Not only a strong end to the week for the monetary precious metals prices, but also a week that began with one of the most significant bombshell news items and criminal lawsuits filed against the often alleged silver and other precious metals market rigging bank, JP Morgan Chase.

The silver spot price closes the week at 18 fiat Federal Reserve notes per troy ounce, up about 50¢ on the week.

The gold spot price ran up thirty bucks an ounce closing right below $1,520 fiat Fed notes per ounce.

The spot platinum price finished flat for the week, right around the $950 mark.

While palladium hit a new nominal price high fiat Fed notes, closing around the $1,645 fiat dollar per troy oz mark.

Now to the week’s most crucial bullion-related headline,

JP Morgan’s Precious Metals Desk Was a Criminal Enterprise, U.S. Says

You can read more of our reaction in the link above.

Chris Powell of the Gold Anti-Trust Action Committee (GATA.org) drops by to discuss this US Department of Justice RICO criminal lawsuit against the Global Head of JP Morgan Precious Metals Trading Desk and other silver, gold, platinum, and palladium trading executives at the too-big to restructure bank.

We dig not only in the details of the train wreck that is JP Morgan in 2019 but also how disgraced the LBMA and CME Group's COMEX NYMEX are by association and public record documentation.

This bombshell lawsuit is just a fraction of the story to likely unfold.

Silver Podcast | Gold Podcast | Chris Powell of GATA.org

-

Welcome to this week’s Metals & Markets wrap, I am your host James Anderson of SD Bullion.

With us this week, a returning guest, Mr. Chris Powell. He is the Secretary and Treasurer of the Gold Anti-Trust Action Committee, visit their website at GATA.org

Chris thank you so much for coming on the show.

Last time we spoke was in January 2018.

Gold Silver Podcast early 2018 | Chris Powell of GATA.org

-

If anyone in the alternative financial media world has the right to be cynical, perhaps it is you guys over at GATA.

You have been covering the rigging of monetary precious metal prices since before this century started.

Here we are two decades into your efforts, and the US Justice Department is now verifying with hard evidence many of the same allegations made at Gata.org and elsewhere.

First, can we get some of your thoughts about this DoJ criminal lawsuit using RICO laws against former precious metal trading heads and executives at JP Morgan Chase?

-

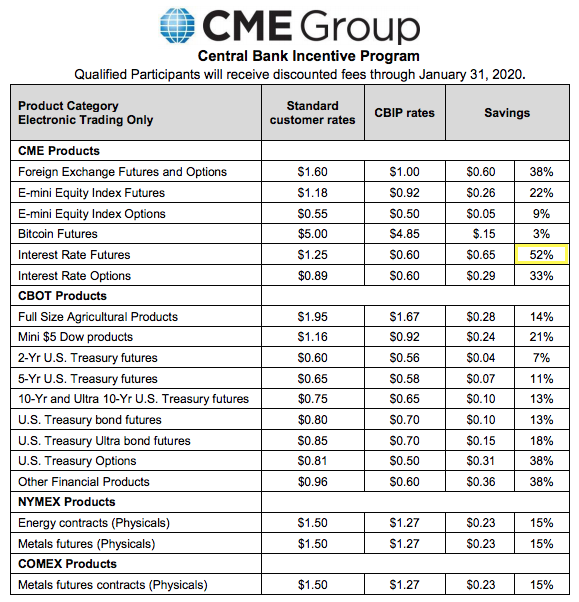

As far back as 2014, Chris Powell at GATA has been citing that the CME Group has been offering foreign central banks to come on into the US commodity markets and move price discovery which might best fit their agenda.

What I like to call manipulation continuation on the CME Group's COMEX / NYMEX is not very confidence-inspiring if you understand the implications on everyday prices.

Any coincidence with COMEX China gold futures contracts coming out next month? What is the US Treasury doing? Is this a 'trade war' or part of the ongoing negotiation?

Will the PBOC (China's central bank) be getting high volume trading discounts on COMEX or NYMEX futures contracts?

-

It turns out alleged JP Morgan RICO criminal Michael Nowak is on the LBMA board of directors. Oh, wait, Mr. Nowak was fired today.

Curiously a Mr. Sid Tipples was Co-Head of Global Metals Trading at JP Morgan along with alleged criminal RICO Co-Head Micheal Nowak for over eight years (2010-2018).

They worked in London together often. It also turns out Sid Tipples jumped the JP Morgan ship in 2018. But he was still on the LBMA Board up until July 2019 collecting check$.

Wonder why Sid left?

-

This LBMA has been disgraced thoroughly this week.

Even journalists at the Financial Times agree more embarrassments may becoming the LBMA's way.

Insult to injury, the LBMA appears to have yet another blood gold scandal brewing.

This time it's not formerly-LBMA approved Ohio Precious Metals, Elemetal Metals, nor Republic Metals.

But now North America's largest bullion refiner, Japanese conglomerate Asahi got listed by a New York Times expose on narco funding blood-gold somehow finding its way through Asahi and into everyday products made with gold produced by Apple, Samsung, Tiffany's, Ford, and GE among others.

Perhaps the LBMA might want want to try and get ahead of this before further disgracing their brand name?

Will they be mentioning any of this, at their upcoming LBMA conference in China next month?

-

Thanks for listening to this week's gold-silver podcast.

***