Can you Buy Silver Wholesale?

Yes, investors can buy silver bullion at wholesale silver prices depending on a few factors which we will discuss here.

When buying physical silver bullion from silver bullion dealers, the price you pay per troy ounce of silver will depend on the following major contributing factors involved.

First, (#1) the quantity of silver bullion you are buying.

Secondly, (#2) the kinds of silver bullion products you are purchasing. Quick aside, learn about the best bullion products from our SD Bullion customers' best gold coin, silver coin, silver bar, gold bar, silver round purchasing patterns.

And finally (#3) the then-current supply-demand silver bullion factors at play when you are making specific silver bullion acquisitions. How much available supply is there versus the current demand?

Virtually all private silver mints and government silver mints sell their physical silver bullion rounds, silver bullion bars, and silver bullion coins exclusively to silver bullion dealers.

It is silver bullion dealers like us who then inventory, safely store, volatile market price hedge, market, buy, and sell silver bullion products at retail and wholesale prices. All to supply the general investing public with bullion at the most competitive prices possible.

How we define retail silver bullion prices vs. wholesale silver bullion prices is usually only a matter of a few percentage points difference, even sometimes mere basis points (typically less than a 1% difference in low premium high silver supply markets).

Our silver bullion business is contingent on high volume purchases and sales of silver bullion products; thus, our silver bullion price premiums relative to the fluctuating silver spot price must be extremely competitive. More often than not, we are the industry leader in low silver bullion price offerings.

If you shop at online silver bullion dealer websites, you often find tiered pricing structures for various silver bullion products.

All silver bullion dealer sales (regardless of size) have fixed overhead costs associated, hence smaller dollar volume transactions will often have slightly higher price premiums compared to larger dollar volume purchases of silver bullion products. The following is a real-life example of this point at work.

Screenshot: taken on February 5, 2018, showing 1 oz RMC Silver Bar premiums

ranging from 99¢ to as low as 70¢ USD above the then silver spot price

Wholesale silver coin prices vs. wholesale silver bullion bar prices and wholesale silver round prices are often slightly different too due to the costs associated between acquisition and sale.

For example, there are varying government mint seigniorage fees, lower private mint manufacturing costs (typically they are more efficient and thus cheaper than government mints), silver bullion product distribution costs associated, etc.

The good news is that at the moment of writing this article (in early 2018), the physical silver bullion industry has some of the lowest premiums or silver bullion prices near the fluctuating silver spot price on record currently.

Many secondary silver bullion products have been recently sold back to silver bullion dealers over the past few years as silver spot prices have gone sideways for some time now (this is a big reason why many government mints, like the US Mint, for example, had lower silver bullion coin sales figures in 2017 compared to virtually all years after the 2008 Financial Crisis).

The ‘weak hands’ recently selling silver bullion products have helped drive current silver premiums to recent low points as second-hand silver bullion product supplies have gotten replenished amongst many silver bullion dealers. More supplies with equivalent or lessening demand is the perfect recipe for lower price premiums on silver bullion products (either new or secondary products).

We have even seen some silver bullion products being sold in small volumes also, either priced at or just above silver spot prices (10 oz silver bar sales priced at the silver spot price, not normal for our industry).

These low silver premiums or prices at or just above silver spot price will change if history is any precedent.

As financial market volatility likely returns to close out this decade moving into the next (2020s) we fully expect increasing price premiums on all silver bullion products as demand returns and possibly surges above what we experienced in the fall of 2008, when many silver bullion products were either sold out, unavailable, or back-ordered at exorbitantly high premium prices for months.

Stock Market Expectation of Volatility 1990 - 2018 (i.e., VIX, Volatility Index, Fear Index)

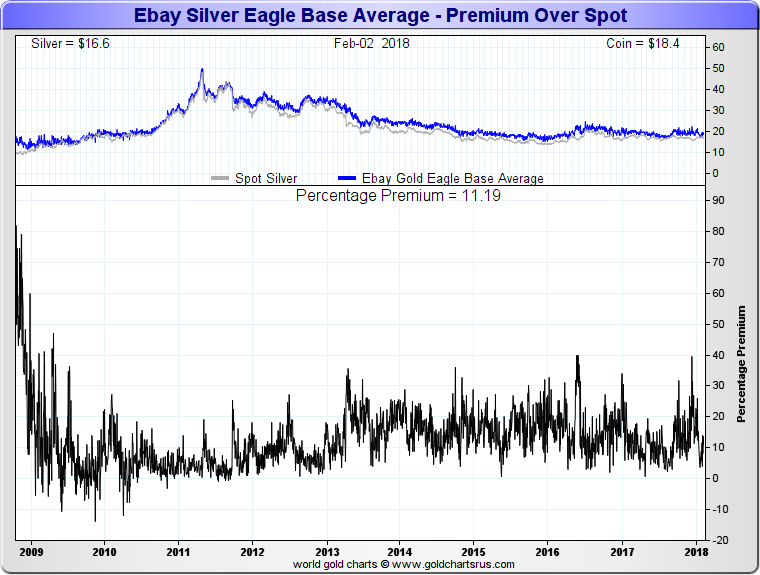

The following 1 oz American Silver Eagle Coin price data shows the ongoing premiums or price volatility for sales on eBay over silver’s fluctuating silver spot price.

