Gold and Silver Prices Today

Precious metals offer an investment that provides the means to weather economic storms and retain value when all else fails.

We provide you with access to gold and silver prices updated every 10-15 seconds to ensure that you always have your finger on the pulse of the market and can make smart decisions with your money.

Not only do we ensure accurate information about the current price of gold and silver, but we also deliver additional information to help you make savvy decisions about physical precious metals.

Gold and Silver Prices and the Need for Accurate Information

Precious metals prices might not change as drastically or as frequently as stock prices since they’re not tied to the vagaries of confidence, company performance, management decisions and the like, but it is vital that you have access to accurate precious metal prices at all times. To that end, we offer free access to metal price chart options for all the major segments including live gold prices, the dynamic silver price, platinum prices, and palladium prices too.

We also regularly update the important Gold Silver Ratio so investors can perhaps better deduce which of the two monetary metals is historically under or overvalued. Without access to the current price of gold and silver today, it is impossible to make sound decisions to build your wealth and safeguard your quality of life in the future. Seasoned investors understand the importance of not just the spot price, but correct price quotes for buying silver bullion and in order to buy gold bullion.

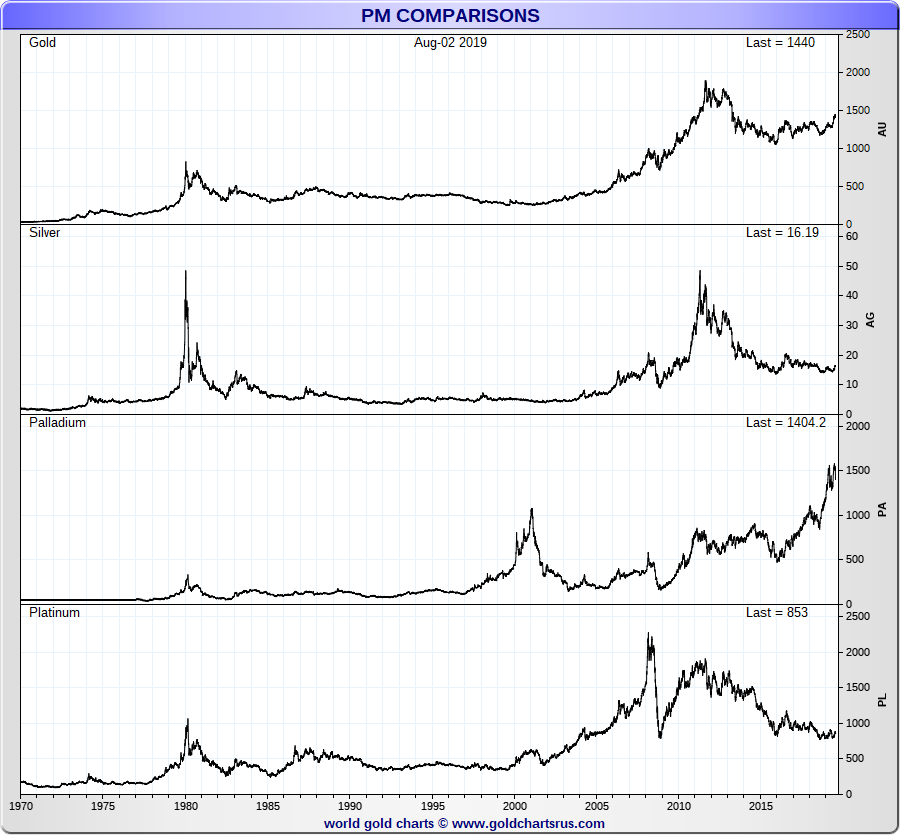

However, it is also important that investors understand the myriad of ways to invest in gold and silver, as well as other precious metals. The following is a long term view of Gold, Silver, Platinum, and Palladium prices in US dollars spanning from 1970 to 2024.

Long Term Precious Metal Prices in U.S. Dollars

In the chart above you can find the per ounce US dollar prices for Gold, Silver, Palladium, and Platinum respectively from 1970 to 2018. Given that this is a static chart, will be updating it every quarter in the months and years to come. For now, this long term precious metal price chart above will give you a better understanding of various past precious metal bull markets (1980 being the most obvious) as well as isolated bullion bull markets for palladium in 2001 for instance.

About Our Precious Metal Price Chart Options

When making an investment in precious metals, it is important to always understand primarily which specific fiat currency is being used to measure against which specific precious metal. Given that we are a US-based bullion dealer, our precious metal price charts are almost always US dollar-based. And secondarily, one must always take into consideration the timeframe being depicted in a precious metals price chart.

Different precious metal price charts may highlight a range of various time periods. They can range from mere minutes to a 24-hour period, to various weeks, six months, a year, a decade, or even over 100 years. With precious metals, it is important to remember that movements over a short period of time are usually just minor fluctuations.

The Difference Between Short-Term and Long Term Gold Price Views

1 Week VS. 1 Year

For instance, the price of gold may rise or fall only a few dollars per troy ounce during a week, or over the course of a month. However, this information is secondary to what you actually need to see. It is more important to consider long-term precious metal prices. That is, how has gold performed over not merely a year, but perhaps a decade or more? What is the trend for gold and silver prices over the course of the coming decades even?

