Many bullion buyers across the nation are getting confronted with new US state sales tax threats.

States such as Washington and Ohio have been recently considering whether or not to slap addition 5.75 to 10.4% taxes on top of precious metal product prices, perhaps to somehow meagerly fill gaps in their poor budget planning and multi-decade running spending over saving deficits.

The founder of SD Bullion, Mr. Tyler Wall, was recently down in Columbus, the capital city of Ohio, to voice our company’s opposition to the idea of raising taxes on Ohio bullion buyers.

Bullion purchasers often buy and sell physical precious metal bullion products using them as long term savings options as they have proven themselves historically worthy for investment diversification and wealth preservation.

You can learn more about each US state bullion tax rates here.

Ohio has yet to decide on whether they will or will not renew the bullion sales tax that was null and voided only a few short years ago.

-

You can watch our company founder's testimony to Ohio state lawmakers at the 8:30 to 14:00-minute mark.

-

If you are currently living in a state which is presently tax prohibitive, you might consider buying and using bullion storage services in US states which do not tax bullion buyers.

Otherwise, you might vote with your feet and move to a state or country that respects your capital and savings more than others currently or perhaps might.

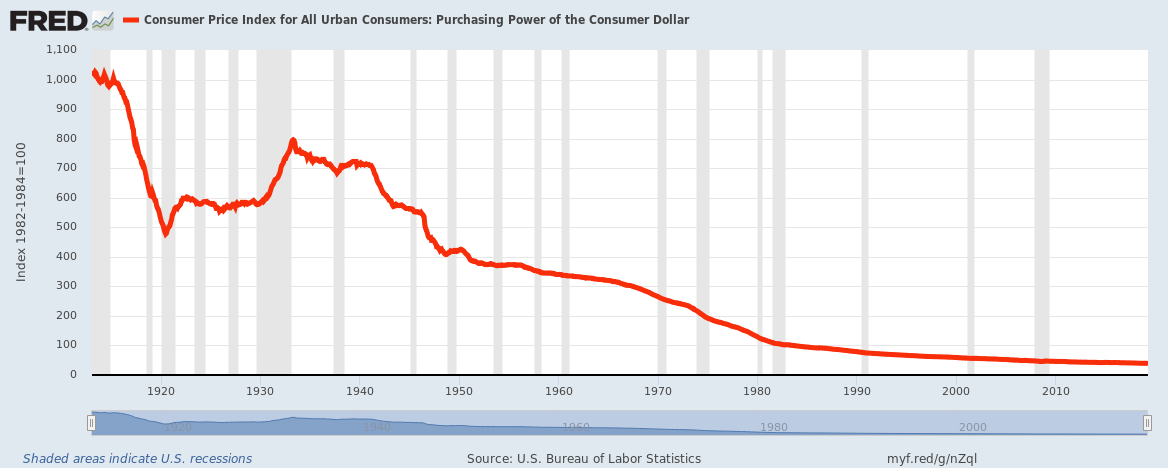

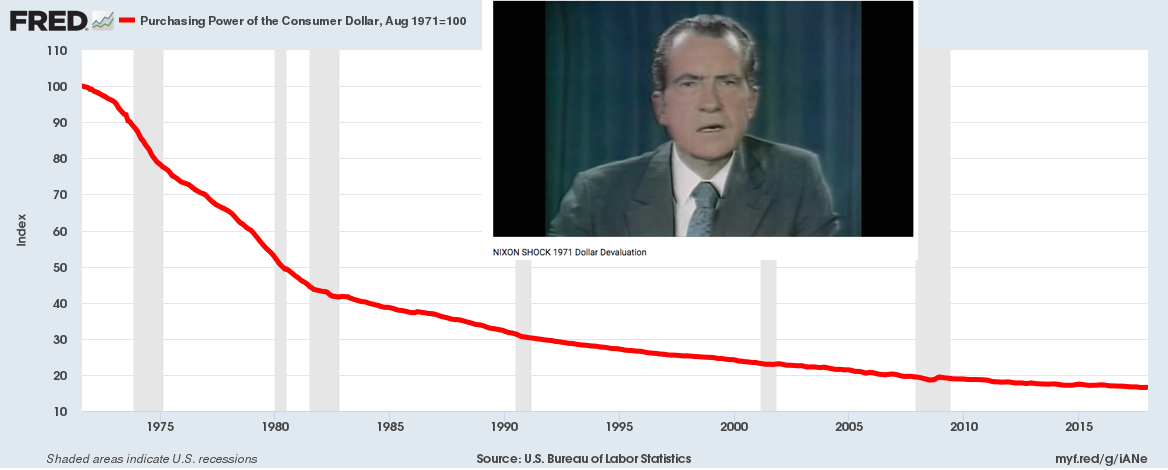

With the fully fiat Federal Reserve note (US dollar) already down over -98% to gold bullion and over -95% to silver bullion since we allowed central banking in this supposed constitutional republic, it appears some state lawmakers are ignoring their past at the cost of both their constituents and future precious metal business potentials.

US Dollar Loss of Purchasing Power Since 1913 & the central Federal Reserve bank founding

-

US Dollar Loss of Purchasing Power Since 1971 Fiat Only Backed by Faith & Decree

-

In the meantime, many United States bullion savers will have to contend with the question of whether or not to render unto each respective state the things that each US state may claim is theirs.

And unto their own respective longterm savings plans that which could, and we would argue should, stay 100% within their long-term rainy day fund, without tax or penalty for prudently saving more than they consume.

Learn more about precious metal investing here with our free 21st Century Bullion Guide.

Thank you for visiting us here at SD Bullion.

***