Jump to: Intro to Silver Coins | Rare and Collectible Coins | Factors Affecting Values | Silver Dollar Values | Graded Silver Coins | Investing in Silver Coins | Most Popular Silver Coin

Silver dollar values range widely, from affordable options like common-date Morgan Dollars, which can cost up to $50 in circulated condition, to rare and historic coins like the 1794 Flowing Hair Silver Dollar, the first to sell for over $10 million and potentially worth $15 million if it returns to auction.

Introduction to Silver Dollar Coins

The Flowing Hair dollar, minted in 1794, marked the beginning of a long and storied tradition of silver coinage in the United States Mint. As the first official silver dollar for general circulation among the United States coins, it holds immense historical and collectible value, enhanced by its silver content.

Starting with Lady Liberty on early silver dollars, U.S. one-dollar coins evolved to include the Peace Dollar, introduced after World War I and struck at various mints, including the now-closed Carson City Mint.

Later, the Eisenhower dollars honored President Eisenhower with business strikes made of a copper-nickel alloy. These were followed by the Susan B. Anthony dollars, and then the Native American dollars featuring Sacagawea, each representing key figures in American history.

Why collect silver dollar coins?

While coin collecting is primarily driven by enjoyment rather than profit, it can also have investment potential, especially with rare errors or high silver content.

Silver dollars, in particular, provide an opportunity to invest in precious metals while owning a piece of American history.

Rare and Collectible Silver Dollar Coins: Types, History, and Value

Some individual coins have sold for millions, especially among rare silver dollar coins. These standout pieces are prized for their historical significance and extreme scarcity. Below is a brief list of the most valuable examples ever sold.

1866 Liberty Seated Dollar No Motto (Proof)

With only two known examples, one of the 1866 Liberty Seated Dollars No Motto ( the traditional motto "IN GOD WE TRUST") is housed in the National Numismatic Collection at the Smithsonian Institution, while the other is privately owned.

The proof coins were initially distributed among collectors, which explains their incredible condition. This coin is so rarely seen in public that collectors often lose track of its rarity value.

Initially sold for $1,207,500 in 2005 at American Numismatic Rarities, if we were to find a similar coin in better condition (PR 65) today, PCGS professionals would expect it to sell for more than $2.5 million.

1870-S Liberty Seated Dollar (Regular Strike)

This coin is not only one of the rarest but also one of the most mysterious ever struck by the US Mint. According to PCGS experts, there’s no definitive agreement on the original production number, but it’s believed that only 12 examples have survived. The only known Mint State survivor is the PCGS-graded MS62 specimen shown above.

The 1870-S Regular Strike Liberty Seated Dollar set a record in 2003 when it sold for $1,092,500 at a Stack's auction. In uncirculated condition today, this coin could likely fetch around $ 2.5 million.

