Jump to: Why Invest in Precious Metals? | Where to Buy? | How Much? | Payment Methods | What Products to Buy? | How to Buy? | How to Store? | FAQs

When it comes to investing in gold, silver, and other precious metals, there are numerous options available in the market.

New investors often wonder how to buy gold and silver, wanting to spend their money wisely. With so many products available, it is easy to feel overwhelmed when choosing or finding fair prices.

With this in mind, in this article, I will take a look at how to buy physical gold and silver products. In addition, we will show where to buy and how to understand the value of precious metals products.

Why invest in Gold and Silver?

Before we dive into why investing in noble metals can be a smart move, let's examine what drives their prices.

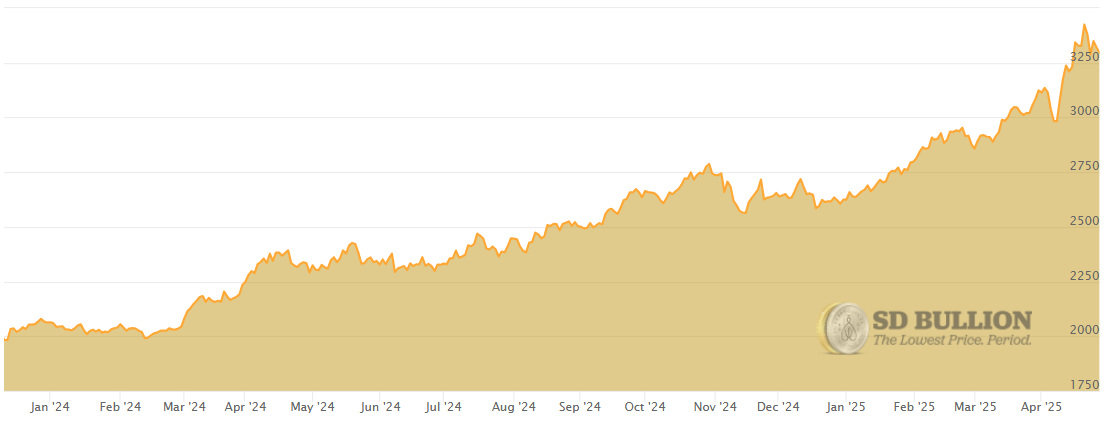

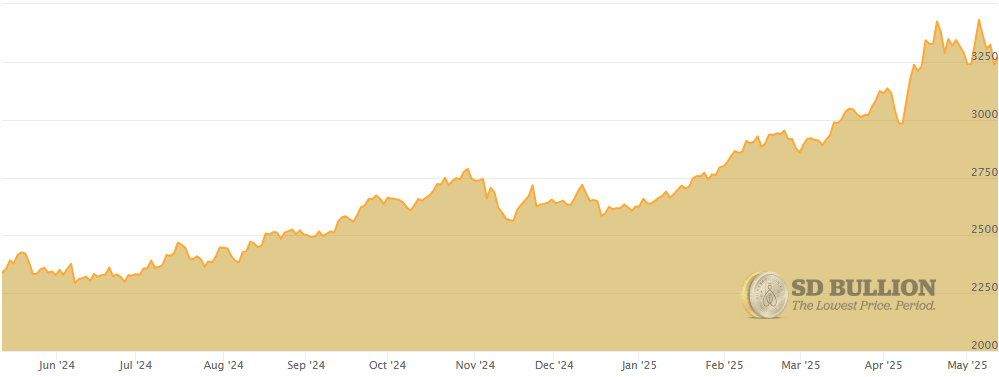

Interestingly, the price of gold has been breaking records since September 2024, reflecting heightened interest in precious metals in the face of escalating geopolitical events.

Besides, all precious metals, such as silver, platinum, and palladium, enjoy high industrial demand due to their diverse applications in technology, the automotive industry, and jewelry, respectively.

This is why, when it comes to diversifying investments, many experts suggest allocating a percentage of your investment portfolio to buying physical assets, such as gold and silver coins, bullion bars, or even silver jewelry.

Because precious metals are a physical asset that has served as a store of value for millennia, their prices tend to perform well in times of political uncertainty and financial crisis, due to their low correlation with other classes of investment. Thus, many now see them as a sensible way to hedge against inflation and fiat currency devaluation.

Where To Buy Gold And Silver Bullion

To begin with, there are generally two primary ways to buy gold bullion and silver products. Investors can acquire bullion metals through a trusted, secure online dealer, as well as in local shops that sell gold and silver the old-fashioned way.

Another investment strategy includes purchasing gold and silver ETFs, or Exchange-Traded Funds. However, both silver and gold ETFs are alternatives to investing directly in gold and silver mining companies by buying their gold and silver mining stocks, and mutual funds, which do not involve personally acquiring tangible, physical metal.

Buying gold and silver online has become a common alternative in modern days. Without a doubt, matters of convenience and inventory play a critical role in this scenario. See the fundamental differences below:

Buying Bullion Online

Online gold and silver dealers are accessible 24/7, allowing anyone with internet access to buy from anywhere in the world with privacy and convenience. This modern approach has transformed the way people invest in precious metals.