By looking at longer-term time frames, you can make wiser decisions based on longer-term price movements and trends, rather than short-term price variances caused by minor events that could soon self-correct. If you were to only look at precious metal prices during these short term price variances, you might be tempted to sell bullion or even avoid buying bullion completely. But when you study the price of silver and gold for both short and long-term movements, you can better learn how to spot the longer-term secular trends.

So, not only is it important to know the spot price of gold or silver (the live dynamic paper and physical prices), but it is crucial that you understand how these prices have moved over longer time periods.

The Nature of Your Investing

Most of those interested in live gold and silver prices are investing for the long term. However, there are plenty of investors who want to get in and get out. This is where a technical analysis of a metal prices chart combined with a number of other essential tools can provide you with the means to determine where the metal is going next, and whether now is a right time to get in or get out while making a potential profit or loss.

Our Stance

We believe that the best way to reap rich rewards from physical precious metals investing is to make smart investments over the course of time – small disciplined bullion purchases at regular intervals. Of course, this really only applies if you’re purchasing precious metals physically. If you’re buying ETFs or other intangible assets, the situation is different with additional myriad counter-party risks involved.

Our goal here is to ensure that you always have access to not only the live gold and silver prices but also the historical price performance of these precious metals to inform your investment decisions for the long term.

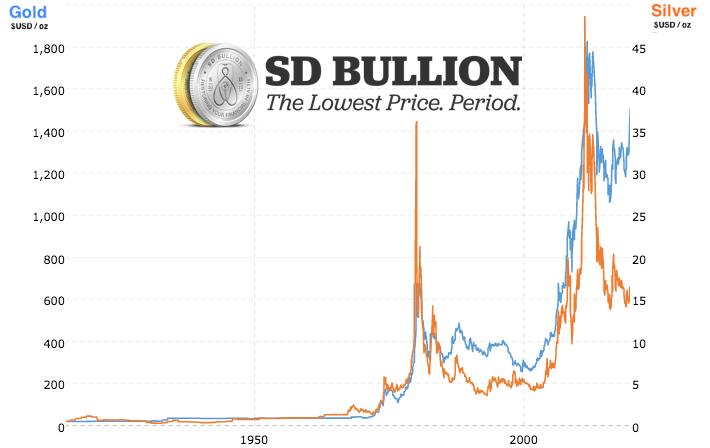

For instance, the following Gold Silver +50 Year Chart begins in the year 1970, spanning up to today.

Within this long term gold silver monthly price chart you can deduce monthly averages for each respective precious metal in US dollars per troy ounce increments. If you would like to dig deeper into daily gold price history and daily silver price history we also publish this day to day price data for each respective monetary precious metal here at SD Bullion.

Frequently Asked Questions

How much is gold and silver worth right now?

As of May 2025, the gold spot price stands at around $3.321 per Troy ounce, whereas the silver spot price fluctuates around $32 per Troy ounce. On April 21, 2025, gold hit an all-time high of $3.424,41, while silver has been fluctuating around the $30 margin since May 2024.

Will silver hit $100 an ounce?

Many silver price predictions anticipate that if certain requirements are met, silver could reach $100 in this decade. It would take rising inflation and an extreme shortage of supply, aligned with global economic uncertainty and investor speculation, but it is not entirely far-fetched.

Is silver about to skyrocket?

Silver is already outperforming most conservative price forecasts, surpassing $34 in Q1 of 2025. With rising industrial demand due to new industrial sectors, such as the solar panel industry, we could see silver prices skyrocketing to over $100 still in this decade.

How much is 1 oz of silver right now?

As of May 2025, the silver spot price is fluctuating at around $32 per Troy ounce. Silver has completed Q1 of 2025 at just over $34 per Troy oz, reaching its highest peak since November 2024. The average silver price since the beginning of 2025 is $23, but just over $30 for the month of June, indicating a possible rising trend until the end of the year.

Do gold and silver coins go up in value?

Both gold and silver coins go up or down in value according to the corresponding precious metals spot prices. Fluctuations are expected in live prices based on supply and demand in the shorter term (low or high-frequency trading trends), whereas in the long term, live spot prices will mostly vary based on geopolitical events and world macroeconomic movements.

What is a good amount of gold and silver to own?

Many experts suggest allocating 5-10% of your investment portfolio to gold and silver, but that number can change, ultimately depending on your goals and your profile as an investor (for instance, risk tolerance and security needs). Physical gold and silver are considered safe havens against market volatility and economic instability. Therefore, physical bullion is typically preferred for long-term investment rather than for short-term gains due to its stability and intrinsic value. Remember to analyze the market conditions as well before asserting the amount of gold and silver you want to own.

Could silver ever be worth more than gold?

It is highly unlikely that silver will ever be worth more than gold in terms of dollar per troy ounce. Silver is much more abundant in the crust of the Earth compared to gold. In fact, the amount of silver mined each year is an average of ten times higher than that of gold. However, it is possible for the silver price to outperform the gold price. The gold/silver ratio tracks the difference in price between these two metals and help investors make informed investment decisions about which of the two could potentially be a better option at a certain point in time.