Note that standard new brilliant uncirculated 1 oz Silver Eagle Coins cannot be acquired by the public directly from the US Mint.

Silver Eagle coin sales on eBay are a mix between secondary and brand new coin sales amongst silver bullion dealers and private silver bullion coin owners.

Notice too how American Silver Eagle Coin premiums rose during high volatility 2008 Financial Crisis era. They were selling at prices on average as high as 80% over the then fluctuating silver spot price for a brief period. In other words, this means the then silver spot price may have been $9 oz USD, yet American Silver Eagle Coins were selling at about $16 oz USD on eBay.

These most heavily purchased 1 troy ounce silver-containing, 22k US government-guaranteed silver coins can only be bought new by the public directly from silver bullion dealers. At a minimum silver bullion dealers acquire these 1 oz Silver Eagle Coins brand new through authorized purchases in 25,000 oz lots priced at $2 oz USD over the fluctuating silver spot price. Silver dealers then add a slight premium to the coins they purchase and then sell them to financial institutions and the investing public.

Secondary sales of 1 oz American Silver Eagle coins can and do happen at prices lower than $2 oz USD over the changing silver spot price though, as illustrated in the chart’s data above (which again takes Silver Eagle Coin prices from both new and secondary sellers).

Trying to Buy Silver at the Lowest Price can Be Risky

Not all supposed sellers of silver bullion are honest nor safe to transact with. There is a litany of examples of this statement documented by an industry whistleblower.

For every allegedly corrupt silver dealer, there are also two-bit silver criminals who use supposed low price silver sales as a way to attract their victims.

Confirm the Silver Selling Counterparty is Legit

You must always be sure of the trustworthiness of the counterparty you are considering buying silver bullion from as counterfeit silver products from China often hurt potential would be silver bullion buyers driven only by lowest price point buying.

We only deal in bonafide silver bullion products from private and government silver mints and guarantee all the silver bullion products we sell as the genuine articles. Any secondary products we buy from customers are also checked and verified legitimate using various methodologies to ensure no counterfeit products are ever introduced into our silver bullion inventories. Still today, the vast majority of the silver bullion products we sell are newly issued.

Our suggestion: any silver bullion dealer you may consider working with we strongly suggest you confirm their latest customer reviews on hard to rig review websites like this one.

Also, be sure to dig into the Negative Reviews of any potential silver bullion dealers BBB page to see the nature and volumes of customer complaints as well how the silver bullion dealer handles any discrepancies which may occur from time to time (especially when they have tens of thousands of transactions per month like ourselves here).

Be careful if the silver seller or silver dealer you are considering has no online track record at all. If you are ever offered silver bullion at prices below spot, then it is most likely a scam in waiting.

While antagonization of would-be scammers may be entertaining, it’s probably best to ignore these potential crimes.

Where can I buy Silver Wholesale? Where to buy Silver Wholesale?

You can acquire silver bullion at wholesale prices from the most significant high volume silver bullion dealers like ourselves here at SD Bullion.

Again to achieve your lowest price point over the silver spot you will want to buy in high volumes, and typically in the popular silver bullion products, we carry which have vast and robust secondary markets, not merely here in the USA but around the physical silver bullion trading world.

For example, various 100 oz silver bars pictured below likely represent the best homogenous, lowest silver price bullion products one can acquire over spot for those parties thinking of allocating capital into silver bullion (e.g.).

Two 100 oz Silver Bars pictured above. These are typically the size silver bars used by low silver premium seeking investors and financial institutions.

These two silver bullion bars pictured above are cast in the USA and Canada respectively.

Likely they represent some of the lowest silver prices one can acquire over spot for those parties thinking of allocating significant dollar figures into silver bullion (e.g.).

Of course, there are smaller sized silver bullion bars commonly stuck in 10 oz silver bar and 1 oz silver bar sizes.

These smaller silver bullion bars are often purchased at prices per troy ounce slightly higher above the fluctuating silver spot price when compared to the larger aforementioned 100 oz silver bullion bars.

How do you Buy Silver Wholesale?

We stand by our tagline here at SDBullion.com “The Lowest Price. Period.”

You can buy silver bullion at wholesale prices either in heavy volume through our website (24x7) or over the phone with us here (during our staff’s regular hours of customer support).

Our highly trained, experienced staff, can help answer your specific silver bullion product related questions, including product choice preferences, delivery options, etc. We can even help you set your very own direct professional non-bank secure logistics long term silver bullion storage account domestically (and even internationally if desired). Many of the silver bullion storage firms we work with have been in the bullion safekeeping business since the 1800s.

We are committed to helping you make your best wholesale silver bullion buying choices combining low prices, long term storage safety, with your best interests, and buying perimeters get fully considered.