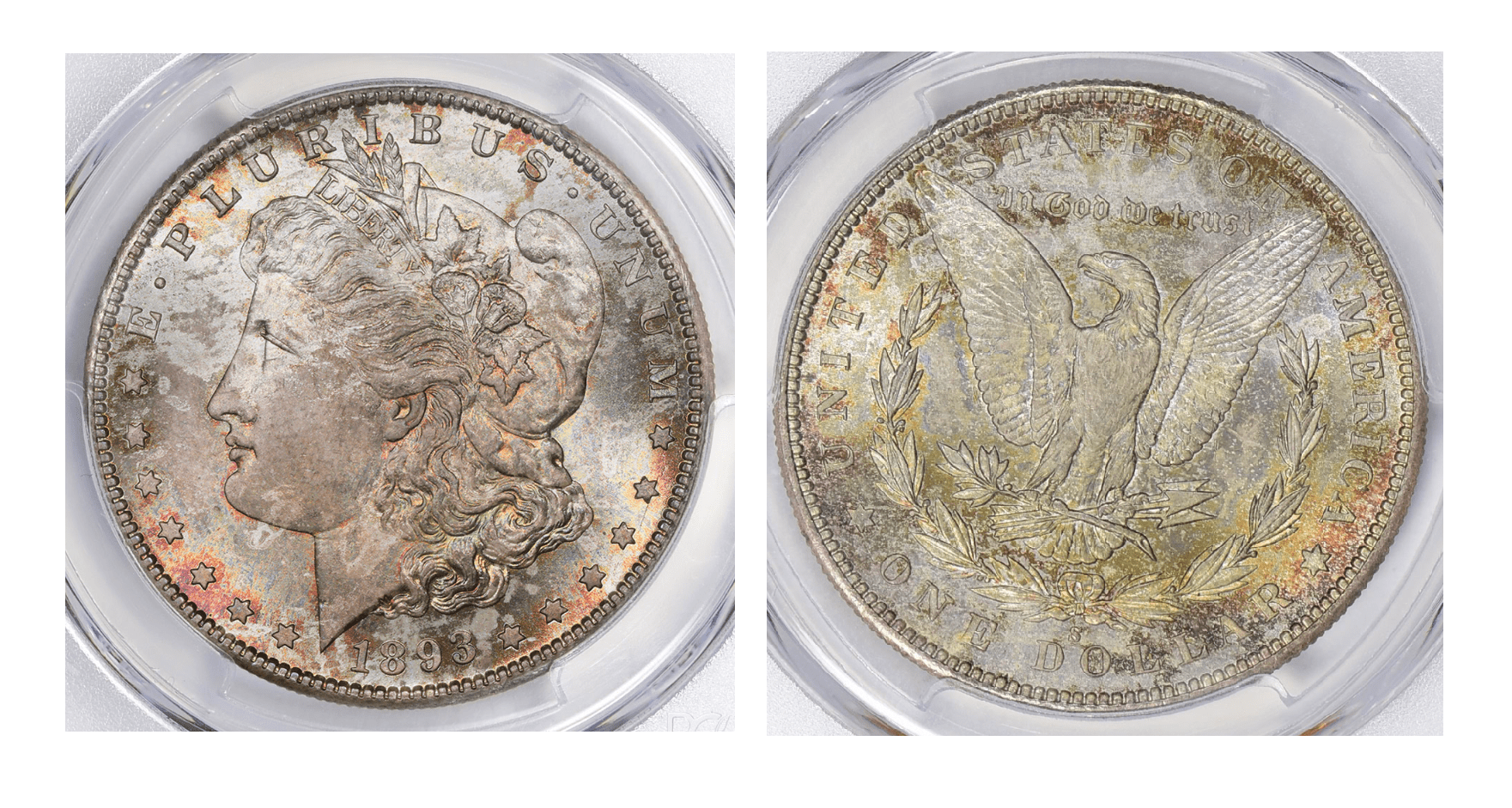

1893-S Morgan Silver Dollar (Regular Strike)

The coin shown above is the most valuable Morgan Dollar coin ever sold. Most 1893-S Morgan silver dollars did not survive their already limited mintage in well-preserved condition.

This particular San Francisco individual, however, appears to have been professionally handled since its minting, and there have only been four owners of this coin since it was minted almost 130 years ago.

This coin was graded PCGS MS67 and sold for $2,086,075 at Great Collections in 2021.

