Summary

- A two-hour interview with Russian President Vladimir Putin was published on multiple social media platforms, garnering over 100 million views and impressions within a day.

- Putin criticized the US Treasury for weaponizing the US dollar and bond market, highlighting the growing national debt, which now stands at $34.2 trillion.

- Eastern nations are increasingly buying gold instead of fixed income securities to mitigate risks associated with US Treasury policies.

- Despite stock market optimism, major and regional bank stocks continue to decline, with Global Systemically Important Banks (GSIBs) also experiencing stock price drops.

- Federal Reserve Chairman Jerome Powell acknowledged failures in bank regulation, particularly concerning major banks' uninsured deposits.

- US budget deficits are projected to exceed $3.5 trillion within the next decade, not factoring in potential economic downturns.

- Market analysts offer diverse predictions for gold, silver, and platinum prices in 2024, with growing interest in silver as a valuable investment.

- China and other countries show increased demand for gold and silver, with reports indicating rising purchases, especially among younger demographics.

- Egypt and other nations experiencing currency devaluations are witnessing a shift towards silver purchases over gold due to perceived value.

- The growing trend of silver buying amid currency fluctuations underscores the importance of considering precious metals as assets in uncertain economic times.

Yesterday a two hour interview of the Russian Federation's President Vladimir Putin was published on Twitter X and a myriad other social media websites. With combined views and impression estimates of over a 100 million already in about one day having passed, the most important clip in my view remains Putin lambasting over the US Treasury's weaponizing of not merely the fiat US dollar but the very bond market and IOU plumbing that affords us so much global dominance to this present day.

Current US National debt is actually 34.2 trillion now. Onwards with Putin's points.

To Putin's point, it is not a coincidence that the last two years net government central bank gold buying has been the highest in record history. Most eastern nations are the large official gold bullion buyers and they are often now opting for bullion over fixed income securities where rules can be changed and assets can be frozen seemingly at the whim of the US Treasury and US political establishment.

While stock market bulls were excited about breaching the nominal record high 5,000 level this week, many major and regional bank stocks continue to crater.

Global Systemically Important Banks or GSIBs have not been immune from stock price pain either. Citigroup, Morgan Stanley, Bank of America and Deutsche Bank are all down between -20 to -30 percent over the same two-year time span. In a noteworthy move this week, Deutsche Bank closed down nearly 8% percent given exposure to collapsing US commercial real estate holdings.

The fiat Federal Reserve's Jerome Powell was on CBS' 60 Minutes last Sunday night, getting asked about how many more bank runs, failures, and mergers are incoming.

Powell's hope that bank failures stay in smaller banks only is not reassuring as BIS G-SIB supranational laws call for major haircuts on unsecured depositors if and when another major commercial bank fails.

WallStreetOnParade writes "According to the FDIC, as of June 30, 2023 there were 4,645 federally-insured commercial banks and savings associations in the United States. Uninsured deposits at all 4,645 institutions totaled $7.134 trillion at the end of the second quarter. But according to call reports filed by JPMorgan Chase Bank, Bank of America, Wells Fargo and Citigroup’s Citibank, as of June 30, just those four banks accounted for $4.185 trillion of uninsured deposits, or 59 percent of all uninsured deposits at all 4,645 federally-insured institutions."

So many uninsured depositors are herded into a few too big to fail banks without seemingly little to no regard for current G-SIB laws agreed upon by the G20 nations since the start of 2015.

Powell at the very least admitted that the Federal Reserve failed as a US bank regulator last year.

OK, well under current policies US Budget Deficits are set to exceed $3.5 trillion within the next ten years. That estimate doesn't take into account any potential recessions, wars, or depressions here to there.

Stick around, on the other side of this short break we are going to look at a few outspoken western and eastern analyst's expectations for gold and silver in 2024.

Examine where and why poor man's gold is beginning to be preferred over gold itself.

And why even in the face of record nominal price high levels in price terms, Chinese gold buying is currently near record high levels in demand, premiums above spot paid, and recent exchange withdrawal volumes.

The silver and gold markets this week traded flat to slightly respectively.

The spot gold price finished its 12th week in a row above the important $2,000 oz price consolidation and coiling. More on that in a minute.

Meanwhile the spot silver price finished sideways basically flat under $23 oz.

