Gold’s $4,000 Rebound and Silver’s Supply Crunch: Why Central Banks and Vault Drains Are Rewriting the Playbook

- Gold and Silver Cool Off but Hold Strong: This week, spot silver closed at $48.51 per ounce and gold at $4,108, after a volatile stretch that tested nerves and algorithms alike. The gold-to-silver ratio sits at 84, still flashing “historically elevated.”

- From the Top: $10,000 Gold Not So Crazy: JPMorgan’s CEO Jamie Dimon casually said “$10,000 gold makes sense” in today’s world — confirming what bullion veterans have whispered for years: gold isn’t speculative anymore, it’s survival capital.

- Silver’s Supply Crunch Deepens: More than 27 million ounces of silver vanished from COMEX vaults in two weeks — part of a larger structural tightness. Unlike gold, silver lacks a “lender of last resort,” meaning physical shortages hit harder and faster.

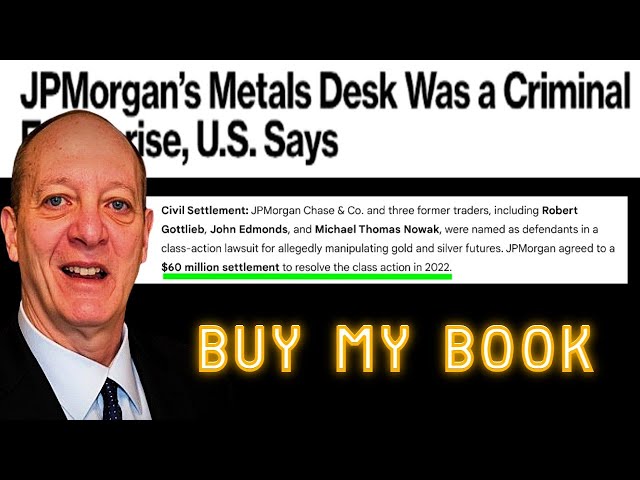

- Old Faces, New Stories: Former JPMorgan trader Robert Gottlieb, once tied to spoofing lawsuits, resurfaced on Kitco News promoting his upcoming 2026 book. He’s now playing market sage, but the record shows he was among those named in the $60 million class-action settlement and JPMorgan’s $920 million penalties for market manipulation.

- A Week of Wild Swings: Gold’s $200 drop and rebound rattled traders, but Gottlieb insists this is just “healthy consolidation.” Since January, gold’s up 57% and silver 69%, reminding us that bull runs rarely move in straight lines.

- Retail Weak Hands Meet Hedge Fund Sharks: Gottlieb points to “weak longs” — new retail investors chasing momentum — who got flushed out by larger hedge funds exploiting overbought conditions. The old guard calls this a cleansing, not a crisis.

- JP Morgan’s New Golden Thesis: A fresh report from Gottlieb’s old employer claims the classic 60/40 stock-bond portfolio is broken, urging heavier gold allocations. Central banks, especially in Europe and Asia, seem to agree, with the ECB now holding more gold than euros.

- Paper Silver Smoke and Mirrors: The London unallocated market still trades hundreds of paper ounces for every real one, a system even veteran trader Peter Hambro called a “bamboozle.” Translation: the “liquidity” you see on screens isn’t real metal moving.

- Global Silver Flows Tell a Story: Turkey imported nearly 3.75 million ounces in September, while India’s ETF appetite may have triggered the latest squeeze. Meanwhile, China’s silver inventories are down 170 million ounces since 2020, showing tightening supply just as domestic investors start buying bars.

- The Silver Bull’s Next Charge: Historical analogs from 1967, 1973, and 1978 suggest silver could double within a year from current levels if the next “cup breakout” plays out. With global debt ballooning past $38 trillion, silver’s role as real money is just getting warmed up.

After gold’s $200 swing and silver’s 27-million-ounce COMEX drain, market veterans say we’re witnessing a structural shift — from a broken 60/40 portfolio world to a new era where bullion is once again the ultimate safe haven and silver’s scarcity story is just beginning.

Cut to yesterday, when a former Bear Sterns & JP Morgan trader went on Kitco News to opine about various ongoings in the precious metals markets at them moment. I will back link the full interview in the show notes here on YouTube but we are going to go through a few highlights here in short order.

Oh surprise, Robert or Bob has a book to sell you. It comes out sometime in Q1 next year 2026.