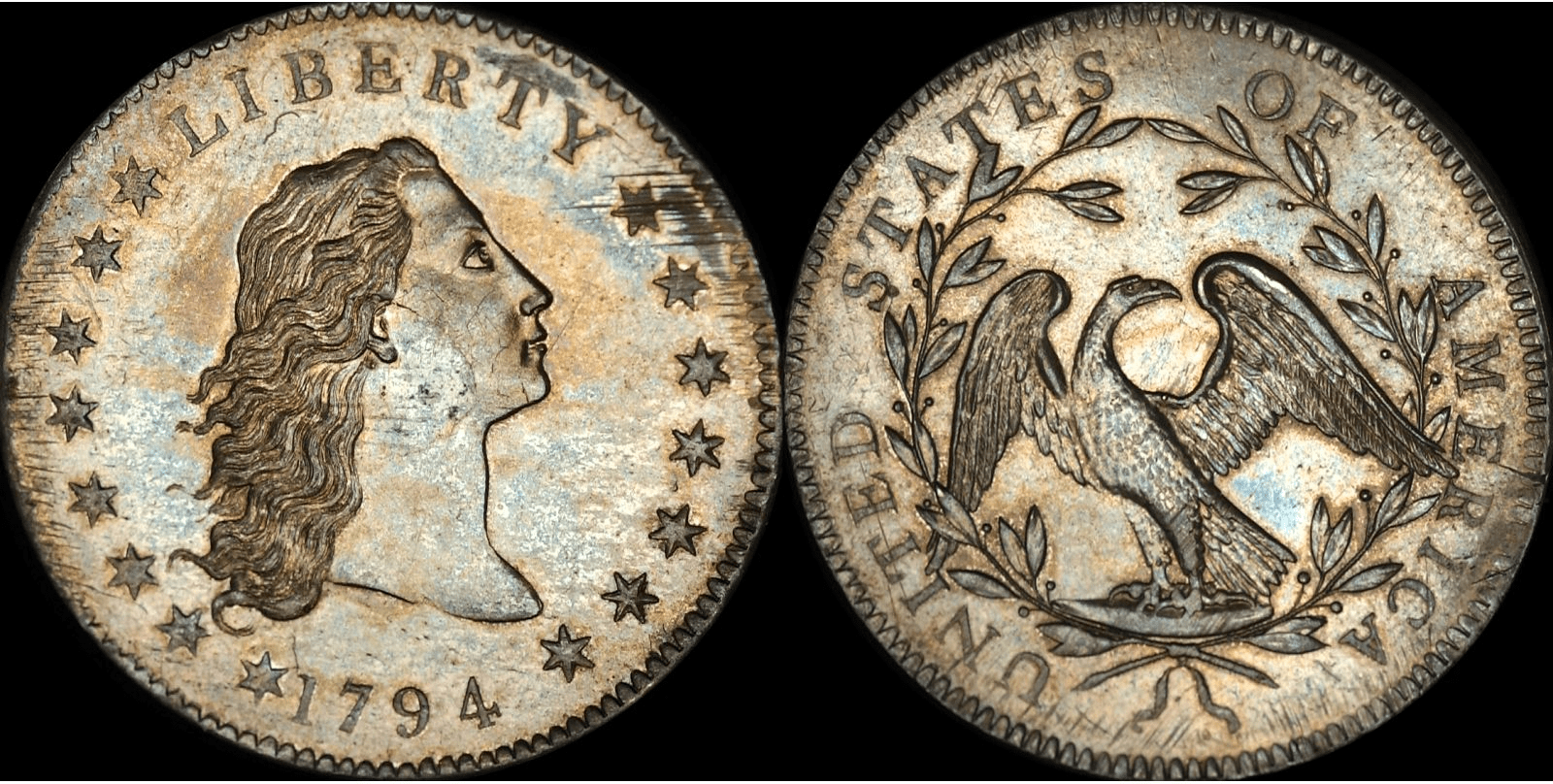

1794 Flowing Hair Silver Dollar (Regular Strike)

The 1794 Flowing Hair dollar is highly prized by collectors worldwide as a key date for the Flowing Hair Dollar Series. Minted at the Philadelphia Mint after the Coinage Act of 1792, it was the first silver coin issued by the U.S., and it symbolized national identity and independence.

With only 1,758 minted and fewer than 200 known to survive, its value lies, obviously, in both rarity and historical significance.

In 2017, a 1794 Flowing Hair dollar, graded MS64 by Stack's Bowers, sold for $2,820,000. A similar coin, however, graded MS66+ by PCGS, has been valued at $8,250,000 by their experts.

1885 Proof Trade Dollar (Proof)

The Trade Dollars were struck from 1873 to 1885, and they are considered not just one of the rarest silver dollars, but also one of the rarest coins in all of U.S. coinage.

With a mintage of just five, all known examples of the 1885 Trade Dollar have been accounted for today. However, the coin’s existence wasn’t publicly known until nearly twenty-five years after it was struck, and it can take years for one to surface at public auction.

The record price for this coin was set in 2019, when it sold for $3,960,000 through Heritage Auctions.

