Late last week, co-founder and current CEO of SD Bullion (Tyler Wall) and Silver Doctors’s editor (Paul ‘Half Dollar’ Eberhart) spoke with Sean of SGTReport about a slew of topics related to the physical bullion markets.

Off top to begin, the discussion from late last week.

Tyler Wall was at a CME Group meeting in New York City with both a chairman of JP Morgan (Jacob A. Frenkel) and most importantly, the Chinese Shanghai Gold Exchange President.

Chinese COMEX Gold? | SGTReport, SD Bullion, Silver Doctors

-

Curious that during a supposedly heated ‘trade war’ the US Treasury would allow a gold price discovery mechanism from China to insert itself into our COMEX derivatives trading markets. Not merely just denominated in fiat US dollars but also supposedly manipulated fiat Yuan-denominated Shanghai Gold Futures Contracts.

Perhaps we are witnessing the collaboration between the west/east gold price discovery mechanics to come?

Curious too is the timing of yesterday’s US Department of Justice criminal charges filed against JP Morgan’s Head of Precious Metals trading desk and other executive-level traders.

Are we perhaps sending a message to China that somehow now, we are serious about prosecuting alleged financial frauds within our commodity markets?

Will the PBOC be getting high volume trading discounts too on the COMEX / NYMEX exchanges?

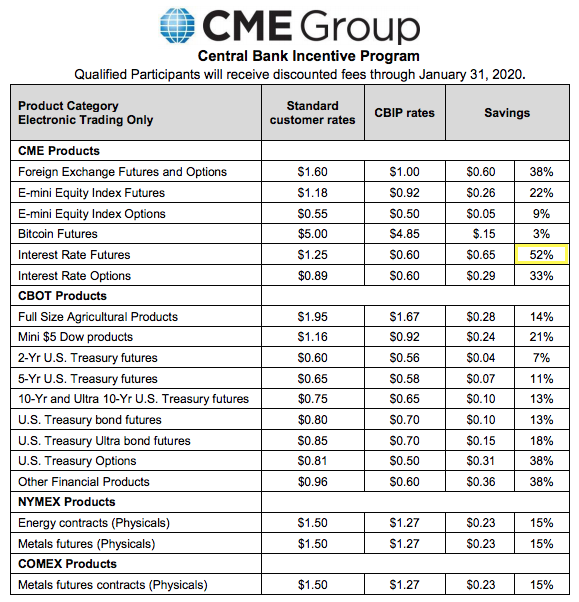

The CME Group's Central Bank Incentive Program shown above is unreported in mainstream financial media. This combined with interest rate fixing, fiat currency creation, all are significant tenents in non-free market capitalism. They mimic much of how China and now the USA operates.

The CME Group is both the current owner and operator of these very exchanges (COMEX / NYMEX) where for a near-decade or more, alleged JP Morgan precious metal trading frauds took place.

Since 2014, the CME has been both marketing and likely handing out high volume commodity futures contract trading discounts to various foreign central banks.

They are effectively allowing fiat currency creators to come in and move price discovery potentially according to their respective agendas.

During a supposed trade war, would not Chinese authorities want to do that too?

-

Regressing to this SGT Report interview with SD Bullion’s CEO and Silver Doctors’ editor the conversation moved on to the subject of the ridiculous ongoing fallacy that we do not have underreported fiat price inflation compounding decade after decade.

Just a cursory look back at previous all-time fiat US dollar silver price highs would tell you the truth is likely much stranger than the “we don’t have enough inflation” fictions we get told.

Matter of fact, we have been living in a negative real interest rate environment here in the USA since the mid-1990s. One of the main reasons that gold bullion has outperformed the broad S&P500 since the year 2000, now about six-fold increased in fiat US dollar value since this century started.

-

Next discussed is the fact that the Royal Canadian Mint is now on product allocation, meaning they only can sell a set amount of bullion per bullion dealer most likely due to increased demand domestically (the fiat Canadian dollar price for gold has recently passed $2,000 oz CAD, well beyond the former all-time nominal record highs hit in 2011).

Pretty easy to deduce that silver bullion buyers in Canada are bypassing Gold Maple Leaf Coins and likely buying Silver Maple Leaf Coins (as the fiat Canadian dollar price for silver is still around -50% lower than its still 2011 price high).

The physical bullion industry has lost various private mints, ones which were formerly LBMA approved, to illegal and dirty gold scandals. Another scandal is brewing there, publicized on FX via the New York Times. The name of the refiner is the largest in North America.

Old recently bankrupted mint names such as Ohio Precious Metals, Elemetal Metals, and Republic Metals have all gone by the wayside in the last few years.

This diminishment of bullion product manufacturing capacity globally has had a consolidating and limited capacity effect on the domestic US bullion industry’s ability to produce products quickly.

Notorious for having top bullion product demand turn on and off like a light switch.

Best Bullion Products According to Our Customers Fiat US dollar Allocations

Both private and government mints are not ready for outsized investor demand to come into these bullion markets. Anything similar to a fall 2008 financial crisis scenario would likely become a repeat of what many of us worked through then.

Perhaps we may again see a dislocated and diverging spot vs. physical bullion price market. One where the former (spot prices) may be falling while the latter (bullion values) are sharply rising.

Paul from Silver Doctors injects into the conversation, facts, and observations regarding 90% Junk Silver coin prices and macro-financial market fundamental observations.

-

Stay tuned to SD Bullion for the most important news and information for bullion stackers and precious metals investors.

Thank you for visiting us today. Pick up your free SD Bullion Guide if you have not already done so.

Bookmark us, and please return soon.

***