Summary

- Many individuals are taking advantage of current lower premiums in the bullion industry, contrasting with western paper holders who are selling underperforming ETFs and miners.

- General Patton, a new offering of silver coins, is likely to sell out soon at SD Bullion.

- Recent updates include a podcast with Royal Canadian Mint executives and a sale on RCM gold, silver, and platinum maple bullion coins.

- China's retail sales volumes during the recent New Year holiday season have been strong, surpassing pre-Covid 2019 levels.

- Swiss physical gold import-export data reflects a shift of physical gold flows from the west to the east.

- Claims about official gold counts globally are often misleading, with potential for higher claims by countries like Russia and China.

- US government spending since 2020, adjusted for inflation, exceeds the combined spending of significant historical periods.

- The escalation of the US migrant crisis and coverage of silver bullishness in financial media are discussed as important topics.

- Spot gold prices are steadily climbing, while silver prices have seen slight declines.

- MoneyWeek from the UK published a bullish article on silver, suggesting potential benefits for bullion amidst coming bond and stock bear markets.

Rather than myopically chasing paper promises, I was heartened to see this week that many of you out there are taking full advantage of current lower premiums in the bullion industry. And while western paper hand holders of underperforming unsecured ETFs and miners are net selling, the shred bullion buyers out there are still coming through at a 2022 pace in terms of bullion buying volumes.

I'm recording this Thursday evening Feb 22, 2024 as I will be traveling tomorrow as this Bullion Market Update premieres.

Before we get into this week's news, a couple updates on recent content and new product offerings as many of you have been asking about the latest Commander Series of Silver Coins at SD Bullion.

General Patton has arrived at SD Bullion and is likely to sellout soon as the first Napoleon 5 oz offering did.

We had a few Royal Canadian Mint executives as guests at our SD Bullion headquarters recently and we published a one hour podcast with them only a few days ago if you missed it. Over 40 thousand of you out there viewed it already.

No coincidence, we are having a nice sale on RCM gold, silver, and platinum maple bullion coins this week. In terms of quality, anti-counterfeit technology, North American and global recognition, RCM makes perhaps the best sovereign bullion product range in the business.

Onwards to news and data from the week.

Reports out of China suggest strong retail sales volumes during their recent New Year holiday festival season.

Sales up well higher this year 2024 versus pre-Covid 2019 levels.

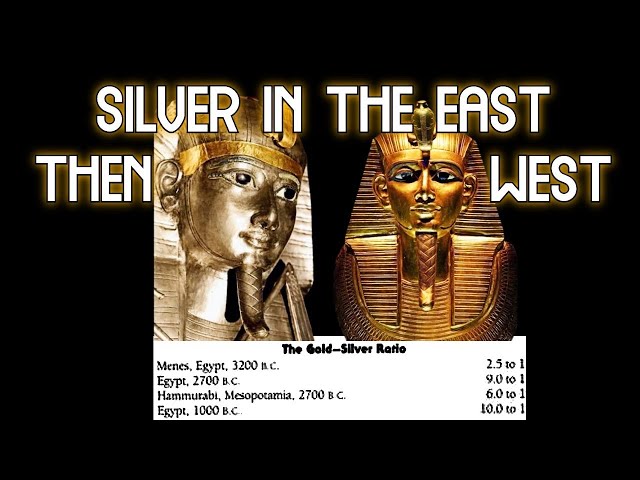

Swiss physical gold import export data for last month jives with these reports as the left hand chart's large blue bar is gold exports out of the USA to the Big 4 gold refiners in Switzerland. With the largest two bars on the right hand side being China first, the second Hong Kong. India, the UAE, Thailand, Saudi Arabia the next largest export blue bars. So, the usual as of late as the west loses physical gold flows to the east.

I saw this misleading graphic floating around the internet this week. And while I don't expect any sovereign nation to actually ever transparently audit their Official Gold Holdings ever. There are a few important points to remember about the current claims of Official Gold Counts in the world.

The amount of eventual Official Gold either the soon to be world's largest miner Russia, or for a decade long running China will ultimately claim is a long topic. But rest assured it is much higher than current claims.

Collectively if we add up the current European Union member states' Official Gold Reserve claims they together have over 11,000 metric tonnes of gold bullion already. So no USA, USA, USA. In terms of major global fiat currency reserve currencies. We're not number one, but already number two officially.

Candidate Trump in 2016 basically admitted we don't dominate in gold like we once did following World War 2.

I know, who cares? Check out these fresh $400 dollar sneakers.

Moving on to further fiscal elephants in the present and future US financing.

Inflation adjusted US gov't spending since 2020 is more than the combined spending of WW1, WW2 and 1970-1990 combined.

And given where US entitlements are projected this is the apparently new normal for the foreseeable eventual walls ahead.

How we gonna finance all this?

Here's another forecast.

Stay tuned to the other side of this week's update.

We're gonna hit on two important gold and silver related topics.

The escalating US migrant crisis.

And the way in which silver bullishness is currently being covered in financial media from India to its former colonial cut and run master, the faded British Empire.

The spot silver and gold price markets through this Thursday evening have been mixed, with gold steadily climbing higher and silver selling off very slightly through the week thus far.

The spot gold is likely to close this week again above the $2,000 oz price support level, with the spot silver price battling to close again above $23 oz.

The spot gold silver ratio has climbed through Thursday at 89.

Recent data reveals the size and scope of the escalating migrant populations into the United States of America.

The vast majority of these immigrants are from dysfunctional states and depressed economies in Central and South America.

With overall food costs currently at 30 year high levels in the USA, escalating welfare handouts and criminal activity will be climbing too.

And while the World Gold Council wants people to believe the world's gold industry physically flows cleanly, the truth is certainly more opaque, sordid, and often ugly.

Over the last near decade now, the dictatorial Maduro regime caused the second largest migration of people only behind Ukraine a few years back. Instead of war being their reason, it was economic dysfunction and a propped up military whose loyalties were often paid off by Amazonian artisan gold proceeds.

It is no surprise that Venezuelan military brass want to take land from neighboring Guayana, after-all their overseers are the one who get large cuts of the profits.

So called blood gold, whatever desperate part of the world it comes from and refines through. It's mostly going to end up in the eastern world as well.

Finally to end this week's SD Bullion update.

MoneyWeek out of the United Kingdom published the following cover article bullish silver earlier this month February 2024.

Let's ignore their silly silver cartoon for now and see what content they actually came with.

To end this week, Jordan Roy-Byrne of The Daily Gold provided this chart of Gold's ongoing historic spot price vs the 60% stocks/40% bonds portfolio.

When the black line below is falling, gold is out of favor and western fiat financialized capital flows away from it.

And vice versa when the black line climbs. The coming bond and stock bear markets have barely begun. Bullion stands to benefit for years to come.

That will be all for our weekly SD Bullion Market Update.

As always to you out there, take great care of yourselves and those you love.