1804 Draped Bust Class I (Proof)

The 1804 Draped Bust Class I Proof Coin has a fascinating backstory. Although dated 1804, these coins were actually first struck in 1834, specifically for diplomatic gifts, not for regular circulation.

In 1835, one was presented as a gift from the United States to Said bin Sultan Al-Said, the Sultan of Muscat and Oman. That is, this coin wasn’t just currency, it was a symbol of diplomacy, crafted to represent a young nation's cordiality and goodwill.

When it went to auction in 2021, it sold for $7,680,000. Should it ever return to the auction block, PCGS experts believe it could easily fetch $10 million.

1794 Flowing Hair Silver dollar, Silver Plug (Special Strike)

This is the first series of silver dollars struck between 1794 and 1795.

David Hall, founder of PCGS, called it the greatest coin he has ever seen. He believes it’s not only the finest known example of the first U.S. silver dollar, but quite possibly the very first piece ever struck of that denomination.

Its exceptional preservation suggests it was handled with special care, used as a test strike rather than intended for circulation.

The impressive Auction Record for this coin was set in 2013, when it was sold for $10,016,875 at Stack's Bowers, which is the most expensive coin ever sold in history. If this coin ever returns to auction, its silver dollar worth is expected to be at least $15 million.

The Legacy

After the early iconic silver dollars, such as the 1794 Flowing Hair and the 1804 Draped Bust, the production of silver dollars was heavily influenced by economic policies, including the Bland-Allison Act of 1878 and the Sherman Silver Purchase Act of 1890.

These laws compelled the U.S. government to purchase large quantities of silver and mint it into coins, resulting in the mass production of the Morgan dollar between 1878 and 1921.

Although the minting of silver dollars later declined, as we abandoned the use of precious metals in circulating coinage, these acts established a precedent for using silver coins as a tool of monetary policy.

Their legacy continues today with modern bullion coins, such as the American Silver Eagle, reflecting a shift from everyday currency to collectible and investment-focused silver dollars.

U.S. Silver Dollar Coins MS65 Value

Below is a table with the estimated average value for an MS65 version of each silver dollar.

