If you found this Silver Price high post in our SD Bullion blog, it is quite likely you want to know what the all-time silver price high for silver bullion is in fiat US dollars.

The answers are below, but they require some thought and real analysis as we move toward future silver price highs.

As the 4-major precious metal prices (silver prices, and gold prices, platinum prices, palladium prices) all appear to be simultaneously readying to account for fully fiat US dollar debasements finally.

For silver bullion bulls, it is the right time to look back and ask ourselves, "What is the all-time highest silver price in fiat Federal Reserve notes?"

The most valuable answer is not some $50 oz JP Morgan short-covering impetus from 2009 into April 2011. Or some silly Hunt Brothers late January 1980 corner narrative (see the 12-minute mark in this Hunt Brothers related interview).

The answer is more complicated than either simpleton stories.

Better we also too consider, "What are the highest silver values paid out in fiat Fed note / US dollar prices all time?"

Here we do just that. We don't just look at a nominal silver price high but also what that was worth in today's fiat US dollars. Some of the answers are shocking in nominal record silver price terms looking backward.

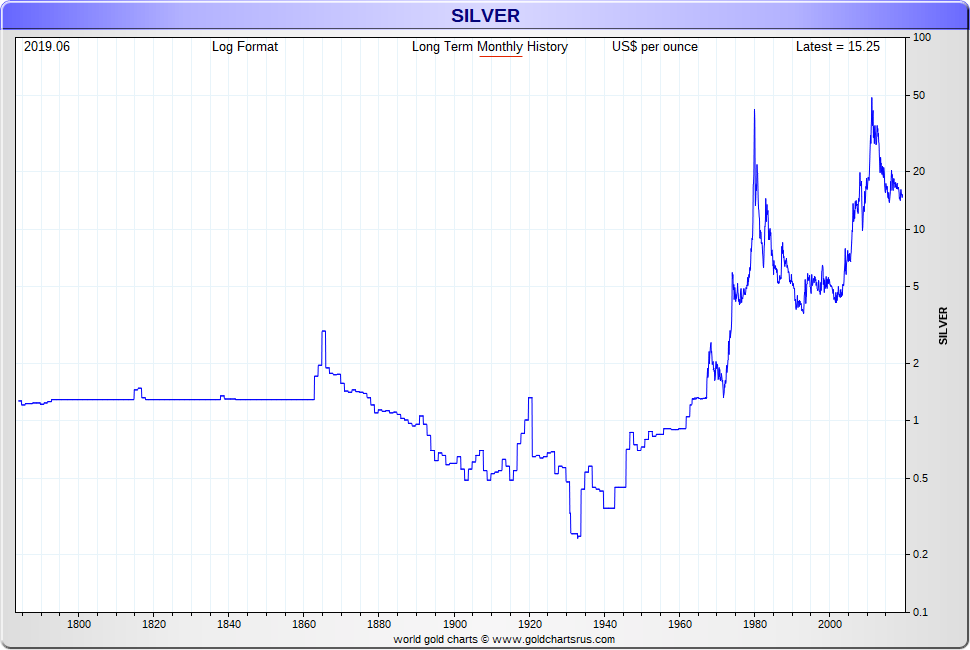

To begin, here is a 220-year look back at the Silver Bullion related price in monthly silver price history terms.

-

Silver Price Highest Peaks in US dollar

-

Silver Price High Context

In years 1980 silver and 2011 silver, are two timeframes in which fiat US dollar prices for silver peaked nominally near $50 fiat US dollars per troy ounce of silver.

The highest price for silver in US dollars is an arguable debate.

On a nominal basis, one could argue either on Jan 18, 1980. Or in late April 2011 that the silver price high got achieved in fiat US dollars.

Which highest price silver are you in search?