Unlike local coin shops, online dealers can offer a wider selection of products without the limitations of physical space. With years of industry experience and direct mint partnerships, they provide diverse options to suit all types of investors, available at any time with fast shipping.

Buying Bullion Locally

Pawn and local coin shops were once the standard for buying precious metals. While online dealers have grown in popularity, physical stores remain relevant because they allow customers to inspect gold and silver in person. Their inventory caters to local demand, offering a hands-on buying experience that some investors prefer.

However, higher operating costs of a local coin shop often lead to limited selection of products and steeper premiums compared to online dealers, raising the question of how much extra you are willing to pay for a physical inspection.

How Much Do Precious Metals Cost?

Physical gold and silver bullion are available in various products, each bearing a specific weight, purity level, and mint of origin. These are responsible for the different prices of gold and silver. Of course, dealers will most likely verify the purity of bullion before distributing it among buyers.

To start with, precious metals prices are based on their spot price, that is, the current price per troy ounce exchanged on global commodity markets. Gold's price and silver's price are susceptible to spikes and falls during business days.

These price fluctuations are normal and tend to occur based on supply and demand in commodity and derivatives markets, such as COMEX and LBMA, much like in the stock market. You can check the header of our website for the latest spot silver and gold prices.

A premium is an additional price charged for a bullion product over its current spot price. These may vary according to factors such as the type of product, its weight, supply, and demand, as well as the overall gold and silver market and global conditions.

Bullion dealers charge premiums on their products to help maintain their businesses. Online sellers generally offer lower premiums when compared to local coin shops. This is because online dealers deal in large volumes and get better pricing from the wholesale market, which they then pass on to their retail customers.

Payment Methods

Once an investor decides which tangible bullion pieces they wish to purchase, they must proceed to payment. The available payment methods may vary from one bullion dealer to another.

Nonetheless, more common options include using a credit or debit card, PayPal, e-check, or bank wire. Some dealers also accept cryptocurrencies such as Bitcoin as payment.

It is worth noting that some methods may offer a discount on your order due to their operational nature. Payments through e-check, bank wire, and cryptocurrencies are commonly eligible for discounts.

That happens because these transactions involve a complete transfer of funds from one account to another. However, these transactions may have a more extended clearance period, as they require the services of third parties, such as a bank.

On the other hand, while transactions using credit or debit cards may not be eligible for a discount, they often have faster clearance periods. This alternative might also allow customers to pay off their charges over an extended period.

Next, let me show you what types of precious metal products are available on the market.

What Silver And Gold Bullion Products To Buy

Silver and gold bullion products are minted in different weights, shapes, and sizes. It is important to note that these can help determine an investor's profile.

Each brings about its benefits as well as premium standards. This is due to factors such as their origin and production process. The most common forms of gold and silver pieces are coins, rounds, and bars.

Coins

Bullion coins are easily recognizable due to their intricate designs and their use as a form of currency. They are legal tender within their country of emission and are generally produced by sovereign mints, such as the United States Mint. Take the case of the American Eagle Silver Coins and the Canadian Silver Maple Leaf - some of the world's most popular bullion coins.

Gold and silver coins offer an easy-to-store and flexible investment option. Their artistic designs give them collectible appeal beyond just metal value. While they typically carry higher premiums due to their quality and recognition, this also makes them more liquid, allowing for quicker sales when needed.

Rounds

This type of bullion product is similar in shape and form to a coin, but it is not used in circulation and is not legal tender, as it does not bear a face value like coins.

Just like the 1 oz Silver Buffalo Round, a popular choice for investors of physical silver, most rounds are produced by private mints. They are chosen by investors mainly due to their precious metal content. Their premiums decrease with bigger weights and are generally higher for small pieces.

Bars

Bullion bars are a popular choice among experienced investors. Silver and gold bars have a rectangular, stackable form. People tend to think that buying gold bars or buying silver bars requires a lot of space to store them. However, you can find bars in various sizes to accommodate your storage needs, ranging from 1-gram gold bars to 1-kilogram gold bars. The same goes for silver.

Gold and silver bars are a convenient option for bulk investments. The premium on precious metal bars decreases as their weight goes up. This means that investors can acquire more ounces of metal for a lower price, in larger purchases.

How To Buy Gold and Silver Coins And Other Products

The process of buying gold and silver for physical possession is simple and straightforward. If you decide to buy gold, silver, or other physical precious metals at the lowest premium, it will take just three steps.

You may decide to make your purchase online or over the phone with one of our assistants.

Online

Step 1

Freely browse our website. Once you decide which and how many silver and gold products to buy, add them to your cart. Proceed to checkout.

Step 2

During the checkout process, enter your basic information, such as your first and last name, shipping address, and shipping method, and select your preferred option. Continue to Billing to enter payment information.

Step 3

After you review your information, proceed to place your order. And a confirmation email will be sent shortly after. Once payment is processed, your products will be shipped to you within 1-3 business days.

