Here at SD Bullion, we often dig deep into physical precious metals research questions such as,

- "How Much Silver is in the World?"

- "How Much Gold does the US have?"

- "How Much Platinum is in the World?"

And not merely coming up with industrial figures, but more so trying to understand how much.999 fine investment-grade bullion in each respective major precious metal there is amongst investors and central bank hoards. Then put that precious info into a context versus other competing asset classes and monetary aggregates outstanding.

In the following video, we again dig deep asking ourselves another time, "How Much Silver is there in the World?"

-

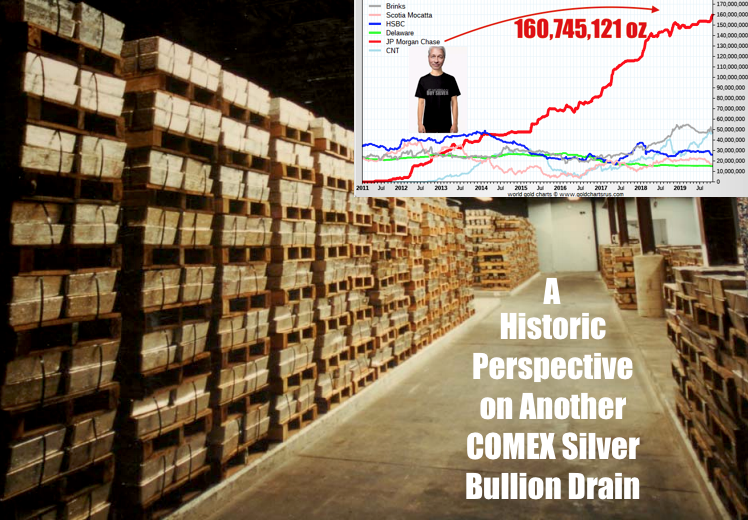

What you are looking at, is just a small sliver, or a single warehouse isle within a bonded non-bank silver bullion depository.

One that is likely located on the east coast of the United States of America, perhaps still operating within the COMEX fractional reserve silver warehouse network.

This image was taken in the year 1995 and it is courtesy of the CPM Group. In the image, one can eyeball estimate just under about 2 million ounces of silver.

The price of 1995 silver fluctuated from a low of around $4.30 oz to a high of $6 fiat Federal Reserve notes and 10¢ cupronickel cents.

Within this high ceiling silver storage facility at the start of the video, there were some 60,000 industrial-sized 1,000 troy ounce silver bullion bars, all held at the time by the Wilmington Trust. Still one of the largest holders of fiduciary assets in the United States and in the world today.

At that time in the year 1995, their 60 million ounces of silver was just over 1/5th of the silver bullion underlying the COMEX fractional reserved, silver price discovery, derivative market.

Within 3 to 4 years following when this image was taken.

About 100Xs what you see here, some 200 million ounces of physical silver got withdrawn from the COMEX silver market.

About 2/3rds of that 200 million ounce withdrawal likely ended up with Warren Buffett and Berkshire Hathaway’s 1997 to 2006 silver bet.

In the link below, I am leaving you with some backlinks documenting my claims here. There are charts there corroborating my points.

Is Past Prelude? | JP Morgan's COMEX Silver Pile Might Get Drained 2020s

-

Warren Buffett's Silver Investment Leaves another Tarnish on His Legacy

-

But for the main focus of our video this week, we’re going to answer the question any silver bullion buyer with common sense should ask themselves before going long silver bullion.

How much Silver is there?

And no we’re not talking phony derivatives, were doing physical estimations here.

We’re also going to most importantly put that answer into both past and potential future silver bullion supply, price discovery, and bid price context.

Hello out there, this is James Anderson with SDBullion.com for our fifth precious metals market update.

The silver spot price backed up and closed this week at $16.64 oz.

The spot gold price fell a few bucks finishing the week at $1462 oz

Remaining can closing flat for the week, the platinum spot price is just under $900 per troy ounce.

Consistently and yet again achieving a new record palladium price, this week closing around $1,900 oz, the palladium physical shortage continues to ramp its price higher.

The gold-silver ratio rose a couple of ounces on the week. It now takes around 87 ounces of silver to acquire 1 ounce of gold.

—

Quick update on the NY Fed REPO Loan program ongoing.

Now around 80 days in operation since middle September of this year. The short term overnight loans with durations lasting up to 42 days, has in aggregate closed in on the $5 trillion fiat Federal Reserve note notional loans to date mark.

Financial tweet of the week goes to Jim Bianco of Bianco Research illustrating what reported amounts of Repo Market support have stuck to the Federal Reserve’s balance sheet thus far.

For those keeping score at home ... Fed support to calm the repo market is now $324 billion.

— Jim Bianco (@biancoresearch) December 2, 2019

Remember it is Not QE!!! pic.twitter.com/0dtLDIY3Jn

Back to our main topic at hand.

How Much Silver is there in the World?

After the Industrial Revolution, with increased outputs via agriculture production, energy use, advances in medicine, indoor plumbing, and combustion engines in mining.

The percentage growth in the human population was ironically mirrored by world silver supply growth.

Gold mining output had a similar but even slightly larger explosion in growth too.

Although for the last 80 years, we humans have mined around 8 parts of silver ore to 1 part gold ore.

Over the last decade-plus, while both investing and working within this industry. I have done this “How Much Silver is there in the World” research and article deep dive multiple times.

Beginning this 21st Century, there was a very small amount of transparently held silver bullion within depositories around the world. That near 20 years ago fact, has since been rumored onwards to somehow mean that today there is somehow less .999 fine silver bullion above ground in the world than there is gold bullion.