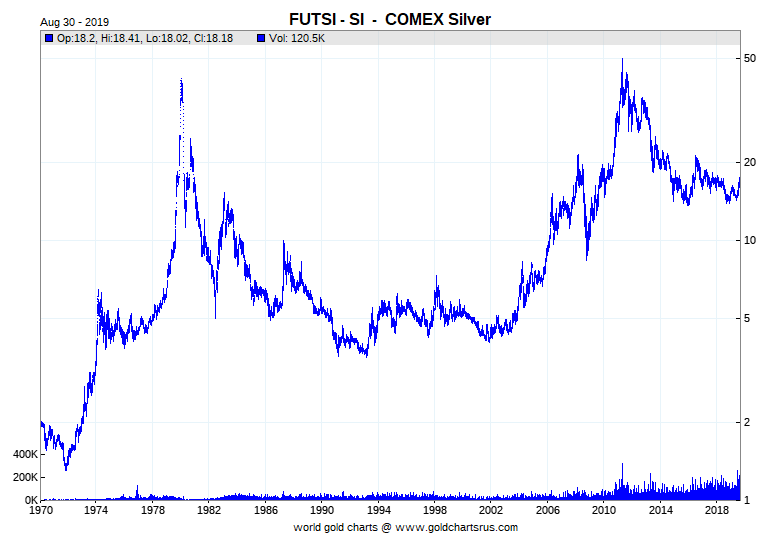

Some derivative index price for theoretical silver that the LBMA runs and has fixed for decades compounding?

The spot price of silver mostly set by the COMEX and other fractional bullion reserved silver derivative exchanges.

The much higher compounding price for silver in the eastern world offset by whatever this silver price discovery is we now use and collectively accept these days?

Or what about the price for physical silver bullion in the investing, manufacturing, wholesale, and retail bullion markets?

Here's some nominal silver price high charts and data for you to consider.

Silver Price High Year |

1980 |

2011 |

LBMA London closing price |

$49.45 (Jan 18) |

$48.70 (April 28 |

LBMA London intraday price |

$50.50 (Jan 18) |

- |

COMEX New York closing price |

$48.70 (Jan 17) |

$48.55 (April 29) |

COMEX New York intraday price |

$50.36 (Jan 18) |

$49.82 (April 25) |

CBOT Chicago closing price |

- |

- |

CBOT Chicago intraday price |

$52.80 (Jan 18) |

- |

Learn more about Silver Price History including in which year was the Lowest Silver Price in US dollar terms per troy ounce reached.

Considering the complexity of the question, "When was the highest silver price?" and all the factors involved.

We consider it accurate to say the following.

-

Highest Silver Price Answer

The highest fiat US dollar price for silver remains the 1980 silver price high in which the Hunt Brothers were and still are, often scapegoated as somehow inciting or causing.

We say this without disrespect to the great 2011 Silver Bull Market.

The same factors that led to the increase in the 2009 silver price low around $9 oz leading to the 2011 silver price high near $50 oz have not yet got resolved as we move into the decade 2020s.

Prices consistently always rising over the long haul. And price inflation symptoms have been compounding since the 1980 silver price high. Through the 2011 silver price high. Until today with you there reading this. The powers that be will continue using our ability to produce consumables more efficiently and cost-effectively against us in terms of price inflation thefts. Real things that are precious like bullion eventually tell the truth when their prices account for compounding lies.

Real underreported price inflation compounding for some four decades must get considered.

-

????

— James Henry Anderson (@jameshenryand) August 30, 2019

$50 oz Silver in $USD 2011

debased to 2X that in today's fiat $

How?!

Gov't inflation data is a

compounding lie yr after yr

$3-digit oz #Silver

pretty much guaranteed*

When to sell some #Silver #Bullion? https://t.co/Ugyx5KOAoF

*baring asteroid

full of $Ag wrecking Earth pic.twitter.com/IG6Jk5ZZfu

-

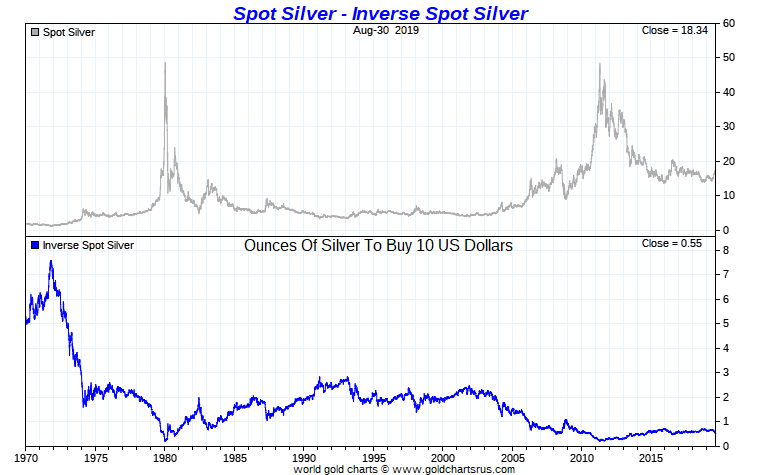

Of course, 1980 fiat US dollars could have purchased many more like-kind goods, services, and financial assets in 1980 versus the year 2011.

