Many market participants are focusing on the President today, and that would include both the departing and the incoming, but when it comes to the economy and the markets, there is perhaps an even bigger story taking place that Silver Bugs, Stackers, and other Smart Investors may want to make note of the official approval for US fiscal and monetary policies to unite and form one happy marriage. Or so market participants think. The mainstream media is indeed rather optimistic, but here’s a little spoiler: This marriage is going to end in financial disaster, and it’s really going to be hard on the couple’s only child, the US Dollar!

THE SMARTEST THING TO DO IS TO “ACT BIG”?

Of course, I’m talking about the near certainty that Janet Yellen, the former Fed Chair turned high-cost event speaker, will become the next US Treasury Secretary. Yesterday, January 19, during her confirmation hearing with Congress, we were given a taste of what is to come, and well, it’s “big”.

From her confirmation hearing, in Janet Yellen’s own words:

“...this relief package...right now, with interest rates at historic lows, the smartest thing we can do is act big...benefits will far outweigh the costs, especially if we care about helping people who have been struggling for a very long time.”.

You see, Janet Yellen is the former Fed Chair, and conflicts of interest aside, she’s about to become the current US Treasury Secretary, which is why it is important that we translate her statement correctly, which I’ve taken the liberty to do.

TRANSLATION: Another round of stimulus is desperately needed to keep the economy and the markets afloat, and we have suppressed interest rates to record lows, so now, we can borrow and spend like we’ve never borrowed or spent before, and it’s the right thing to do!

Or is that not what Janet Yellen is really saying?

Now, beyond the translation is the meaning, however, and especially what it means for gold prices & silver prices. It means that the US national debt is about to skyrocket, and in the end, there is only one thing that can ever provide a check against out of control debt: Gold & silver.

In other words, Janet Yellen is talking about “debt demonetization,” or simply “money printing,” which is what we’ve seen recently in Zimbabwe, or in Venezuela, and now, the United States is going down that same exact path. There is a saying that Main Street is about to learn, but unfortunately, most people will learn it the hard way, after it’s already too late: You can’t print gold.

YELLEN IS ANTI-BITCOIN/ANTI-CRYPTO

When Janet Yellen is talking about “illicit financing” and “money laundering”, it’s kind of hard to make the case that Janet Yellen is “good for crypto”. From part of the Q&A during her hearing, in particular, here’s one thing Yellen said when asked about crypto:

“I think many [cryptocurrencies] are used, at least in transactions sense, mainly for illicit financing and I think we really need to examine ways in which we can curtail their use and make sure that anti-money laundering doesn’t occur through those channels.”.

While this is “bad for crypto”, this is “good for gold” (and silver).

How so?

It’s simple, and it's called "risk mitigation".

Moreover, here’s another saying that Main Street is about to learn, but once again, unfortunately, most people will learn it the hard way, after it’s already too late: If you don’t hold it, you don’t own it.

I would imagine most people have no clue as to what Napster originally was. Ahh, those were the late 1990s good old days of the Internet, for it’s so much more locked-down now.

But I digress.

Napster was a decentralized, peer-to-peer platform for sharing music.

How ‘bout those buzz words?

Regardless of where one stands when it comes to piracy and the legality of sharing music, the bottom line is Napster was ultimately taken down and is no longer the file-sharing ecosystem it once was. My point is that if the government really wanted to take down Bitcoin, the actual, credentialed tech expert in me says they can absolutely take down Bitcoin. The risk mitigation part has to do with the fact that some Bitcoin and crypto holders may want to lighten up their holdings and diversify into something real that can’t just be zapped with the click of a mouse: Gold & Silver.

Gold & silver are the ultimate forms of private money that also have the added benefit of being, if so desired, being completely out of the financial system, and that would be both the digital financial system and the real financial system (i.e. vault storage service, etc).

INFLATION, INTEREST RATES, AND A BRAND NEW, ULTRA-LONG BOND?

Janet Yellen is rather drab in her speech. She quite literally is the female version of current Fed Chair Jerome Powell in the way she speaks and answers questions, so she says a whole lot while saying a whole lot of nothing. I imagine she’ll stick to her script rather fine, which for now means that inflation, whether it’s measured by the Fed or the US Government, is always too low and always just under the constantly moving target, which used by being 2.0%, but as everybody knows, the Fed is wanting inflation to “run hot” so that over time it averages 2.0%.

During her confirmation hearing, Janet Yellen was asked about a 50-Year Bond. The current “long bond” is a 30-Year Bond, and here's what Yellen said about the possibility of an ultra-long bond:

“There is an advantage to funding the debt, especially when interest rates are very low, by issuing long-term debt, and I would be very pleased to look at this issue and examine what the market would be like for bonds of this maturity.”.