Let's do some public record research on this self-proclaimed legendary bullion bank trader, shall we?

Oh here's a Reuters piece written by an old journalist I used to engage many messages with during the COVID and Silver Squeeze Q1 2021 era. Peter Hobson has an article here from Sep 12, 2019 describing how Robert Gottlieb at the time was named as a defendent in at least one civil suit related to precious metals price spoofing.

A December 2018 class action complaint, for example, said that Edmonds, Nowak, Gottlieb and others made hundreds of spoof orders or more as “part of a conspiracy” with the bank and other internal traders.

I asked Google Gemini to give me publicly available information further on regarding the civil lawsuit and the falling out of that 2010s alleged JP Morgan precious metals spoofing desk.

Here's what Google had to say when I asked, "What was the end result of lawsuits against Robert Gottlieb at JP Morgan for manipulating precious metals markets late 2010s?"

The available information suggests that Robert Gottlieb was named as a defendant in a civil class-action lawsuit concerning the manipulation of the precious metals markets at JPMorgan, but the specific public result of a criminal case directly against him is less clear compared to other traders.

Here are the key outcomes related to the overall investigation:

Civil Settlement: JPMorgan Chase & Co. and three former traders, including Robert Gottlieb, John Edmonds, and Michael Thomas Nowak, were named as defendants in a class-action lawsuit for allegedly manipulating gold and silver futures. JPMorgan agreed to a $60 million settlement to resolve the class action in 2022.

JPMorgan Penalties: JPMorgan Chase, the bank, entered into a three-year deferred prosecution agreement in September 2020 and paid more than $920 million in criminal and civil monetary penalties, disgorgement, and victim compensation to settle charges with the Department of Justice (DOJ), Commodity Futures Trading Commission (CFTC), and Securities and Exchange Commission (SEC) related to the market manipulation (spoofing) in precious metals and U.S. Treasury futures.

Other Traders' Criminal Sentences: Several other former JPMorgan precious metals traders faced criminal charges and were convicted for their roles in the scheme, which spanned from approximately May 2008 to August 2016:

Gregg Smith was sentenced to two years in prison and a $50,000 fine.

Michael Nowak was sentenced to one year and one day in prison and a $35,000 fine.

John Edmonds and Christian Trunz pleaded guilty and cooperated with the government.

Christopher Jordan was convicted of wire fraud in 2022.

The records confirm Robert Gottlieb was a key figure mentioned in the civil case and internal discussions related to the silver desk, but his specific individual legal outcome (such as a separate public criminal conviction, plea, or sentencing) is not detailed in the available summaries, unlike Smith and Nowak.

OK so Bob is a free man, and over the last year he has been out and about in the public precious metals commentary circuit, apparently preparing listeners to buy his upcoming book.

Let's hear from Robert Gottlieb and interviewer Jeremy Szafron the clips released yesterday Thursday Oct 23, 2025.

Hello Bob, got to cut in here real quick.

This is a common piece of London precious metals propaganda both you and a recent Bloomberg journalist use when referring to London unallocated silver trading. The inference that 250 million ounces of daily silver trading on screens doesn't mean 1,000 oz bars are actually being moved merely it means unallocated price exposure. Long time London precious metals trader Peter Hambro admitted on July 4th, 2022 after spending decades working in London, that their unallocated precious metals market is a complete bamboozle market flooded with paper trading on screens, but not really price discovering with actual bullion trades. Estimates of leverage within London's silver market are multi-100s of ounces of paper silver vs 1 ounce that actually settled physically on a daily basis.

I am pleased to have seen in the comments of the near 45 minute video, a few handfuls of viewers out there knew the back story about Robert's career in the precious metals markets. And they weren't having it.

Moving on to look at silver reports around the world.

Turkey imported a nice chunk of close to 3.75 million oz of silver bullion for the month of September. Of course that is last month's flows that occurred before stuff started to his the silver squeeze fan in London this month October.

And if you local fiat currency market looked like this you'd be saving hard in bullion too.

Likely it is London's number one silver importer India that set this thing off with its massive unsecured Silver ETF demands of late.