What will 1 oz of silver be worth in 10 years?

In the last 10 years, silver prices have doubled in value (from $16 in May of 2015 to $32 in May of 2025). If this bullish trend continues for the next 10 years, we can expect silver to be worth at least $42 in 2034. However, many long-term price forecasts are pricing silver above the $70 margin in 10 years, possibly even $150, if prices continue to rise exponentially, rather than proportionally.

Precious metals offer an investment that provides the means to weather economic storms and retain value when all else fails.

We provide you with access to gold and silver prices updated every 10-15 seconds to ensure that you always have your finger on the pulse of the market and can make smart decisions with your money.

Not only do we ensure accurate information about the current price of gold and silver, but we also deliver additional information to help you make savvy decisions about physical precious metals.

View Gold Price Charts |

View Silver Price Charts |

View Platinum Price Charts |

Precious Metals Prices and the Need for Accurate Information

Precious metals prices might not change as drastically or as frequently as stock prices since they’re not tied to the vagaries of confidence, company performance, management decisions and the like, but it is vital that you have access to accurate precious metal prices at all times. To that end, we offer free access to metal price chart options for all the major segments including live gold prices, the dynamic silver price, platinum prices, and palladium prices too. We also regularly update the important Gold Silver Ratio so investors can perhaps better deduce which of the two monetary metals is historically under or overvalued.

Without access to the current price of gold and silver today, it is impossible to make sound decisions to build your wealth and safeguard your quality of life in the future. Seasoned investors understand the importance of not just the spot price, but correct price quotes for buying silver bullion and in order to buy gold bullion. However, it is also important that investors understand the myriad of ways to invest in gold and silver, as well as other precious metals.

The following is a long term view of Gold, Silver, Platinum, and Palladium prices in US dollars spanning from 1970 to 2018.

[ 2019 Q2 - Chart updated Quarterly ]

Long Term Precious Metal Prices in US dollars

In the chart above you can find the per ounce US dollar prices for Gold, Silver, Palladium, and Platinum respectively from 1970 to 2018. Given that this is a static chart, will be updating it every quarter in the months and years to come.

For now, this long term precious metal price chart above will give you a better understanding of various past precious metal bull markets (1980 being the most obvious) as well as isolated bullion bull markets for palladium in 2001 for instance.

About Our Precious Metal Price Chart Options

When making an investment in precious metals, it is important to always understand primarily which specific fiat currency is being used to measure against which specific precious metal. Given that we are a US-based bullion dealer, our precious metal price charts are almost always US dollar-based.

And secondarily, one must always take into consideration the timeframe being depicted in a precious metals price chart. Different precious metal price charts may highlight a range of various time periods. They can range from mere minutes to a 24-hour period, to various weeks, six months, a year, a decade, or even over 100 years.

With precious metals, it is important to remember that movements over a short period of time are usually just minor fluctuations. For instance, the price of gold may rise or fall only a few dollars per troy ounce during a week, or over the course of a month.

However, this information is secondary to what you actually need to see. It is more important to consider long-term precious metal prices. That is, how has gold performed over not merely a year, but perhaps a decade or more? What is the trend for gold and silver prices over the course of the coming decades even?

By looking at longer-term time frames, you can make wiser decisions based on longer-term price movements and trends, rather than short-term price variances caused by minor events that could soon self-correct.

If you were to only look at precious metal prices during these short term price variances, you might be tempted to sell bullion or even avoid buying bullion completely. But when you study the price of silver and gold for both short and long-term movements, you can better learn how to spot the longer-term secular trends.

So, not only is it important to know the spot price of gold or silver (the live dynamic paper and physical prices), but it is crucial that you understand how these prices have moved over longer time periods.

The Nature of Your Investing

Most of those interested in live gold and silver prices are investing for the long term. However, there are plenty of investors who want to get in and get out. This is where a technical analysis of a metal prices chart combined with a number of other essential tools can provide you with the means to determine where the metal is going next, and whether now is a right time to get in or get out while making a potential profit or loss.

Our Stance

We believe that the best way to reap rich rewards from physical precious metals investing is to make smart investments over the course of time – small disciplined bullion purchases at regular intervals. Of course, this really only applies if you’re purchasing precious metals physically. If you’re buying ETFs or other intangible assets, the situation is different with additional myriad counter-party risks involved.

Our goal here is to ensure that you always have access to not only the live gold and silver prices but also the historical price performance of these precious metals to inform your investment decisions for the long term.

For instance, the following Gold Silver +100 Year Chart begins in the year 1915, spanning up to today.

Within this long term gold silver monthly price chart you can deduce monthly averages for each respective precious metal in US dollars per troy ounce increments.

If you would like to dig deeper into daily gold price history and daily silver price history we also publish this day to day price data for each respective monetary precious metal here at SD Bullion.

100 Years of Gold vs Silver Prices in US dollar terms per troy ounce

[ 2019 Q2 - Chart updated Quarterly ]

Live Gold Price Charts |

Live Silver Price Charts |

Live Platinum Price Charts |