|

Coin Series |

Years |

Silver Content (Troy oz) |

Approx. MS65 Value |

|

Flowing Hair Dollar |

1794–1795 |

0.773 |

$750,000–$5,250,000 |

|

Draped Bust Dollar |

1795–1804 |

0.773 |

$250,000–$5,000,000 |

|

Liberty Seated Dollar |

1836–1873 |

0.773 |

$45,000–$725,000 |

|

Trade Dollar |

1873–1885 |

0.787 |

$8,250–$4,750,000 |

|

Morgan Dollars |

1878–1921 |

0.773 |

$185–$90,000 |

|

Peace Dollars |

1921–1935 |

0.773 |

$185–$300,000(rarer dates) |

|

Eisenhower Dollar |

1971–1978 |

0.316 (only 40% silver Eisenhower Dollars) |

$26–$2,500 (silver collector issues only) |

|

Modern Morgan/Peace Dollar Reproductions |

2021–present |

0.858 |

$100–$150 |

Factors Affecting Silver Dollar Value

Date, mintmark, and errors

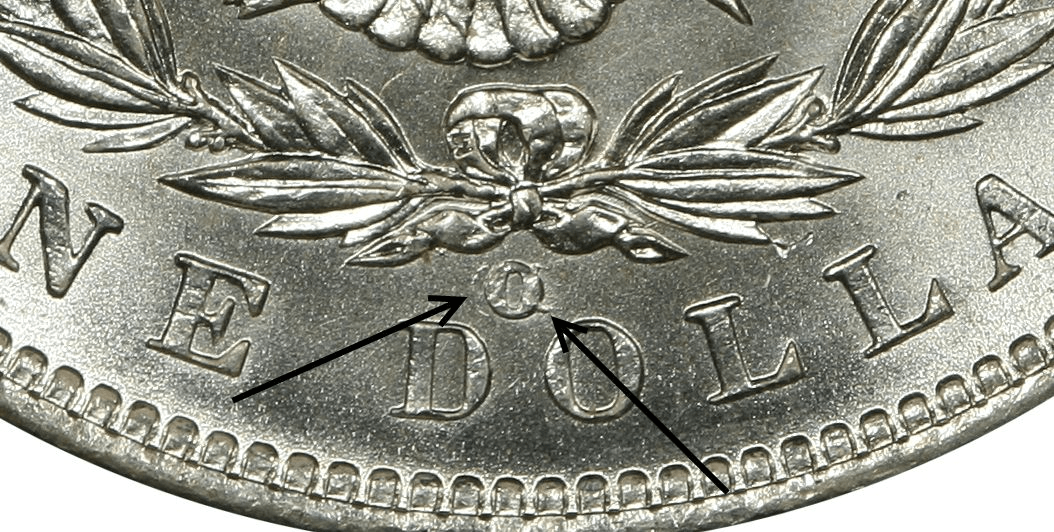

Mint Marks are letters placed on the obverse of a coin to indicate which facility of the U.S. Mint the coin was minted at. Some facilities mint fewer coins than others, which can lead to a higher rarity level. Other facilities, such as New Orleans (O) or Carson City (CC), were closed relatively recently and are mint marks sought after for collectors who value historical background.

The 1900-O/CC Morgan Dollar coin features a New Orleans mintmark struck over a Carson City mintmark, which is a clear and unmistakable overmintmark error.

Although this coin is relatively common and still accessible in Mint State condition, its value lies specifically in this rare minting mistake.

A top-graded MS67+ example has reached a value of around $45,000, with the record price set in 2015 when it sold for $52,875 at Legend Rare Coin Auctions.

The Carson City Mint, known for producing some of the rarest silver dollars, operated for only a brief period from 1870 to 1893, making it the shortest-lived of all major U.S. mints.

Many of its coins had extremely low mintages, often just a few thousand or tens of thousands, far fewer than those struck at the Philadelphia or San Francisco Mint.