Well good luck Indians finding silver elsewhere because from the looks of it China's combined SGE and SHFE silver warehouse inventory levels have been steadily falling since their peak in late 2020. China has seen over -170 million oz of industrial silver flow out its two respective warehouse exchanges. Only 71 million oz for the world's largest industrial silver bullion consumer is not much. And it looks like Chinese investors are beginning to join the buy silver bullion bar trends worldwide.

Dear Chinese viewers, you local silver prices have to basically double and half in spot prices simply to meet what gold has done in China since its legit cup breakout beginning in 2023 until now in 2025.

Stack silver if you want better performance long term but get ready for major volatility along the way.

Speaking of volatile comments of late, I forgot to show you the soon to retire CEO of this hideous pretend art decco headquarters of JP Morgan was out and about last week basically telling people in public that $10,000 oz gold makes sense in the world we live in now.

There you have it fellow plebeians, one of the world's most overpaid CEOs just dropped five figure gold confirming the ongoing thesis I have been pounding the table here for years. Thanks Jaime.

After this short break I want to give silver bullion bull viewers out there an idea of the coming timing for the emerging silver bull price runs to come.

I will also leave links in the show notes of many intra week video updates myself and the team here at SD Bullion published this week to give you all a better sense of what is happening both behind the scenes and how price action is behaving of late.

DON'T PANIC: Gold & Silver Crash Explained (Is It Over?)

Physical Silver SHORTAGE Is Here – We’re Seeing It Firsthand

Silver and Gold traded down on the week.

The spot price of silver closed at $48.51 oz with the spot gold price ending the week at $4,108 oz bid price.

The spot gold silver ratio is still historically high floating higher and ending this week at 84.

On Sunday Nov 2nd the Day of the Dead, following All Saint's Day.

And in the spirit of Halloween, hopefully you liked my new Silver art skull in the slide prior.

I'm gonna be reporting to you next week from New Orleans, Louisiana where I will be attending the USA's longest running Gold & Silver focused Investment Conference.

We're going to end tonight's Weekly Bullion Market Update with a wonderful chart and silver related data set provide by this man, Jordan Roy-Byrne.

But first let's look back in US financial history for a moment, and recall the first time levered paper gold contracts blew the US price of gold and silver into a then mania phase never before seen in the nation. It was in the year 1869.

Back then not much bullion actually changed hands, certainly not in comparison to the frenetically leveraged long silver and gold futures contracts that made the prices of both precious metals run up walls and call into account the then over printed full fiat Greenback used to finance the then recently ended US Civil War.

Well in that same year 1869, while speaking at a monetary conference in Paris, France. Baron Rothschild stated the following publicly, "The suppression of silver would amount to a veritable destruction of values without any compensation."

And so they did, silver was demonitized in 1873 and the Western USA basically got Great Taken over the next three decades which following, being crushed by debts paid in gold which of course went into premium without silver to keep it in check.

And that was the first cup of the 1,2,3 silver price history step in US financial history hitting a low of 25¢ oz in 1933 running to a nominal price high just over $50 oz by January 1980 in fiat US dollars that were much more powerful then versus what they are today.

We're now threatening in the present day silver market to begin the climb towards an eventual cup three. A climb that will likely take us to triple digit landia per troy ounce of silver.

And that won't be the end either. Until we've come to account with our world record and growing $38 trillion debt pile, and $100s of trillion in unfunded liabilities increasingly coming due this decade in the next ones. Well silver is going to store of value scream through that reckoning.

Industry colleague and X feed friend Jordan Roy-Byrne of TheDailyGold website and youtube channel had a wonderful chart that overlaid silver's price breakouts from the old 1, 2, 3 silver steps of the last Western world driven silver bull from the late 1960s until 1980.

If silver were to perform on a percentage basis as it has in past price cup breakouts from 1967, 1973, and 1978 (off the page mania phase).

Well pick and mimic any of them and we are talking a near doubling of the spot silver price within the next year of time coming.

Of course gold has already paved the way having doubled from it old $2000 oz launch pad, so to see silver do this in a worldwide bull market. Well that is to be expected.

That will be all for this week's SD Bullion Market Update.

And as always, take great care of yourselves and those you love.

REFERENCES:

Bullion Bank Insider: This is a 'Different Kind of Rally' for Gold | Robert Bob Gottlieb

https://www.youtube.com/watch?v=HuV-w6T2Vso

Robert Bob Gottlieb's JP Morgan Public Record & His Partial Legacy:

https://gemini.google.com/share/b3e87597befb