Jump to: Why Stack Silver | Types of Silver | How to Start Stacking | FAQs

During political and economic instability, investors frequently seek refuge in physical assets, mainly due to a diminished confidence in fiat currencies and intangible forms of investment.

The tangible nature of precious metals offers a distinct sense of security, as the ability to physically possess and feel one's wealth provides reassurance that abstract financial instruments often cannot.

With that in mind, I have prepared an entire article on how to stack silver for those who see storing silver as a wealth preservation or investment approach.

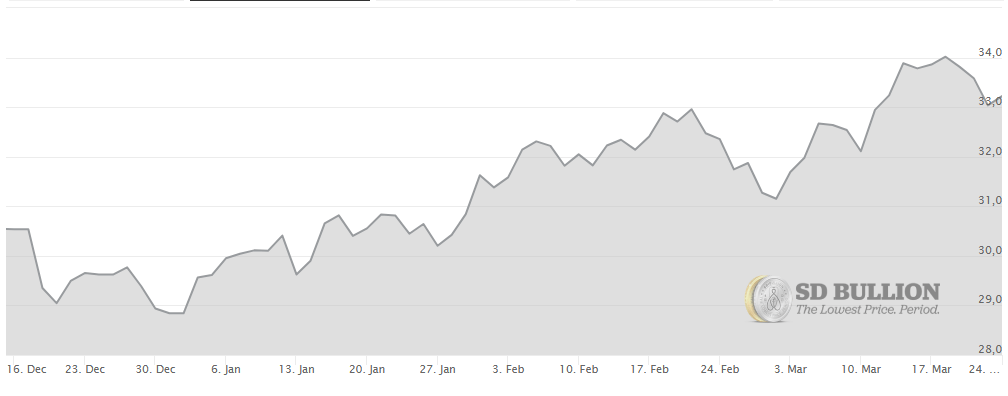

I also briefly explained how silver navigates the market volatility and provided a simple analysis of the current market trends.

Why Stack Silver?

Silver is a precious metal with thousands of years of history as currency and trade. It remains a trusted store of wealth, valued for its intrinsic value and stability until nowadays. Available in various forms, it offers financial security and is even included in some retirement portfolios, such as IRAs.

It is important to understand why silver is valuable, but it is also essential to understand why many choose to stack silver.

Knowing the fundamentals can help you make informed decisions and potentially provide peace of mind in uncertain times, whether for its intrinsic value, financial security, or role in diversified investment strategies. Let me present to you the main reasons people choose to stack silver below:

-

Hedge Against Inflation: An inflation hedge is an investment intended to protect the investor against a decrease in the purchasing power of money due to inflation. Precious metals typically serve well in this role due to their inherent characteristic of holding value over long periods.

-

Silver as a Tangible Asset: Silver and gold have long served as currency, with silver used as payment as early as 3000 BC. The shekel, an ancient unit of weight from Sumer in Mesopotamia, reflects the lasting value societies have placed on silver, a worth still recognized worldwide today.

-

Investment Portfolio Diversification: Investors typically prioritize safety, which in the context of investing often means diversifying across multiple asset classes. As a result, many choose to allocate funds to gold and silver and other investment vehicles.

Types of Silver to Stack

You can purchase different products when stacking silver, and the premium plays a significant part when choosing a product. The premium in the precious metals market is above the spot price you pay for crafting the product.

Silver Bullion: Silver bullion refers to high-purity silver, typically .999 or .9999 pure silver, shaped into coins, bars, or rounds and valued mainly for its metal content rather than collectibility. Silver bullion is produced by private or government mints, like the U.S. Mint, and sold through authorized bullion dealers.

Silver Rounds

Silver rounds are disc-shaped ingots made by private mints, valued for their silver content rather than their legal tender status.

Though less collectible than coins, these silver products are more affordable, easier to stack, and popular among those new to the silver stacking journey and seasoned investors.

Silver Rounds

Silver Coins

Silver coins, like the 1 oz American Silver Eagle and Canadian Silver Maple Leaf, are popular for their investment potential and historical significance. Due to intricate designs and security features, silver and gold coins are more expensive than rounds and bars, having a strong collectible appeal with limited and sometimes special series.

The 2025 1 oz American Silver Eagle Coin, produced by the United States Mint, contains 1 oz of .999 fine silver, and it is the official bullion coin of the United States.