Grade, condition, and rarity

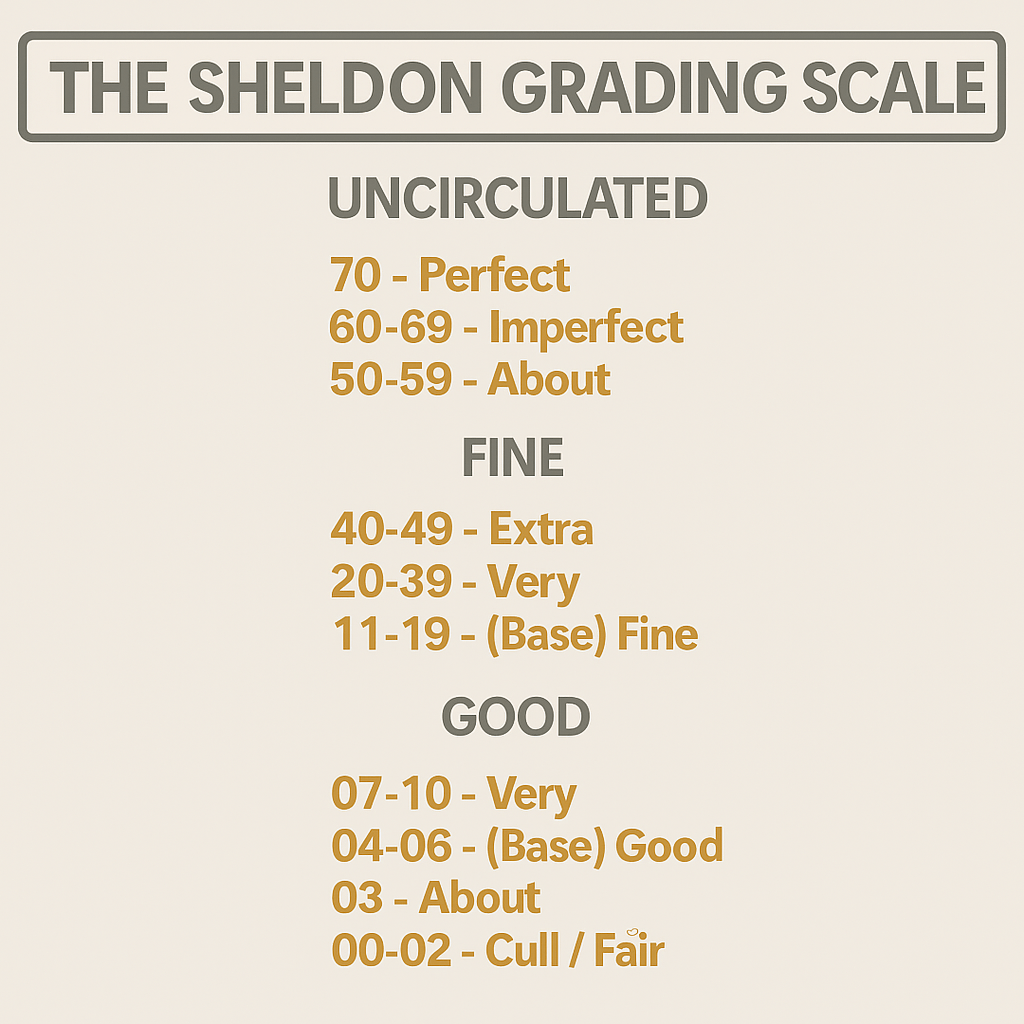

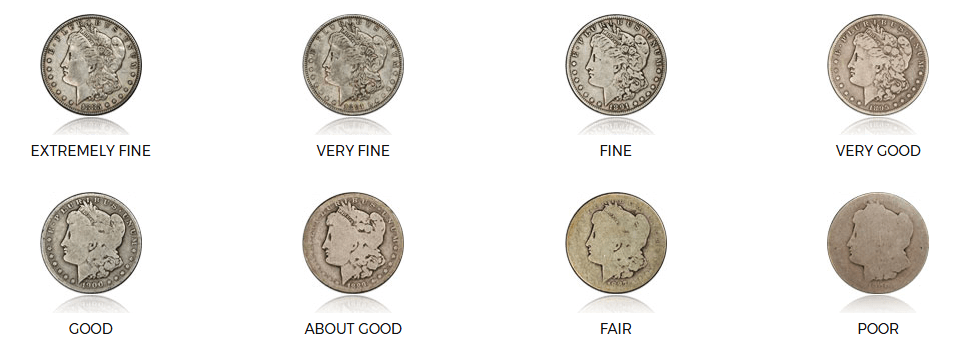

Grading plays a crucial role in determining the value of coins. To put it simply, the most acceptable way of classifying a coin's condition is the Sheldon Scale, which is divided from 1 to 59 and 60 to 70.

Coins graded from 60 to 70 are considered Mint State, meaning they are in uncirculated condition, showing a fresh luster and sharp designs. Grades below 60 indicate circulated coins, which show signs of wear or handling.

Coins in uncirculated condition and with a higher grade can be more valuable to reputable dealers and coin collectors in general than those that are worn or damaged (lower grades).

Determining Silver Dollar Value

How to determine the value of silver dollar coins

PCGS offers an incredible tool called PCGS Photograde, which helps estimate coin grades using high-resolution images.

While the value of a silver dollar can be influenced by factors such as silver content, rarity, and market demand, and even though there are ways to estimate its value on your own, we recommend a professional appraisal.

Trusted third-party grading companies like PCGS and NGC specialize in evaluating a coin’s condition, population, rarity, and even identifying specific varieties.

These companies are widely respected in the numismatic community, and serious collectors often rely on their certifications for authenticity.

Having your coin graded by one of them not only confirms its authenticity but also provides a recognized, market-backed assessment of its value, giving buyers and sellers greater confidence in any transaction.