Based on many sources of reliable data, that is not true.

There is conservatively about

2.5 billion oz of Gold Bullion and

4 billion oz of Silver Bullion in the world today in the forms of coins, bars collectively.

We’ll put these two bullion piles into the total global asset and financial world context shortly.

But know that when compared to gold bullion, there is more than double that amount of physical gold spread throughout the world too in jewelry, artifacts, and within industrial applications.

Considering total silver bullion piles, these is easily 5 to perhaps even 10 times that amount of silver spread amongst the thousands of electrical and industrial applications we use day-to-day. As well there are tend of billions of ounces of silver spread amongst the world’s collective silver jewelry, silverware, and artifact piles too.

-

The impetus for my covering this topic today is that a well known and respected industry colleague of mine Jan Nieuwenhuijs also known for writing under the moniker, Koos Jansen for many years. He recently published an article for Voima Gold entitled, “How Much Silver Is Above Ground?”

Reading through Jan’s recent work I was pleased to see the accuracy of his above-ground silver numbers was corroborating many handfuls of hours I spent researching the matter myself.

There are a few additive points I would like to make in this video for the silver bullion context.

In his article, Jan states the United State Geological Survey estimates that all-time silver mined through the year 2017 is just under 56 billion ounces. The USGS in an email correspondence reported by Jan, went on to claim 7 to 10% of all-time silver has been lost to landfills. There was no corroborating backlink nor data associated with that historical silver loss assertion.

I find that dubious. Not sure any entity other than omniscience might confidently know how much silver we humans have lost to landfills, not recycled. If you simply think about the rampant global consumerism of the past 5+ decades, I am not confident anyone knows how much trace silver we have thrown out, not recycled.

The more important point about the context, of ‘how much silver is in the world’ estimations is this.

-

It really does not matter how much industrial silver we have pilfered away because recycling it was not worth the monetary return. When it finally becomes worthwhile to recycle silver, it will become worthwhile to do so globally.

The world silver refining industry does not have the capacity to meet another major global silver melt akin to the one that happened in the late 1970s and early 1980s.

If you have been paying attention to the silver bullion and silver refining industries over the last few years you are well aware of the consolidations and bankruptcies that have occurred.

Once LBMA approved Gold and Silver bullion bar refiners quickly became bankrupt alleged and or prosecuted blood gold silver refiners. Names such as Ohio Precious Metals, Elemetal, Republic Metals. All once large silver refineries, there now gone.

The largest remaining LBMA approved gold and silver refinery in North America recently got called out in a New York Times expose shown on the FX television channel.

The TV show asserts that North America’s largest gold and silver refinery has been selling alleged “blood gold” illegally wildcat mined in countries around the Amazon rainforest such as Colombia, Venezuela, Brazil, Peru, & Ecuador.

Multinational corporations named on the blood gold expose include Apple, Ford, Samsung, & Tiffany's jewelry (you know, the overpriced one, with the blue box).

In Colombia below,

— James Henry Anderson (@jameshenryand) November 29, 2019

Tight ongoing correlation between lawless coca-growing campesino jungles & wildcat #Gold mineros who get extorted whole way up refining chain (e.g. ¿Plata o Plomo?) - https://t.co/HGMEsb3Tp1

Similar stories in

VZ, Peru, Ecuador, Bolivia

h/t @LBMAexectutive

-

So we can add up all the world’s sterling silverware, impure silver jewelry piles, or other uneasily exchangeable silver combined at the moment.

What is past is prelude, and just quick walk down memory lane tells silver bullion buyers interested in selling some silver into a mania, should always consider the form of silver bullion they stack.

This short clip of Chris Martenson speaking with long time precious metals dealer Robert Mish, what a gold bubble mania looks like. Recorded back in early 2012, Mish talks about silver and the discounts people were taking on sterling silver bids due to silver refinery backorders and delays.

-

-

As promised, here we will finally put these monetary bullion piles into the total global asset and financial world context.

Here again, not shown to scale we have former Federal Reserve governor, John Exter’s updated upside-down pyramid showing what asset class people flock to during bankruptcies, financial spill-over events, and crises.

Physical gold bullion makes up the financial foundation valued currently at just under $4 trillion in notional value. Even if we add in all the gold jewelry and industrial gold globally, we have a total value of around $9 trillion currently.

But this Visual Capitalist illustration is now near the current financial market scale brings the 4 billion ounces of silver bullion into a financial world context.

This dot represents $100 billion in silver bullion, that assumes by the time we make it to $25 an ounce silver, we still have around 4 billion ounces of .999 fine silver amongst global investors.

The silver industry is tiny, completely dwarfed by even the largest multinational corporations. Annual GDPs, top 100 or more billionaire lists, The Federal Reserve’s now over $4 trillion Fed note balance sheet, hard total M1 fiat cash notes circulating across the globe, physical gold’s value globally, various combined stock markets around the world, World M2 and M3 monetary supplies, $255 trillion in global debt levels, total global real estate, and then derivative bets and hedges made between large financial institutions.

You get the idea.

Comparing the world’s silver bullion pile especially to the amounts of illusory fiat currencies masquerading as bona fide money, this is there the fear and or greed induced mania for silver can get silly.

When real capital flows start finally pouring into gold, precious metals, and especially the silver market.

The monetary and industrial rush to own physical silver should give the 4 billion ounces of silver bullion stout and rising bid price leverage.

That is all for this week, make sure you pick up our free SD Bullion guide by email before you go.

***