The 2025 1 oz Canadian Silver Maple Leaf Coin, produced by the Royal Canadian Mint, contains 1 oz of .9999 fine silver.

Silver bullion coins can be a valuable addition for those considering owning physical silver and investing in a precious metal collection simultaneously.

Silver bars

Silver bars are valued for their metal content, making them an excellent option for investors seeking to maximize their silver investments. The 1 oz silver bar is the most popular size due to its easy storage and liquidity in the silver market.

Silver Bars

Bars typically have lower premiums than coins, offering a more cost-effective way to accumulate more silver per ounce.

For beginners, starting with 50 to 100 oz of silver or various sizes of junk silver can be a practical way to enter the market. Opt for widely recognized and easily tradable forms like American Silver Eagles or 1-ounce rounds to ensure liquidity.

How to Start Stacking Silver

People stack silver for various reasons, such as retirement savings or barter. Also, many silver stackers aim to sell it when prices rise.

However, it’s important to note that silver is more volatile than gold, so the silver stacker who plan to navigate market fluctuations or rely on their silver stack for long-term income might need to accumulate a more enormous amount.

Before buying, define your goal, whether it is long or short-term. Like a shopping list, it keeps you focused and helps you avoid unnecessary or unhelpful purchases that don’t support your strategy.

Where to Buy Silver

Start stacking precious metals by choosing reputable dealers with strong reputations, and begin your stack with affordable silver coins, rounds, or bars to limit losses from beginner mistakes.

Always verify authenticity through proper markings or certificates, and assess premiums over spot price when buying and considering future resale.

Reliable local or online dealers offer fair prices (never below spot, as that is unrealistic), are upfront about fees, and deal with reputable mints and government-issued coins.

They also have positive reviews, clear policies, easy contact features, and prioritize transparency. Buying from established sources helps minimize the risk of counterfeit or misleading purchases.

Check out our Scottsdale Silver Stacker Collection

Storing Your Silver

Direct possession of physical silver requires secure storage and possibly insurance to protect against theft or damage, adding to the investment cost. Check the main storage options below when it comes to collecting silver bullion:

Home Storage: Many people choose to store their assets at home, which can be a reasonable option. However, what often goes unnoticed is that some insurance policies do not cover theft or loss of precious metals. Even those that do may only offer limited coverage. As a result, thorough research on various policies is essential.

Bank Safe Deposit Boxes: While they provide some security, they typically do not cover losses due to natural disasters or theft. Access can also be an issue, as banks usually impose time restrictions on when you can access your box.

Third-Party Storage: Private storage services are another option, and many people prefer them because they offer the flexibility to access your assets whenever needed, without the concern of having to store them yourself.

Learn all about our fully segregated and insured SD Depository.

Evaluating Silver's Value

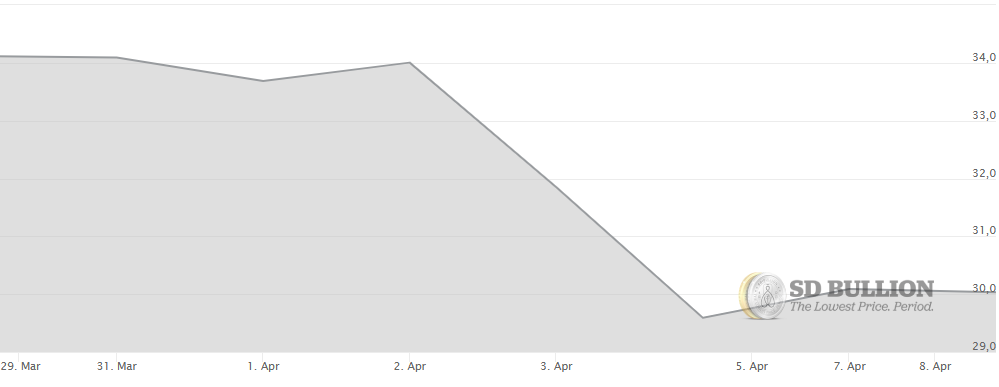

As April began, we saw a remarkable price drop of over $4 within just two days during the first week, a sharp decline that stands out compared to the past decade.

The last time prices dropped this significantly in a two-day period was in 2011. While some may view the low prices as a concern, savvy investors often seize these opportunities to purchase more during market dips.

