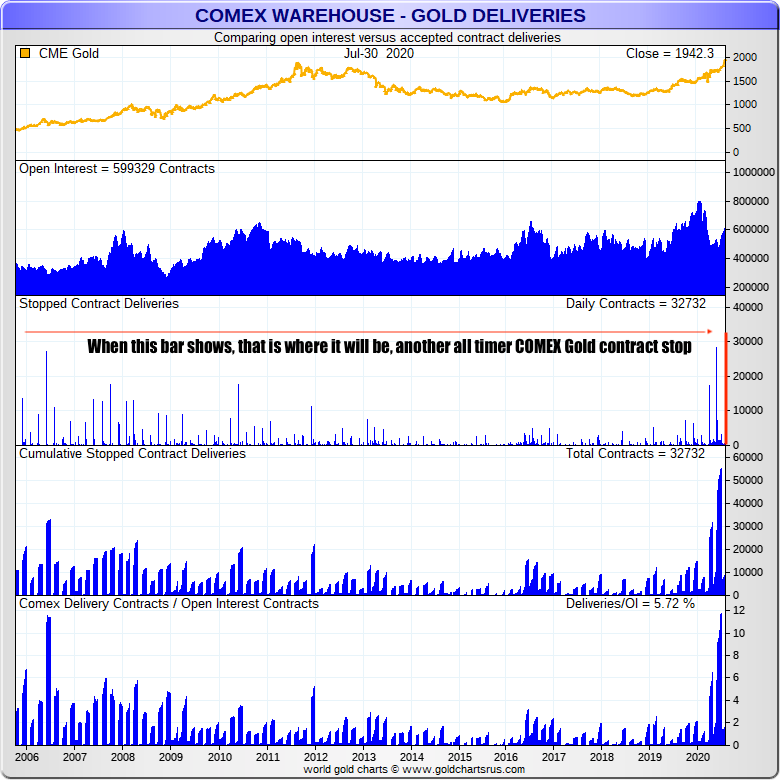

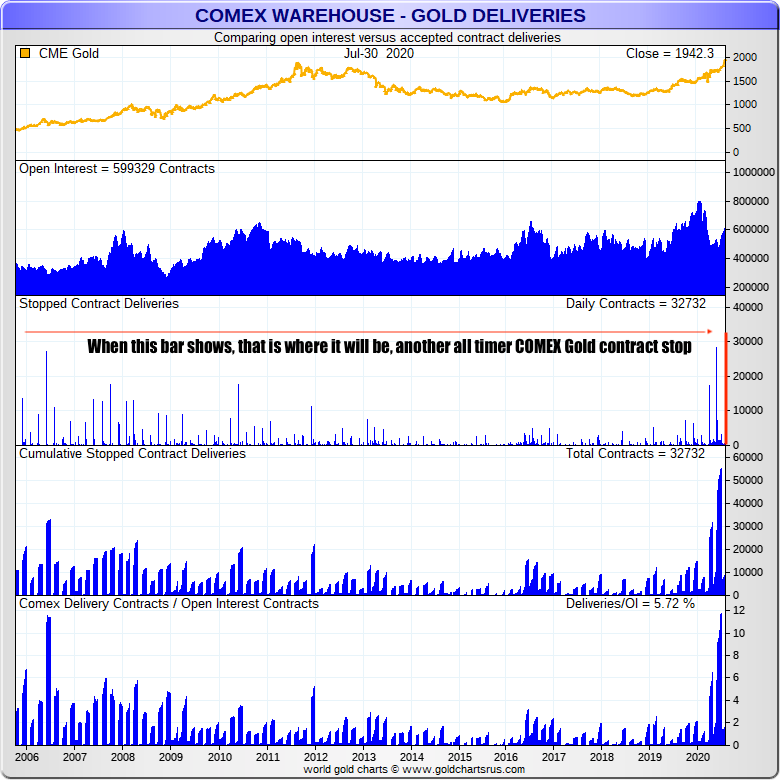

As mentioned, more record data was made today in the COMEX gold futures market for stopped contracts for August 2020.

Apparently more Family Offices & High Net Worth "Other Reportable" have again decided to Stand for Delivery and Stop Contracts at new record size.