Current market demand and prices

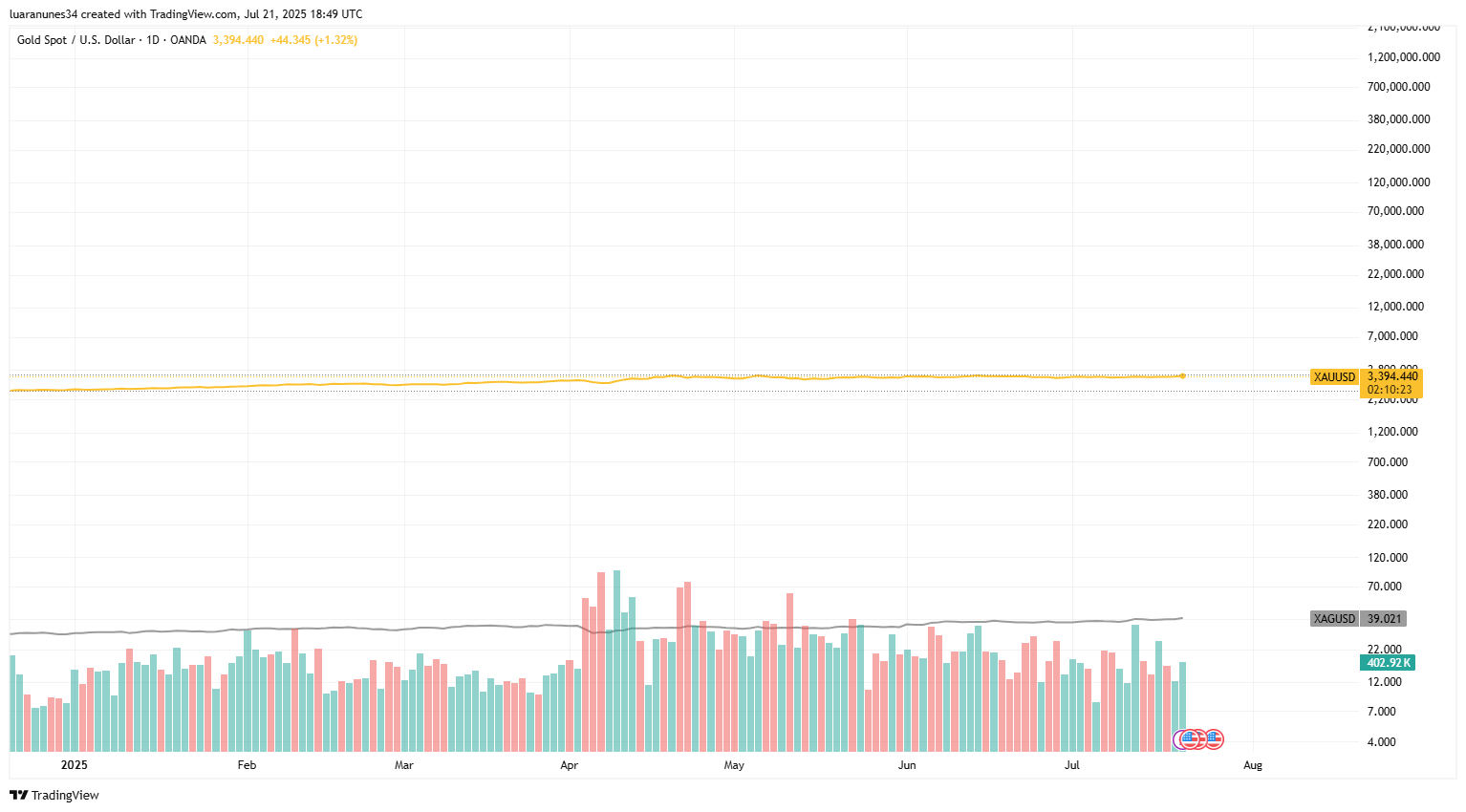

Coin collecting is, at its core, a hobby, and much of its value is influenced by the sentiment within the collector community. However, silver itself has gained attention in recent years as a strategic precious metal.

However, there's a growing trend among "stackers" who include silver as part of their investment holdings.

As a result, silver coins often feel the impact of this broader demand. When silver prices rise, even common silver coins, not just rare ones, can see their market value increase significantly. With that in mind, purchasing silver dollars can be both a hobby and a potential investment.

Silver Content

The silver content of a coin can significantly impact its value, especially for collectors and investors. Coins made with a high percentage of silver, typically 90%, have what's called melt value, meaning their worth is tied to the current price of silver.