While the tech industry typically drives the price of precious metals, gold continues to dominate as the primary focus for investors. Political and economic events more directly influence gold, and its higher demand as a precious metal often increases its value due to price fluctuations.

However, recent political developments have amplified silver's inherent volatility, leading to even more significant price fluctuations.

By the second week, however, we are already seeing silver prices rise as it gradually returns to its usual levels, indicating that silver remains relatively lower in price than its yellow counterpart while remaining a wise choice for investors looking to diversify their portfolios and protect their wealth.

Staying informed about political events and silver prices while practicing due diligence helps you understand market dynamics, not to predict the future, but to recognize patterns and better position yourself to seize the right moments to buy or sell.

Final Considerations

In conclusion, stacking silver in 2025 remains a viable strategy for protecting wealth, particularly during times of economic and political uncertainty. It offers a tangible hedge against inflation and diversification, and the opportunity to accumulate a valuable asset.

By choosing the proper forms of silver, such as bullion, bars, or coins, and understanding storage and market fluctuations, investors can build a strong silver stack to safeguard their financial future.

FAQs

What is the best type of silver to stack for beginners?

It depends. Bullion products tend to have more liquidity for an easier sell: Silver coins like one-ounce American Eagles or Canadian Maples offer investment potential and collectibility, though they come with higher premiums. Silver bars are ideal for maximizing silver content at a lower cost, while silver rounds are affordable and easy to stack but lack collectible value. Junk silver (pre-1964 U.S. coins) combines silver content with historical value and can be helpful for barter.

How does silver compare to gold as an investment?

Gold outperforms silver as an investment due to its greater stability, especially during economic uncertainty. While both metals can offer growth potential, gold tends to be more resilient, with investors often turning to it during market turbulence as a safe haven.

Are there any risks associated with stacking silver?

Stacking silver does come with several risks. While precious metals like silver tend to appreciate over time, they do not generate income unless bought at low prices and sold when prices rise. Additionally, some home insurance policies may not fully cover the value of your silver holdings, and there’s always the risk of theft. Silver is also more volatile than gold, meaning its value fluctuates significantly. Furthermore, proper storage is essential to maintain the quality of your silver, as improper conditions can affect its condition and resale value.

How can I verify the authenticity of my silver purchases?

There are several ways to test silver at home, but purchasing from authorized dealers is the most reliable method to ensure authenticity. Trusted dealers typically offer realistic prices (not below the spot price), are transparent about fees, and work with reputable mints. It also has positive reviews, clear policies, easy contact options, and a commitment to transparency. By buying from established sources, you can minimize the risk of counterfeit or misleading purchases.

What are the tax implications of buying and selling silver?

Tax rules vary globally and by U.S. state, but silver is considered a collectible at the federal level. Profits from sales after one year are taxed as long-term capital gains with a maximum rate of 28%. If held for less than a year, profits are taxed as ordinary income at your regular rate.

How often should I buy silver to build my stack?

Silver offers security for those who plan to live off their stack because its value is unlikely to disappear. Focusing on silver products with collectible appeal, such as coins, can be a good choice, as they tend to appreciate more over time. Waiting for a dip might be an option for those looking to use silver for barter, but there's no certainty that the "perfect" moment will come. The most secure strategy is often to buy the most affordable silver available right now, ensuring you maximize your investment. Always consider your goals and budget when deciding how much to stack.

Are silver bars a good option for stacking?

Silver bars can be an excellent option for stacking, depending on your goals. Larger bars (10 oz or 100 oz) have lower premiums, making them cost-effective for long-term investors. Smaller bars (1 oz) offer more flexibility and easier storage, ideal for those who want to trade or sell in smaller amounts. Many stackers prefer the 10 oz bars, as they balance storage, liquidity, and affordability well. Consider your budget, storage space, and whether you must sell in smaller portions.

Should I stack junk silver?

Junk silver coins are an attractive option for stacking because of their low premiums and high silver content. They are easy to store, highly liquid, and offer a cost-effective way to preserve wealth. As part of a long-term silver stacking strategy, junk silver coins provide tangible asset ownership, hedge against inflation, and offer potential profit during economic uncertainty while diversifying your portfolio. You might want to invest in proper storage solutions that prevent tarnishing and damage.