With the spot gold silver ratio dipping to 89 as a result of gold's relative trading weakness this week.

When it comes to the current price level of gold above $2,000 oz. I polled premiere watchers of our very own SD Bullion Market Update last Friday asking viewers at the time if we will again see the spot gold price below $2,000 oz to come.

The result was about 50% saying no, and about 50% saying yes.

This week macroeconomic analyst Luke Gromen, was interviewed on the "On the Tape" podcast, his take on where gold goes by the end of this year will.

Singaporean UBS analyst, Jovi Teves, made headlines in western financial media this week regarding silver's coming valuation gain potential.

She followed the very next day, stating this on Bloomberg TV.

Her respective takes on silver 2024, left hand side is not all that 'dramatic' as the CNBC headline misled onlookers to believe.

Her take on platinum in 2024 on the right hand is nothing outrageous especially as it threatens to overtake competing palladium in price and potential coming demand under physical supply deficits.

China's industry known for raiding NYMEX platinum warehouses following the COVID 2020 spike is likely being attempted in silver as well. Trouble is, almost half of the right hand side COMEX fractional silver warehouse reserves are reportedly unsecured silver supposedly backstopping the world's largest ETF.

The fact that registered availability for delivery piles of silver have shrunk over the last few years is just further evidence that the physical silver world has undergone supply deficits over the past five years as demand has outstripped annual new mining and scrap supplies.

While this 2020s silver supply deficit is projected to continue into the 2030s, a look back at the 1990s version is here which ultimately resulted in silver nominally multiplying ten times in price in the decade that followed.

Judging by the fact that silver bullion buyers in China are at the moment paying premiums for wholesale silver bullion bars at spot +12% price premiums. It is obvious traders and manufacturers there see great value and willing to pay up to $2.71 oz over spot for large industrial sized bars currently.

This week Chinese Lunar New Year festivities kicked off with reports around the world of a seemingly insatiable appetite for gold and silver related item buying of late.

This week Bloomberg reported the following this week.

Channel News Asia had the following report on how younger Chinese are now the biggest buyers in the world's biggest physical gold market.

Thailand was reported this week, as having a large uptick in gold demand in 2023.

That is not a surprise if one simply takes a quick gander at their local fiat currency Thai Baht getting smoked by gold's ongoing value.

What is also of importance here remains the simple axiom of where gold goes, silver eventually follows.

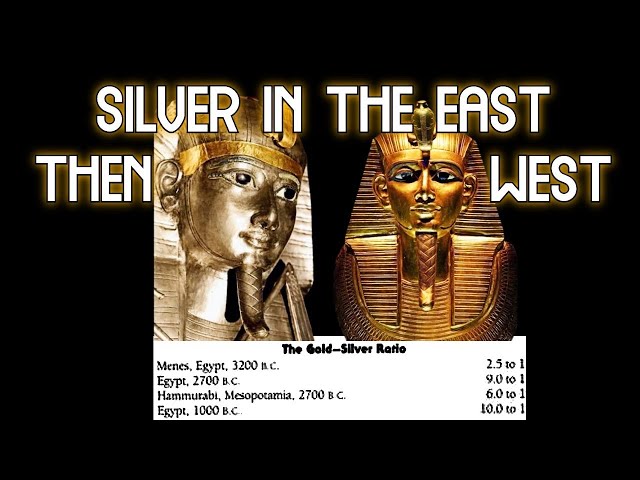

As we swing now to northern Africa and the long time gold and silver saving culture of Egypt.

Apparently now gold is locally being increasingly shunned by common physical buyers, opting for silver as the better value purchase. As you can see even with this understated official exchange rate long term chart of gold and silver in fiat Egyptian pounds, where gold went silver followed.

Locally in the real world we can multiply these charts by more than two fold as the real street level exchange rate has recently spiked to over 70 fiat Egyptian pounds to $1 fiat US dollar.

Here's Reuters this week on why silver buying in Egypt is growing versus gold.

A similar growing silver buying phenomenon occurs in virtually every culture whose fiat currency goes through durations of devaluations.

To think we're immune to akin happening here is exceptional foolishness. So, take advantage of relatively low spot prices and premiums while they last here in the western world.

That will be all for our weekly SD Bullion Market Update.

As always to you out there, take great care of yourselves and those you love.