Over The Phone

Step 1

Please call us toll-free at 1(800)294-8732.

Step 2

One of our customer assistants will take your order and be ready to help.

Step 3

An order confirmation will be sent via email. Once your payment is processed, your order will be shipped to you within 1-3 business days. After it is shipped, it might take 5-10 business days or less to arrive.

How To Store Gold and Silver Investments

Unlike many other assets, buying physical gold or silver requires secure storage, a key step in precious metals investment.

Proper storage preserves the condition and reduces the risk of theft. Investors typically choose between home storage (accessible but less secure) or professional vaults (safer but less convenient), balancing safety and accessibility in their traditional investing approach.

Home Storage

When you buy precious metals like gold coins, home storage offers immediate access and complete control, making it ideal for small to medium-sized portfolios. Standard options include safes or hidden spots, but proper conditions are crucial. Avoid damp, humid areas to prevent tarnishing, especially with silver. Consider using desiccant packets for added protection.

Third-Party Storage

For those who start investing in physical bullion but want to avoid storage hassles at home, banks or depositories offer secure solutions. While less accessible, these insured facilities protect your investment in gold from theft and environmental damage. Though costlier than home storage, they provide added security, insurance coverage (unlike most home policies), and peace of mind.

Final Words

Investing in physical gold and silver remains a trusted strategy for those seeking to diversify their portfolios and protect their wealth against economic uncertainty. By understanding how precious metals are priced, where to buy them, and how to store them securely, investors can make informed decisions that align with their financial goals. Whether you are purchasing coins, rounds, or bars, and whether you buy online or locally, careful research and planning are essential for building a resilient portfolio.

FAQs

Where can I buy physical gold and silver?

You can buy physical gold and silver from reputable online dealers or local coin shops. Check for certifications, online reviews, American Numismatic Association affiliation (which ensures adherence to ethical standards), Better Business Bureau accreditation, and whether the dealer is a U.S. Mint-authorized purchaser. All of these are strong signs of legitimacy.

How do I know if a gold or silver dealer is reputable?

To protect your investment, choose reputable dealers who offer gold and other precious metals at or near market price, never below the spot price. Also, look for companies with certifications, strong online reviews, an affiliation with the American Numismatic Association, Better Business Bureau accreditation, and US Mint Authorized Purchaser status. A strong track record of positive reviews and certification from recognized authorities is a clear indicator of reliable service.

What is the difference between coins, bars, and rounds?

Coins, bars, and rounds all serve as investments in gold and silver, but they differ in key ways. Governments mint coins, carry legal tender status, and often have higher premiums due to their design and collectibility. Rounds are privately minted, lack legal tender status, and offer simpler designs at lower premiums. Bars are the most cost-effective form of other precious metal products, and can provide investors with a low-premium way to accumulate metal, although they are not legal tender.

How is the price of gold and silver determined?

The prices of gold and silver are influenced by various factors, including global demand, geopolitical events, and industrial use, especially in the case of silver, which is heavily used in the technology sector. The spot price, which is the current market price for immediate delivery, is primarily driven by the interaction of supply and demand in global markets. In the U.S., these prices are influenced mainly by precious metals futures contracts, which reflect investor expectations and trading activity on major exchanges plataforms, such as the COMEX.

What are the best ways to store my gold and silver?

Storage depends on your budget and access needs. Home storage requires careful insurance planning, as coverage may be limited. Safe deposit boxes at banks offer security but restrict access. Private storage services, however, designed for precious metal investors, often provide 24/7 access and full insurance, making them a top choice for many.

Is it safe to buy gold and silver online?

There are many safe and reliable places online to buy gold and silver today for competitive prices. The most trustworthy sellers are typically authorized dealers affiliated with reputable mints. In the U.S., look for delaers that hold U.S. Mint Authorized Purchaser status. Reputable dealers often have strong online reviews, visible certifications, and affiliations with organizations like the American Numismatic Association (ANA), which ensures that they adhere to ethical standards. These factors indicate a strong commitment to quality and trustworthy service.

What is the difference between bullion and collectible gold/silver coins?

Bullion coins are primarily valued for their precious metal content, which must be at least 99.5% pure, and are produced mainly for investment purposes. Their value is closely tied to the metal’s spot price, though limited editions or unique designs can add some collectible appeal. Collectible coins, however, are valued primarily for their numismatic qualities, such as rarity, history, and variety. While they may also contain precious metals, their composition is secondary to their appeal among collectors.

Can I include gold and silver in my retirement account (IRA)?

Yes, you can include gold and silver in a self-directed IRA, also known as a precious metals IRA. To do so, you will need a specialized custodian to set it up, as well as an IRS-approved depository to store the physical metals. Keep in mind that silver and gold IRAs usually come with higher fees than a regular IRA, due to the additional costs of storage and administration. For instance, some companies may require a steep minimum investment that can range between $2,000 and $50,000. Furthermore, Gold IRA setup fees can range from $0 to $275, and annual account fees can range between $195 and $305.