I bring up that statement because it really speaks to the dishonesty of our current fiscal and monetary policies. That is to say, critical thinkers, not propagandists, see no need to “examine what the market would be like” because, well, the Fed is the market, and Janet Yellen knows this, and hence, the dishonesty. That statement is also dishonest in that yes, “interest rates are very low,” but they’re only very low because the Fed is suppressing interest rates via non-stop market intervention. The Fed used to be the buyer of last resort for US debt, but now, the Fed is the buyer of first resort, and when the debt becomes a crisis that cannot simply be papered over with more debt?

Two words: Debt Reset.

To more words: Gold & Silver.

The gold-to-silver ratio is still in the low 70s:

How low will the ratio go with the so-called "blue wave" and "green new deal"?

YIkes!

I am amazed that silver is still sitting at $25, down over 5% since the start of the new year:

I do not think we'll be sitting at this price for much longer, however, for we are about to learn why it's called "precious".

And don't let the upcoming "death cross" in gold fool you:

It should actually entice Stackers and other Smart Investors because more dollars are being printed every day, and yet the price of gold is going down?

Woot!

Palladium is showing very little movement in the price:

My call is still for palladium to continue marking time while the other precious metals catch-up.

Unlike gold & silver, platinum is slightly up on the year:

Is platinum miss-priced, or are gold & silver miss-priced?

I think that everybody will soon miss low crude oil prices:

The price of crude oil is rising because of inflation (money printing), because of ongoing supply chain disruptions, and because of other issues, regardless of whether the Biden Administration will be "good for oil" or "bad for oil".

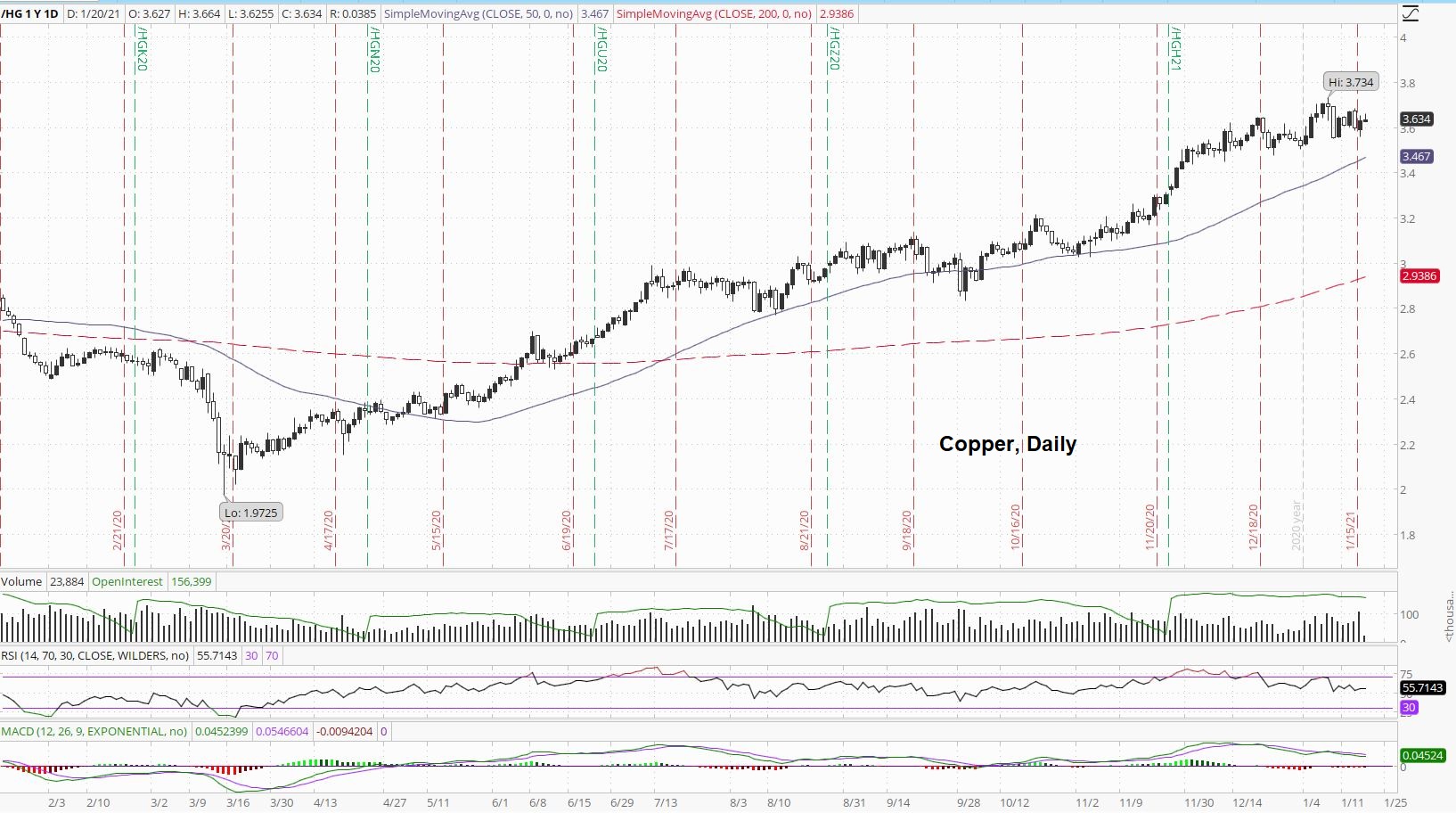

Copper has been refusing to crash:

But why would copper crash if governments around the world are printing money like crazy and using some of that funny money for infrastructure projects?