It was 1980; therefore, that remains not only the all-time highest nominal fiat US dollar price point for silver ever reached.

The beginning of the year 1980, we also saw the highest value for silver ever traded in modern history.

Highest Silver Price VALUE?

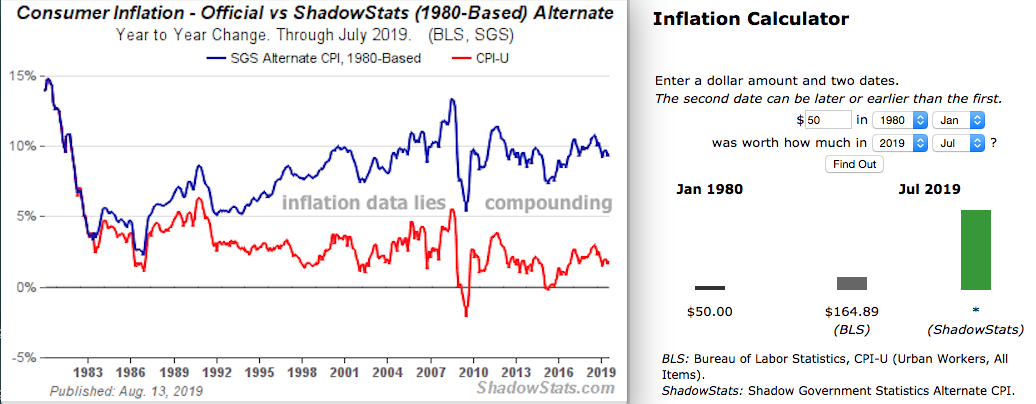

The following chart uses the consistent government rigged BLS statistics on consumer price inflations since the rigging began in 1980 and has only gotten worse with the last four decades.

Alterations in methods used to report fiat US dollar price inflation have drastically changed over recent decades in the United States.

They were likely designed to move the concept of the CPI (core price inflation) away from being a measure of the cost of living needed to maintain a constant standard of living.

Government CPI is a measurement which understates and allows the US federal government, states, and other corporate partners to under-deliver on pensions and payment promises made (e.g., underfunded government promises, western pension crisis ongoing and ahead.

Just a quick gander and a cursory glance backward using underreported CPI inflation data show a 1980 silver price high of over $160 oz.

Again this is using the US federal gov't rigged data. It is understating how much $1 fiat USD was worth then versus now 40 years later.

Silver Price High History via CPI Inflation 1/2 Truth Data Published by the BLS

Finally, we will use the most accurate historical inflation data available produced by ShadowStats to better understand silver’s US dollar value for our nation’s history.

The chart below uses the ShadowStats 1980-based Inflation Measure, which is an attempt at adjusting government benefiting CPI-U inflation underreporting which has worsened since 1980.

Even the 2011 price high for silver is now triple digits in today's fiat US dollar debasements, see below.

And yes, admittedly the record 1980 silver price high of over $800 oz looks nuts.

But that is the power of compounding some -5% to -7% inflation lies for about forty years can do nutty things to society.

Silver Price High History via Shadow Government Statistics more Accurate Inflation Data

The last near 5-decades of our continued time living under a full fiat global monetary order is headed to a change structurally.

Within the tumult to come, we expect all four precious metals to find new nominal price highs along the way in fiat US dollars (one already has been).

That means $50 oz silver in fiat US dollars, will one day sooner than most may think, be looked back upon by silver bulls as quaint times of the past when silver bullion was stupid cheap.

Is this overall trend evident and clear enough yet?

Silver Price Highest Ahead as Fiat US dollar Keeps Devaluing by Design

-

For further information on silver investing fundamentals and silver bullion buying/selling, pick up our free 21st Century Gold Rush guide.

Thank you for visiting us here at SD Bullion.

***