Even if a coin isn’t rare or in perfect condition, its silver weight gives it a baseline value. These are often referred to as junk silver coins, not collectible for rarity, but valuable for their metal content. When silver prices rise, so does the value of these coins.

Pre-1965 90% silver coins are often regarded as an economical way to accumulate silver bullion. Although they're called junk silver, this is not a reference to poor condition, but rather because they do not carry numismatic value like the other coins mentioned here.

For collectors, coins with both pure silver content and historical or numismatic value (like rarity, errors, or mint marks) can be worth even more, combining metal value with collector demand.

Authenticating Silver Dollar Coins

Tips for avoiding fraudulent silver dollar coins

Knowing a coin’s official weight and dimensions is helpful, but modern counterfeiting is so advanced that additional safeguards and due diligence are essential.

|

Coin Type |

Diameter (inches/millimeters) |

Weight (grams) |

Silver Content (oz t of silver + %) |

|

Flowing Hair Dollar (1794–1795) |

~1.54 in (39–40 mm) |

26.96 |

0.773 oz t (89.24%) |

|

Draped Bust Dollar (1795–1804) |

~1.54 in (39–40 mm) |

26.96 |

0.773 oz t (89.24%) |

|

Trade Dollar (1873–1885) |

1.50 in (38.1 mm) |

27.22 |

0.787 oz t (90%) |

|

Morgan Dollar (1878–1921) |

1.50 in (38.1 mm) |

26.73 |

0.773 oz t (90%) |

|

Peace Dollar (1921–1935) |

1.50 in (38.1 mm) |

26.73 |

0.773 oz t (90%) |

|

American Silver Eagle (1986–present) |

1.60 in (40.6 mm) |

31.10 |

1.000 oz t (99.9%) |

Be cautious of offers selling silver coins at a price below the spot price of silver. Any silver coin must carry a small premium over its melt value, as coin dealers factor in profit margins. Old silver dollars can be worth significantly more if they are rare coins, especially when well preserved.

Check the spot price of silver here

Investing in Silver Dollar Coins

To invest in silver dollar coins, start by understanding the two main paths: bullion coins, such as the American Silver Eagle, valued for their silver content and global liquidity, and old silver dollars, like the Peace Silver Dollars, which may gain value through rarity and collector demand.

In times of market uncertainty, investors often turn to assets known as "safe havens", those that tend to hold or gain value during economic downturns. While gold remains the most recognized and popular option, silver has increasingly gained attention as a strategic asset in its own right.

Many experts believe the best protection lies in a diversified portfolio, with safe havens sharing key traits: low correlation to the broader economy, high liquidity, limited supply, steady demand, and long-term value.

While silver isn't as stable as gold and tends to react less to geopolitical events, it is more influenced by industrial and technological trends. Still, it checks many of the key boxes for a safe-haven asset, especially as industrial and investment interest continue to grow.

See here how geopolitical events might affect the precious metals price.

The Most Popular Silver Dollar Coin

Since its debut in 1986, the American Silver Eagle has become an extremely popular silver bullion coin in the market. Collectors and investors also value the American Gold Eagle, which is the official gold bullion coin of the United States. The 2025 edition contains a full troy ounce of .999 fine silver in Brilliant Uncirculated condition.

Minted by the U.S. Mint, it carries a face value of $1 backed by the U.S. government. The obverse features the classic Walking Liberty design, while the reverse design showcases Emily Damstra’s striking bald eagle artwork.

Modern silver dollars, like the American Silver Eagle and the Silver Maple Leaf, are widely recognized as bullion products used for stacking, investing, and even included in Individual Retirement Accounts (IRAs).

Check IRA-approved silver Coins Here.

Final Words

In this article, we examine the factors that drive the value of silver dollars, including their silver content, rarity, and market demand. We also shared key tips to avoid counterfeits. While weight and diameter are helpful, the price you're asked to pay can also hint at authenticity.

We also covered how prices vary depending on whether the coin is a rare collectible or a bullion product.

Finally, we touched on silver’s growing importance in today’s market. As a strategic, tangible asset, silver continues to attract investors due to rising industrial demand and global economic uncertainty, reinforcing its role alongside gold as a safe haven.