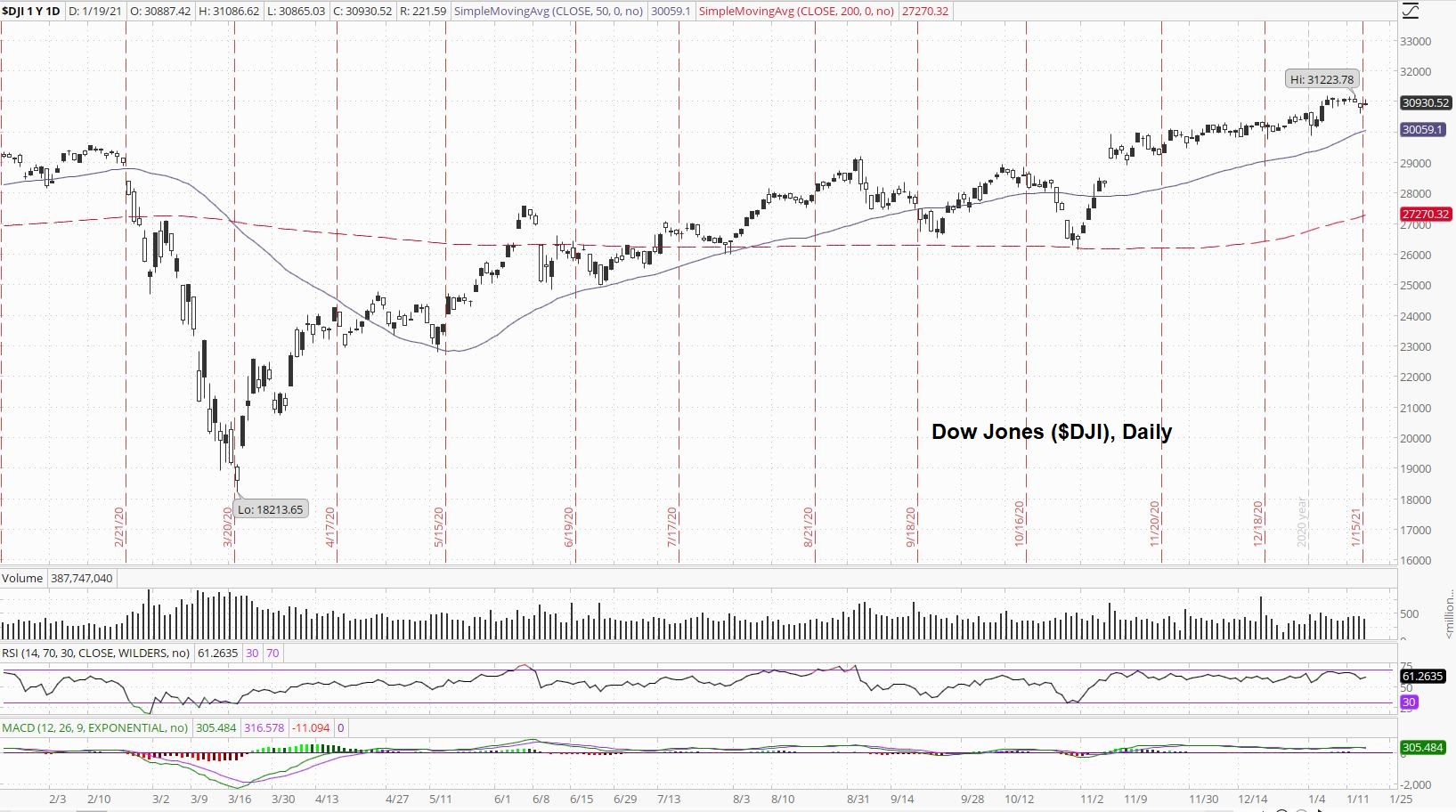

The stock market looks tired:

Will an additional $1400 in "stimmy checks" be enough to perk it up?

The VIX continues to trend lower:

Market participants seemingly have no fear, for the "Fed Put" seems to be more powerful than a Biden Administration being "bad for stocks".

The US government is currently paying over 1.0% for 10-year loans:

What will inflation be over the next 10 years?

Yikes again!

Here's the "Biden Bounce" in the US dollar:

Word is Janet Yellen's not looking for a weak dollar.

Is it possible to have our cake and eat it too?

I wouldn't count on it, and I'd look at actions, not words.

Thanks for reading,

Paul Eberhart